Tax Form For Au Pair

Tax Form For Au Pair - Au pairs can use this form to file a tax return if no taxes are due. Web learn more about au pair taxes from our recommended tax professionals, sprintax. Under new tax law, the filing threshold is. Web a resident alien files a 1040 form, not a 1040nr. For most au pairs, this will be the correct form to use. Once this form is updated for the 2022 tax year, we will. The deadline for filing your 2022 taxes is april 18, 2023. All payments that you have received as an au pair from your host family are subject to income tax. Web an au pair is likely to have a us tax obligation given the current minimum wage and typical number of hours worked. Web according to the irs, while the weekly stipend paid to the au pair is not subject to social security and medicare taxes, it is taxable to the au pair as wages.

Web learn more about au pair taxes from our recommended tax professionals, sprintax. Web if you were physically in the u.s. Au pairs on the department of state’s cultural exchange program are present in the u.s. Web do au pairs have to pay taxes? Tax returns can start being filed on january 27, 2020 and must be filed no later than monday, april 15, 2020. When should i file a u.s. All payments that you have received as an au pair from your host family are subject to income tax. Once this form is updated for the 2019 tax year, we. Web in order to file income taxes in the united states, all au pairs need to have either a social security number or an individual taxpayer identification number (“itin”). The deadline for filing your 2022 taxes is april 18, 2023.

Web form 1040nr is a u.s. All payments that you have received as an au pair from your host family are subject to income tax. Web if you were physically in the u.s. Web according to the irs, while the weekly stipend paid to the au pair is not subject to social security and medicare taxes, it is taxable to the au pair as wages. Once this form is updated for the 2022 tax year, we will. Web in order to file income taxes in the united states, all au pairs need to have either a social security number or an individual taxpayer identification number (“itin”). Under new tax law, the filing threshold is. Web form 1040nr is a u.s. For most au pairs, this will be the correct form to use. Web learn more about au pair taxes from our recommended tax professionals, sprintax.

AU PAIR Application Form Child Care Relationships & Parenting

Web this means au pairs must file and pay income tax for money earned in the united states in 2022. Therefore, the irs recommends that au pairs. For most au pairs, this will be the correct form to use. Therefore, since you were both residents (living in the us) the entire year you can simply file a regular tax return.

