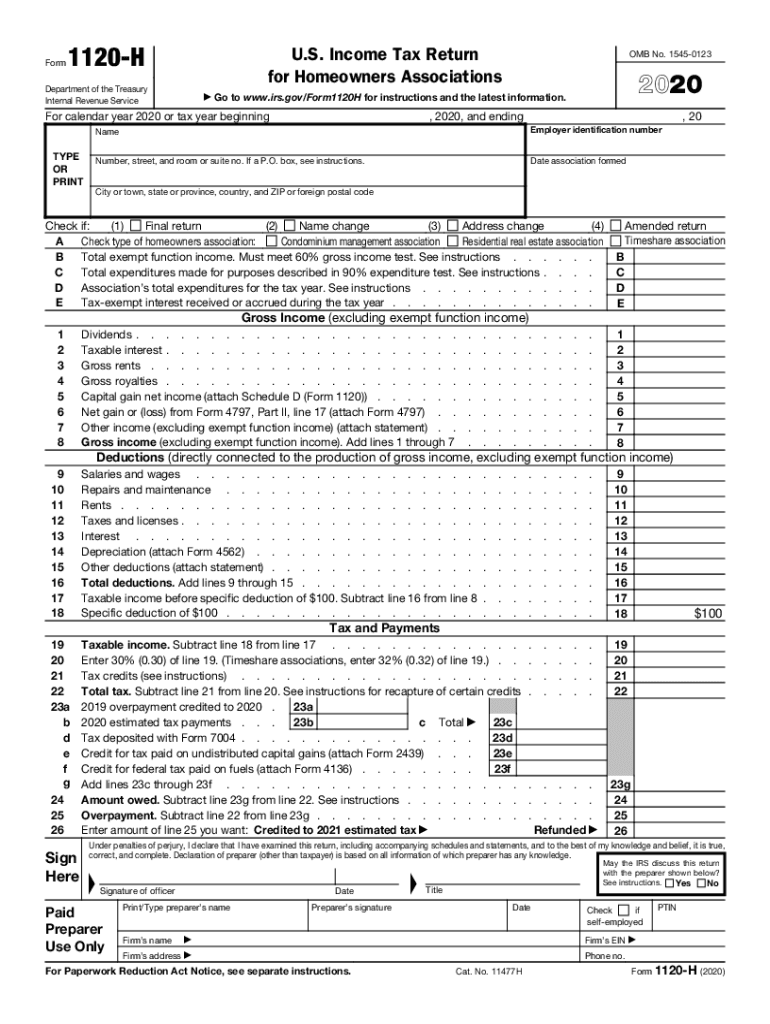

Tax Form 1120-H 2022

Tax Form 1120-H 2022 - Get ready for tax season deadlines by completing any required tax forms today. Web the corporation must show its 2023 tax year on the 2022 form 1120 and take into account any tax law changes that are effective for tax years beginning after december 31, 2022. There are some important differences. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Ad access irs tax forms. Income tax return for homeowners associations. This form is for income earned in tax year 2022, with tax returns due in april. Income tax return for homeowners associations keywords: Form 1120 and 1120h united states (english) united states (spanish) canada (english) canada (french) full service for personal taxes tax refund.

Complete, edit or print tax forms instantly. Click on the button get form to open it and begin modifying. Web it appears you don't have a pdf plugin for this browser. Use the following irs center address. This form is for income earned in tax year 2022, with tax returns due in april. There are some important differences. Web credited to 2022 estimated tax. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Web updated for tax year 2022 • june 2, 2023 08:47 am overview depending on your business type, there are different ways to prepare and file your taxes. Ad easy guidance & tools for c corporation tax returns. Complete, edit or print tax forms instantly. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Get ready for tax season deadlines by completing any required tax forms today. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. Income tax return for homeowners associations keywords: Income tax return for homeowners associations. Complete, edit or print tax forms instantly.

