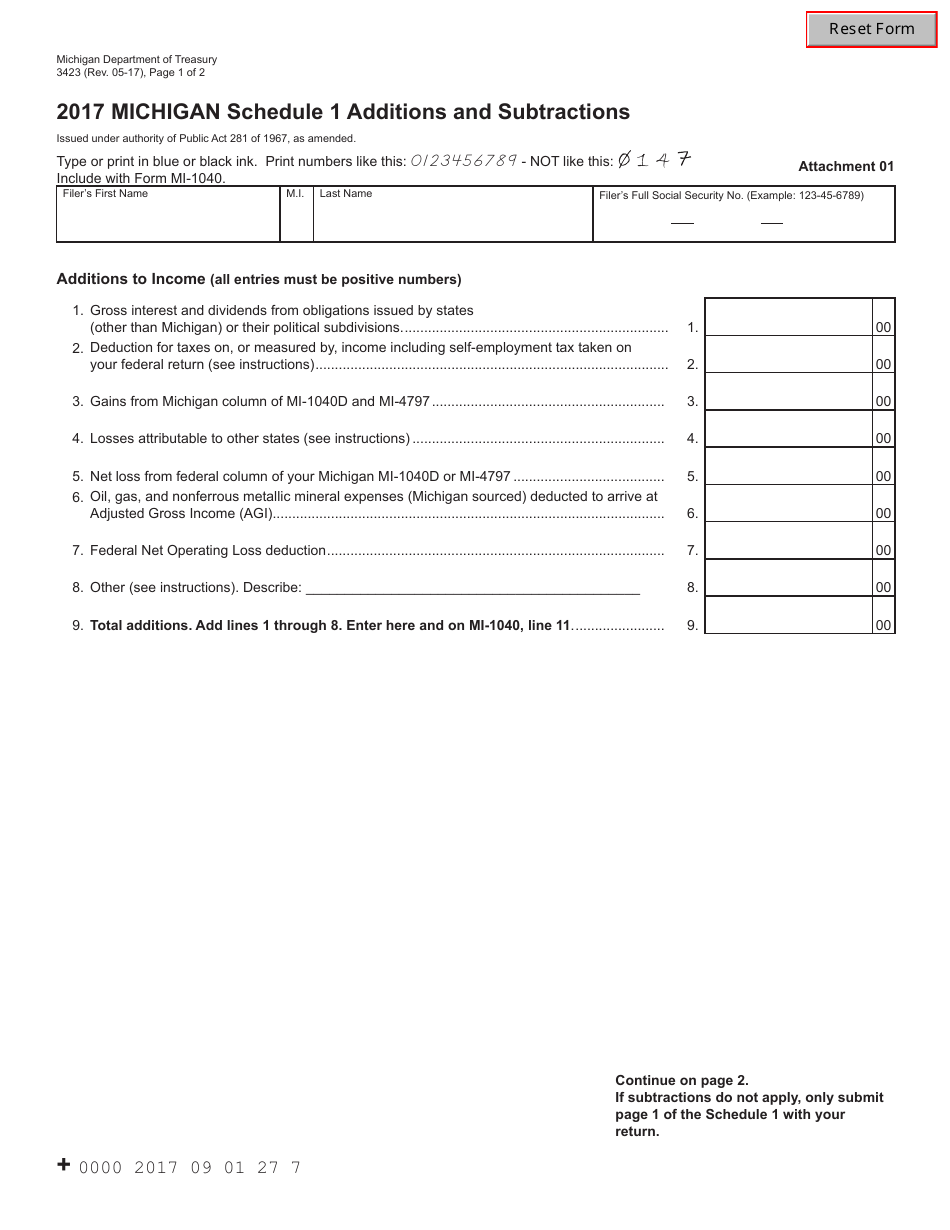

Schedule 1 Michigan Tax Form

Schedule 1 Michigan Tax Form - 2021 michigan schedule 1 additions and subtractions. Schedule amd (form 5530) amended return explanation of changes: More about the michigan schedule 1 we last updated. Web instructions michigan state income tax forms for current and previous tax years. Here is a comprehensive list of. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need. Web michigan pension schedule (form 4884) and schedule 1, line 25. More about the michigan schedule 1 instructions. Web must be reported on •the michigan pension schedule (form 4884) and schedule 1, line 25.