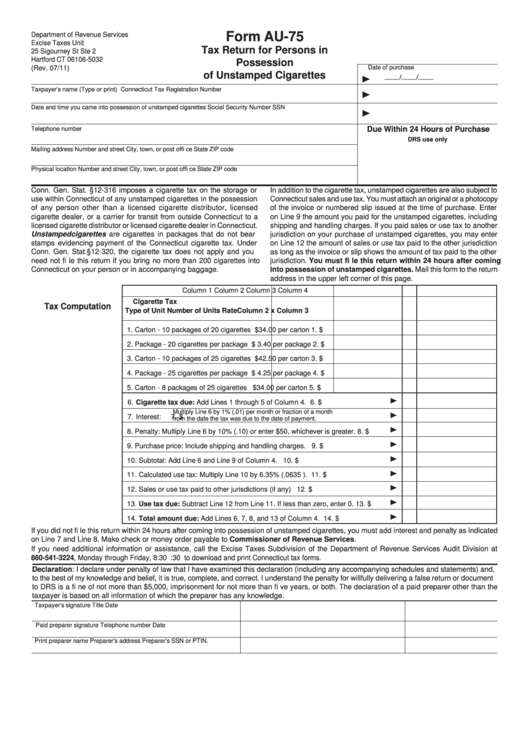

Form Au75 Tax Return For Persons In Possession Of Unstamped

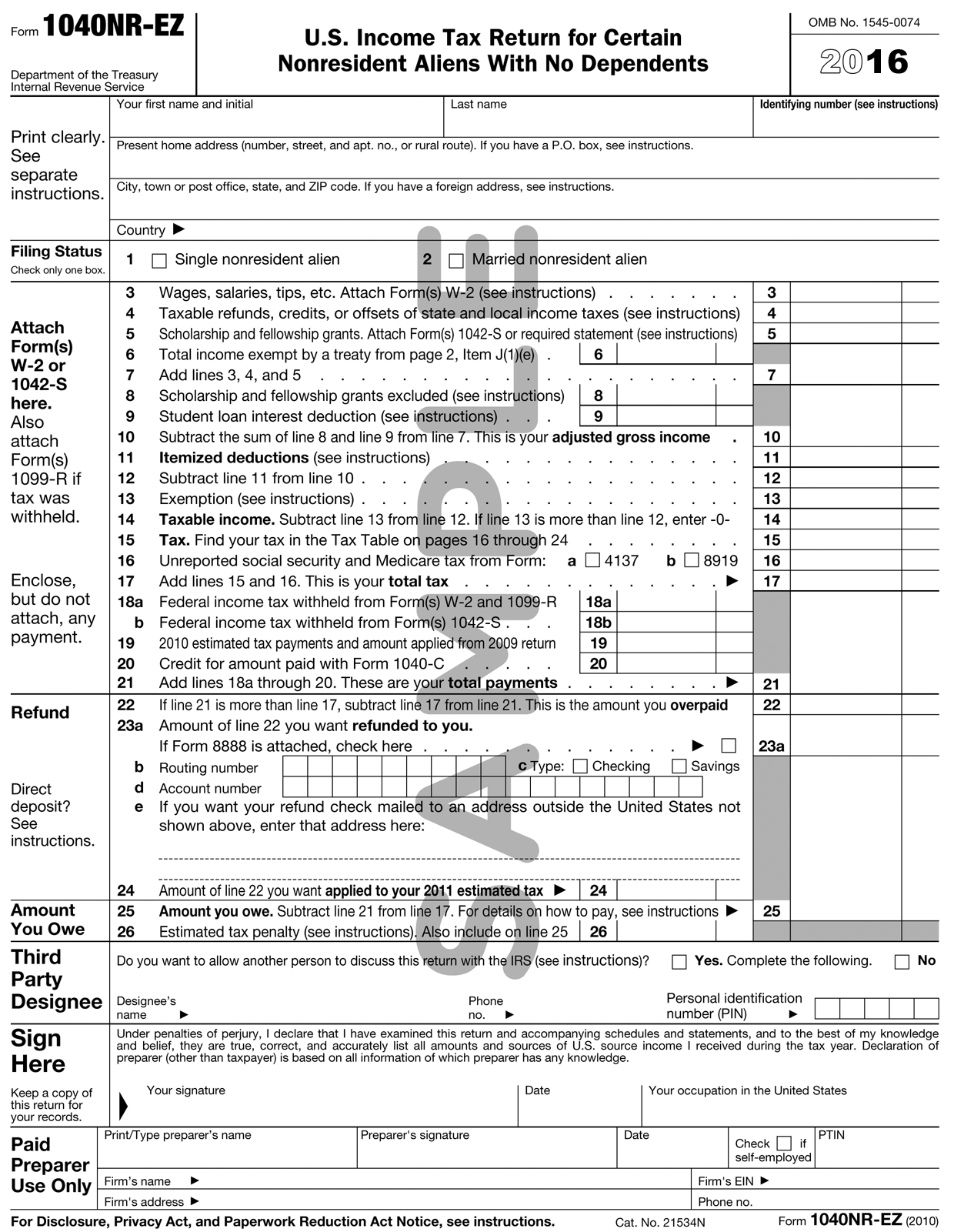

Web form 1040nr is a u.s. Web in order to file income taxes in the united states, all au pairs need to have either a social security number or an individual taxpayer identification number (“itin”). Once this form is updated for the 2022 tax year, we will. Law requires au pairs who earn more than the filing threshold in stipends.

Au Pair Taxes Explained Tax Return Filing Guide [2021]

All payments that you have received as an au pair from your host family are subject to income tax. Under new tax law, the filing threshold is. When should i file a u.s. Web form 1040nr is a u.s. The basic tax process step 1:

Au Pair Tax Deduction Guide for Host Families Go Au Pair

Web an au pair is likely to have a us tax obligation given the current minimum wage and typical number of hours worked. The deadline for filing your 2022 taxes is april 18, 2023. Tax returns can start being filed on january 27, 2020 and must be filed no later than monday, april 15, 2020. The basic tax process step.

