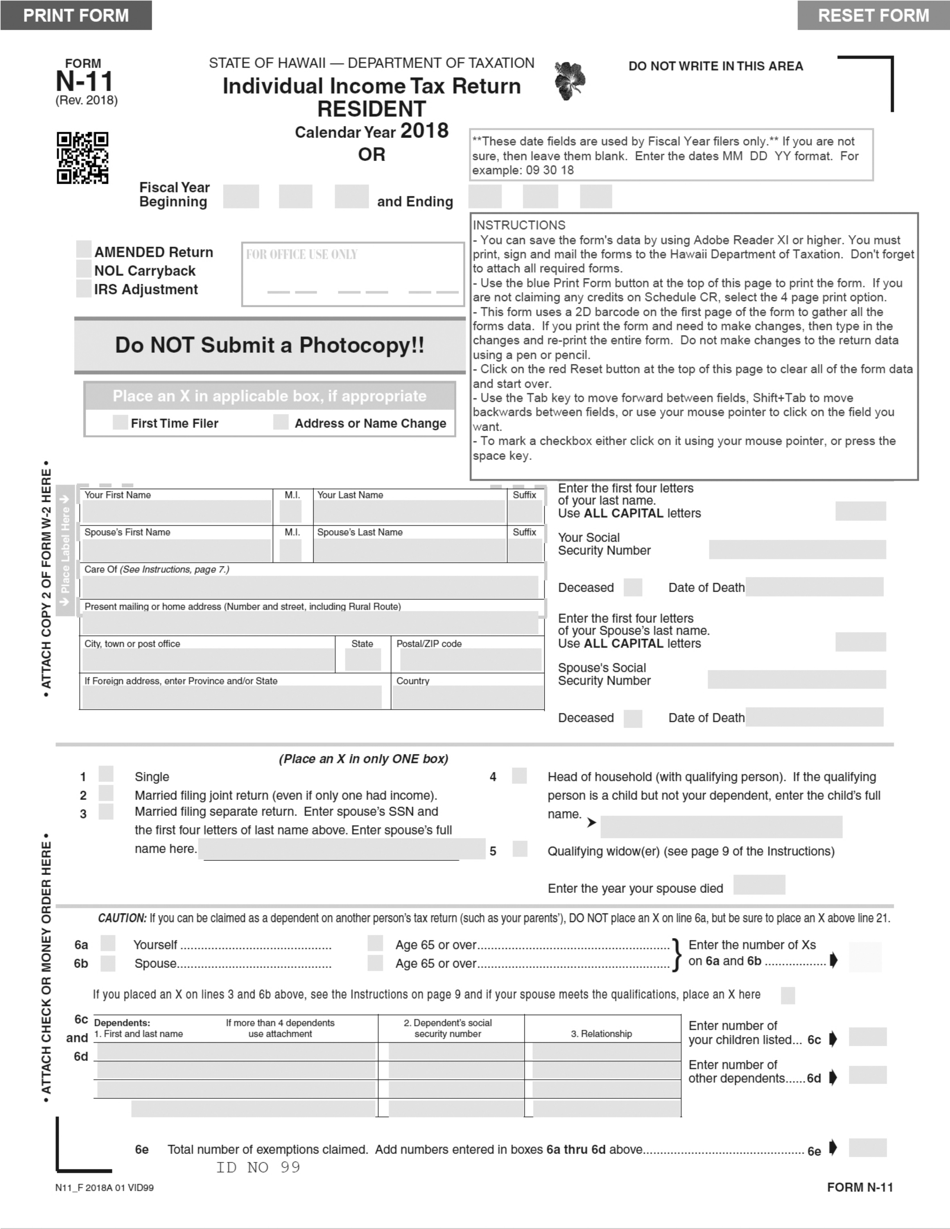

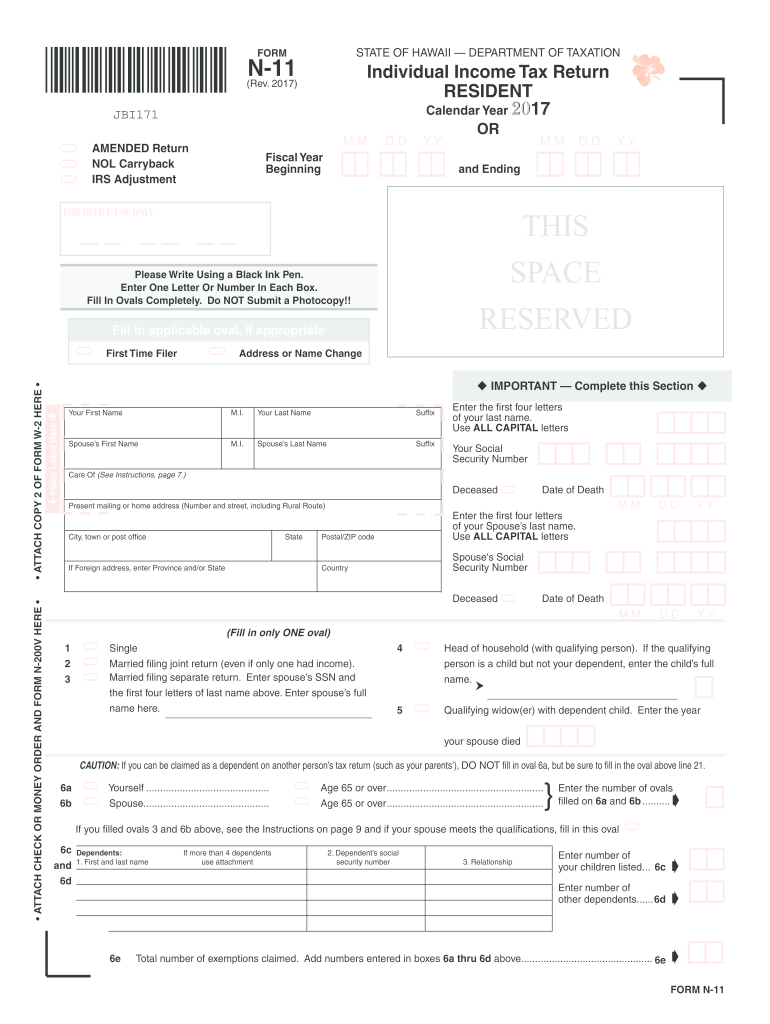

Tax Form N-11

Tax Form N-11 - Multiply line 11 by appropriate percentages on lines 5y and 5s. Individual income tax return (resident form) caution:. File your 2290 tax now and receive schedule 1 in minutes. The form features space to include your income, marital status as well. Employers engaged in a trade or business who. If tax is from the capital gains tax worksheet, enter the net capital gain from line 14 of that worksheet. Individual tax return form 1040 instructions; Employee's withholding certificate form 941; 2021) n11_i 2021a 01 vid01 state of hawaii — department of taxation do not write in this area individual income tax return resident. Don't miss this 50% discount.

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Original music by aaron esposito. Web 123 rows tax forms beginning with n; Multiply line 11 by appropriate percentages on lines 5y and 5s. At this time, it is expected to be available on january 27, 2022. Previous balance with applicable interest at % per year and payments received through. $250.00 we applied $500.00 of your 2016 form 1040. Web missouri department of revenue home page, containing links to motor vehicle and driver licensing services, and taxation and collection services for the state of missouri. Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and more. For information and guidance in its preparation, we have helpful publications and.

Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. $250.00 we applied $500.00 of your 2016 form 1040. Web popular forms & instructions; The form features space to include your income, marital status as well. At this time, it is expected to be available on january 27, 2022. Web 123 n harris st harvard, tx 12345. Multiply line 11 by appropriate percentages on lines 5y and 5s. This form is for income earned in tax year 2022, with tax returns due in april 2023. Don't miss this 50% discount. Web 123 rows tax forms beginning with n;

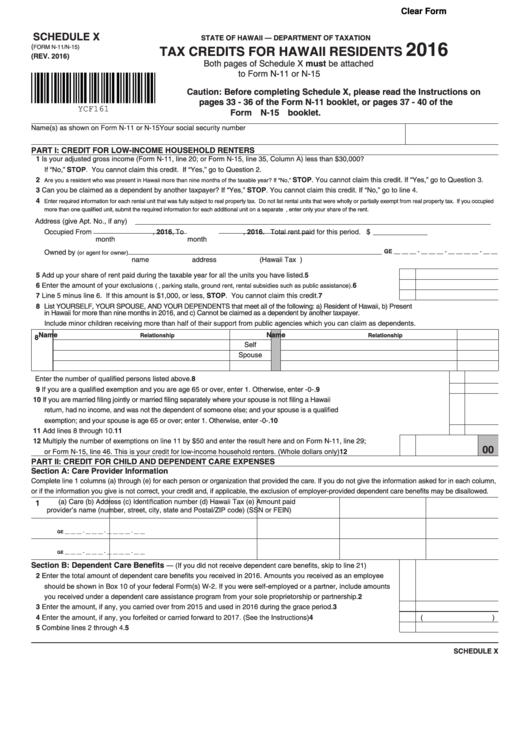

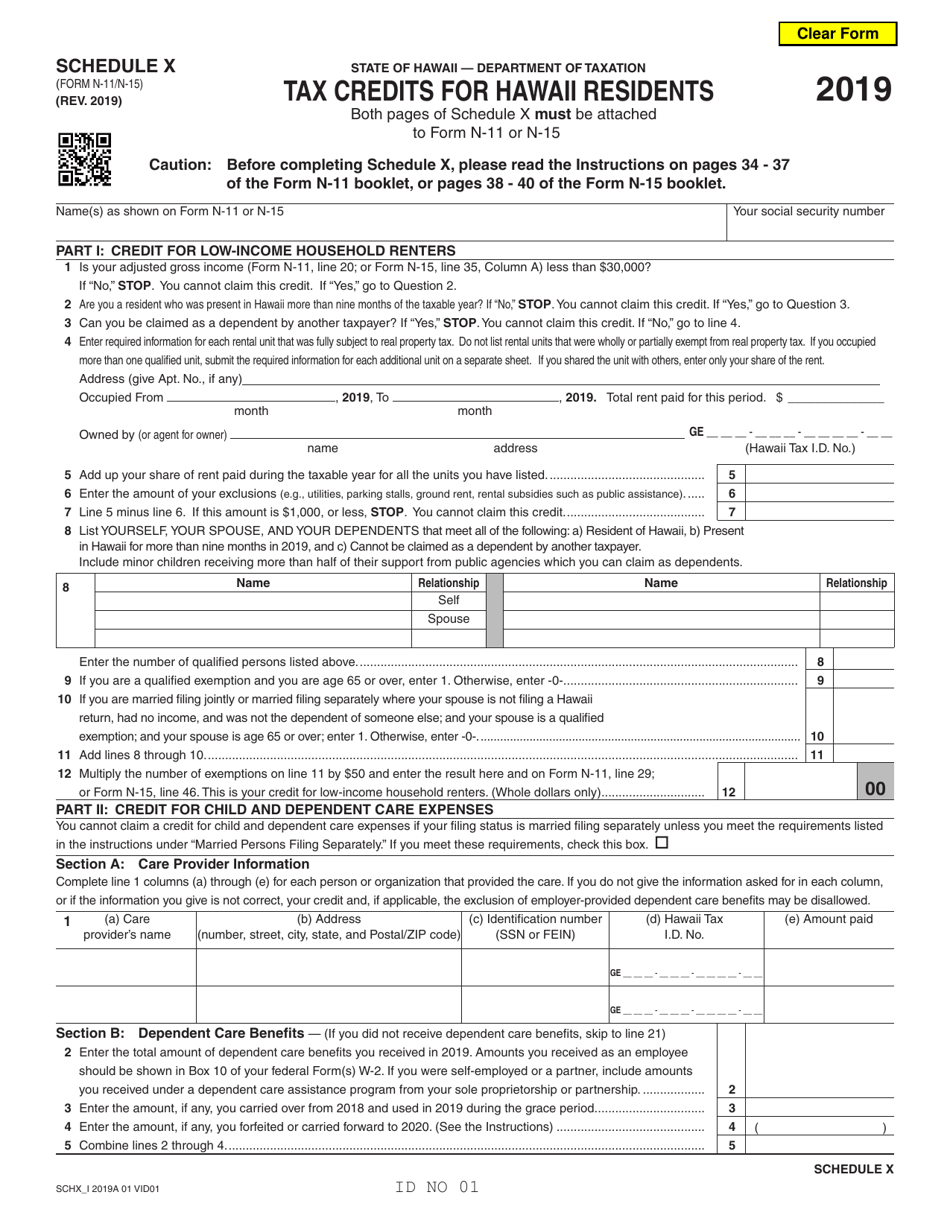

Fillable Form N11/n15 Tax Credits For Hawaii Residents printable

Total nebraska and local sales and use tax due (line 9 plus line 10). 2021) page 3 of 4 27a. Individual income tax return (resident form) caution:. Individual income tax return (resident form) caution: For information and guidance in its preparation, we have.

