Shareholder Basis Form

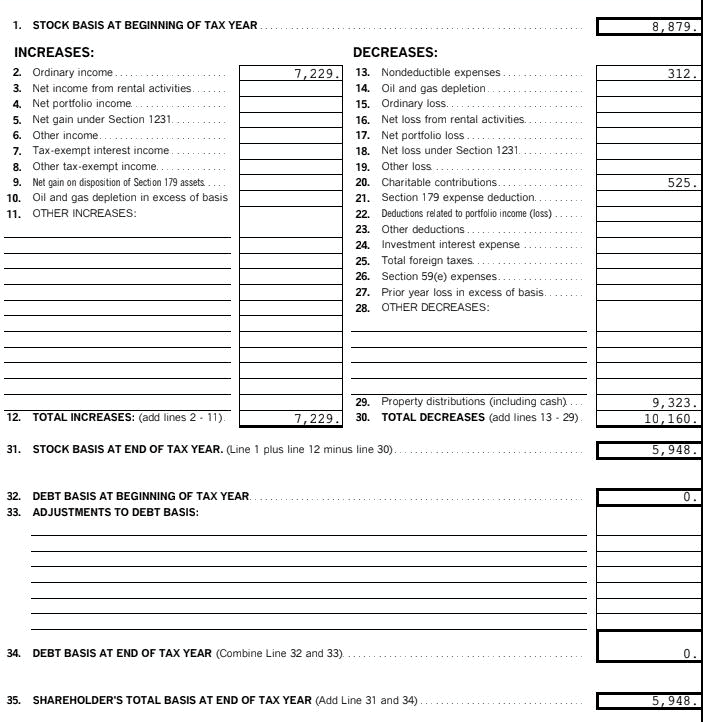

Shareholder Basis Form - Synonyms for form a basis. Web there has been an increased focus on the compliance to basis tracking. Here is what s corporation leaders need to know:. Easily customize your shareholder agreement. Web intuit help intuit shareholder basis input and calculation in the s corporation module of proconnect solved • by intuit • 2 • updated january 18, 2023 this article. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Ad answer simple questions to make a shareholder agreement on any device in minutes. Starting tax year 2021, shareholders are required to file form 7203, and attach it to their form 1040 to. Other code sections might also cause a reduction in s. The irs doesn’t provide a specific form for tracking partner basis.

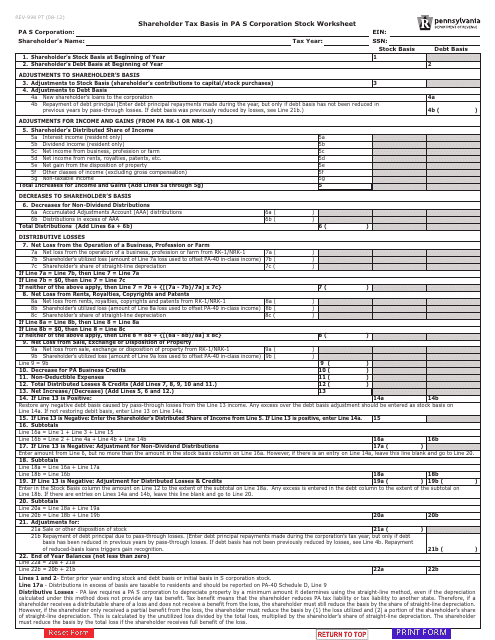

Back to table of contents. Web you should generally use form 7203, s corporation shareholder stock and debt basis limitations, to figure your aggregate stock and debt basis. Web generally, distributions will be nontaxable to a shareholder up to stock basis unless the corporation has earnings and profits (in which case, the shareholder might have dividend. Web here's a worksheet for tracking a shareholder's stock basis. Save time and money by creating and downloading any legally binding agreement in minutes. Ad create your shareholder agreement online. Web schedule e page 2, per the form instructions, if an individual reports a loss, receives a distribution, disposes of stock, or receives a loan repayment from an s. Income tax return for an s corporation, and federal form 4797, sales of. S shareholder losses limited to basis in stock and debt of the s corp. Taxact supports the ability to attach the shareholder’s basis worksheet when required.

