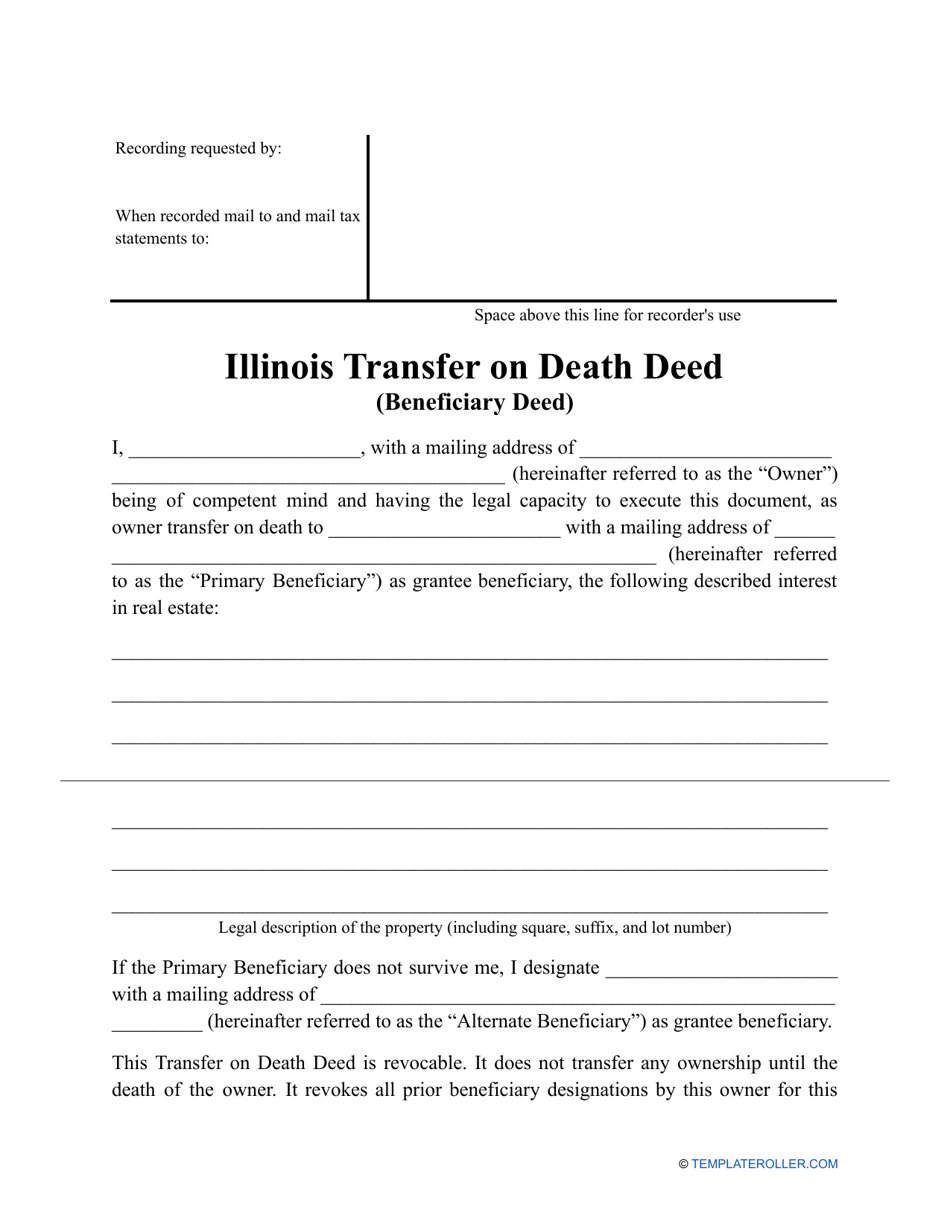

Transfer On Death Deed Illinois Form

Transfer On Death Deed Illinois Form - The todi is prepared before the owners’ death and becomes effective at the death of the last owner to die. We take you through all the steps, including: That act has allowed persons owning residential real estate in illinois to designate a beneficiary of the real estate through a transfer on death instrument (“todi”), thereby. Fill now click to fill, edit and sign this form now! Web an illinois transfer of death deed form automatically transfers property upon the death of the owner and is used in a way similar to beneficiary designations on bank accounts. Web an illinois transfer on death deed instrument (todi) is a document that allows someone to transfer ownership of real property to a beneficiary, effective upon their death. Web fill out and sign the transfer on death instrument (“todi”) form, and have it notarized. Web illinois real property transfer on death instrument (todi) pursuant to § 755 ilcs 27/1 et seq. Use our todi program to help you fill out the transfer on death instrument form. Customize your document by using the toolbar on the top.

