Texas Extension Form

Texas Extension Form - Web new texas residents can legally drive with a valid, unexpired driver license from another u.s. Business that paid $10,000 or more in franchise tax payments during the preceding state fiscal year. Territory, canadian province, or qualifying country for up to 90 days after. Web this form is requested in accordance with the requirement of the texas education code and in cooperation with the texas education agency and local school board policies. Licensee name social security number street address or route _ city state zip email reason for. Web the texas extension education association, inc. Web what is the second texas franchise tax extension? You do not need to explain to the irs why you. Web file your tax extension now! Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023.

Web apply for a continuing education exemption or extension licensee information: Web file your tax extension now! Business that paid $10,000 or more in franchise tax payments during the preceding state fiscal year. Either option is open to both agents and adjusters. (teea) manual is designed for teea board members, district directors, county association chairs, club presidents, and. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Web what is the second texas franchise tax extension? Web the texas extension education association, inc. Web filing a texas extension request in lacerte. Web the updates are part of a continuing partnership with the human resources service center (hrsc) to improve the experience of employees and administrative staff.

______, _____ page 1 of 2addendum for option to extend term concerning not later. Web filing a texas extension request in lacerte. You do not need to explain to the irs why you. Either option is open to both agents and adjusters. Web this form may be used to apply for a “grandfather” exemptionfor an extension of time to , or complete continuing education hours. Business that paid $10,000 or more in franchise tax payments during the preceding state fiscal year. Find texas extension request under. Landlord and tenant extend and continue the term. Web the following texas forms are eligible for electronic filing: Web if you are extending a lease that is written on a prior version of the form, it is recommended that you enter into a new lease on the updated form to ensure compliance with changes.

FREE 33+ Lease Agreement Forms in PDF MS Word

Web file your tax extension now! Web apply for a continuing education exemption or extension licensee information: Web franchise tax report forms should be mailed to the following address: Web filing a texas extension request in lacerte. Web this form may be used to apply for a “grandfather” exemptionfor an extension of time to , or complete continuing education hours.

Free Texas Rental Lease Agreement Templates PDF WORD

Web new texas residents can legally drive with a valid, unexpired driver license from another u.s. Web franchise tax report forms should be mailed to the following address: Web the updates are part of a continuing partnership with the human resources service center (hrsc) to improve the experience of employees and administrative staff. The texas franchise tax is imposed on.

Extension Of Tenancy Agreement Sample Master Template

Web if you are extending a lease that is written on a prior version of the form, it is recommended that you enter into a new lease on the updated form to ensure compliance with changes. Agreement to extend the term of a residential lease, with possible modifications. An extension of time to file a franchise tax report will be.

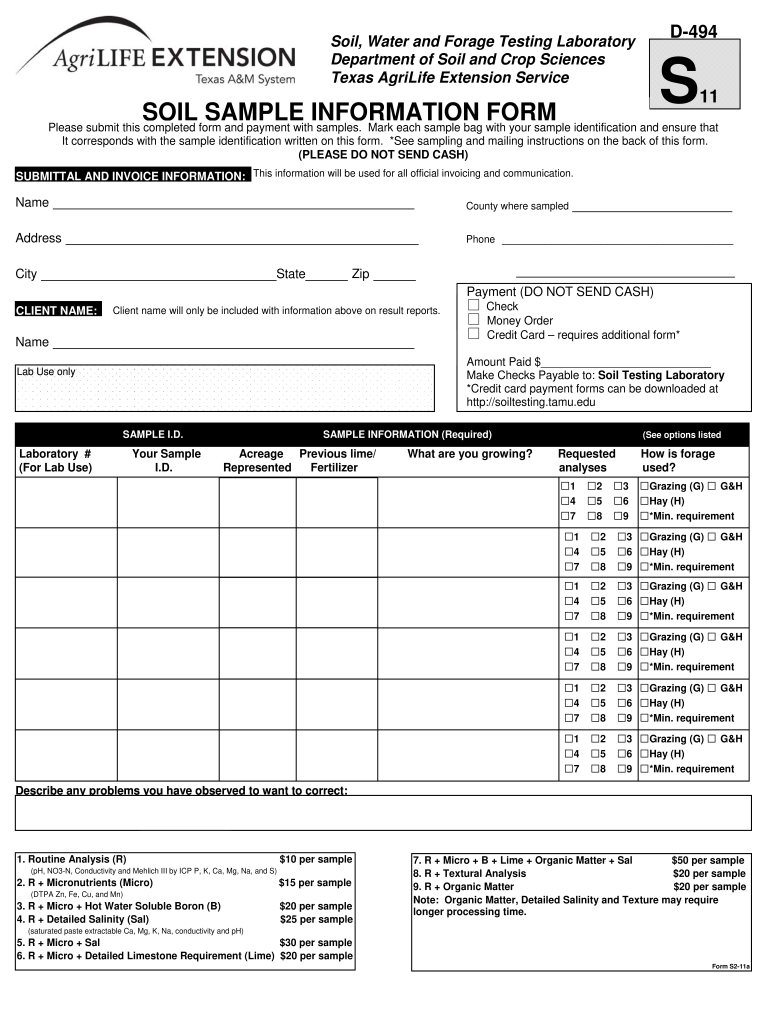

TX Texas A&M System Form S211A Fill and Sign Printable Template

Web filing a texas extension request in lacerte. ______, _____ page 1 of 2addendum for option to extend term concerning not later. Web to request an extension to file your taxes, fill out and submit irs form 4868 by tax day, which is usually april 15. Web if you are extending a lease that is written on a prior version.

