Tax Form 4972

Tax Form 4972 - Other items you may find useful all form 4972 revisions It allows beneficiaries to receive their entire benefit in a single payment. The biggest requirement is that you have to be born before january 2, 1936. This form is usually required when: Web purpose of form use this form if you elect to report your child’s income on your return. The form’s primary function is to calculate and record the tax associated with these benefits. If you do, your child will not have to file a return. 2020 tax computation schedule for line 19 and line 22 line 4: Irs form 4972 eligibility 1. See capital gain election, later.

You can make this election if your child meets all of the following conditions. This happens with two kinds of plans, either an inherited account or an employer account. See capital gain election, later. Current revision form 4972 pdf recent developments none at this time. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of different accounts. It allows beneficiaries to receive their entire benefit in a single payment. Web tax revenue is based on values determined by the assessor in conjunction with the levies (including excess levies) set by the authorized levying bodies. This form is usually required when: Irs form 4972 eligibility 1.

Multiply line 17 by 10%.21. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of different accounts. If you do, your child will not have to file a return. It allows beneficiaries to receive their entire benefit in a single payment. Irs form 4972 eligibility 1. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. This happens with two kinds of plans, either an inherited account or an employer account. You can make this election if your child meets all of the following conditions. 2020 tax computation schedule for line 19 and line 22 line 4: Web tax revenue is based on values determined by the assessor in conjunction with the levies (including excess levies) set by the authorized levying bodies.

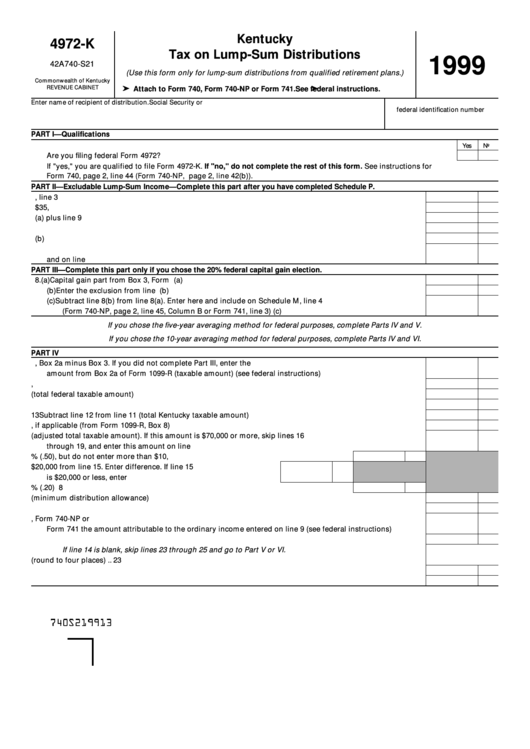

Kentucky Tax On LumpSum Distributions (Form 4972K 1999) printable pdf

Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of different accounts. Web tax form 4972 is used for reducing taxes. Web tax revenue is based on values determined by the assessor in conjunction with the levies (including excess levies) set by the authorized levying bodies. If you.

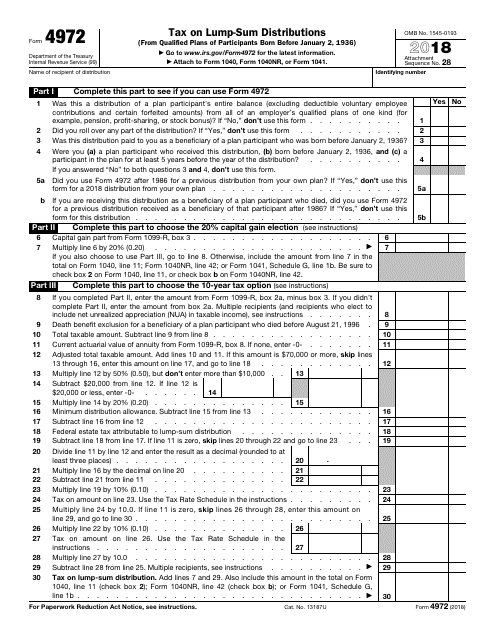

Form 4972 Tax on LumpSum Distributions (2015) Free Download

You can make this election if your child meets all of the following conditions. If you do, your child will not have to file a return. Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. The form’s primary function is to calculate and record the tax associated with these.

revenue.ne.gov tax current f_1040n

You can make this election if your child meets all of the following conditions. The biggest requirement is that you have to be born before january 2, 1936. Web tax revenue is based on values determined by the assessor in conjunction with the levies (including excess levies) set by the authorized levying bodies. If you do, your child will not.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. The biggest requirement is that you have to be born before january 2, 1936. The form’s primary function is to calculate and record the tax associated with these benefits. Multiply line 17 by 10%.21. Current revision form 4972 pdf recent developments none.

IRS Form 4972 Download Fillable PDF or Fill Online Tax on LumpSum

Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. 2020 tax computation schedule for line 19 and line 22 line 4: This form is usually required when: It allows beneficiaries to receive their entire benefit in a single payment. Your client gets a payment of the plan participant's entire.