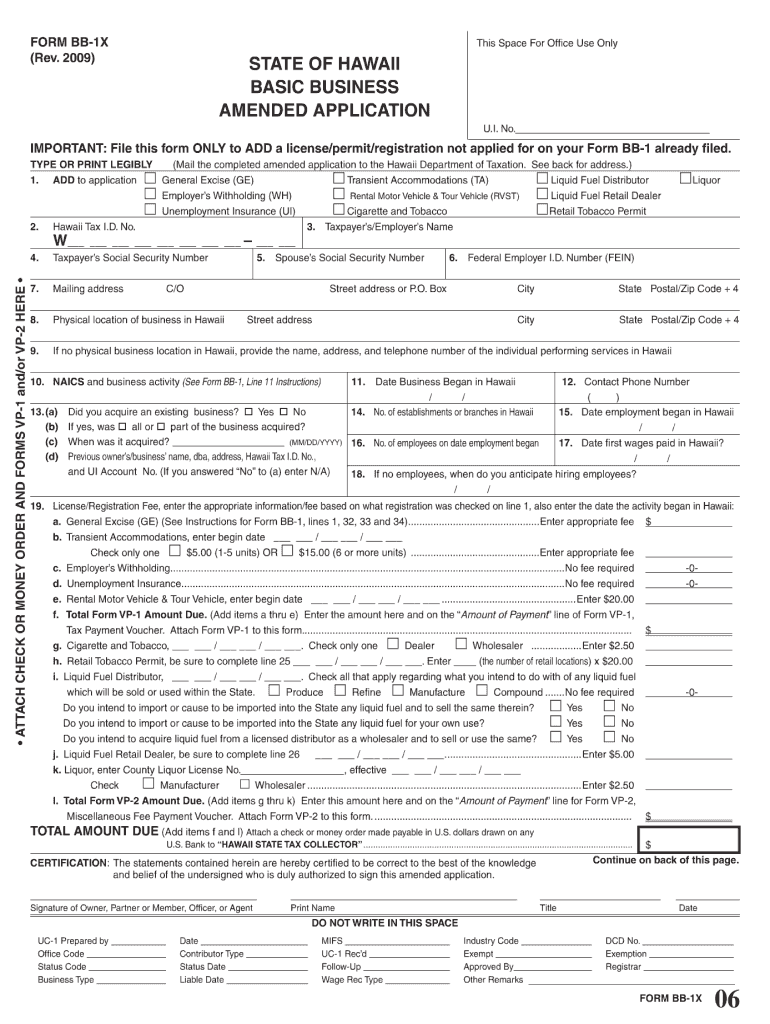

HI BB1X 2009 Fill out Tax Template Online US Legal Forms

Sign it in a few clicks draw your signature, type it,. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Multiply line 11 by appropriate percentages on lines 5y and 5s. This form is for income earned in tax year 2022, with tax returns due in april 2023. 2021) n11_i 2021a 01 vid01 state of hawaii.

Form N11 Download Fillable PDF or Fill Online Individual Tax

Employee's withholding certificate form 941; If tax is from the capital gains tax worksheet, enter the net capital gain from line 14 of that worksheet. Web january 24, 2022 4:29 pm. Don't miss this 50% discount. Web july 30, 2023, 6:00 a.m.