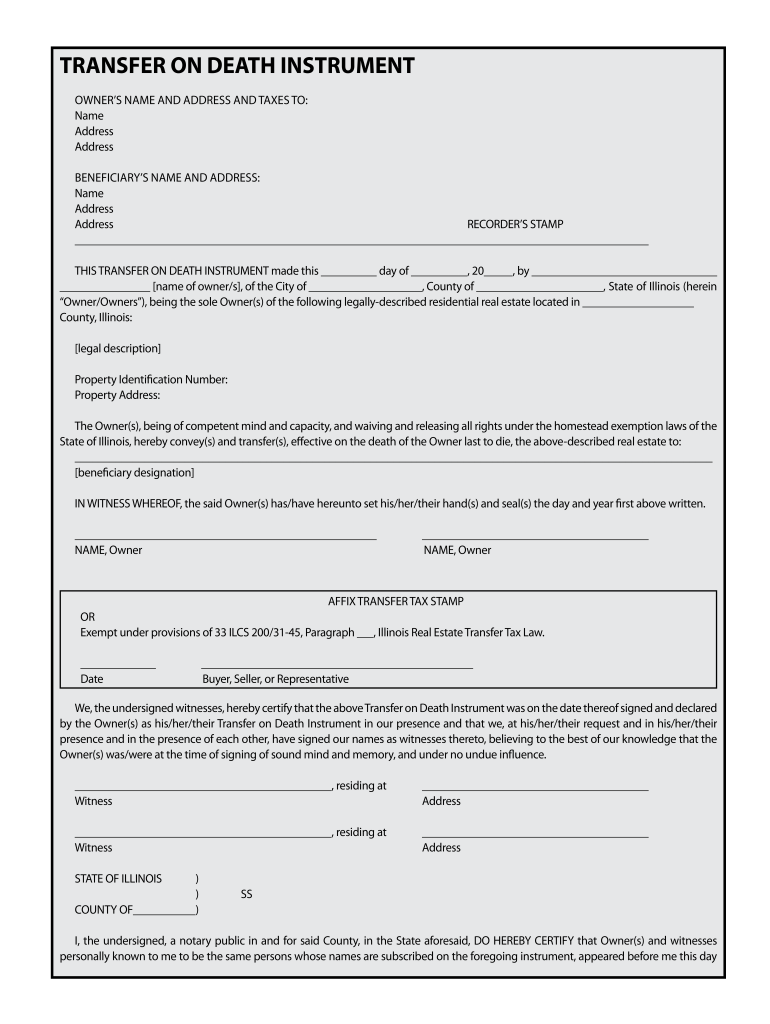

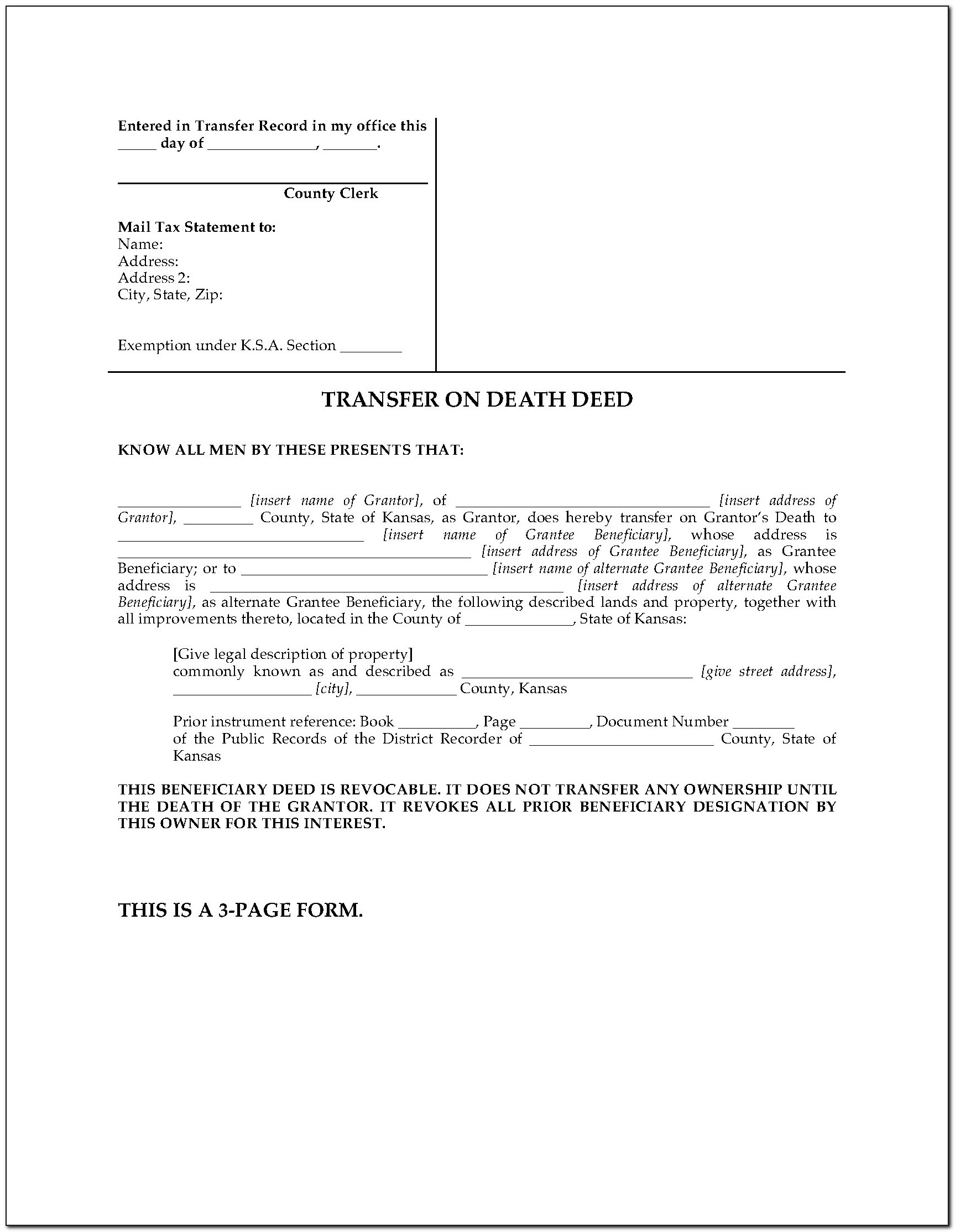

Web transfer on death instrument made before, on, or after the effective date of this amendatory act of the 102nd general assembly by an owner dying on or after the effective date of this amendatory act of the 102nd general assembly. Web get form download the form how to edit and sign illinois tod deed online read the following instructions to use cocodoc to start editing and signing your illinois tod deed: 1, 2022, the illinois transfer on death instrument act was expanded. Fill now click to fill, edit and sign this form now! Get a customized tod deed online. In the beginning, direct to the “get form” button and click on it. Web illinois transfer on death deed form. _____, by the property owner or owners, Web illinois residential transfer on death instrument (todi) pursuant to § 755 ilcs 27/1 et seq. [legal description] property identification number:

