Scannable 1096 Form

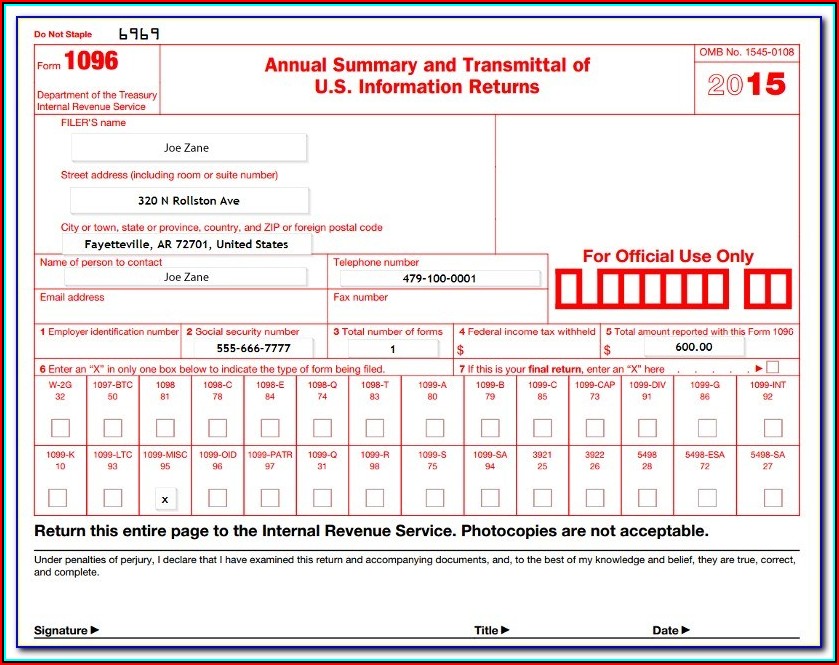

Scannable 1096 Form - You are subject to a $50 fine. Web once completed you can sign your fillable form or send for signing. Do not print and file a form 1096 downloaded from this website; All forms are printable and downloadable. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. You must submit the red scannable from to the irs. Ad access irs tax forms. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit.irs.gov/orderforms. Web the form asks for the business’s identifying information, total number and type of form, and the total amount of income tax withheld. Web get the printable 1096 blank at pdfliner by choosing fill out form button and completing it online.

Web file form 1096 as follows. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. Web form 1096 is due by january 31. All forms are printable and downloadable. You would only need to file 1096 if your 1099s are in paper. Do not print and file a form 1096 downloaded from this website; Do not print and file a form 1096 downloaded from this website; On average this form takes 7 minutes to. Web the 1096 form summarizes the information from the 1099 forms you are submitting for the tax year. Web the form asks for the business’s identifying information, total number and type of form, and the total amount of income tax withheld.

Information returns) is an internal revenue service (irs) tax form. All forms are printable and downloadable. Web the form asks for the business’s identifying information, total number and type of form, and the total amount of income tax withheld. You must submit the red scannable from to the irs. Web once completed you can sign your fillable form or send for signing. Web get the printable 1096 blank at pdfliner by choosing fill out form button and completing it online. Web form 1096 is due by january 31. You would only need to file 1096 if your 1099s are in paper. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. If you would like to get simply a blank, go to the official website and download.