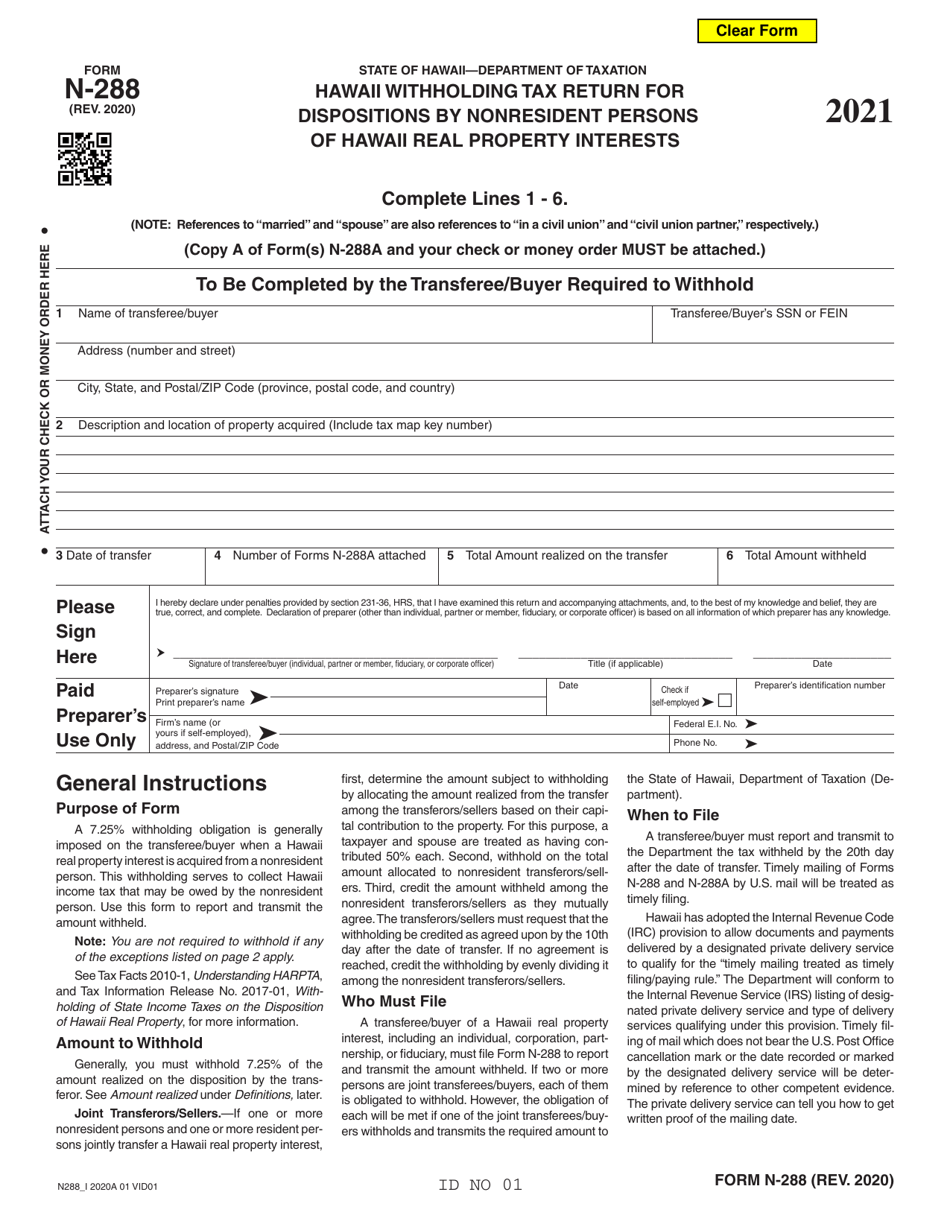

Form N288 Download Fillable PDF or Fill Online Hawaii Withholding Tax

Previous balance with applicable interest at % per year and payments received through. File your 2290 tax now and receive schedule 1 in minutes. Multiply line 11 by appropriate percentages on lines 5y and 5s. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Individual tax return form 1040 instructions;

Form N11 (N15) Schedule X Download Fillable PDF or Fill Online Tax

Individual income tax return (resident form) caution: Previous balance with applicable interest at % per year and payments received through. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. If tax is from the capital gains tax worksheet, enter the net capital gain from line 14 of that worksheet. Edit your form n 11 form online.

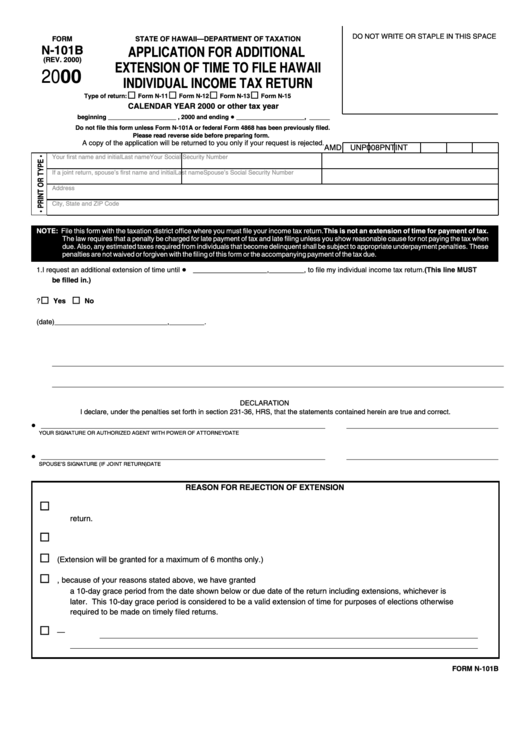

Form N101b Application For Additional Extension Of Time To File

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web january 24, 2022 4:29 pm. Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and more. 2021) n11_i 2021a 01 vid01 state of hawaii — department of taxation do not write in this area.