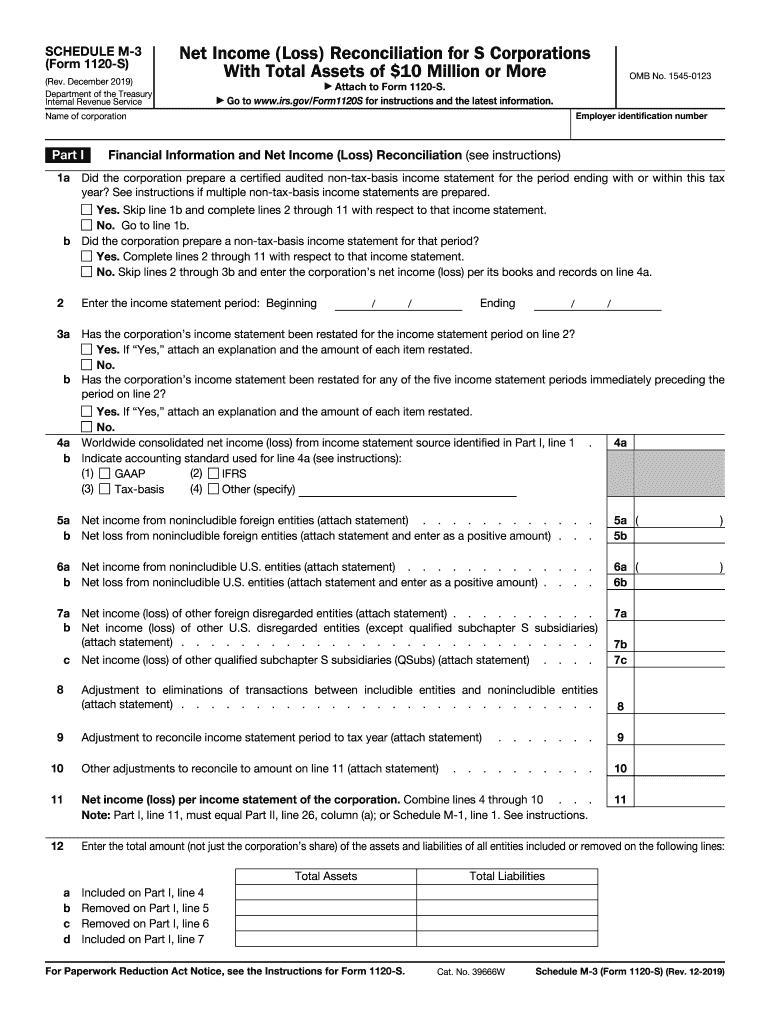

20192021 Form IRS 1120S Schedule M3 Fill Online, Printable

Click on the button get form to open it and begin modifying. Web updated for tax year 2022 • june 2, 2023 08:47 am overview depending on your business type, there are different ways to prepare and file your taxes. Web the corporation must show its 2023 tax year on the 2022 form 1120 and take into account any tax.

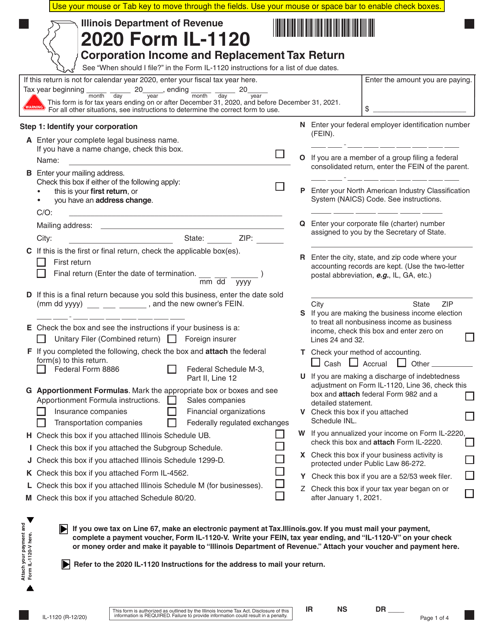

Form IL1120 Download Fillable PDF or Fill Online Corporation

Web credited to 2022 estimated tax. Web updated for tax year 2022 • june 2, 2023 08:47 am overview depending on your business type, there are different ways to prepare and file your taxes. Use the following irs center address. Ad access irs tax forms. Income tax return for homeowners associations keywords:

1120s schedule d instructions

Web the corporation must show its 2023 tax year on the 2022 form 1120 and take into account any tax law changes that are effective for tax years beginning after december 31, 2022. Ad access irs tax forms. Click on the button get form to open it and begin modifying. Web summary but the interesting part is that hoas actually.

Fillable Schedule H (Form 1120) Section 280h Limitations For A

Click on the button get form to open it and begin modifying. Web updated for tax year 2022 • june 2, 2023 08:47 am overview depending on your business type, there are different ways to prepare and file your taxes. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of.