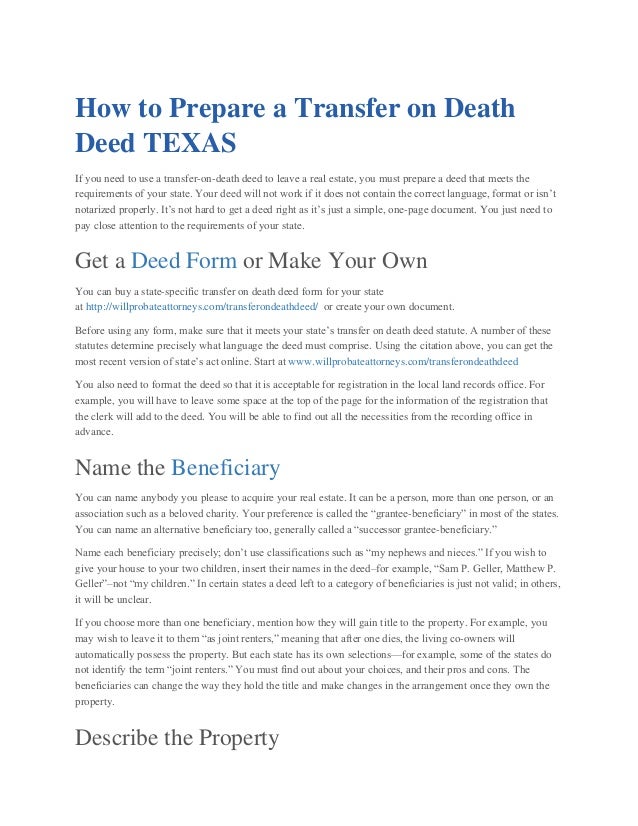

It functions in much the same way as a beneficiary designation on a bank account. _____, by the property owner or owners, We take you through all the steps, including: Depending on the state, a transfer on death deed may also be referred to as. 1, 2022, the illinois transfer on death instrument act was expanded. Illinois law requires that the transfer on death instrument be signed, witnessed, notarized and recorded with the county recorder of deeds before the owner's death. The todi is prepared before the owners’ death and becomes effective at the death of the last owner to die. This means that it may be used not only for one’s home but also for farm, commercial, industrial, recreational or any other real estate. You retain ownership, responsibility, and control over the property during your life. Fill out the required forms it is often wise to hire a lawyer to help fill out the following forms.

Transfer On Death Deed Illinois Form 20202022 Fill and Sign

We take you through all the steps, including: Fill now click to fill, edit and sign this form now! If you own your home and want to give it to someone when you die, you can use a transfer on death instrument (todi) to do so. _____, by the property owner or owners, Unlike a will, a todi can only.

Transfer On Death Deed Form West Virginia Form Resume Examples

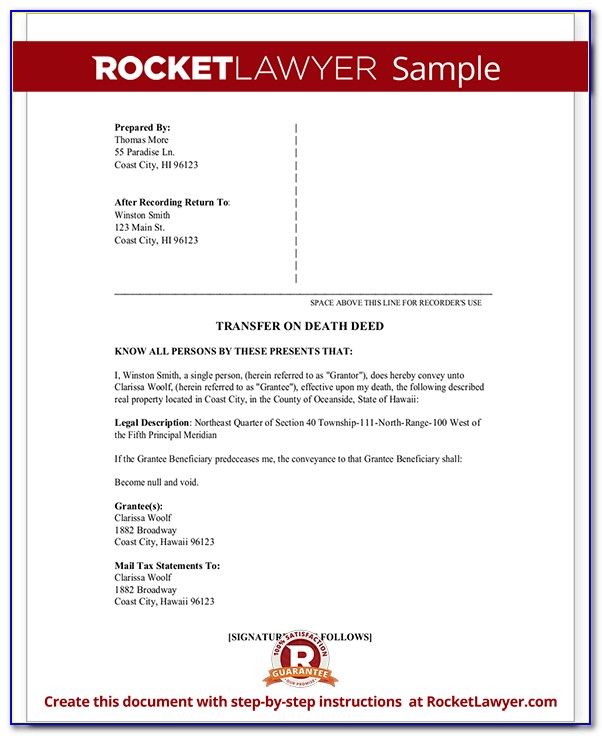

It now may be used to transfer any real estate at death. It functions in much the same way as a beneficiary designation on a bank account. Web $34.99 buy now use this form to leave your illinois real estate without probate. Web an illinois transfer on death deed instrument (todi) is a document that allows someone to transfer ownership.

