Texas Tax Code Chapter 171

Texas Tax Code Chapter 171 - The exemption applies only to a period for which no tax. Paying off a loan by regular installments. Web texas tax code (ttc) 171.0003(b). 2022 2021 2019 2017 2015 other previous versions. Temporary credit for business loss carryforwards under texas tax code section 171.111 (effective for reports originally due on or after jan. Section 171.0003, definition of passive entity. Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. Means the comptroller of public accounts of the state of texas.see texas tax code. 1, 2008) research and development activities credit under texas tax code chapter 171… (b) the tax imposed under this chapter extends to the limits of the united.

Paying off a loan by regular installments. Franchise tax tax code subtitle f. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250 and 1254 considered passive income? Tx tax code § 171.0005. Definition of conducting active trade or business. (1) internal revenue code means the internal revenue code. (b) the tax imposed under this chapter extends to. (b) the tax imposed under this chapter extends to the limits of the united. Section 171.0003, definition of passive entity. To the extent the irc treats the recapture of depreciation under these sections as ordinary income, the recaptured amount.

Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. Web the following franchise tax credits are available: Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. 2022 2021 2019 2017 2015 other previous versions. A taxable entity that does not owe any tax under this chapter for any period is not required to file a report under section 171.201 (initial report) or 171.202 (annual report). Franchise tax tax code subtitle f. Web texas tax code (ttc) 171.0003(b). (b) the tax imposed under this chapter extends to. A periodic (usually annual) payment of a fixed sum of money for either the life of the. Paying off a loan by regular installments.

MillyTsneem

Adjustment of eligibility for no tax due, discounts, and compensation deduction. 2022 2021 2019 2017 2015 other previous versions. Tx tax code § 171.651 (2021) sec. There is a newer version of the texas statutes. A taxable entity that does not owe any tax under this chapter for any period is not required to file a report under section 171.201.

Miscellaneous Texas Tax Forms35100 Texas Loan Administration Fee Re…

Means the comptroller of public accounts of the state of texas.see texas tax code. Adjustment of eligibility for no tax due, discounts, and compensation deduction. (1) the property comprising the estate of a deceased person, or (2) the property in a trust account.; 1, 2008) research and development activities credit under texas tax code chapter 171… Web general definitions 171.001.

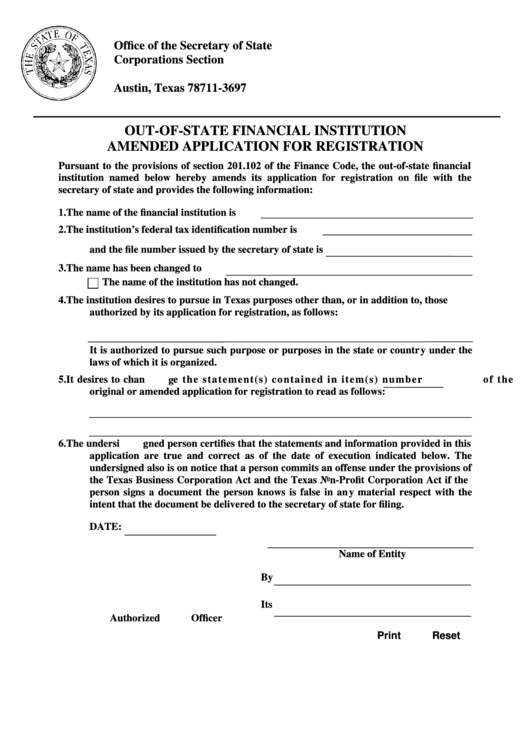

Fillable OutOfState Financial Institution Amended Application For

(a) a franchise tax is imposed on each taxable entity that does business in this state or that is chartered or organized in this state. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. To the extent the irc treats the recapture of depreciation under these sections as ordinary income, the.

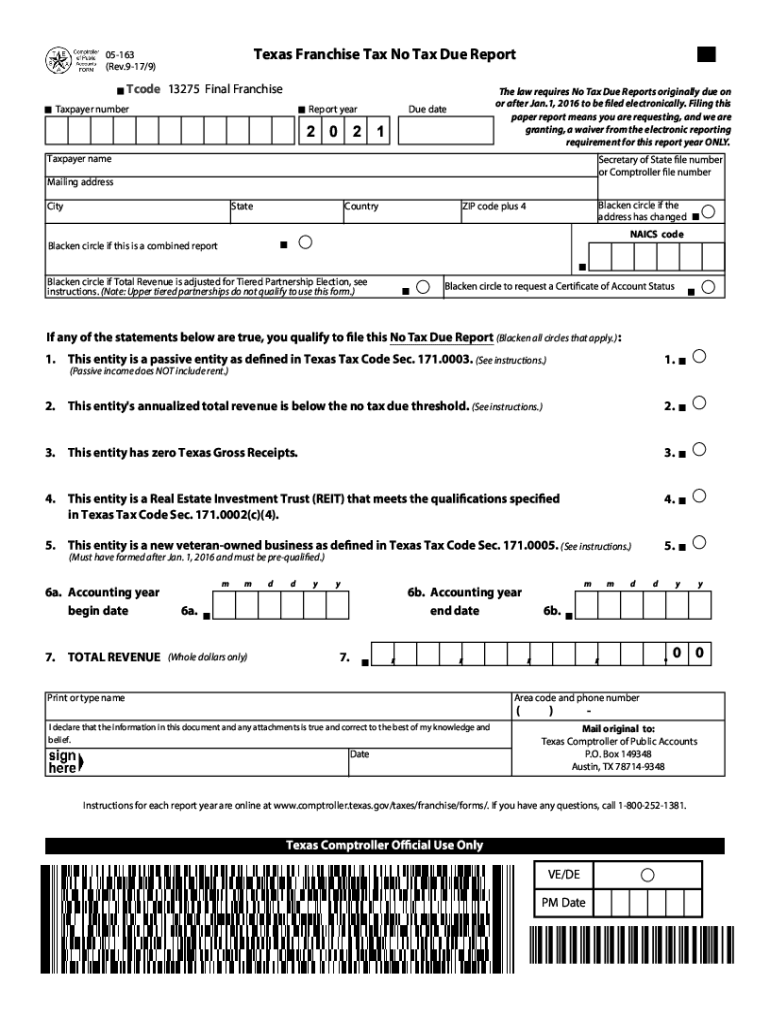

2021 Form TX Comptroller 05163 Fill Online, Printable, Fillable, Blank

(1) the property comprising the estate of a deceased person, or (2) the property in a trust account.; Web statutes title 2, state taxation; Web general definitions 171.001 tax imposed 171.002 rates 171.0002 definition of taxable entity 171.003 increase in rate requires voter approval 171.0003 definition of passive entity 171.0004 definition of conducting active trade. A periodic (usually annual) payment.

Regret or resuscitate? The fate of Texas Tax Code Chapter 313 Dallas

(1) the property comprising the estate of a deceased person, or (2) the property in a trust account.; View our newest version here. Web general definitions 171.001 tax imposed 171.002 rates 171.0002 definition of taxable entity 171.003 increase in rate requires voter approval 171.0003 definition of passive entity 171.0004 definition of conducting active trade. Web all provisions of tax code,.

DaylHarrison

Section 171.0003, definition of passive entity. (a) a franchise tax is imposed on each taxable entity that does business in this state or that is chartered or organized in this state. 1, 2008) research and development activities credit under texas tax code chapter 171… (1) affiliated group means a group of one or more entities in which a controlling interest.

Texas Tax Code 2017 Apps 148Apps

(1) internal revenue code means the internal revenue code. A periodic (usually annual) payment of a fixed sum of money for either the life of the. (b) the tax imposed under this chapter extends to the limits of the united. Definition of conducting active trade or business. Tx tax code § 171.10131 (2021) sec.

DanicaKaelen

Tax credit for certain research and development activities. To the extent the irc treats the recapture of depreciation under these sections as ordinary income, the recaptured amount. (a) a franchise tax is imposed on each taxable entity that does business in this state or that is chartered or organized in this state. Is the recapture of depreciation under internal revenue.

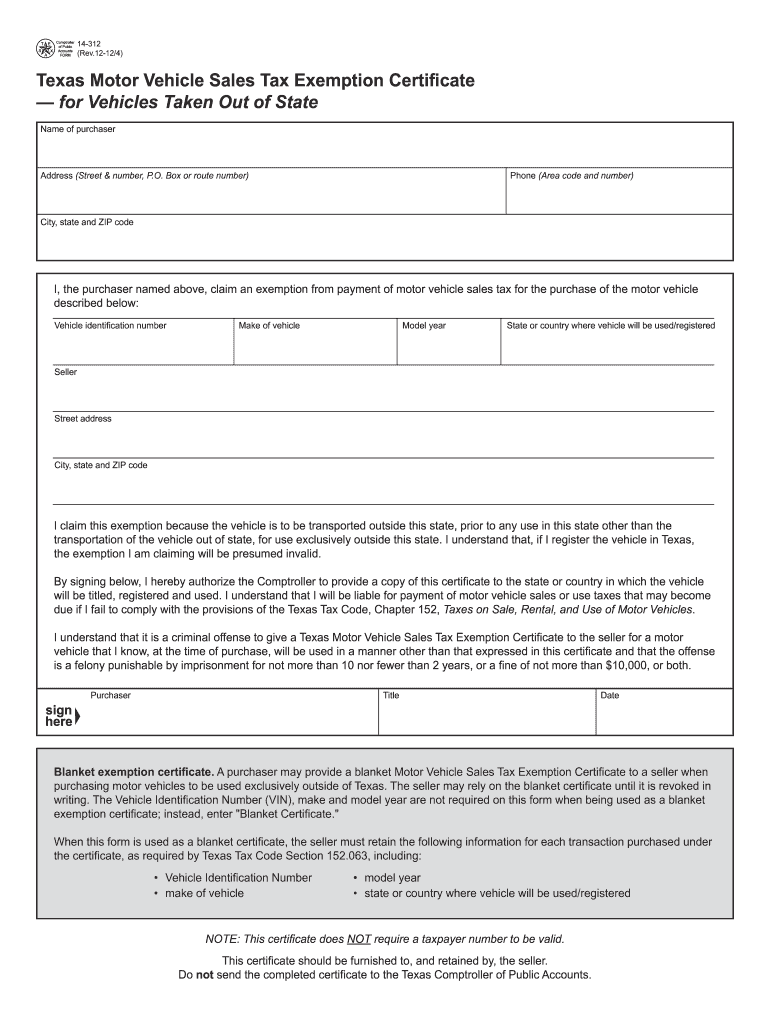

Texas Motor Vehicle Tax Fill Out and Sign Printable PDF Template

Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. Section 171.0003, definition of passive entity. Tx tax code § 171.0005. Web tax code section 171.2022. 2022 2021 2019 2017 2015 other previous versions.

Interactive Exploit the Texas Tax Code like a billionaire Houston

(1) internal revenue code means the internal revenue code. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code, §171.0011. There is a newer version of the texas statutes. (a).

2022 2021 2019 2017 2015 Other Previous Versions.

2005 texas tax code chapter 171. To the extent the irc treats the recapture of depreciation under these sections as ordinary income, the recaptured amount. A periodic (usually annual) payment of a fixed sum of money for either the life of the. Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code, §171.0011.

Paying Off A Loan By Regular Installments.

A final report and payment of the additional tax are due within 60 days after the taxable entity no longer has sufficient nexus with texas to be subject to the franchise tax. Nonprofit entities that have requested and been granted an exemption from the comptroller's office do not have to file franchise tax. There is a newer version of the texas statutes. The exemption applies only to a period for which no tax.

Tx Tax Code § 171.10131 (2021) Sec.

Web the following franchise tax credits are available: Web tax code section 171.2022. Franchise tax tax code subtitle f. View our newest version here.

Web Statutes Title 2, State Taxation;

Section 171.0003, definition of passive entity. Temporary credit for business loss carryforwards under texas tax code section 171.111 (effective for reports originally due on or after jan. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. (a) a franchise tax is imposed on each taxable entity that does business in this state or that is chartered or organized in this state.