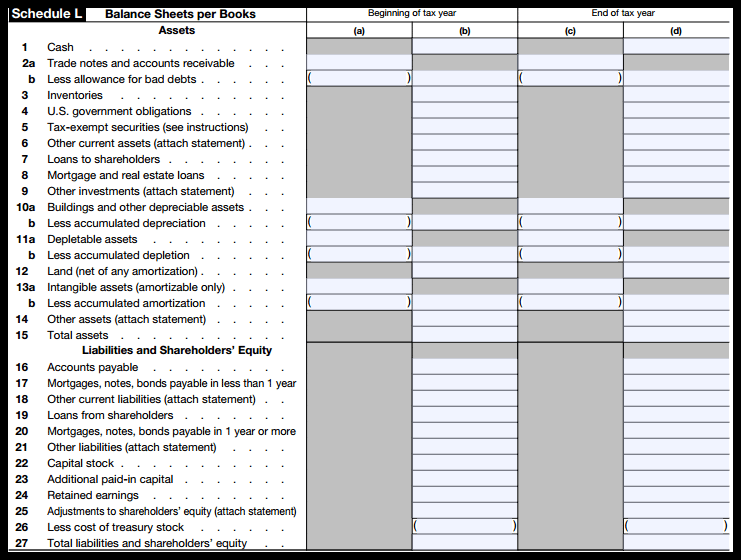

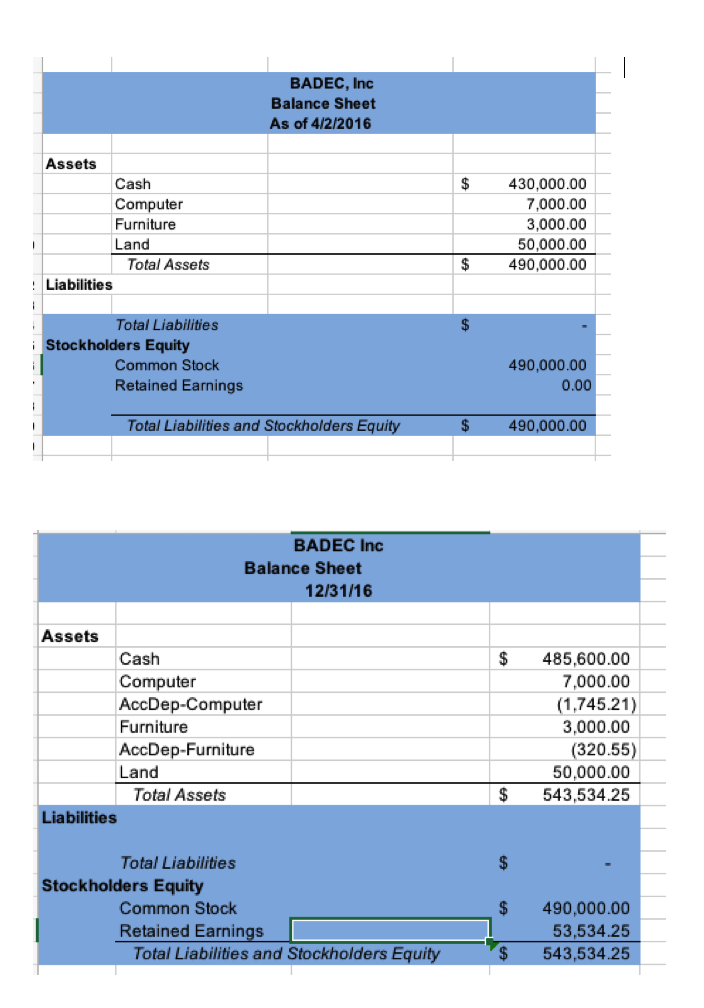

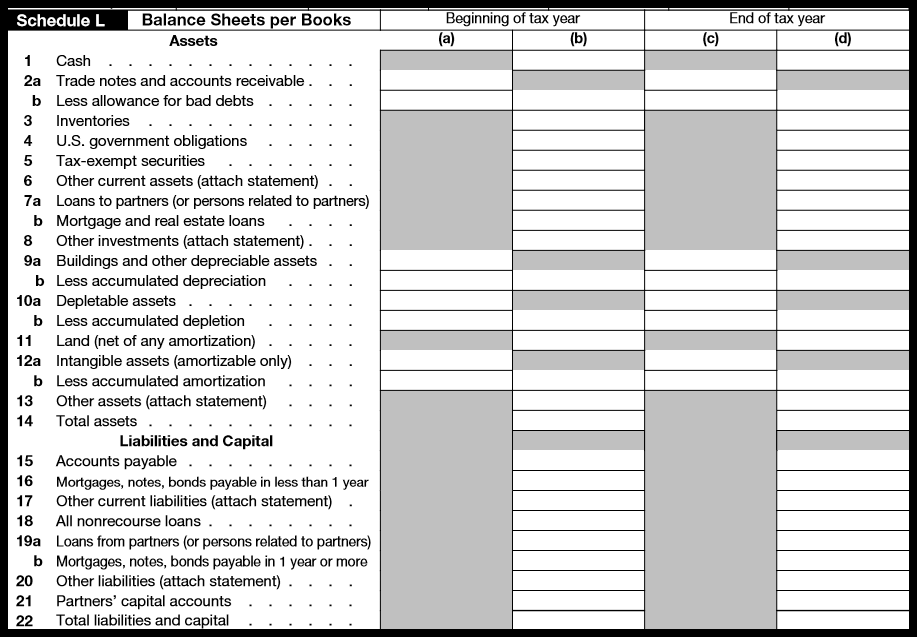

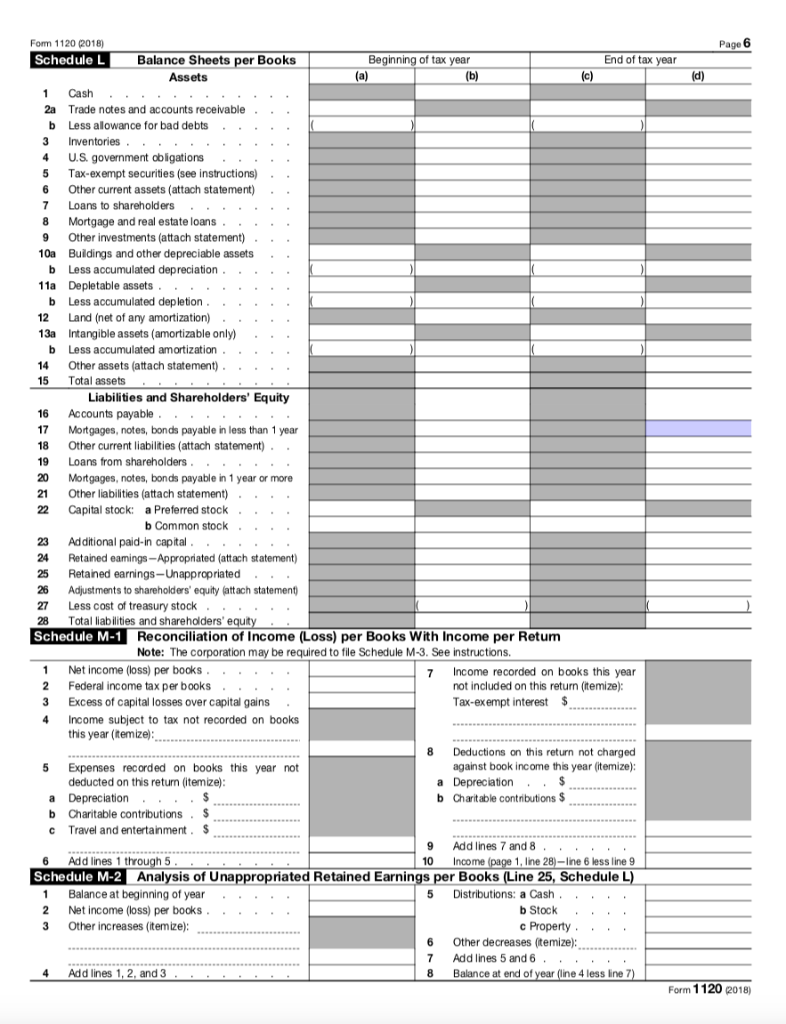

Schedule L Balance Sheet

Schedule L Balance Sheet - Reconciliation of income (loss) per books. If your corporation's total receipts for the tax year. Web schedule l first, make sure you actually have to file schedule l.

Reconciliation of income (loss) per books. If your corporation's total receipts for the tax year. Web schedule l first, make sure you actually have to file schedule l.

Web schedule l first, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year. Reconciliation of income (loss) per books.

Sensational Schedule L Balance Sheet Example Format Excel Free Download

Reconciliation of income (loss) per books. Web schedule l first, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year.

Schedule L (Balance Sheets per Books) for Form 1120S White Coat

If your corporation's total receipts for the tax year. Web schedule l first, make sure you actually have to file schedule l. Reconciliation of income (loss) per books.

IRS Form 1120S Schedules L, M1, and M2 (2018) Balance Sheet (L

Reconciliation of income (loss) per books. If your corporation's total receipts for the tax year. Web schedule l first, make sure you actually have to file schedule l.

Schedule L Transactions with Interested Persons Definition

Reconciliation of income (loss) per books. Web schedule l first, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year.

How to Complete Form 1120S Tax Return for an S Corp

If your corporation's total receipts for the tax year. Web schedule l first, make sure you actually have to file schedule l. Reconciliation of income (loss) per books.

1120 EF Message 0042 Schedule M2 is out of Balance (M1, M2, ScheduleL)

Web schedule l first, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year. Reconciliation of income (loss) per books.

Balance Sheet By Location QuickBooks Data in Google Sheets

Reconciliation of income (loss) per books. If your corporation's total receipts for the tax year. Web schedule l first, make sure you actually have to file schedule l.

Solved Form complete Schedule L for the balance sheet

Reconciliation of income (loss) per books. Web schedule l first, make sure you actually have to file schedule l. If your corporation's total receipts for the tax year.

Balance Sheet for Business Owners

Web schedule l first, make sure you actually have to file schedule l. Reconciliation of income (loss) per books. If your corporation's total receipts for the tax year.

Reconciliation Of Income (Loss) Per Books.

If your corporation's total receipts for the tax year. Web schedule l first, make sure you actually have to file schedule l.

:max_bytes(150000):strip_icc()/schedL-4d80767f28944a2c919bd3e0bcf4a761.jpg)