Transfer On Death Deed Willprobateattorneys

Web illinois real property transfer on death instrument (todi) pursuant to § 755 ilcs 27/1 et seq. Web to transfer the ownership to the beneficiary, the beneficiary must submit the title (if available), applicable title fee, certified death certificate of the vehicle’s legal owner, and the appropriate tax form and check payable to illinois department of revenue, if applicable. A.

Free Interspousal Transfer Deed California Form Form Resume

Web illinois transfer on death instrument information. After your death, ownership transfers to the beneficiary you name. Web get form download the form how to edit and sign illinois tod deed online read the following instructions to use cocodoc to start editing and signing your illinois tod deed: We take you through all the steps, including: It functions in much.

Illinois Transfer On Death Deed Form Download Printable Pdf Gambaran

After your death, ownership transfers to the beneficiary you name. That act has allowed persons owning residential real estate in illinois to designate a beneficiary of the real estate through a transfer on death instrument (“todi”), thereby. Web fill out and sign the transfer on death instrument (“todi”) form, and have it notarized. Web $34.99 buy now use this form.

Transfer On Death Deed Mn Form Fill Out and Sign Printable PDF

Web illinois real property transfer on death instrument (todi) pursuant to § 755 ilcs 27/1 et seq. Web a transfer on death deed is a legal document that enables the change of ownership of real property on the death of the property’s owner. Web an illinois transfer on death deed instrument (todi) is a document that allows someone to transfer.

