Tax Form 945

Tax Form 945 - Form 945 is a summary form, showing all the different nonpayroll payments you've made. Annual return of withheld federal income tax. These types of payments can include: They tell you who must file form 945, how to complete it line by line, and when and where to file it. Use this form to correct administrative errors only. Form 945 is the annual record of federal tax liability. Department of the treasury internal revenue service. Web information about form 945, annual return of withheld federal income tax, including recent updates, related forms and instructions on how to file. This form must also be completed by any business that accumulates $100,000 of tax liability during any month of the tax year. This form should be completed by semiweekly schedule depositors.

For more information on income tax withholding, see pub. Use this form to correct administrative errors only. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for qualified pensions, gambling profits, and military retirement and pay. Web these instructions give you some background information about form 945. December 2020) annual record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form945a for instructions and the latest information. Web form 945 is used to report income tax withholding on non payroll payments including backup withholding and withholding on pensions, annuities, ira's military retirement and gambling winnings. Use form 945 to report withheld federal income tax from nonpayroll payments. Annual return of withheld federal income tax. This form should be completed by semiweekly schedule depositors. Form 945 is the annual record of federal tax liability.

Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. December 2020) annual record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form945a for instructions and the latest information. Web information about form 945, annual return of withheld federal income tax, including recent updates, related forms and instructions on how to file. This form should be completed by semiweekly schedule depositors. Form 945 is a summary form, showing all the different nonpayroll payments you've made. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for qualified pensions, gambling profits, and military retirement and pay. They tell you who must file form 945, how to complete it line by line, and when and where to file it. Use this form to correct administrative errors only. For more information on income tax withholding, see pub. These types of payments can include:

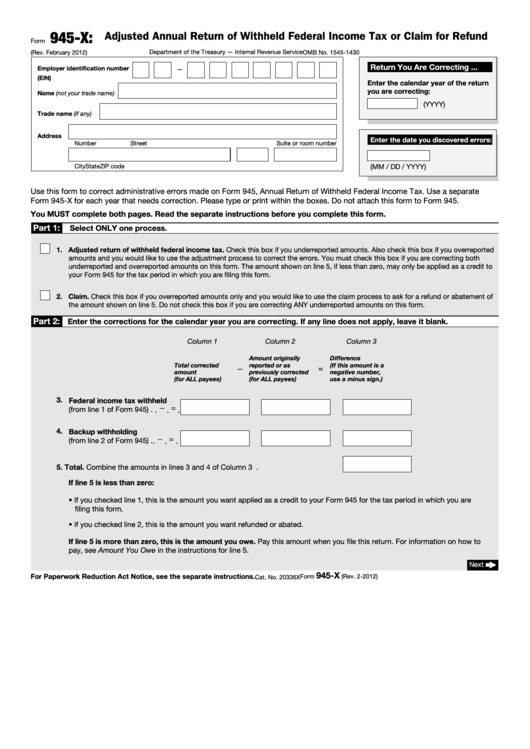

Form 945X Adjusted Annual Return of Withheld Federal Tax or

Web these instructions give you some background information about form 945. For more information on income tax withholding, see pub. They tell you who must file form 945, how to complete it line by line, and when and where to file it. Department of the treasury internal revenue service. Web form 945 pertains only to what the irs calls nonpayroll.