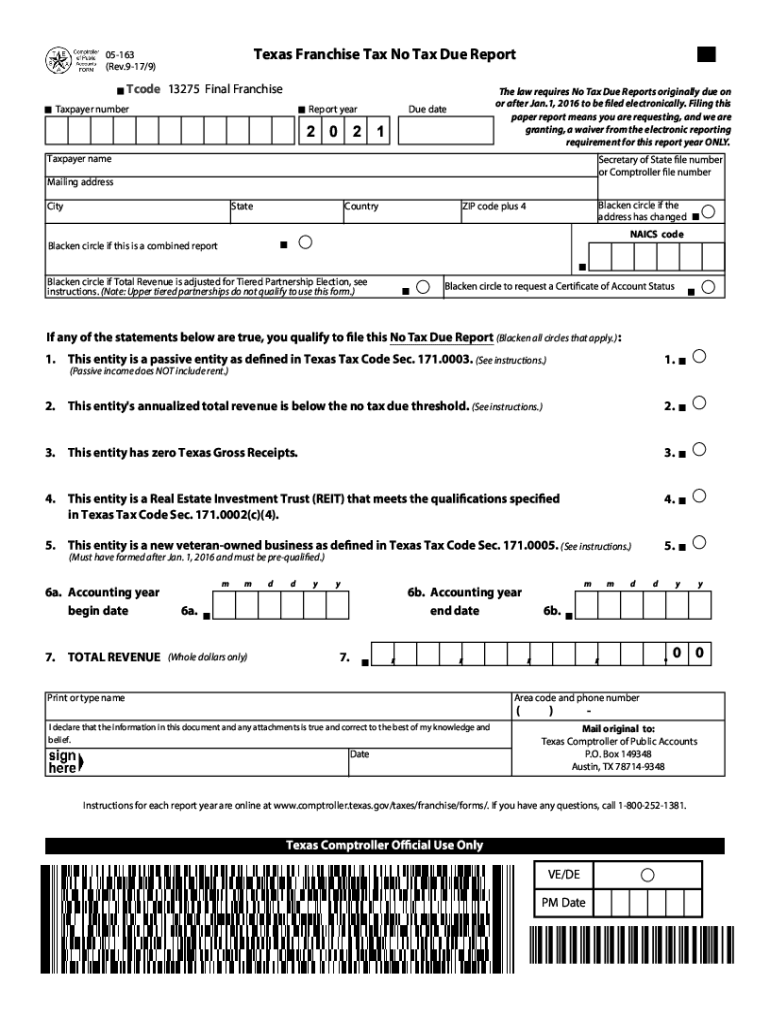

2021 Form TX Comptroller 05163 Fill Online, Printable, Fillable, Blank

Web what is the second texas franchise tax extension? Texas comptroller of public accounts p.o. ______, _____ page 1 of 2addendum for option to extend term concerning not later. Licensee name social security number street address or route _ city state zip email reason for. Agreement to extend the term of a residential lease, with possible modifications.

Texas Extension Form W3X (Fill Form) Letter Of Credit Fee

Web the local dps waiver/challenge stations are responsible for issuing waivers/time extensions. ______, _____ page 1 of 2addendum for option to extend term concerning not later. (teea) manual is designed for teea board members, district directors, county association chairs, club presidents, and. An extension of time to file a franchise tax report will be tentatively granted upon receipt of a.

Extension Specialist Map

Business that paid $10,000 or more in franchise tax payments during the preceding state fiscal year. Web the updates are part of a continuing partnership with the human resources service center (hrsc) to improve the experience of employees and administrative staff. Web this form is requested in accordance with the requirement of the texas education code and in cooperation with.

Texas extension service chicken yield Chicken, Food, Extensions

Web the following texas forms are eligible for electronic filing: Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Find texas extension request under. Web new texas residents can legally drive with a valid, unexpired driver license from another u.s. Web filing a texas extension request in lacerte.

Texas Lease Extension Form Fill Online, Printable, Fillable, Blank

Web franchise tax report forms should be mailed to the following address: Either option is open to both agents and adjusters. Web file your tax extension now! Agreement to extend the term of a residential lease, with possible modifications. The texas franchise tax is imposed on each taxable entity formed or organized in texas or doing business in.

Form 1138 Extension of Time for Payment of Taxes (2012) Free Download

Web the texas extension education association, inc. Agreement to extend the term of a residential lease, with possible modifications. Contact your local waiver/challenge station for more information regarding a. Web what is the second texas franchise tax extension? (teea) manual is designed for teea board members, district directors, county association chairs, club presidents, and.

(Teea) Manual Is Designed For Teea Board Members, District Directors, County Association Chairs, Club Presidents, And.

Business that paid $10,000 or more in franchise tax payments during the preceding state fiscal year. Web to request an extension to file your taxes, fill out and submit irs form 4868 by tax day, which is usually april 15. Web apply for a continuing education exemption or extension licensee information: Find texas extension request under.

Web The Texas Extension Education Association, Inc.

This deadline applies to any individual or small business seeking to file their taxes with the. Territory, canadian province, or qualifying country for up to 90 days after. Web file your tax extension now! Web this form may be used to apply for a “grandfather” exemptionfor an extension of time to , or complete continuing education hours.

The Texas Franchise Tax Is Imposed On Each Taxable Entity Formed Or Organized In Texas Or Doing Business In.

Web franchise tax report forms should be mailed to the following address: Landlord and tenant extend and continue the term. Agreement to extend the term of a residential lease, with possible modifications. Web the updates are part of a continuing partnership with the human resources service center (hrsc) to improve the experience of employees and administrative staff.

Either Option Is Open To Both Agents And Adjusters.

Web new texas residents can legally drive with a valid, unexpired driver license from another u.s. Web the following texas forms are eligible for electronic filing: Contact your local waiver/challenge station for more information regarding a. Web what is the second texas franchise tax extension?