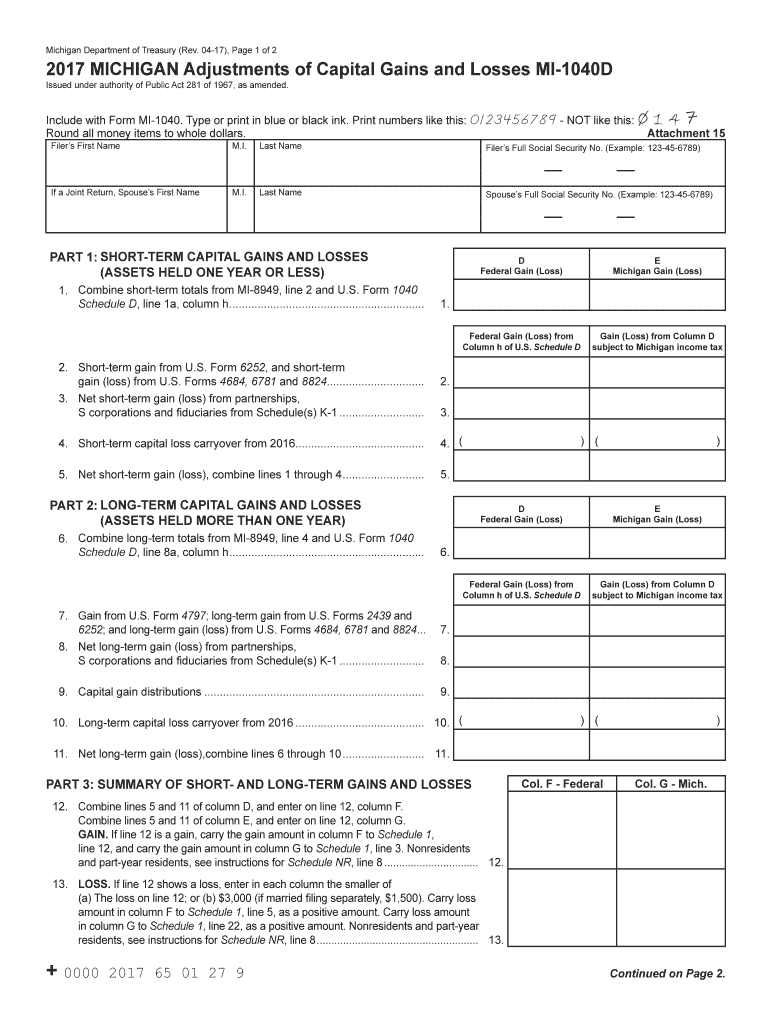

Schedule amd (form 5530) amended return explanation of changes: Web must be reported on •the michigan pension schedule (form 4884) and schedule 1, line 25. 2020 michigan schedule 1 additions and subtractions. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. This form is used by michigan residents who file an individual income tax return. Web instructions michigan state income tax forms for current and previous tax years. Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Web michigan pension schedule (form 4884) and schedule 1, line 25. Here is a comprehensive list of. More about the michigan schedule 1 instructions.

Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Web michigan pension schedule (form 4884) and schedule 1, line 25. More about the michigan schedule 1 we last updated. Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need. Web michigan department of treasury 3423 (rev. Issued under authority of public act 281 of 1967,. 2020 michigan schedule 1 additions and subtractions. Web michigan department of treasury 3423 (rev. Here is a comprehensive list of.

Michigan Schedule 1 Form Fill Out and Sign Printable PDF Template

Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Issued under authority of public act 281 of 1967,. Web must be reported on •the michigan pension schedule (form 4884) and schedule 1, line 25. More about the michigan schedule 1 we last updated. 2020 michigan schedule 1 additions and subtractions.