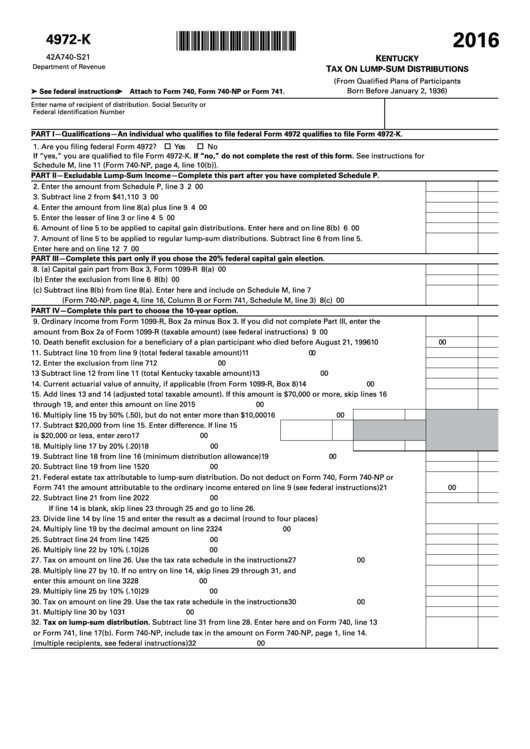

4972K Kentucky Tax on Lump Sum Distribution Form 42A740S21

It allows beneficiaries to receive their entire benefit in a single payment. Web tax form 4972 is used for reducing taxes. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of different accounts. You can make this election if your child meets all of the following conditions. This.

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2016

You can make this election if your child meets all of the following conditions. The biggest requirement is that you have to be born before january 2, 1936. Irs form 4972 eligibility 1. Current revision form 4972 pdf recent developments none at this time. If you do, your child will not have to file a return.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

You can make this election if your child meets all of the following conditions. Web tax form 4972 is used for reducing taxes. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. Web purpose of form use this form if you elect to report your child’s income on your return. This.

Form 1040NR U.S. Nonresident Alien Tax Return Form (2014

2020 tax computation schedule for line 19 and line 22 line 4: Your client gets a payment of the plan participant's entire balance. Irs form 4972 eligibility 1. The biggest requirement is that you have to be born before january 2, 1936. This happens with two kinds of plans, either an inherited account or an employer account.

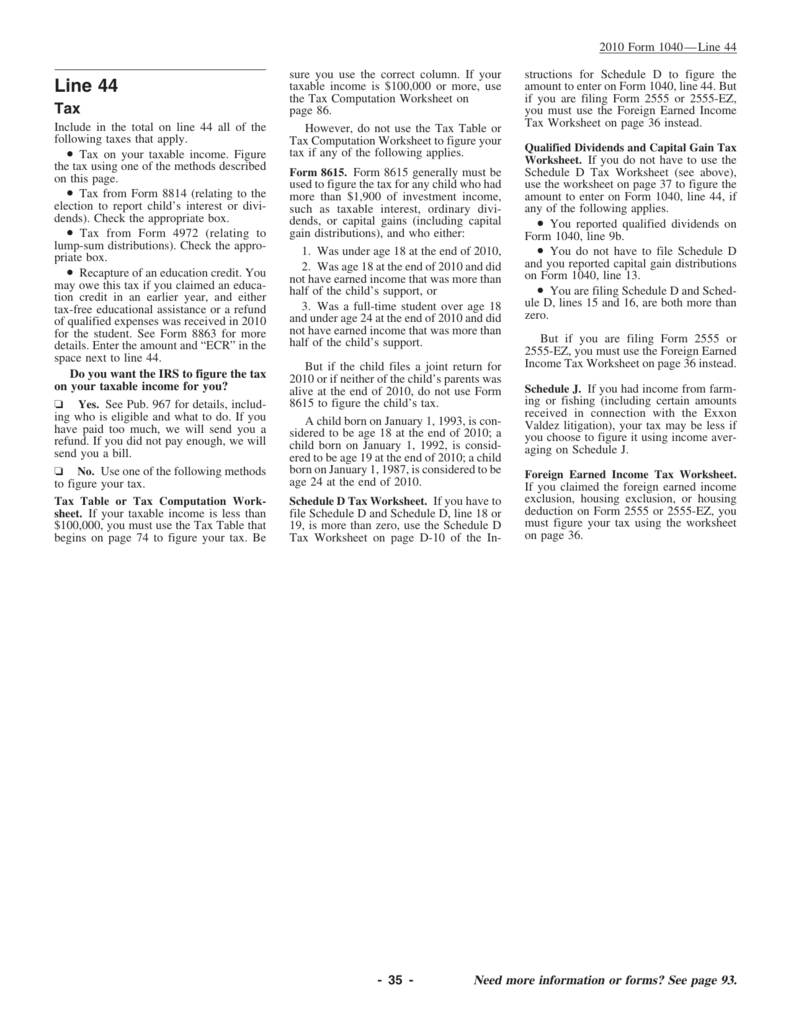

instructions for line 44

Web tax form 4972 is used for reducing taxes. 2020 tax computation schedule for line 19 and line 22 line 4: This form is usually required when: You can make this election if your child meets all of the following conditions. The biggest requirement is that you have to be born before january 2, 1936.

You Can Make This Election If Your Child Meets All Of The Following Conditions.

Irs form 4972 eligibility 1. Your client gets a payment of the plan participant's entire balance. This form is usually required when: Web tax revenue is based on values determined by the assessor in conjunction with the levies (including excess levies) set by the authorized levying bodies.

This Happens With Two Kinds Of Plans, Either An Inherited Account Or An Employer Account.

The form’s primary function is to calculate and record the tax associated with these benefits. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of different accounts. Current revision form 4972 pdf recent developments none at this time. The biggest requirement is that you have to be born before january 2, 1936.

See Capital Gain Election, Later.

Other items you may find useful all form 4972 revisions Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. If you do, your child will not have to file a return. Web purpose of form use this form if you elect to report your child’s income on your return.

Web Tax Form 4972 Is Used For Reducing Taxes.

9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. 2020 tax computation schedule for line 19 and line 22 line 4: Multiply line 17 by 10%.21. It allows beneficiaries to receive their entire benefit in a single payment.