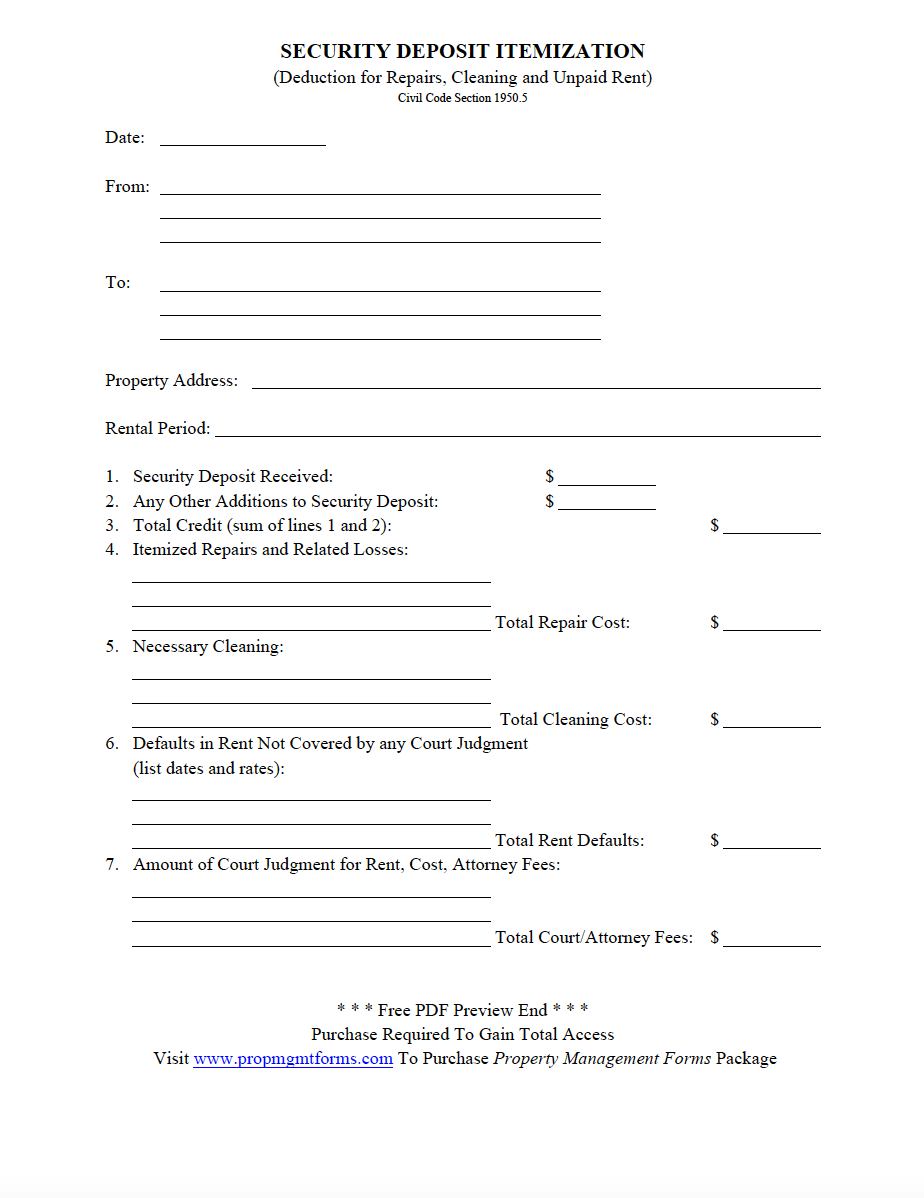

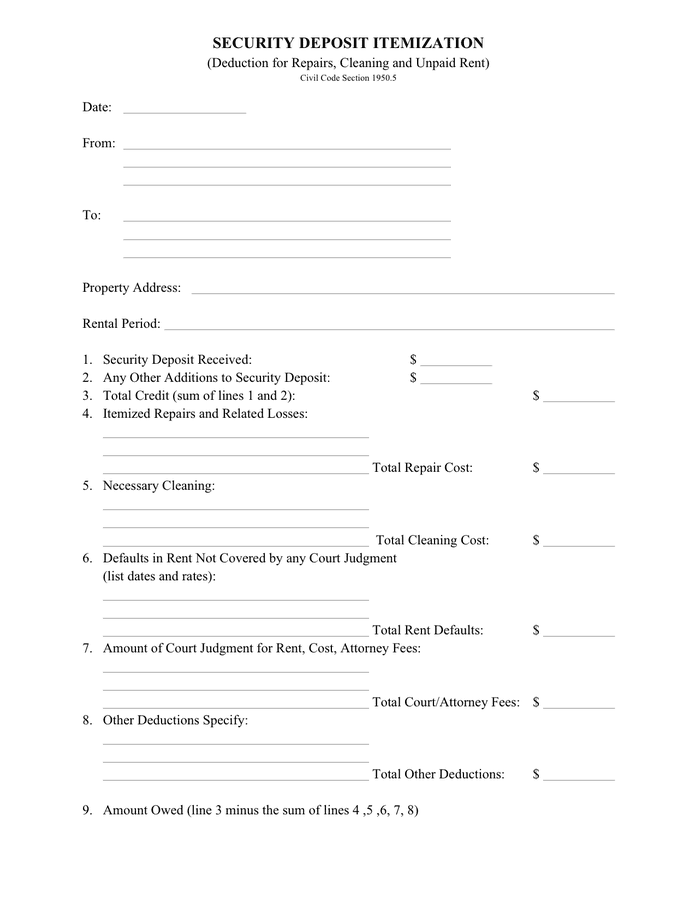

Security Deposit Itemized Deduction Form

Security Deposit Itemized Deduction Form - Amount owed (line 3 minus. The deductions exceed the security deposit tendered. Web itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster. Web one, all subtractions must be made with writing with an itemized security deposit form (see below for our free template) two, you should receive all deposition deductions. Web security deposit received $ _____ list of damaged property with amount deducted. Web amount of court judgment for rent, cost, attorney fees: Web this section requires a landlord who is withholding a portion of a security deposit to provide an itemized and written list of the deductions to the tenant. Web this form is used by a residential property manager or landlord when a tenant has vacated a premises and the landlord holds the tenant's security deposit, to provide the tenant. What the withheld amount will be used for; How much of the tenant’s security deposit is being withheld;