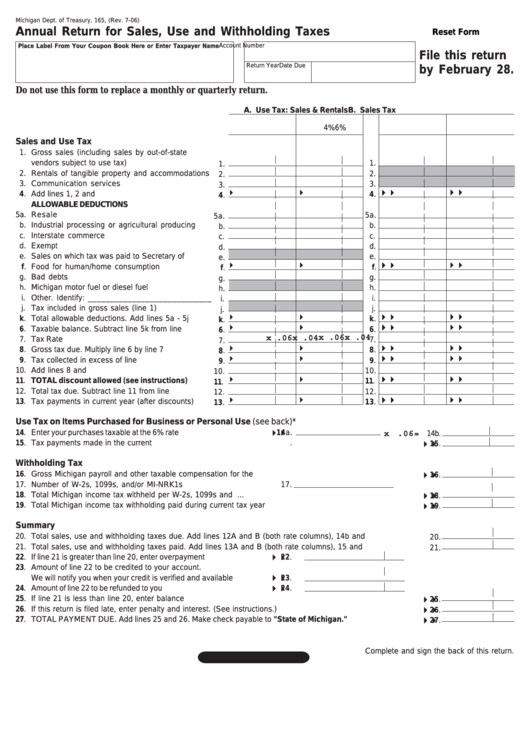

006 Page1 1200Px State And Local Sales Tax Rates Pdf Michigan Form

Issued under authority of public act 281 of 1967,. Web must be reported on •the michigan pension schedule (form 4884) and schedule 1, line 25. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Web michigan department of treasury 3423 (rev. More about.

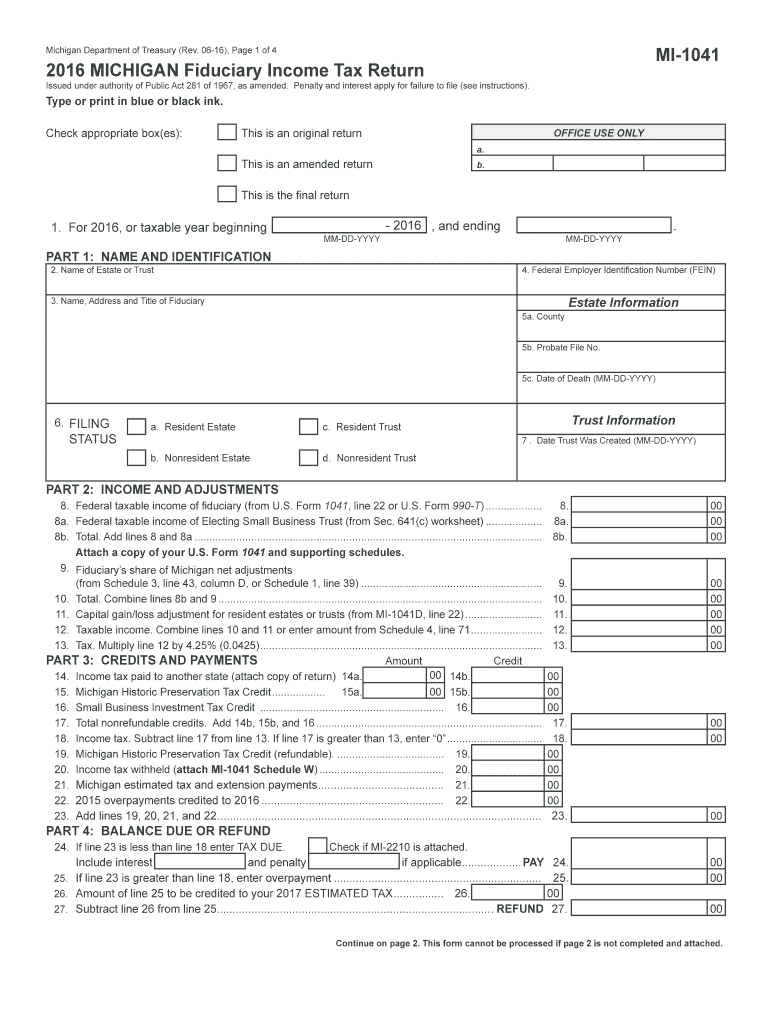

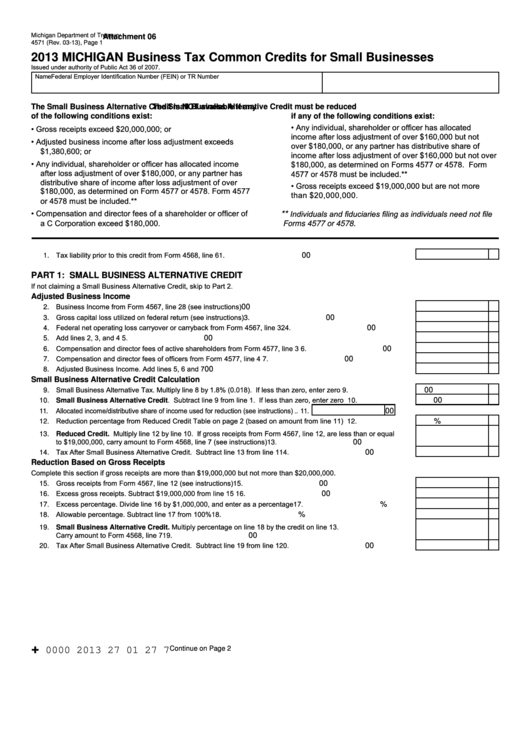

Form 4571 Michigan Business Tax Common Credits For Small Businesses

Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. More about the michigan schedule 1 we last updated. Issued under authority of public act 281 of 1967,. Schedule amd (form 5530) amended return explanation of changes: Web must be.

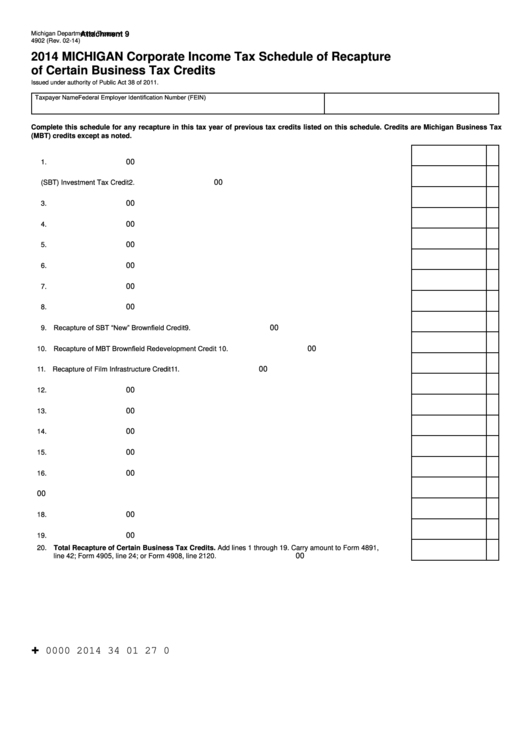

Form 4902 Michigan Corporate Tax Schedule Of Recapture Of

For example, if you know the form has the word change in the title,. Web michigan pension schedule (form 4884) and schedule 1, line 25. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. More about the michigan schedule 1 we last updated..

Michigan State Tax Form 2020 23 Tips That Will Make You Influential

More about the michigan schedule 1 we last updated. Web michigan pension schedule (form 4884) and schedule 1, line 25. More about the michigan schedule 1 instructions. Issued under authority of public act 281 of 1967,. 2020 michigan schedule 1 additions and subtractions.

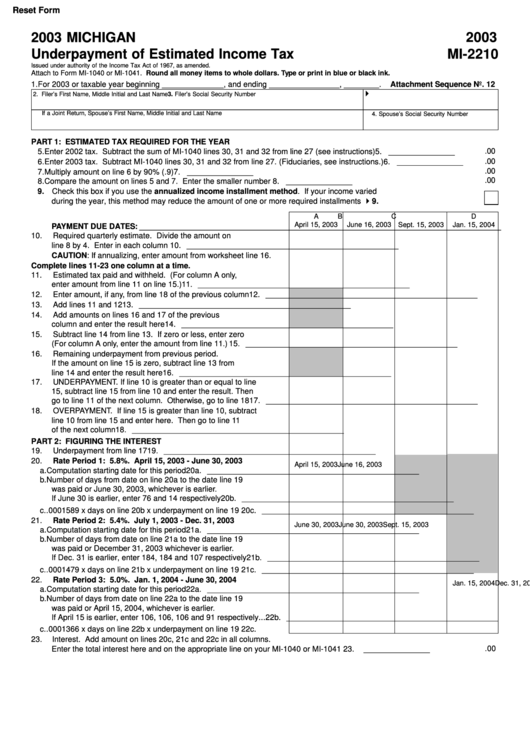

Fillable Form Mi2210 Michigan Underpayment Of Estimated Tax

Issued under authority of public act 281 of 1967,. Web instructions michigan state income tax forms for current and previous tax years. Web michigan department of treasury 3423 (rev. For example, if you know the form has the word change in the title,. More about the michigan schedule 1 we last updated.