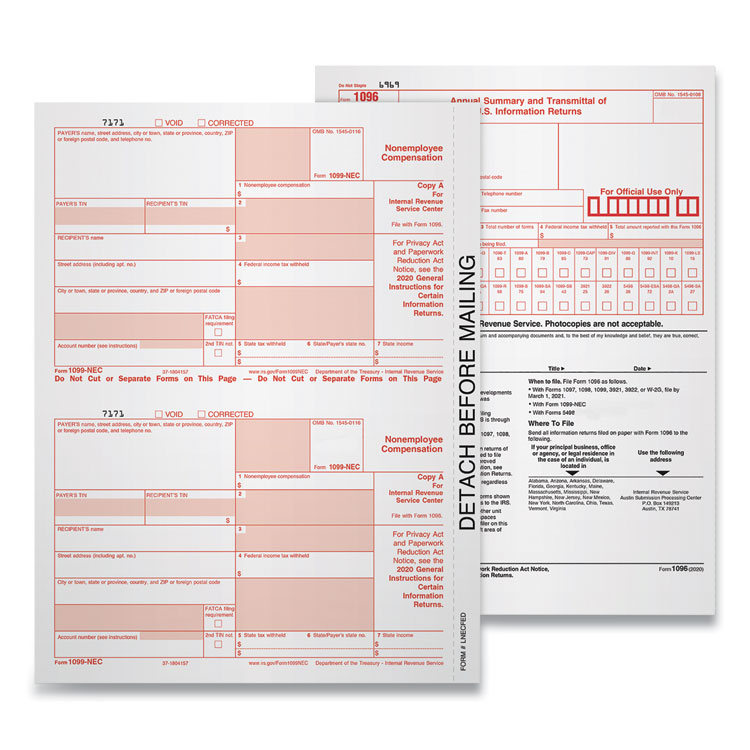

5Part 1099NEC Tax Forms, 8.5 x 11, 50/Pack TOP22993NECES

Do not print and file a form 1096 downloaded from this website; Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit.irs.gov/orderforms. Web form 1096 is due by january 31. Ad access irs tax forms. Web the 1096 form summarizes the information from the 1099 forms you are submitting for the.

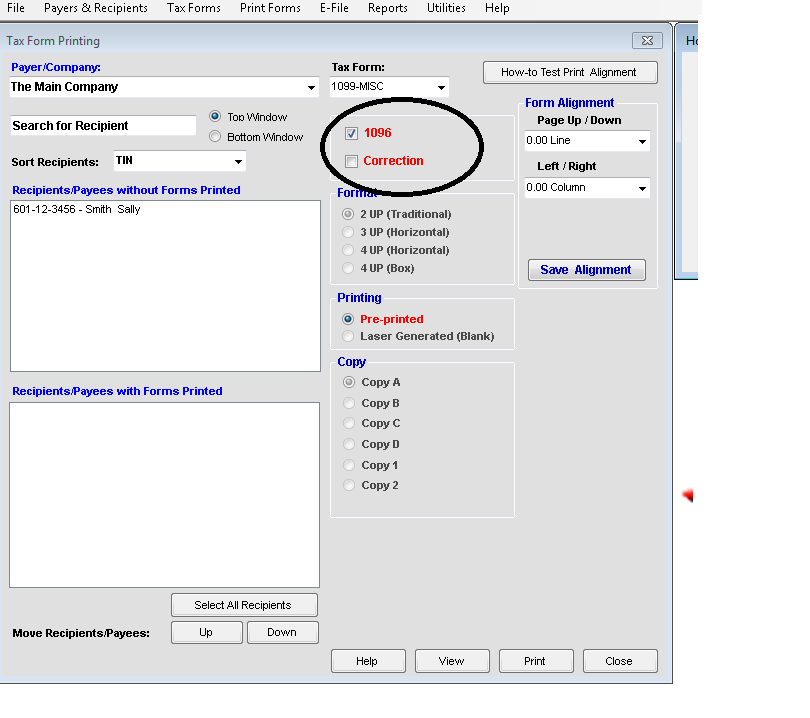

How to Print a 1096 Form Tax Software & Web Support Services

Do not print and file a form 1096 downloaded from this website; Web form 1096 is due by january 31. You would only need to file 1096 if your 1099s are in paper. You are subject to a $50 fine. Complete, edit or print tax forms instantly.

Printable 1096 Form 2021 Customize and Print

Ad get the latest 1096 form online. Web the irs provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. You must have a scannable version of the. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Fill, edit, download & print.

Printable Form 1096 / Form 1096 Annual Summary And Transmittal Of U S

Web the form asks for the business’s identifying information, total number and type of form, and the total amount of income tax withheld. Web form 1096 is due by january 31. On average this form takes 7 minutes to. Do not print and file a form 1096 downloaded from this website; Web the irs provide tax assistance to taxpayers and.