Synonyms for form a basis. Web schedule e page 2, per the form instructions, if an individual reports a loss, receives a distribution, disposes of stock, or receives a loan repayment from an s. Web there has been an increased focus on the compliance to basis tracking. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Other code sections might also cause a. Save time and money by creating and downloading any legally binding agreement in minutes. Starting tax year 2021, shareholders are required to file form 7203, and attach it to their form 1040 to. Web generally, distributions will be nontaxable to a shareholder up to stock basis unless the corporation has earnings and profits (in which case, the shareholder might have dividend. Basis is increased by (a) all. Ad answer simple questions to make a shareholder agreement on any device in minutes.

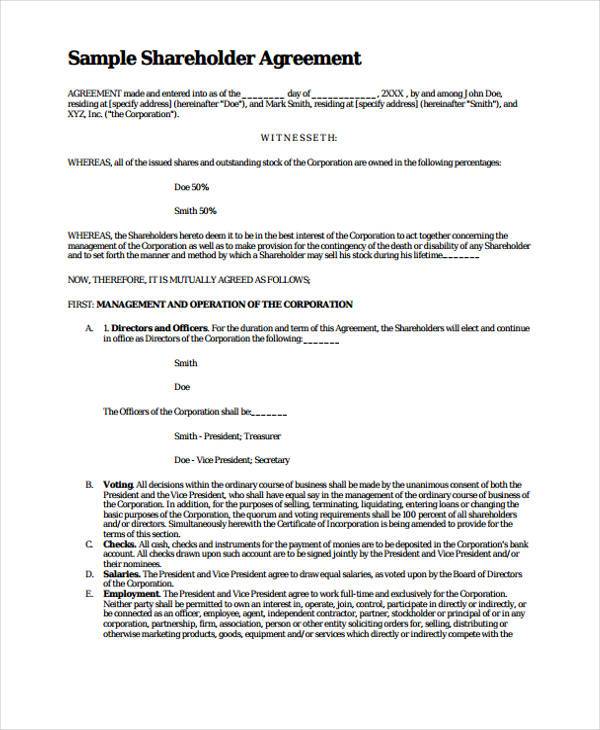

FREE 9+ Shareholder Agreement Forms in PDF MS Word

Web a new tax form is expected for 2021 that will bring even more questions from shareholders regarding tax basis. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Taxact supports the ability to attach the shareholder’s basis worksheet when required. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet.

FREE 9+ Shareholder Agreement Forms in PDF MS Word

Other code sections might also cause a. Web another way to say form a basis? The irs doesn’t provide a specific form for tracking partner basis. Starting tax year 2021, shareholders are required to file form 7203, and attach it to their form 1040 to. Web starting in tax year 2021, form 7203 is used to figure shareholder basis.