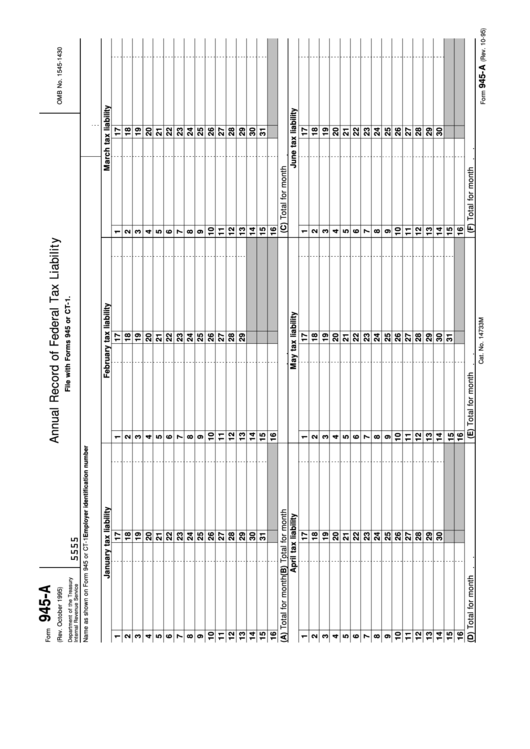

Form 945A Annual Record Of Federal Tax Liability printable pdf download

Annual return of withheld federal income tax. This form should be completed by semiweekly schedule depositors. For more information on income tax withholding, see pub. Web form 945 is used to report income tax withholding on non payroll payments including backup withholding and withholding on pensions, annuities, ira's military retirement and gambling winnings. These types of payments can include:

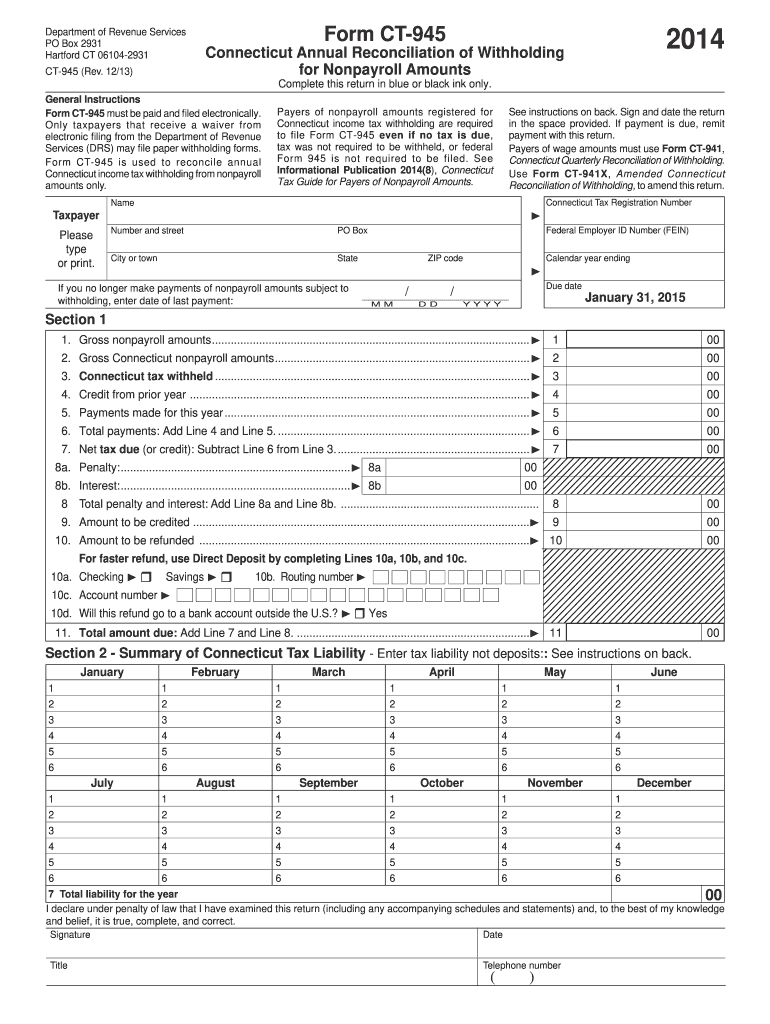

Irs Form 945 Fill Out and Sign Printable PDF Template signNow

Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for qualified pensions, gambling profits, and military retirement and pay. Form 945 is a summary form, showing all the different nonpayroll payments you've made. They tell you who must file form 945, how to.

