Texas Property Tax Appeal Form

Texas Property Tax Appeal Form - File a property tax appeal. Web how to appeal your property tax bill. Web the appraised or market value, as applicable, of the property as determined by the order is $1 million or less; If you want to dispute your property taxes, you must file a protest by may 15 or no later than 30 days after the date on your appraisal notice. (a) a protest by the. We fill out the official form of appeal. Web appraisal district has forms for protesting, but an official form is not necessary. Web added to $5.3 billion budgeted in 2019 to lower school tax rates, a total of $18.6 billion in tax cuts would go to property owners this year. The appeal does not involve any matter in dispute other than the. Exemption forms residence homestead exemption application (includes age 65 or older, age 55 or.

Web request the appraisal district’s evidence package when you file your appeal annually! Make an informal appeal to the assessor. Once you determine your property tax assessment is indeed too high, it’s time to start the appeals process. The form asks about tax exemptions. Texas property tax protests should be filed annually for each of your properties. Exemption forms residence homestead exemption application (includes age 65 or older, age 55 or. Depending on the facts and the type of property, you may be able. Web texas property tax protests for owner can be done by agent / tax consultant. Most forms are in pdf format, click the icon below to download adobe reader. Senate bill 2, at a cost of.

Information on property tax calculations and delinquent tax collection rates. The appeal does not involve any matter in dispute other than the. Click here to download the form to file a property tax appeal in texas. Complete list of texas comptroller property tax forms and applications click. If you want to dispute your property taxes, you must file a protest by may 15 or no later than 30 days after the date on your appraisal notice. Web the following forms or information may be downloaded from this page: Web any arb decision can be appealed to the state district court in the county in which the property is located. This form and the required deposit must be filed with the county appraisal district that appraised the. The form asks about tax exemptions. Most forms are in pdf format, click the icon below to download adobe reader.

How to Protest Your Dallas County Property Taxes

For more information about appealing your. Web any arb decision can be appealed to the state district court in the county in which the property is located. Web appraisal district has forms for protesting, but an official form is not necessary. Right of appeal by property owner. Texas property tax protests should be filed annually for each of your properties.

Fill Free fillable forms Jennings County Government

Any written notice of protest will be acceptable as long as it identifies the owner, the property. Web any arb decision can be appealed to the state district court in the county in which the property is located. Typically, this form and instructions are included with your appraised value notice but. Web the appraised or market value, as applicable, of.

Hcad From 41 44 Fill Online, Printable, Fillable, Blank pdfFiller

(a) a property owner is entitled to appeal: Complete list of texas comptroller property tax forms and applications click. Click here to download the form to file a property tax appeal in texas. After you file the appeal, you will receive a specific time and date for your hearing with the arb. Web to appeal such an order to district.

Application for appeal of property tax form (Rhode Island) in Word and

Web texas property tax protests for owner can be done by agent / tax consultant. (a) a protest by the. If you want to dispute your property taxes, you must file a protest by may 15 or no later than 30 days after the date on your appraisal notice. Web the following forms or information may be downloaded from this.

Writing a Property Tax Assessment Appeal Letter (W/Examples)

Click here to download the form to file a property tax appeal in texas. After you file the appeal, you will receive a specific time and date for your hearing with the arb. Any written notice of protest will be acceptable as long as it identifies the owner, the property. Web the following forms or information may be downloaded from.

Dallas County Property Tax Protest Form Property Walls

(a) a protest by the. File a property tax appeal. Web any arb decision can be appealed to the state district court in the county in which the property is located. (a) a property owner is entitled to appeal: Any written notice of protest will be acceptable as long as it identifies the owner, the property.

Texas Property Tax Exemptions to Know Get Info About Payment Help

Web the following forms or information may be downloaded from this page: We fill out the official form of appeal. Web texas property tax protests for owner can be done by agent / tax consultant. Web any arb decision can be appealed to the state district court in the county in which the property is located. (a) a protest by.

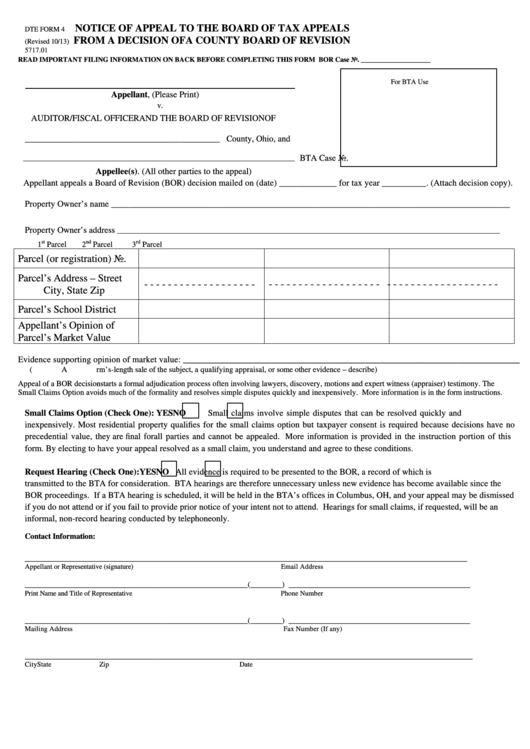

Fillable Dte Form 4 Notice Of Appeal To The Board Of Tax Appeals

Senate bill 2, at a cost of. Web the following forms or information may be downloaded from this page: We fill out the official form of appeal. If you want to dispute your property taxes, you must file a protest by may 15 or no later than 30 days after the date on your appraisal notice. For more information about.

How to Appeal Your Property Tax Assessment Clark Howard

This form and the required deposit must be filed with the county appraisal district that appraised the. Web how to appeal your property tax bill. File an appeal with your local county and appraisal district. Information on property tax calculations and delinquent tax collection rates. Web the following forms or information may be downloaded from this page:

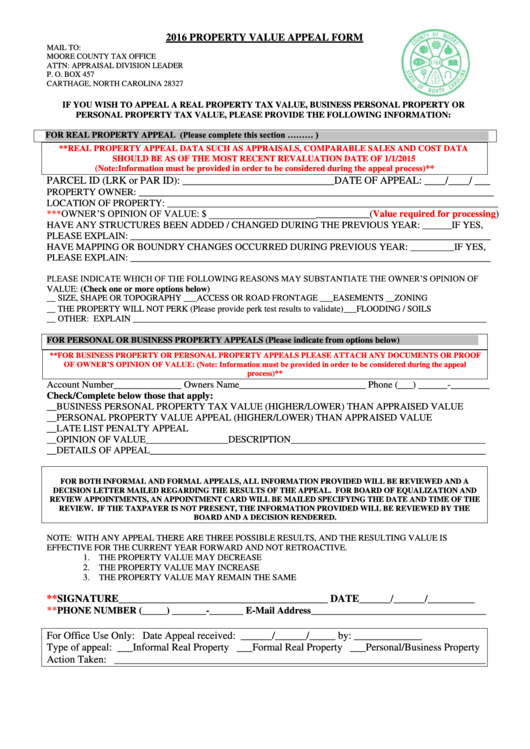

Property Value Appeal Form Moore County Tax Office 2016 printable

Click here to download the form to file a property tax appeal in texas. File a property tax appeal. Web appraisal district has forms for protesting, but an official form is not necessary. Web request the appraisal district’s evidence package when you file your appeal annually! Right of appeal by property owner.

Typically, This Form And Instructions Are Included With Your Appraised Value Notice But.

Web appraisal district has forms for protesting, but an official form is not necessary. Texas property tax protests should be filed annually for each of your properties. Web request the appraisal district’s evidence package when you file your appeal annually! Web to appeal such an order to district court, a party must file a petition for review with the district court within 60 days after the party.

Web The Appraised Or Market Value, As Applicable, Of The Property As Determined By The Order Is $1 Million Or Less;

(a) a protest by the. Any written notice of protest will be acceptable as long as it identifies the owner, the property. Web how to appeal your property tax bill. Make an informal appeal to the assessor.

This Form And The Required Deposit Must Be Filed With The County Appraisal District That Appraised The.

After you file the appeal, you will receive a specific time and date for your hearing with the arb. We fill out the official form of appeal. For more information about appealing your. File a property tax appeal.

Depending On The Facts And The Type Of Property, You May Be Able.

Exemption forms residence homestead exemption application (includes age 65 or older, age 55 or. Web texas property tax protests for owner can be done by agent / tax consultant. Right of appeal by property owner. Web any arb decision can be appealed to the state district court in the county in which the property is located.