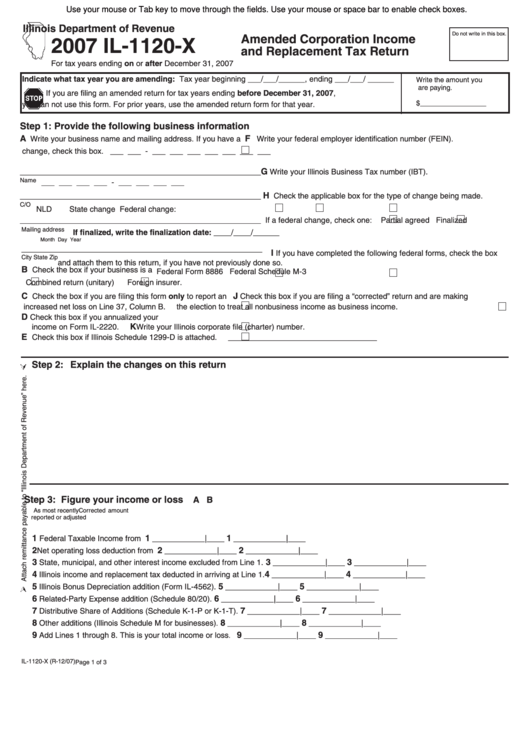

Fillable Form Il1120X Amended Corporation And Replacement

Income tax return for homeowners associations. Complete, edit or print tax forms instantly. Use the following irs center address. Ad access irs tax forms. Ad access irs tax forms.

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

Income tax return for homeowners associations. Get ready for tax season deadlines by completing any required tax forms today. Form 1120 and 1120h united states (english) united states (spanish) canada (english) canada (french) full service for personal taxes tax refund. Web updated for tax year 2022 • june 2, 2023 08:47 am overview depending on your business type, there are.

Form 1120 Fill out & sign online DocHub

There are some important differences. Web it appears you don't have a pdf plugin for this browser. Ad access irs tax forms. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly.

Ssurvivor Form 2553 Sample

Use the following irs center address. Web summary but the interesting part is that hoas actually have an option to file two different tax forms: Form 1120 and 1120h united states (english) united states (spanish) canada (english) canada (french) full service for personal taxes tax refund. There are some important differences. Web credited to 2022 estimated tax.

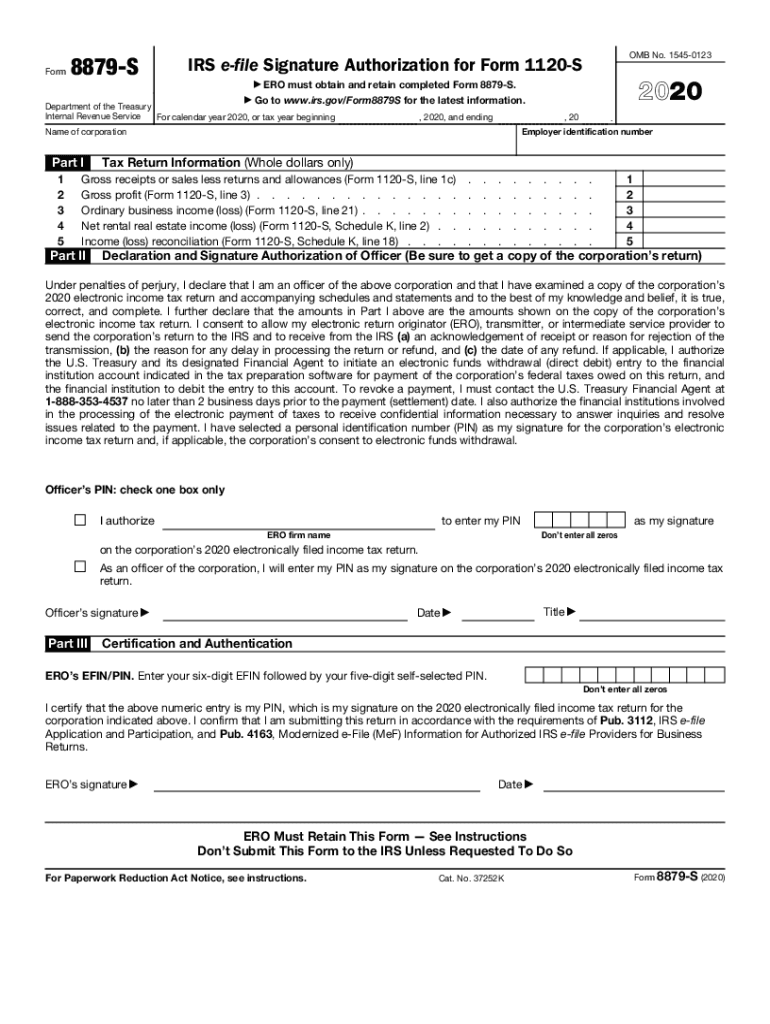

8879 Fill Out and Sign Printable PDF Template signNow

There are some important differences. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Form 1120 and 1120h united states (english) united states (spanish) canada (english) canada (french) full service.