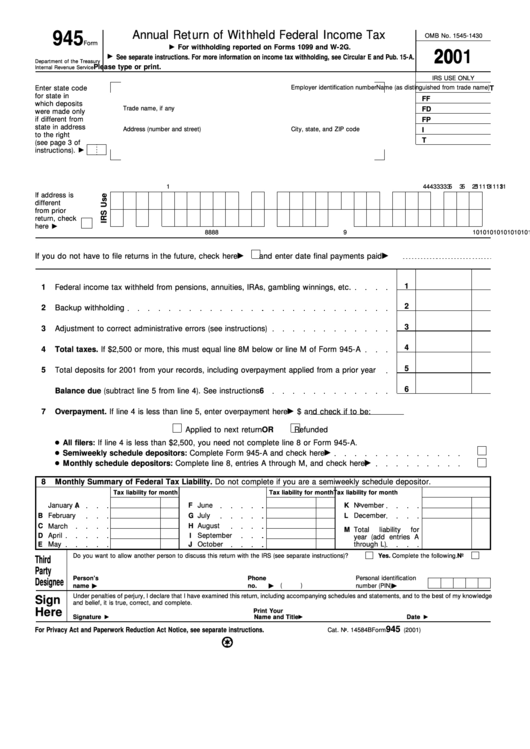

Fillable Form 945 Annual Return Of Withheld Federal Tax 2001

For more information on income tax withholding, see pub. Form 945 is a summary form, showing all the different nonpayroll payments you've made. Use this form to correct administrative errors only. Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. Web form 945 is used to report income tax withholding on non.

Form 945X Adjusted Annual Return of Withheld Federal Tax or

This form should be completed by semiweekly schedule depositors. Web form 945 is used to report income tax withholding on non payroll payments including backup withholding and withholding on pensions, annuities, ira's military retirement and gambling winnings. For instructions and the latest information. Department of the treasury internal revenue service. December 2020) annual record of federal tax liability department of.

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

For instructions and the latest information. These types of payments can include: For more information on income tax withholding, see pub. Use this form to correct administrative errors only. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for qualified pensions, gambling profits,.

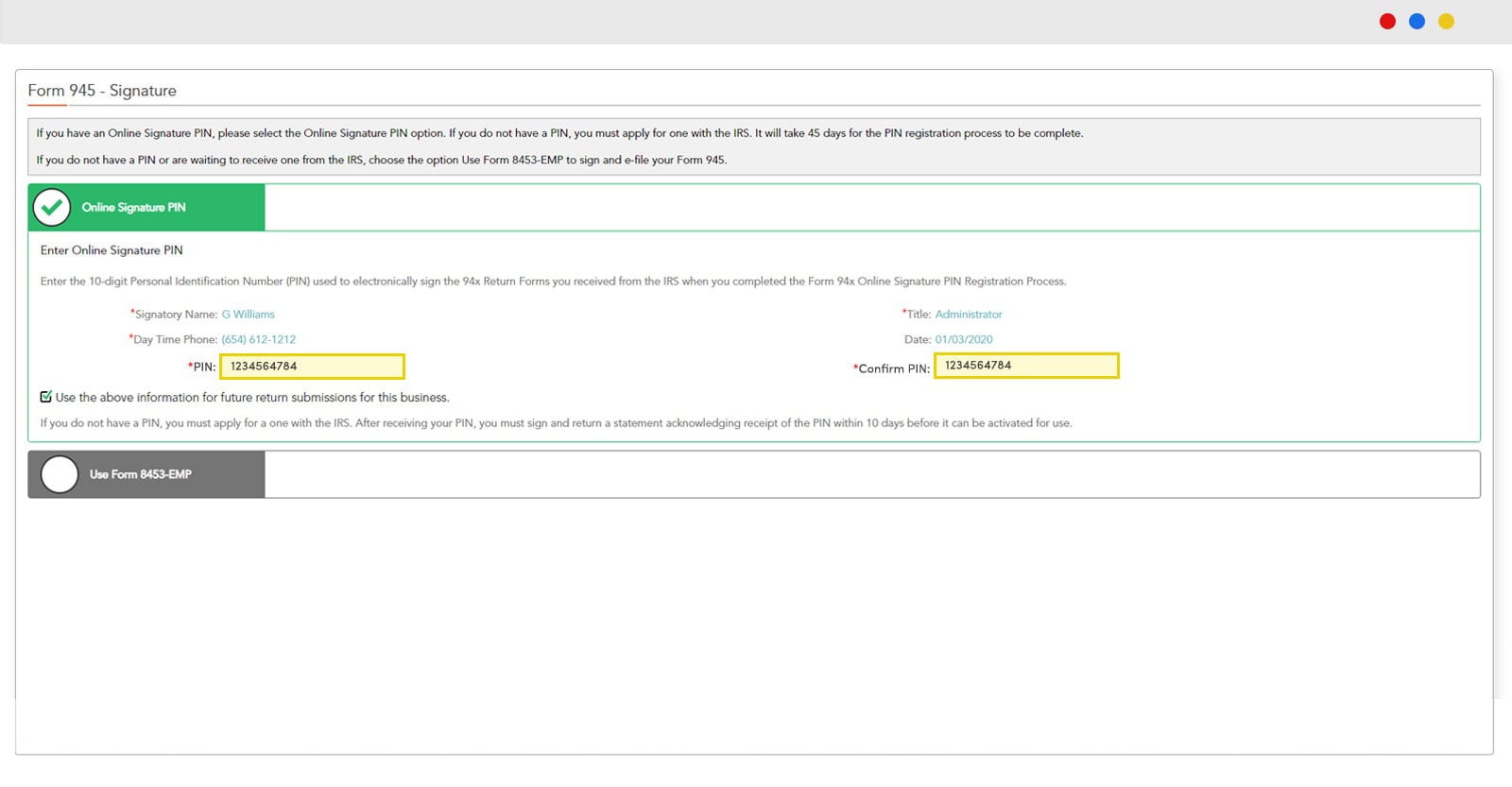

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

This form should be completed by semiweekly schedule depositors. Use form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments. Web form 945 is used to report income tax withholding on non payroll payments including backup withholding and withholding on pensions, annuities, ira's military retirement and gambling winnings. Form 945 is a summary form,.

Form 945 Annual Return of Withheld Federal Tax Form (2015

This form must also be completed by any business that accumulates $100,000 of tax liability during any month of the tax year. Annual return of withheld federal income tax. Use this form to correct administrative errors only. These types of payments can include: They tell you who must file form 945, how to complete it line by line, and when.

Download Instructions for IRS Form 945 Annual Return of Withheld

This form should be completed by semiweekly schedule depositors. These types of payments can include: Web form 945 is used to report income tax withholding on non payroll payments including backup withholding and withholding on pensions, annuities, ira's military retirement and gambling winnings. For instructions and the latest information. Web information about form 945, annual return of withheld federal income.

Fillable Form 945X Adjusted Annual Return Of Withheld Federal

Web form 945 is used to report income tax withholding on non payroll payments including backup withholding and withholding on pensions, annuities, ira's military retirement and gambling winnings. Form 945 is a summary form, showing all the different nonpayroll payments you've made. This form must also be completed by any business that accumulates $100,000 of tax liability during any month.

Department Of The Treasury Internal Revenue Service.

This form should be completed by semiweekly schedule depositors. Form 945 is the annual record of federal tax liability. Web these instructions give you some background information about form 945. Web form 945 is used to report income tax withholding on non payroll payments including backup withholding and withholding on pensions, annuities, ira's military retirement and gambling winnings.

Form 945 Is A Summary Form, Showing All The Different Nonpayroll Payments You've Made.

This form must also be completed by any business that accumulates $100,000 of tax liability during any month of the tax year. For instructions and the latest information. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for qualified pensions, gambling profits, and military retirement and pay. These types of payments can include:

Use Form 945 To Report Federal Income Tax Withheld (Or Required To Be Withheld) From Nonpayroll Payments.

For more information on income tax withholding, see pub. Use form 945 to report withheld federal income tax from nonpayroll payments. Annual return of withheld federal income tax. Web information about form 945, annual return of withheld federal income tax, including recent updates, related forms and instructions on how to file.

They Tell You Who Must File Form 945, How To Complete It Line By Line, And When And Where To File It.

Use this form to correct administrative errors only. December 2020) annual record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form945a for instructions and the latest information.