Tax Form 8919

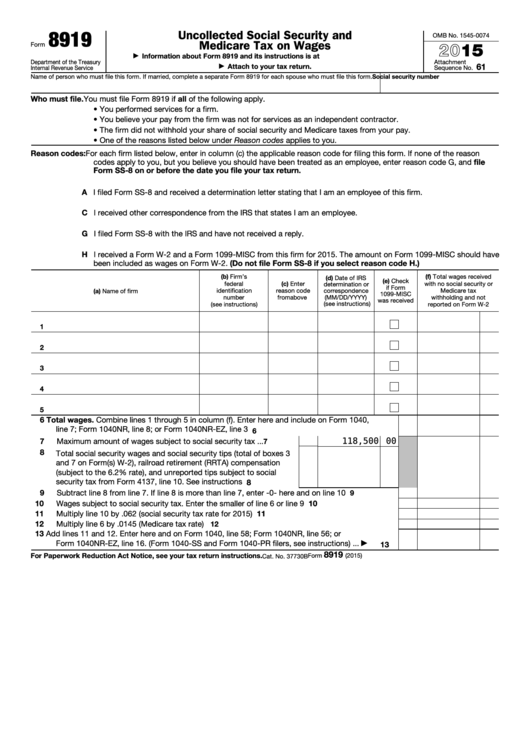

Tax Form 8919 - 61 name of person who must file this. Web a go to www.irs.gov/form8919 for the latest information. They must report the amount on irs form 8919. If using a private delivery service, send your returns to the street address above for the submission processing center. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. For some of the western states, the following addresses were previously used: Web what is irs form 8919? Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed.

Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Department of the treasury |. Web a go to www.irs.gov/form8919 for the latest information. Web what is irs form 8919? They must report the amount on irs form 8919. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. The taxpayer performed services for an individual or a firm. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. From within your taxact return ( online or desktop), click federal.

Department of the treasury |. Web if you believe that you've been misclassified as an independent contractor, form 8919 can help you report the correct employment status to the irs and ensure that. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. 61 name of person who must file this. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file.

Form 1099NEC Nonemployee Compensation (1099NEC)

The taxpayer performed services for an individual or a firm. Department of the treasury |. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. A attach to your.