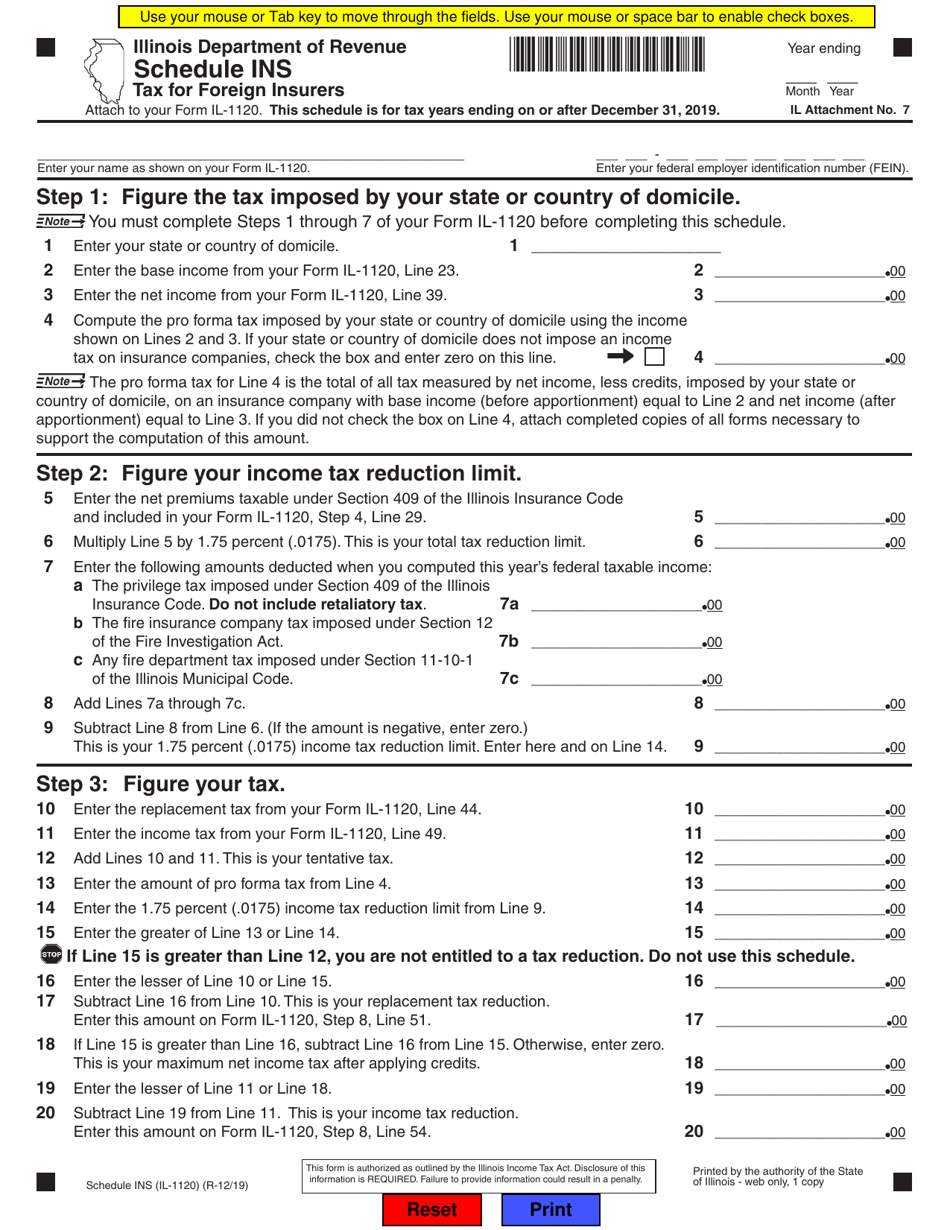

Form IL1120 Schedule INS Download Fillable PDF or Fill Online Tax for

Complete, edit or print tax forms instantly. Ad easy guidance & tools for c corporation tax returns. Click on the button get form to open it and begin modifying. Web it appears you don't have a pdf plugin for this browser. There are some important differences.

Click On The Button Get Form To Open It And Begin Modifying.

Web summary but the interesting part is that hoas actually have an option to file two different tax forms: There are some important differences. Get ready for tax season deadlines by completing any required tax forms today. Form 1120 and 1120h united states (english) united states (spanish) canada (english) canada (french) full service for personal taxes tax refund.

Income Tax Return For Homeowners Associations.

Ad easy guidance & tools for c corporation tax returns. Web credited to 2022 estimated tax. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. This form is for income earned in tax year 2022, with tax returns due in april.

Use The Following Irs Center Address.

Ad access irs tax forms. Ad access irs tax forms. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Web updated for tax year 2022 • june 2, 2023 08:47 am overview depending on your business type, there are different ways to prepare and file your taxes.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Complete, edit or print tax forms instantly. Income tax return for homeowners associations keywords: Web the corporation must show its 2023 tax year on the 2022 form 1120 and take into account any tax law changes that are effective for tax years beginning after december 31, 2022. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return.