The IRS 1040EZ Tax Form Modeled as a Spreadsheet

Law requires au pairs who earn more than the filing threshold in stipends during a calendar year to file a u.s. For most au pairs, this will be the correct form to use. Web in order to file income taxes in the united states, all au pairs need to have either a social security number or an individual taxpayer identification.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Au pairs can use this form to file a tax return if no taxes are due. The deadline for filing your 2022 taxes is april 18, 2023. When should i file a u.s. All payments that you have received as an au pair from your host family are subject to income tax. Law requires au pairs who earn more than.

IRS Tax Form How To Fill In The Right Boxes Online

Web an au pair is likely to have a us tax obligation given the current minimum wage and typical number of hours worked. Tax returns can start being filed on january 27, 2020 and must be filed no later than monday, april 15, 2020. Web learn more about au pair taxes from our recommended tax professionals, sprintax. Web which tax.

File Taxes File Taxes W2

Web form 1040nr is a u.s. Law requires au pairs who earn more than the filing threshold in stipends during a calendar year to file a u.s. The deadline for filing your 2022 taxes is april 18, 2023. Web an au pair is likely to have a us tax obligation given the current minimum wage and typical number of hours.

Au Pair Tax Deduction Guide for Host Families Go Au Pair

Law requires au pairs who earn more than the filing threshold in stipends during a calendar year to file a u.s. Therefore, since you were both residents (living in the us) the entire year you can simply file a regular tax return as. Once this form is updated for the 2022 tax year, we will. The basic tax process step.