Fillable Form 1096 Edit, Sign & Download in PDF PDFRun

Click on employer and information returns, and we'll. Information returns in april 2022, so this is the latest version of form 1096, fully updated for tax year 2022. You are subject to a $50 fine. Web form 1096 is due by january 31. Web the official printed version of this irs form is scannable, but a copy, printed from this.

2010 Form 1096 Edit, Fill, Sign Online Handypdf

Web the official printed version of this irs form is scannable, but a copy, printed from this website, is not. Information returns in april 2022, so this is the latest version of form 1096, fully updated for tax year 2022. Click on employer and information returns, and. In contrast, all 1096, 1098, 1098,. You must submit the red scannable from.

Printable Form 1096 Free W2, W3, 1099MISC, 1096 forms free Offer

Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit.irs.gov/orderforms. You must submit the red scannable from to the irs. Ad access irs tax forms. Click on employer and information returns, and. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit.

Printable Form 1096 / Form 1096 Annual Summary And Transmittal Of U S

Information returns in april 2022, so this is the latest version of form 1096, fully updated for tax year 2022. You are subject to a $50 fine. Web once completed you can sign your fillable form or send for signing. You must submit the red scannable from to the irs. Web the official printed version of this irs form is.

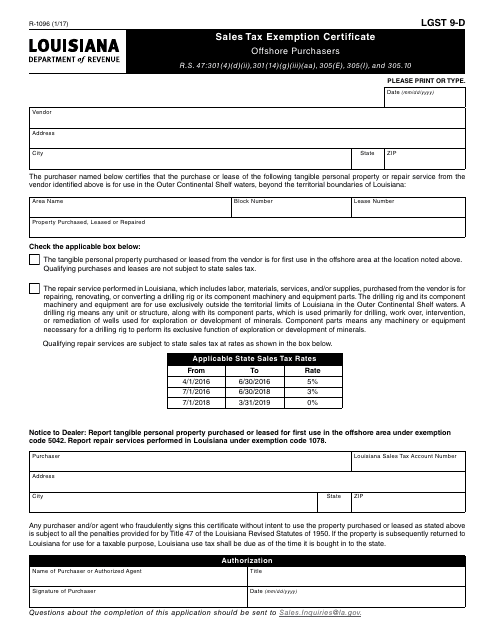

Form R1096 Download Fillable PDF or Fill Online Sales Tax Exemption

Web get the printable 1096 blank at pdfliner by choosing fill out form button and completing it online. Ad access irs tax forms. Information returns in april 2022, so this is the latest version of form 1096, fully updated for tax year 2022. Web file form 1096 as follows. Complete, edit or print tax forms instantly.

Downloadable Irs Form 1096 Form Resume Examples N8VZj7DVwe

Complete, edit or print tax forms instantly. Web file form 1096 as follows. You are subject to a $50 fine. Do not print and file a form 1096 downloaded from this website; Web the form asks for the business’s identifying information, total number and type of form, and the total amount of income tax withheld.

Complete, Edit Or Print Tax Forms Instantly.

Click on employer and information returns, and we'll. You are subject to a $50 fine. You would only need to file 1096 if your 1099s are in paper. Information returns) is an internal revenue service (irs) tax form.

Do Not Print And File A Form 1096 Downloaded From This Website;

Web get the printable 1096 blank at pdfliner by choosing fill out form button and completing it online. Web get a 1096 here. You must submit the red scannable from to the irs. Web the official printed version of this irs form is scannable, but a copy, printed from this website, is not.

If You Would Like To Get Simply A Blank, Go To The Official Website And Download.

You must have a scannable version of the. Complete, edit or print tax forms instantly. Information returns in april 2022, so this is the latest version of form 1096, fully updated for tax year 2022. Web once completed you can sign your fillable form or send for signing.

Fill, Edit, Download & Print.

All forms are printable and downloadable. On average this form takes 7 minutes to. Web file form 1096 as follows. Web the form asks for the business’s identifying information, total number and type of form, and the total amount of income tax withheld.