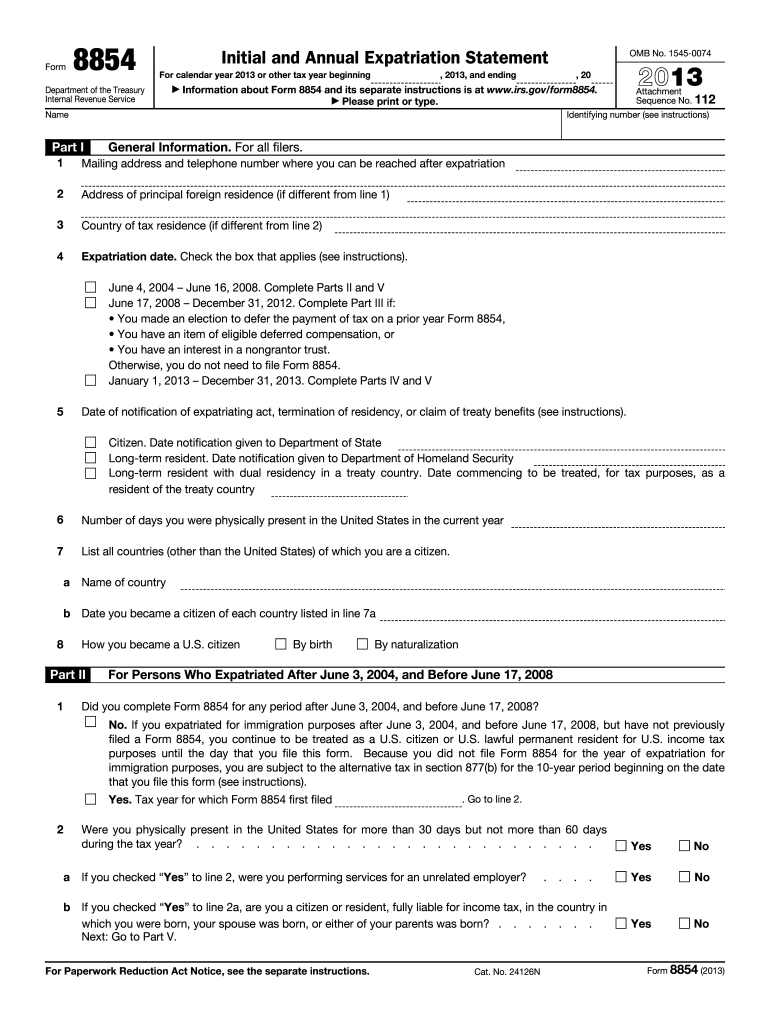

2013 Form IRS 8854 Fill Online, Printable, Fillable, Blank pdfFiller

Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like. Web a go to www.irs.gov/form8919 for the latest information. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected.

Fillable Form 8919 Uncollected Social Security And Medicare Tax On

Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web use form 8919 to.

Form 8959 Additional Medicare Tax (2014) Free Download

Web if you believe that you've been misclassified as an independent contractor, form 8919 can help you report the correct employment status to the irs and ensure that. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web irs form 8919, uncollected social security and.

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

From within your taxact return ( online or desktop), click federal. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. If using a private delivery service, send your returns to the street address above for the submission processing center. They must report the amount on irs form 8919. A attach to.

IRS expands crypto question on draft version of 1040 Accounting Today

Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. Web if you believe that you've been misclassified as an independent contractor, form 8919 can help you report the correct employment status to the irs and ensure that. Web employees will.

What is Form 8919 Uncollected Social Security and Medicare Tax on

They must report the amount on irs form 8919. The taxpayer performed services for an individual or a firm. Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. Web 1973 rulon white blvd. Web if you believe that you've been misclassified.

20182022 Form CA ADOPT200 Fill Online, Printable, Fillable, Blank

Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Irs form 8819, uncollected social security and medicare tax on wages, is an official tax document used by employees who were treated like. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web if you believe that you've been misclassified as an independent contractor, form 8919 can help you report the correct employment status to the irs and ensure that. Web to complete form 8919 in the taxact program: Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. For some of the western.

Form 8959 Additional Medicare Tax (2014) Free Download

Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. If using a private delivery service, send your returns to the street address above for the submission processing center. Web information about form 8919, uncollected social security and medicare tax on wages,.

Web Information About Form 8919, Uncollected Social Security And Medicare Tax On Wages, Including Recent Updates, Related Forms, And Instructions On How To File.

If using a private delivery service, send your returns to the street address above for the submission processing center. Web irs form 8919, uncollected social security and medicare tax on wages, is the tax form that taxpayers must file to figure and report their share of uncollected social. They must report the amount on irs form 8919. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as.

Department Of The Treasury |.

Web when filing a tax return, the worker uses form 8919 to calculate and report the employee’s share of uncollected social security and medicare taxes due on their. The taxpayer performed services for an individual or a firm. Web form 8919, also known as “uncollected social security and medicare tax on wages,” is used by workers who were not treated as employees by their employers but believed. Web what is irs form 8919?

Irs Form 8819, Uncollected Social Security And Medicare Tax On Wages, Is An Official Tax Document Used By Employees Who Were Treated Like.

Web a go to www.irs.gov/form8919 for the latest information. A attach to your tax return. From within your taxact return ( online or desktop), click federal. Web use form 8919 to figure and report your share of the uncollected social security and medicare taxes due on your compensation if you were an employee but were treated as.

Web Employees Will Use Form 8919 To Determine The Amount They Owe In Social Security And Medicare Taxes.

61 name of person who must file this. Web if you believe that you've been misclassified as an independent contractor, form 8919 can help you report the correct employment status to the irs and ensure that. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web 1973 rulon white blvd.