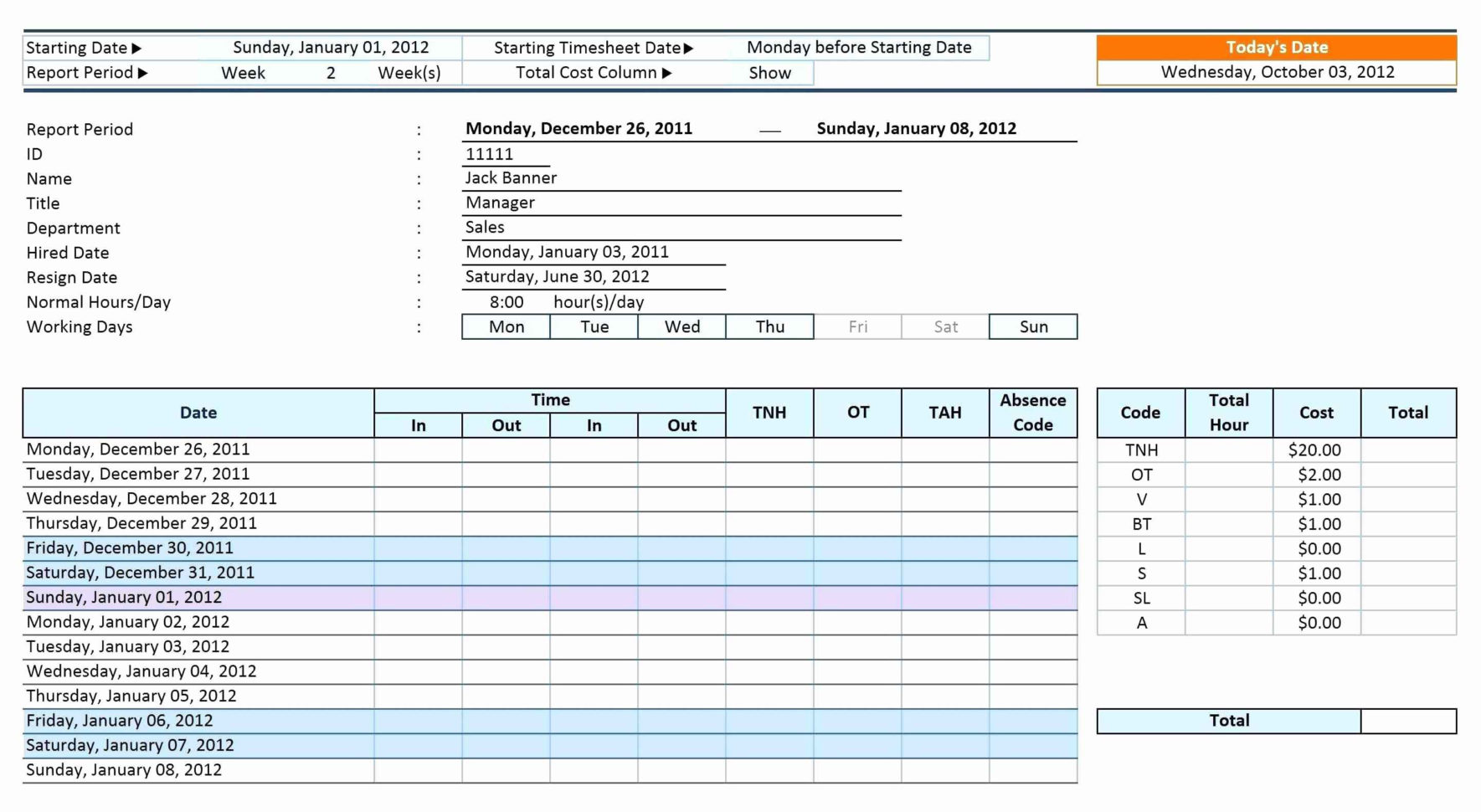

S Corp Basis Worksheet Studying Worksheets

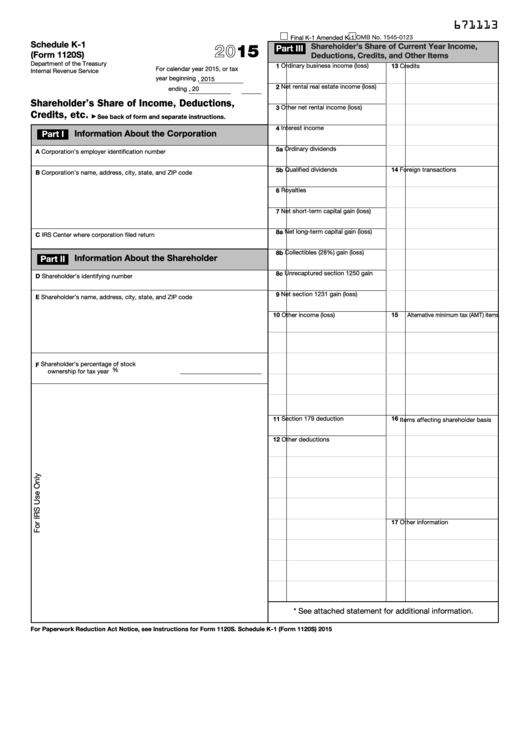

Web solved • by intuit • 149 • updated january 18, 2023 this article will help you generate shareholder basis statements that you can provide to shareholders with their. Income tax return for an s corporation, and federal form 4797, sales of. Starting tax year 2021, shareholders are required to file form 7203, and attach it to their form 1040.