Michigan State Tax Form 2020 23 Tips That Will Make You Influential

Schedule amd (form 5530) amended return explanation of changes: For example, if you know the form has the word change in the title,. 2021 michigan schedule 1 additions and subtractions. Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need. Web michigan department of treasury 3423 (rev.

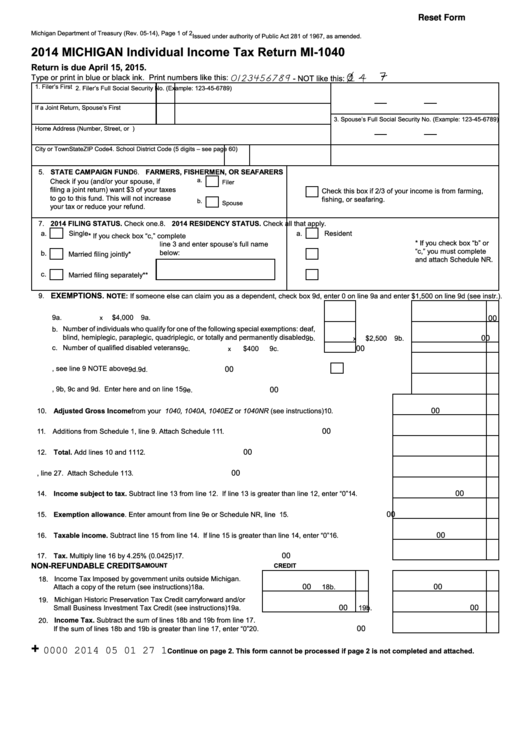

Mi 1040 Fill Out and Sign Printable PDF Template signNow

Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need. This form is used by michigan residents who file an individual income tax return. Web instructions michigan state income tax forms for current and previous tax years. Schedule amd (form 5530) amended return explanation of changes: More.

Form 3423 Schedule 1 Download Fillable PDF or Fill Online Additions and

Web michigan department of treasury 3423 (rev. Issued under authority of public act 281 of 1967,. Here is a comprehensive list of. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. Issued under authority of public act 281 of.

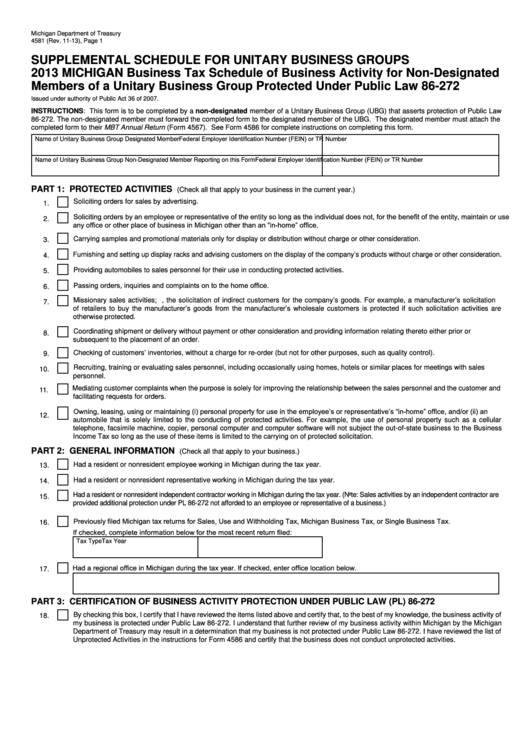

Form 4581 Michigan Business Tax Schedule Of Business Activity For Non

Here is a comprehensive list of. Web michigan department of treasury 3423 (rev. More about the michigan schedule 1 we last updated. Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Issued under authority of public act 281 of 1967,.

Here Is A Comprehensive List Of.

Web instructions michigan state income tax forms for current and previous tax years. Web michigan pension schedule (form 4884) and schedule 1, line 25. Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need.

Schedule Amd (Form 5530) Amended Return Explanation Of Changes:

2021 michigan schedule 1 additions and subtractions. Web michigan department of treasury 3423 (rev. This form is used by michigan residents who file an individual income tax return. Web michigan department of treasury 3423 (rev.

Web Must Be Reported On •The Michigan Pension Schedule (Form 4884) And Schedule 1, Line 25.

Issued under authority of public act 281 of 1967,. More about the michigan schedule 1 we last updated. Issued under authority of public act 281 of 1967,. 2020 michigan schedule 1 additions and subtractions.

More About The Michigan Schedule 1 Instructions.

For example, if you know the form has the word change in the title,. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022.