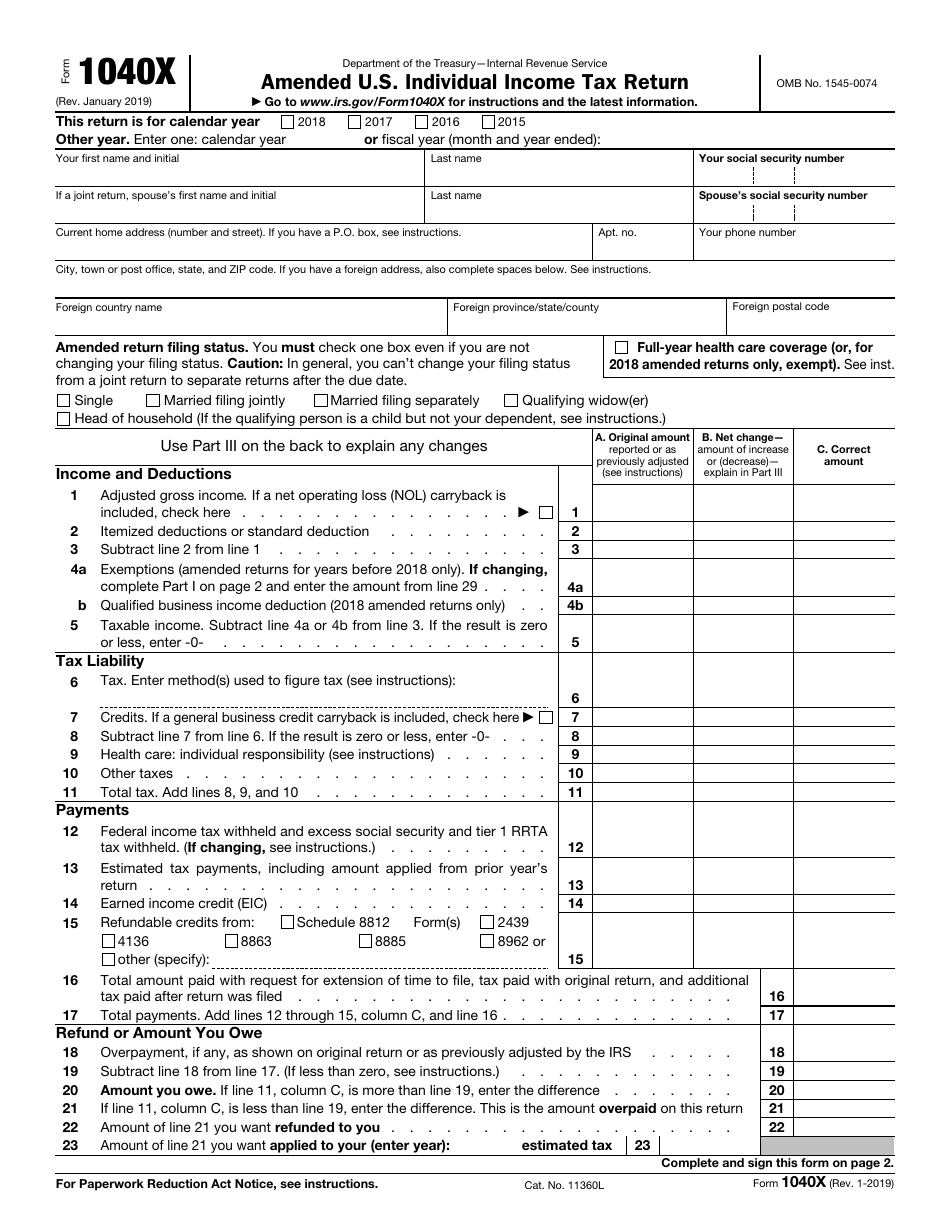

IRS Form 1040X Download Fillable PDF or Fill Online Amended U.S

Therefore, since you were both residents (living in the us) the entire year you can simply file a regular tax return as. Web this means au pairs must file and pay income tax for money earned in the united states in 2022. Web according to the irs, while the weekly stipend paid to the au pair is not subject to.

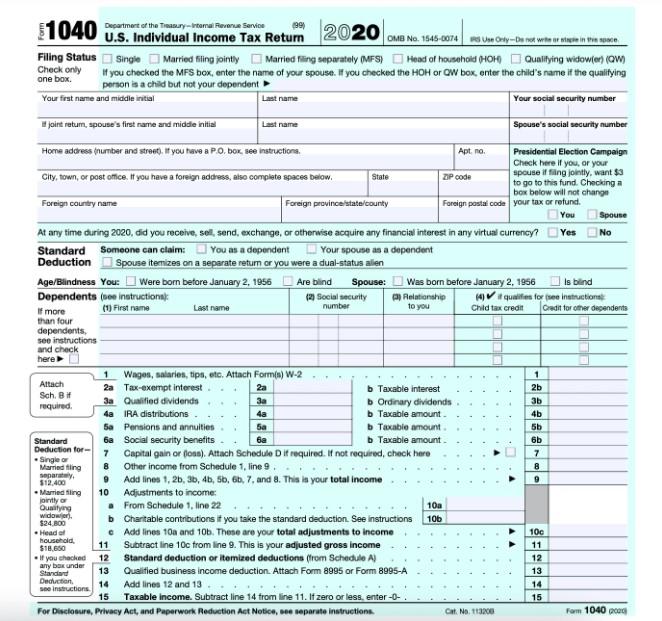

Web Which Tax Forms Do I Need To File?

Web irs forms for au pair tax returns: Once this form is updated for the 2022 tax year, we will. For most au pairs, this will be the correct form to use. Therefore, since you were both residents (living in the us) the entire year you can simply file a regular tax return as.

Once This Form Is Updated For The 2020 Tax Year, We Will.

Web do au pairs have to pay taxes? Under new tax law, the filing threshold is. Web this means au pairs must file and pay income tax for money earned in the united states in 2022. Web according to the irs, while the weekly stipend paid to the au pair is not subject to social security and medicare taxes, it is taxable to the au pair as wages.

Web A Resident Alien Files A 1040 Form, Not A 1040Nr.

Au pairs on the department of state’s cultural exchange program are present in the u.s. Web if you were physically in the u.s. All payments that you have received as an au pair from your host family are subject to income tax. Web learn more about au pair taxes from our recommended tax professionals, sprintax.

For Most Au Pairs, This Will Be The Correct Form To Use.

Au pairs can use this form to file a tax return if no taxes are due. Web an au pair is likely to have a us tax obligation given the current minimum wage and typical number of hours worked. When should i file a u.s. Law requires au pairs who earn more than the filing threshold in stipends during a calendar year to file a u.s.

![Au Pair Taxes Explained Tax Return Filing Guide [2021]](http://blog.sprintax.com/wp-content/uploads/2016/09/filing-out-tax-treaty-form-1-min-768x512.jpg)