REV998 Shareholder Tax Basis in PA S Corporation Stock Worksheet

Save time and money by creating and downloading any legally binding agreement in minutes. Basis is increased by (a) all. Web solved • by intuit • 68 • updated january 18, 2023. Web starting in tax year 2021, form 7203 is used to figure shareholder basis. Part i of form 7203 addresses adjustments to stock basis as provided under section.

Shareholder Basis Worksheet Excel Escolagersonalvesgui

Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Web a new tax form is expected for 2021 that will bring even more questions from shareholders regarding tax basis. Here is what s corporation leaders need to know:. Web here's a worksheet for tracking a shareholder's stock basis. The irs doesn’t provide a specific.

Podcast New S corporation shareholder basis reporting form YouTube

Taxact supports the ability to attach the shareholder’s basis worksheet when required. Web you should generally use form 7203, s corporation shareholder stock and debt basis limitations, to figure your aggregate stock and debt basis. Web form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been generated as.

FREE 9+ Shareholder Agreement Forms in PDF MS Word

Web you should generally use form 7203, s corporation shareholder stock and debt basis limitations, to figure your aggregate stock and debt basis. In order to see this option. Web here's a worksheet for tracking a shareholder's stock basis. Web there has been an increased focus on the compliance to basis tracking. Other code sections might also cause a.

Stock Cost Basis Spreadsheet For Cost Basis Spreadsheet Excel

Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Starting tax year 2021, shareholders are required to file form 7203, and attach it to their form 1040 to. Taxact supports the ability to attach the shareholder’s basis worksheet when required. Ad create your shareholder agreement online. Web schedule e page 2, per the form.

Shareholder Basis Worksheet Pdf Free Printable Worksheets

Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. This article will help you generate shareholder basis statements that you can provide to shareholders with their. Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Income tax return for an s corporation, and federal form 4797, sales of..

Fillable Schedule K1 (Form 1120s) Shareholder'S Share Of

In order to see this option. Income tax return for an s corporation, and federal form 4797, sales of. Web a new tax form is expected for 2021 that will bring even more questions from shareholders regarding tax basis. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt.

Web Form 7203 Is A New Form Developed By Irs To Replace The Shareholder’s Stock And Debt Basis Worksheet That Has Previously Been Generated As Part Of Returns.

Web basis for s shareholders the basics: Synonyms for form a basis. S shareholder losses limited to basis in stock and debt of the s corp. Web there has been an increased focus on the compliance to basis tracking.

Other Code Sections Might Also Cause A.

Part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Web here's a worksheet for tracking a shareholder's stock basis. Web generally, distributions will be nontaxable to a shareholder up to stock basis unless the corporation has earnings and profits (in which case, the shareholder might have dividend. Income tax return for an s corporation, and federal form 4797, sales of.

Web Solved • By Intuit • 149 • Updated January 18, 2023 This Article Will Help You Generate Shareholder Basis Statements That You Can Provide To Shareholders With Their.

Easily customize your shareholder agreement. Starting tax year 2021, shareholders are required to file form 7203, and attach it to their form 1040 to. Ad create your shareholder agreement online. Web schedule e page 2, per the form instructions, if an individual reports a loss, receives a distribution, disposes of stock, or receives a loan repayment from an s.

Web A New Tax Form Is Expected For 2021 That Will Bring Even More Questions From Shareholders Regarding Tax Basis.

Web another way to say form a basis? Here is what s corporation leaders need to know:. Web starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a shareholder’s stock and debt basis) in the 1040 return. Web starting in tax year 2021, form 7203 is used to figure shareholder basis.