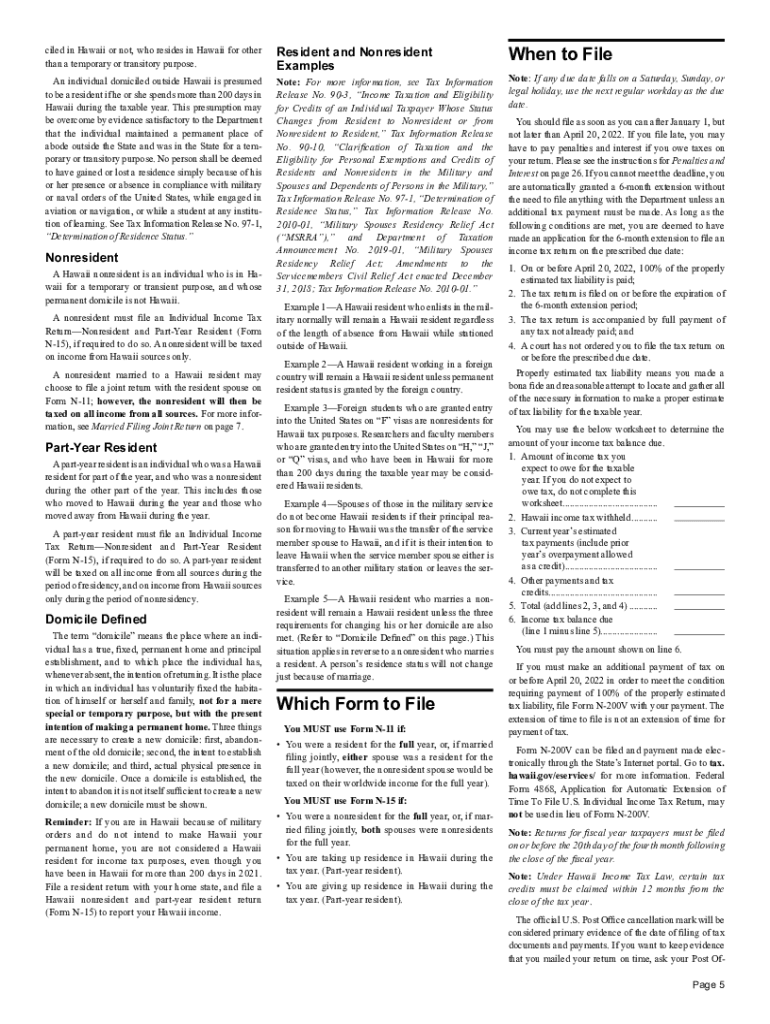

Hawaii Tax Instructions Fill Out and Sign Printable PDF Template

Employee's withholding certificate form 941; Employers engaged in a trade or business who. At this time, it is expected to be available on january 27, 2022. Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and more. 2021) page 3 of 4 27a.

Tax payment concept. State taxes. Vector illustration of Businessman

Employers engaged in a trade or business who. Individual tax return form 1040 instructions; Total nebraska and local sales and use tax due (line 9 plus line 10). Individual income tax return (resident form) caution: Web july 30, 2023, 6:00 a.m.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Web popular forms & instructions; The form features space to include your income, marital status as well. We applied your 2016 form 1040 overpayment to an unpaid balance refund due: Produced by adrienne hurst and aaron esposito. Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and more.

N11 Form Fill Out and Sign Printable PDF Template signNow

2021) n11_i 2021a 01 vid01 state of hawaii — department of taxation do not write in this area individual income tax return resident. Individual tax return form 1040 instructions; Web 123 n harris st harvard, tx 12345. If tax is from the capital gains tax worksheet, enter the net capital gain from line 14 of that worksheet. Web january 24,.

Employers Engaged In A Trade Or Business Who.

Web january 24, 2022 4:29 pm. 2021) page 3 of 4 27a. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web 123 rows tax forms beginning with n;

Don't Miss This 50% Discount.

Employee's withholding certificate form 941; Web july 30, 2023, 6:00 a.m. Individual income tax return (resident form) caution: 2021) n11_i 2021a 01 vid01 state of hawaii — department of taxation do not write in this area individual income tax return resident.

Multiply Line 11 By Appropriate Percentages On Lines 5Y And 5S.

Edit your form n 11 form online type text, add images, blackout confidential details, add comments, highlights and more. For information and guidance in its preparation, we have. The form features space to include your income, marital status as well. File your 2290 tax now and receive schedule 1 in minutes.

If Tax Is From The Capital Gains Tax Worksheet, Enter The Net Capital Gain From Line 14 Of That Worksheet.

Individual income tax return (resident form) caution:. Web missouri department of revenue home page, containing links to motor vehicle and driver licensing services, and taxation and collection services for the state of missouri. $250.00 we applied $500.00 of your 2016 form 1040. Previous balance with applicable interest at % per year and payments received through.