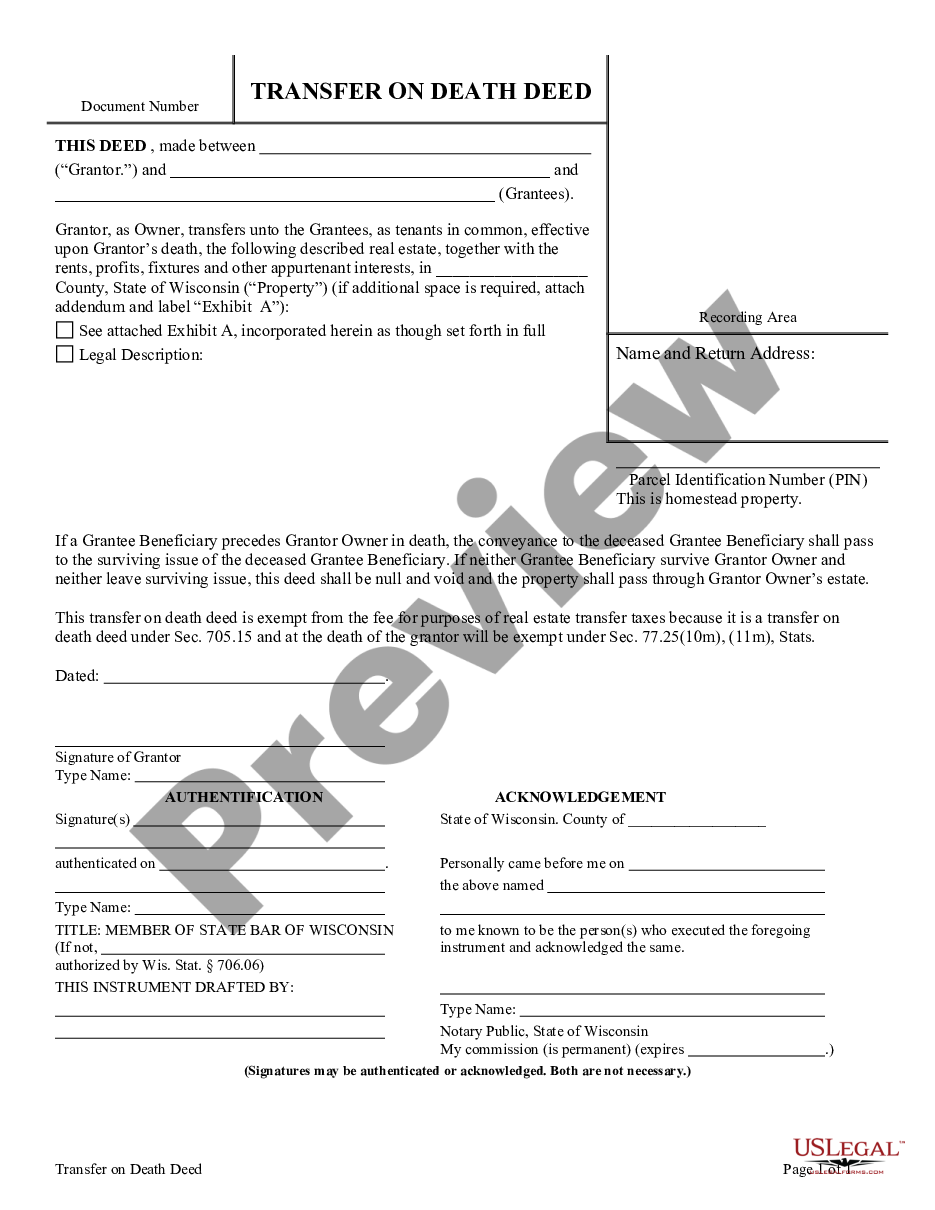

Wisconsin Transfer on Death Deed or TOD Transfer Death Deed US

That act has allowed persons owning residential real estate in illinois to designate a beneficiary of the real estate through a transfer on death instrument (“todi”), thereby. Web an illinois transfer on death deed instrument (todi) is a document that allows someone to transfer ownership of real property to a beneficiary, effective upon their death. Web transfer on death instrument.