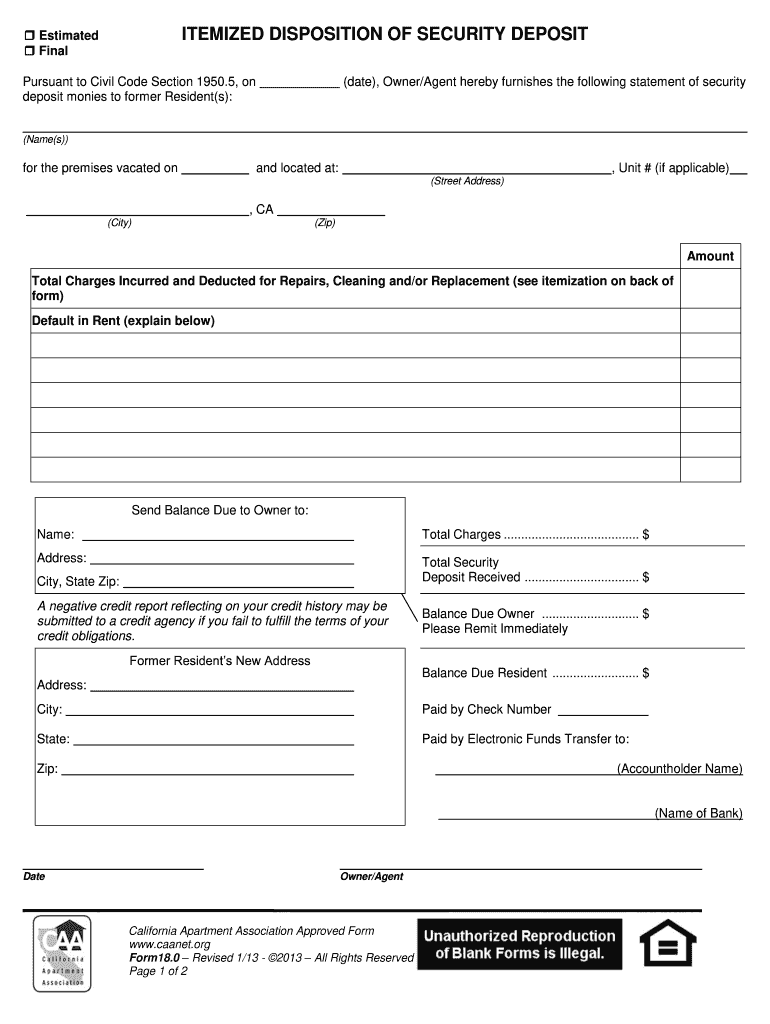

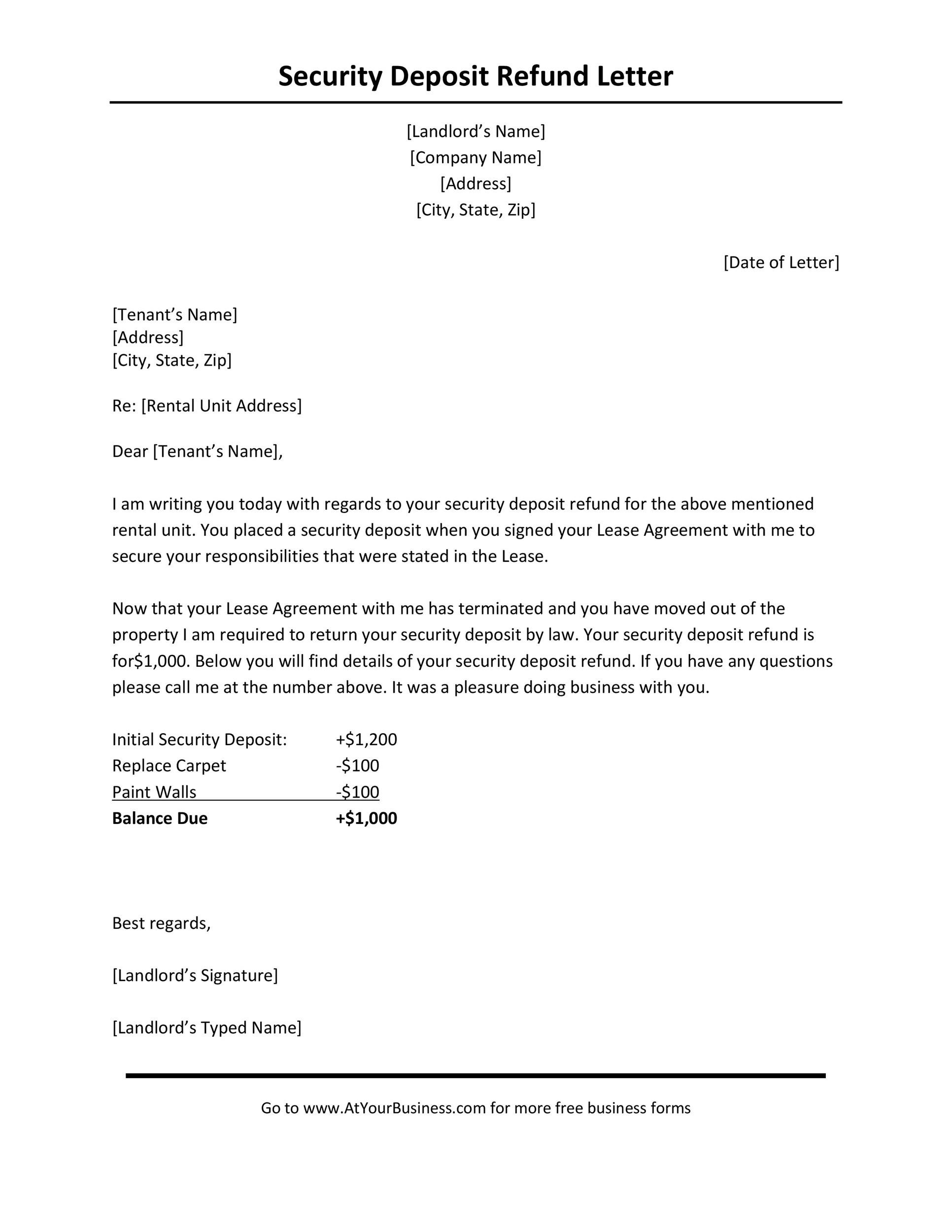

Web the landlord’s itemized security deposit deductions list while you can copy this list wholesale, we recommend paying attention to your own local market. What the withheld amount will be used for; Ad register and subscribe now to work on itemized security dep deduction letter & more forms. Web the total amount of itemized deductions is then summed on the form, and this total is carried onto the second page of the form 1040. Web a disposition of security deposit, or security deposit deduction form, is used by landlords to provide tenants a detailed breakdown of charges applied against the. How much of the tenant’s security deposit is being withheld; Web if a security deposit amount is to be used as the tenant's final month's rent, it is advance rent that you include as income when you receive it, rather than when you. Web 2022 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. Avoid security deposit disputes by clearly itemizing your deductions when a tenant moves out. The deductions exceed the security deposit tendered.

Web itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster. Web 2022 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. Amount owed (line 3 minus. Web one, all deductions must be made the script is an itemized security deposit form (see down for our free template) two, you should claim all deposit deductions as soon as. Web if a security deposit amount is to be used as the tenant's final month's rent, it is advance rent that you include as income when you receive it, rather than when you. Cleaning the rental unit when a tenant moves out, but only to make it as clean as. Web the total amount of itemized deductions is then summed on the form, and this total is carried onto the second page of the form 1040. In most cases, your federal income tax will be less if. The deductions exceed the security deposit tendered. Web this form is used by a residential property manager or landlord when a tenant has vacated a premises and the landlord holds the tenant's security deposit, to provide the tenant.

Property Management Forms Contracts, Agreements, Templates Download

What the withheld amount will be used for; Cleaning the rental unit when a tenant moves out, but only to make it as clean as. Web one, all deductions must be made in writing with an itemized security deposit form (see below for our free template) two, you should claim all deposit deductions as soon as. Web one, all deductions.

The Landlord's Itemized List of Common Tenant Deposit Deductions

Web up to 25% cash back buy now. The deductions exceed the security deposit tendered. Web amount of court judgment for rent, cost, attorney fees: Web a security deposit deposition is a form that explains: Ad register and subscribe now to work on itemized security dep deduction letter & more forms.

Security deposit itemization form in Word and Pdf formats

In most cases, your federal income tax will be less if. Web one, all deductions must be made in writing with an itemized security deposit form (see below for our free template) two, you should claim all deposit deductions as soon as. How much of the tenant’s security deposit is being withheld; Use get form or simply click on the.

Security Deposit Return California Fill Out and Sign Printable PDF

Avoid security deposit disputes by clearly itemizing your deductions when a tenant moves out. Web amount of court judgment for rent, cost, attorney fees: Web $ $ $ $ $ $ $ $ $ which represents the balance of the security b. Web one, all subtractions must be made with writing with an itemized security deposit form (see below for.

8 Simple Security Deposit Form For Your Legally Agreement hennessy events

Web up to 25% cash back buy now. Web a security deposit deposition is a form that explains: Cleaning the rental unit when a tenant moves out, but only to make it as clean as. Web itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster..

Free Michigan Security Deposit Itemized Deductions Notice Itemized

Web this form is used by a residential property manager or landlord when a tenant has vacated a premises and the landlord holds the tenant's security deposit, to provide the tenant. Use this form to detail exactly why you're legally. Web one, all deductions must be made the script is an itemized security deposit form (see down for our free.

Free printable legal form. Itemized security deposit deduction form

Web one, all subtractions must be made with writing with an itemized security deposit form (see below for our free template) two, you should receive all deposition deductions. Web security deposit received $ _____ list of damaged property with amount deducted. Web this form is used by a residential property manager or landlord when a tenant has vacated a premises.

Itemized Security Deposit Deduction Letter Database Letter Template

Web if a security deposit amount is to be used as the tenant's final month's rent, it is advance rent that you include as income when you receive it, rather than when you. Avoid security deposit disputes by clearly itemizing your deductions when a tenant moves out. Web the total amount of itemized deductions is then summed on the form,.

Get Our Sample of Request For Return Of Security Deposit Form Being a

Web $ $ $ $ $ $ $ $ $ which represents the balance of the security b. Web a landlord can only deduct certain items from a security deposit the landlord can deduct for: Web amount of court judgment for rent, cost, attorney fees: Landlord hereby demands payment of the excess. Use this form to detail exactly why you're.

Get Our Example of Rental Security Deposit Refund Form Deduction

The deductions exceed the security deposit tendered. Web a security deposit deposition is a form that explains: Web one, all deductions must be made the script is an itemized security deposit form (see down for our free template) two, you should claim all deposit deductions as soon as. Web $ $ $ $ $ $ $ $ $ which represents.

Web A Security Deposit Deposition Is A Form That Explains:

Web the total amount of itemized deductions is then summed on the form, and this total is carried onto the second page of the form 1040. Web one, all deductions must be made in writing with an itemized security deposit form (see below for our free template) two, you should claim all deposit deductions as soon as. How much of the tenant’s security deposit is being withheld; Amount owed (line 3 minus.

Web This Section Requires A Landlord Who Is Withholding A Portion Of A Security Deposit To Provide An Itemized And Written List Of The Deductions To The Tenant.

Web one, all deductions must be made the script is an itemized security deposit form (see down for our free template) two, you should claim all deposit deductions as soon as. Avoid security deposit disputes by clearly itemizing your deductions when a tenant moves out. Web amount of court judgment for rent, cost, attorney fees: Cleaning the rental unit when a tenant moves out, but only to make it as clean as.

The Deductions Exceed The Security Deposit Tendered.

Web the landlord’s itemized security deposit deductions list while you can copy this list wholesale, we recommend paying attention to your own local market. Ad register and subscribe now to work on itemized security dep deduction letter & more forms. Web this form is used by a residential property manager or landlord when a tenant has vacated a premises and the landlord holds the tenant's security deposit, to provide the tenant. What the withheld amount will be used for;

In Most Cases, Your Federal Income Tax Will Be Less If.

Web if a security deposit amount is to be used as the tenant's final month's rent, it is advance rent that you include as income when you receive it, rather than when you. Web a landlord can only deduct certain items from a security deposit the landlord can deduct for: Use get form or simply click on the template preview to open it in the editor. Web itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster.