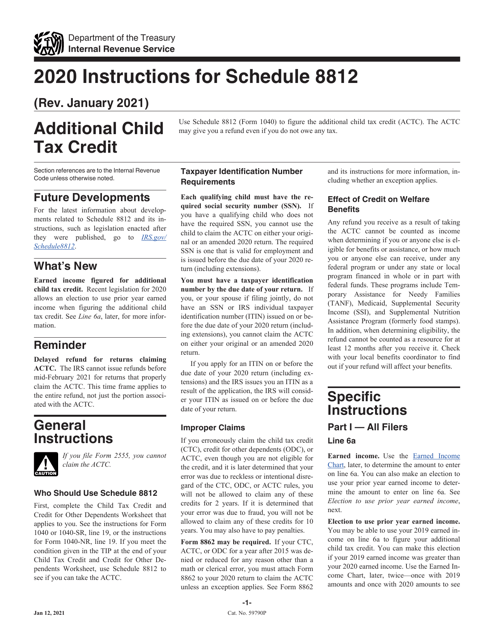

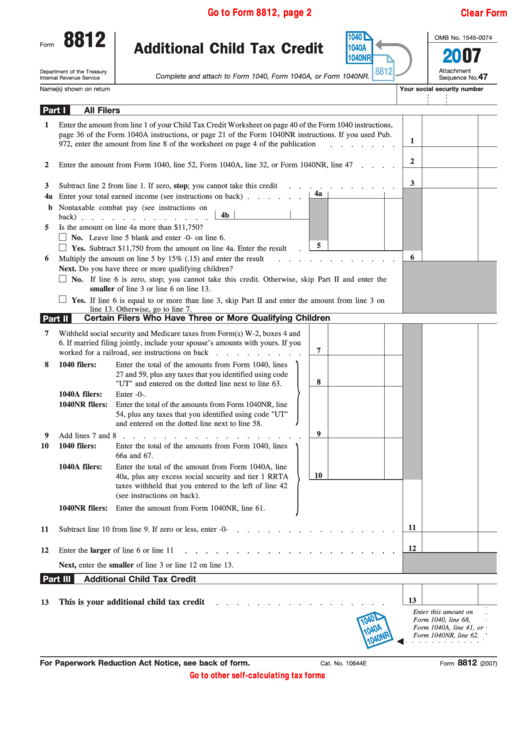

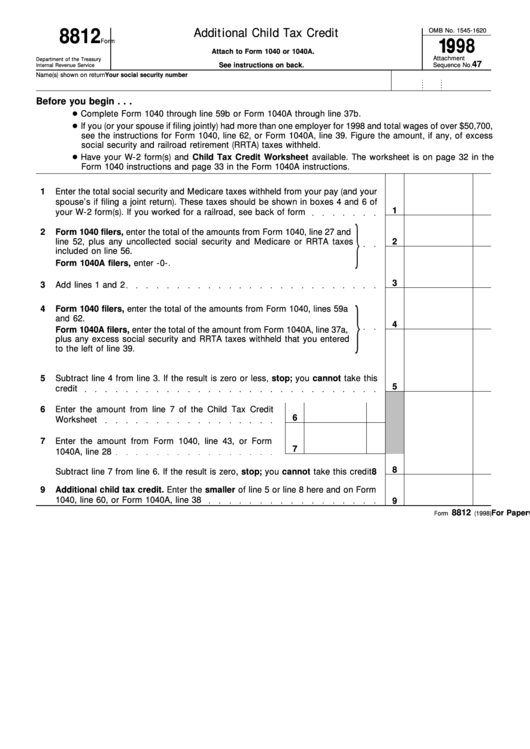

Schedule 8812 Form 2022

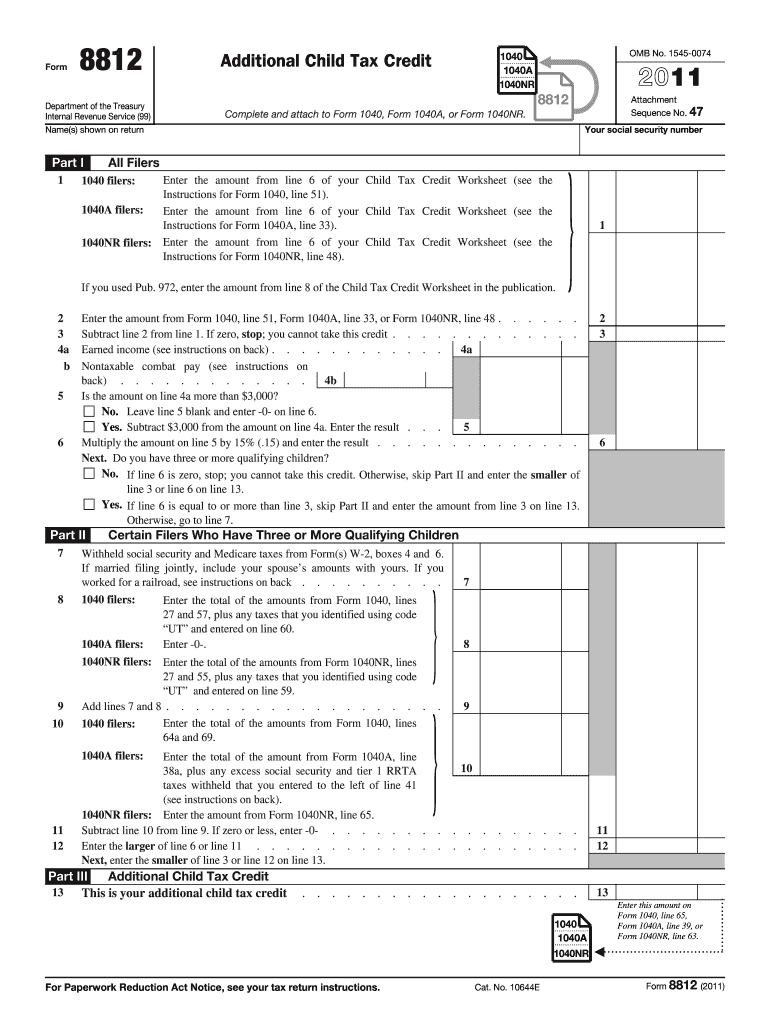

Schedule 8812 Form 2022 - Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax. You can download or print current or. Choose the correct version of the editable pdf. Ad access irs tax forms. Web 8812 name(s) shown on return your social security number part i all filers caution: You cannot claim the additional child tax credit. If you file form 2555, stop here; Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Child tax credit and credit for other dependents.

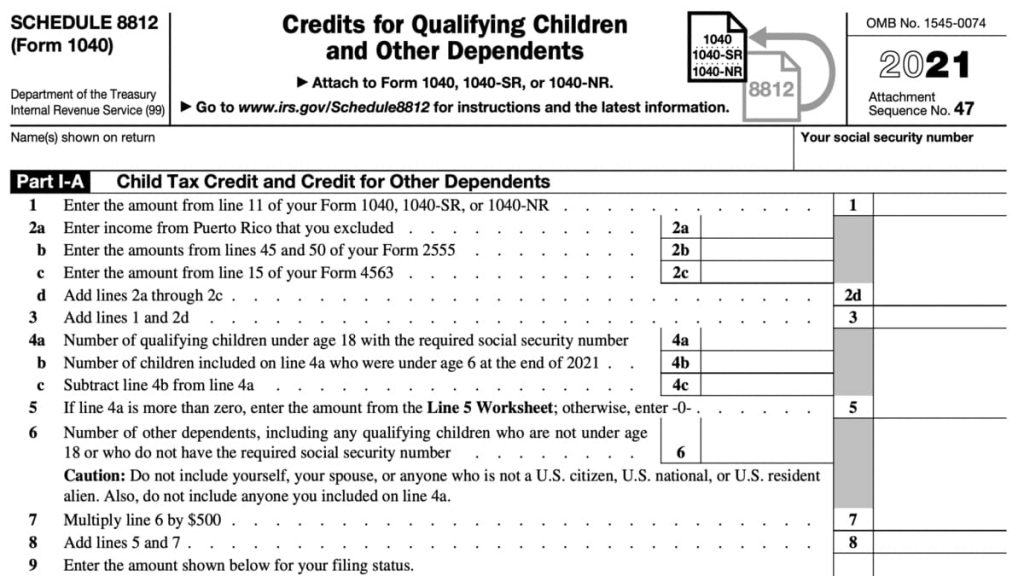

From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web 🚧 schedule 8812 the form type a_1040_schedule_8812_2022 supports data capture from the irs 1040 schedule 8812 only. This form is for income earned in tax year 2022, with tax returns due. I discuss the 3,600 and 3,000 child tax credit. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Complete, edit or print tax forms instantly. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to. Web we last updated federal 1040 (schedule 8812) in december 2022 from the federal internal revenue service.

Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. In part i, you'll enter information from your form. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to. Complete, edit or print tax forms instantly. Choose the correct version of the editable pdf. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Claim your child tax credit along with your other credits for. Should be completed by all filers to claim the basic child tax credit. Web for 2022, there are two parts to this form: Child tax credit and credit for other dependents.

Download Instructions for IRS Form 1040 Schedule 8812 Additional Child

Claim your child tax credit along with your other credits for. Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. I discuss the 3,600 and 3,000 child tax credit. Complete, edit or print tax forms instantly. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc),.

Top 8 Form 8812 Templates free to download in PDF format

This form is for income earned in tax year 2022, with tax returns due. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Claim your child tax credit along with your other credits for. Web 🚧 schedule 8812 the form type a_1040_schedule_8812_2022 supports data capture from the irs 1040 schedule 8812.

What Is The Credit Limit Worksheet A For Form 8812

Claim your child tax credit along with your other credits for. Choose the correct version of the editable pdf. Web we last updated federal 1040 (schedule 8812) in december 2022 from the federal internal revenue service. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and.

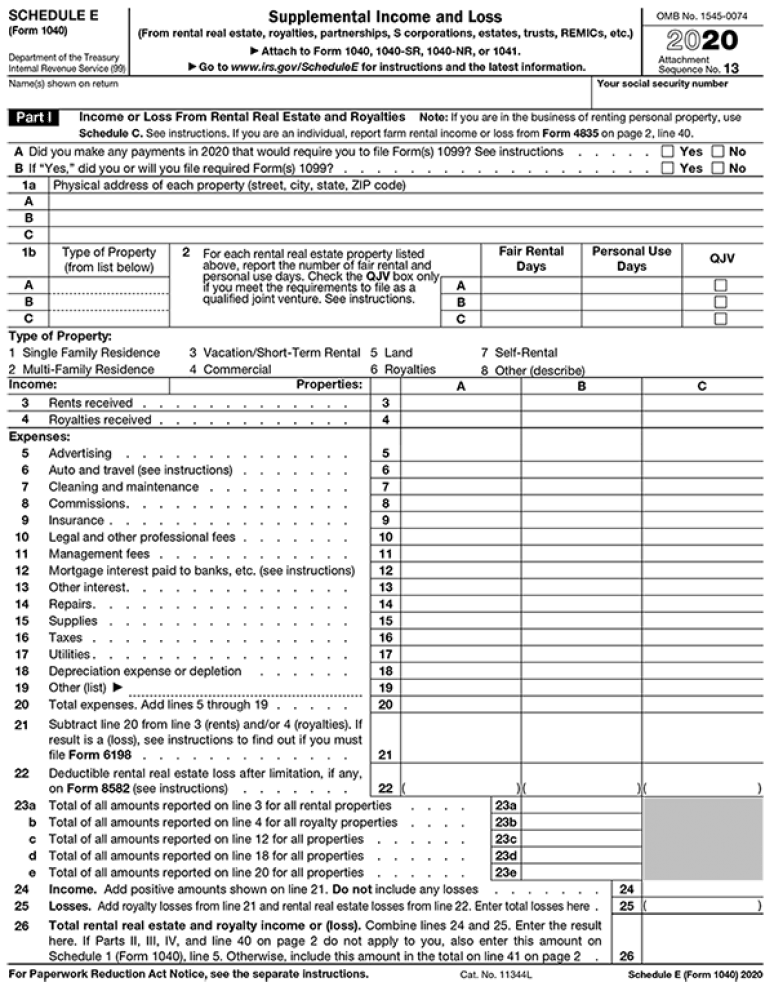

2020 Tax Form Schedule E U.S. Government Bookstore

Web solved • by turbotax • 3264 • updated january 25, 2023. Choose the correct version of the editable pdf. Form 1040 (first 2 pages) is processed as a. You cannot claim the additional child tax credit. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax.

️Form 8812 Worksheet 2013 Free Download Goodimg.co

Ad access irs tax forms. Web we last updated the child tax credit in december 2022, so this is the latest version of 1040 (schedule 8812), fully updated for tax year 2022. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to. Form 1040 (first 2 pages).

Schedule 8812 Credit Limit Worksheet A

Web for tax year 2021 only: Web 8812 name(s) shown on return your social security number part i all filers caution: Web below are answers to frequently asked questions about the credits for qualifying children and other dependents, schedule 8812. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Web you.

2022 Form IRS 1040 Schedule 8812 Instructions Fill Online, Printable

From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax. Web 8812 name(s) shown on return your social security number part i all filers caution: Web 🚧 schedule 8812 the form type a_1040_schedule_8812_2022 supports data capture from the irs 1040 schedule 8812 only. Web solved • by turbotax • 3264 • updated january.

8812 Worksheet

Web solved • by turbotax • 3264 • updated january 25, 2023. This form is for income earned in tax year 2022, with tax returns due. Ad access irs tax forms. Complete, edit or print tax forms instantly. If you file form 2555, stop here;

2023 Schedule 3 2022 Online File PDF Schedules TaxUni

Ad access irs tax forms. Irs instructions for form 8812. Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to. Web 🚧 schedule 8812 the form type a_1040_schedule_8812_2022 supports data capture from the irs 1040 schedule 8812 only. You cannot claim the additional child tax credit.

Schedule 8812 Instructions for Credits for Qualifying Children and

Irs instructions for form 8812. Web for 2022, there are two parts to this form: Web schedule 8812 (form 1040) 2021 credits for qualifying children and other dependents department of the treasury internal revenue service (99) attach to. If you file form 2555, stop here; Complete, edit or print tax forms instantly.

Web For 2022, There Are Two Parts To This Form:

Complete, edit or print tax forms instantly. Claim your child tax credit along with your other credits for. I discuss the 3,600 and 3,000 child tax credit. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any.

Ad Access Irs Tax Forms.

Web solved • by turbotax • 3264 • updated january 25, 2023. Child tax credit and credit for other dependents. You cannot claim the additional child tax credit. Should be completed by all filers to claim the basic child tax credit.

From July 2021 To December 2021, Taxpayers May Have Received An Advance Payment Of The Child Tax.

This form is for income earned in tax year 2022, with tax returns due. You can download or print current or. If you file form 2555, stop here; Web you should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year.

Web For Tax Year 2021 Only:

In part i, you'll enter information from your form. Web below are answers to frequently asked questions about the credits for qualifying children and other dependents, schedule 8812. Web 8812 name(s) shown on return your social security number part i all filers caution: Form 1040 (first 2 pages) is processed as a.