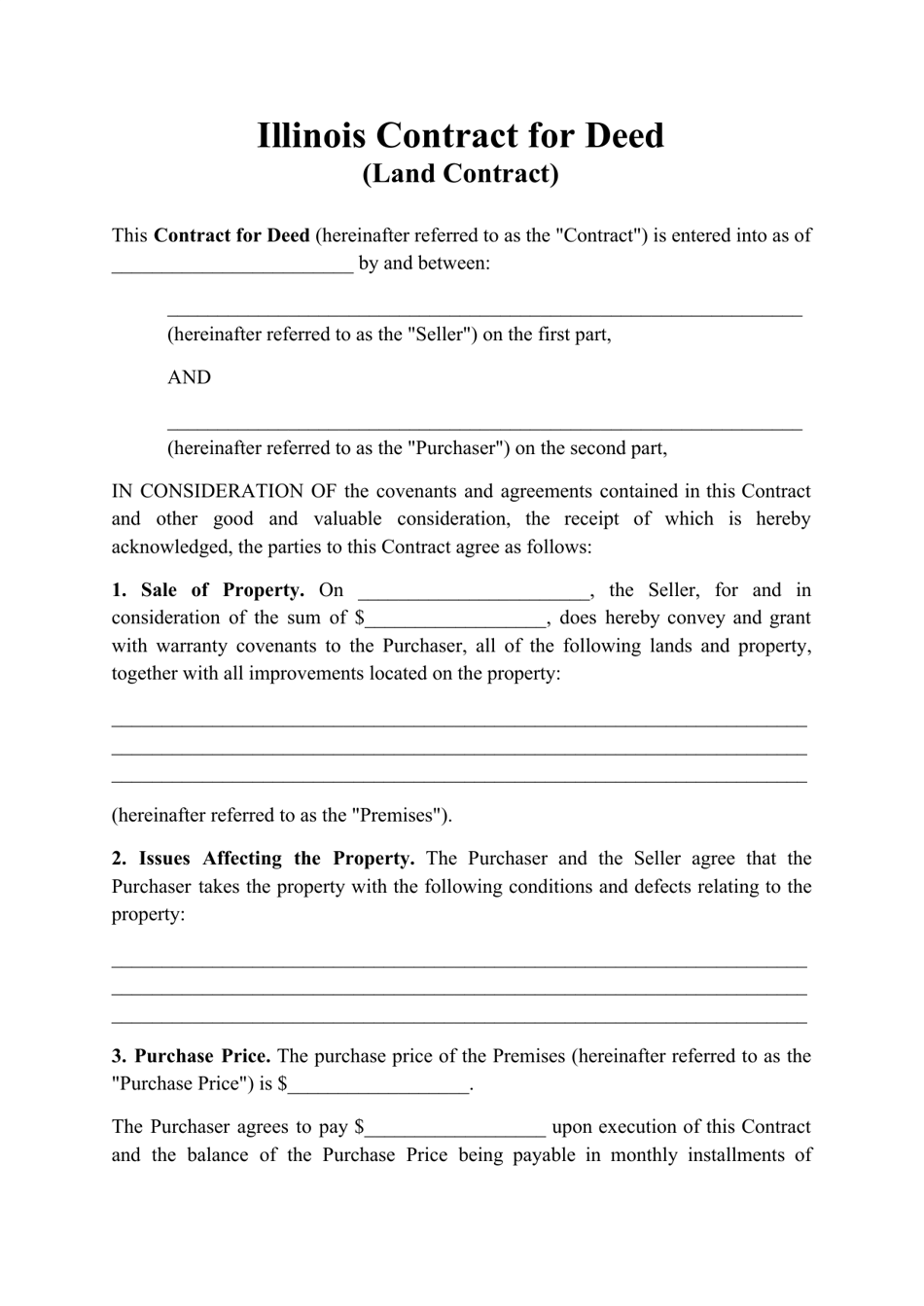

Illinois Contract for Deed (Land Contract) Download Printable PDF

An illinois transfer on death deed allows property owners to name a beneficiary to transfer the title to in the event of their death. Web illinois real property transfer on death instrument (todi) pursuant to § 755 ilcs 27/1 et seq. We take you through all the steps, including: Depending on the state, a transfer on death deed may also.

Illinois Quit Claim Deed Cook County Illinois Quit Claim Deed Form

Unlike a will, a todi can only transfer one thing. Use our todi program to help you fill out the transfer on death instrument form. , state of illinois (herein Illinois law requires that the transfer on death instrument be signed, witnessed, notarized and recorded with the county recorder of deeds before the owner's death. Web an illinois transfer on.

Texas Transfer On Death Deed Form sharedoc

Wait until illinois tod deed is shown. Web $34.99 buy now use this form to leave your illinois real estate without probate. Web fill out and sign the transfer on death instrument (“todi”) form, and have it notarized. Fill now click to fill, edit and sign this form now! Illinois law requires that the transfer on death instrument be signed,.

In The Beginning, Direct To The “Get Form” Button And Click On It.

You retain ownership, responsibility, and control over the property during your life. Web transfer on death instrument made before, on, or after the effective date of this amendatory act of the 102nd general assembly by an owner dying on or after the effective date of this amendatory act of the 102nd general assembly. However, it can save your loved ones time and money down the line. 1, 2022, the illinois transfer on death instrument act was expanded.

Web Illinois Residential Transfer On Death Instrument (Todi) Pursuant To § 755 Ilcs 27/1 Et Seq.

_____, by the property owner or owners, Describes and attaches form to revoke a transfer on death instrument that you have filed with a county recorder of deeds. Web $34.99 buy now use this form to leave your illinois real estate without probate. Web to transfer the ownership to the beneficiary, the beneficiary must submit the title (if available), applicable title fee, certified death certificate of the vehicle’s legal owner, and the appropriate tax form and check payable to illinois department of revenue, if applicable.

Web Help Ilao Open Opportunities For Justice.

Wait until illinois tod deed is shown. Fill out the required forms it is often wise to hire a lawyer to help fill out the following forms. Naming your beneficiaries writing a description of the property Comparable to ladybird, beneficiary, and enhanced life estate deeds, these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner's death, while retaining absolute possession of and control over the property while alive.

This Transfer On Death Instrument (Hereinafter Referred To As A Todi), Which Was Completed And Signed Before A Notary Public On The Following Date:

Web on july 9, 2021, governor pritzker signed a bill amending the illinois residential real property transfer on death instrument act (the “act”), effective january 1, 2022. This means that it may be used not only for one’s home but also for farm, commercial, industrial, recreational or any other real estate. , state of illinois (herein Web get form download the form how to edit and sign illinois tod deed online read the following instructions to use cocodoc to start editing and signing your illinois tod deed: