Ttb Excise Tax Form

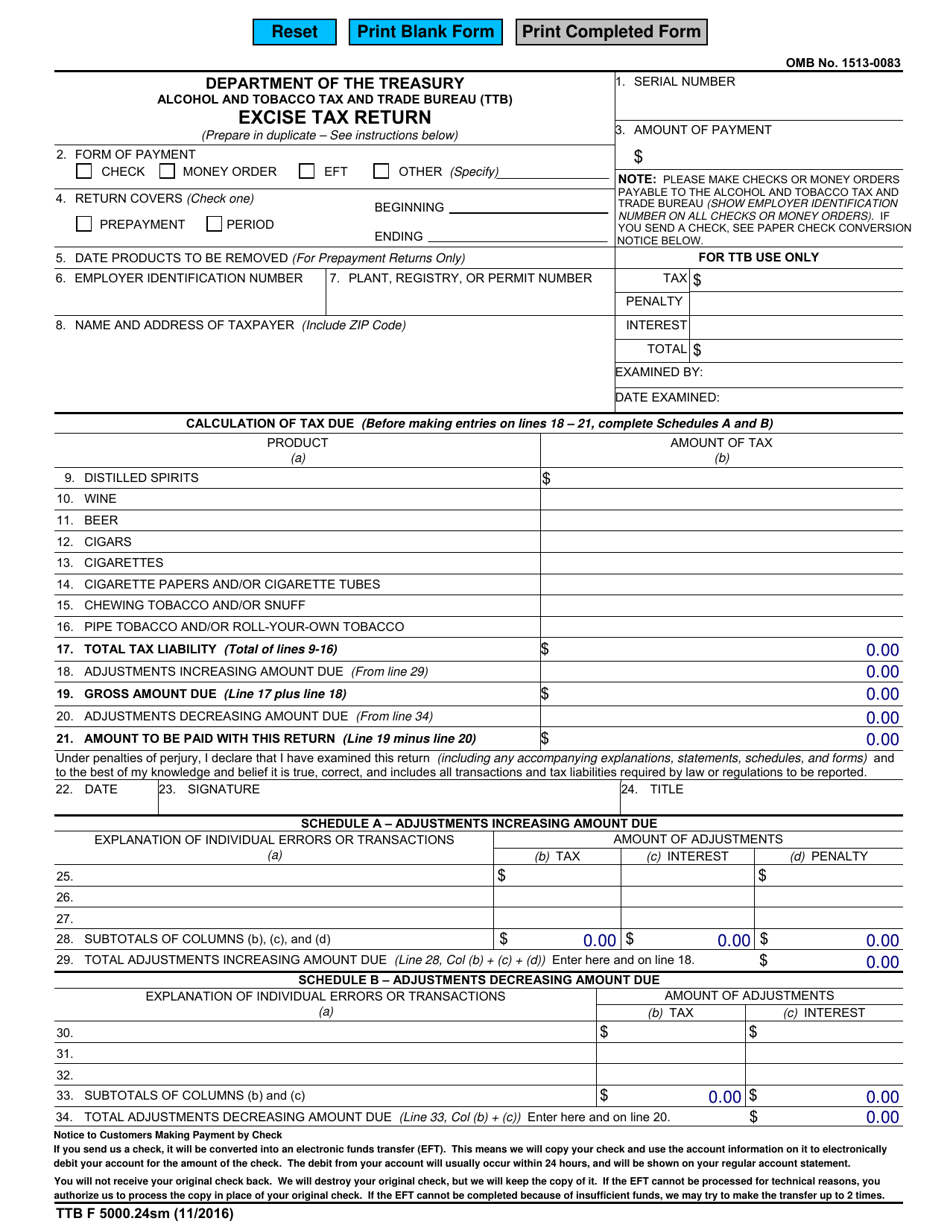

Ttb Excise Tax Form - Ttb5000.24sm & more fillable forms, register and subscribe now! Web in summary, the benefits of doing your ttb reporting as an ekos user include: Web 23 rows form number. Web 20 rows ttb now accepts this form through permits online. Web please note that large taxpayers (liable during any calendar year for $5 million or more in excise taxes) must pay excise taxes by electronic funds transfer (eft). Power of attorney ttb now accepts this form through permits online: Franchise & excise tax returns and schedules for prior tax filing years. Web july 25, 2023│ office of communications. Keg tag registration (postage has increased) regulations and statutes. Web ttb form 5000.24 must be used as both a prepayment tax return and a deferred payment tax return.

Web ttb form 5000.24 must be used as both a prepayment tax return and a deferred payment tax return. Except as noted below, you must file ttb f 5000.24 for each tax return. Go to the location or drive (example: Ad upload, modify or create forms. Except as noted below, you must file ttb f 5000.24 for each tax return. Use the links below to access official ttb forms and methods for downloading. Select and open the file. Web please note that large taxpayers (liable during any calendar year for $5 million or more in excise taxes) must pay excise taxes by electronic funds transfer (eft). Web while you must have signing authority (ttb form 5100.1) or power of attorney (ttb form 5000.8) on file with ttb to submit federal excise tax returns. Show details how it works open the ttb excise tax and follow the.

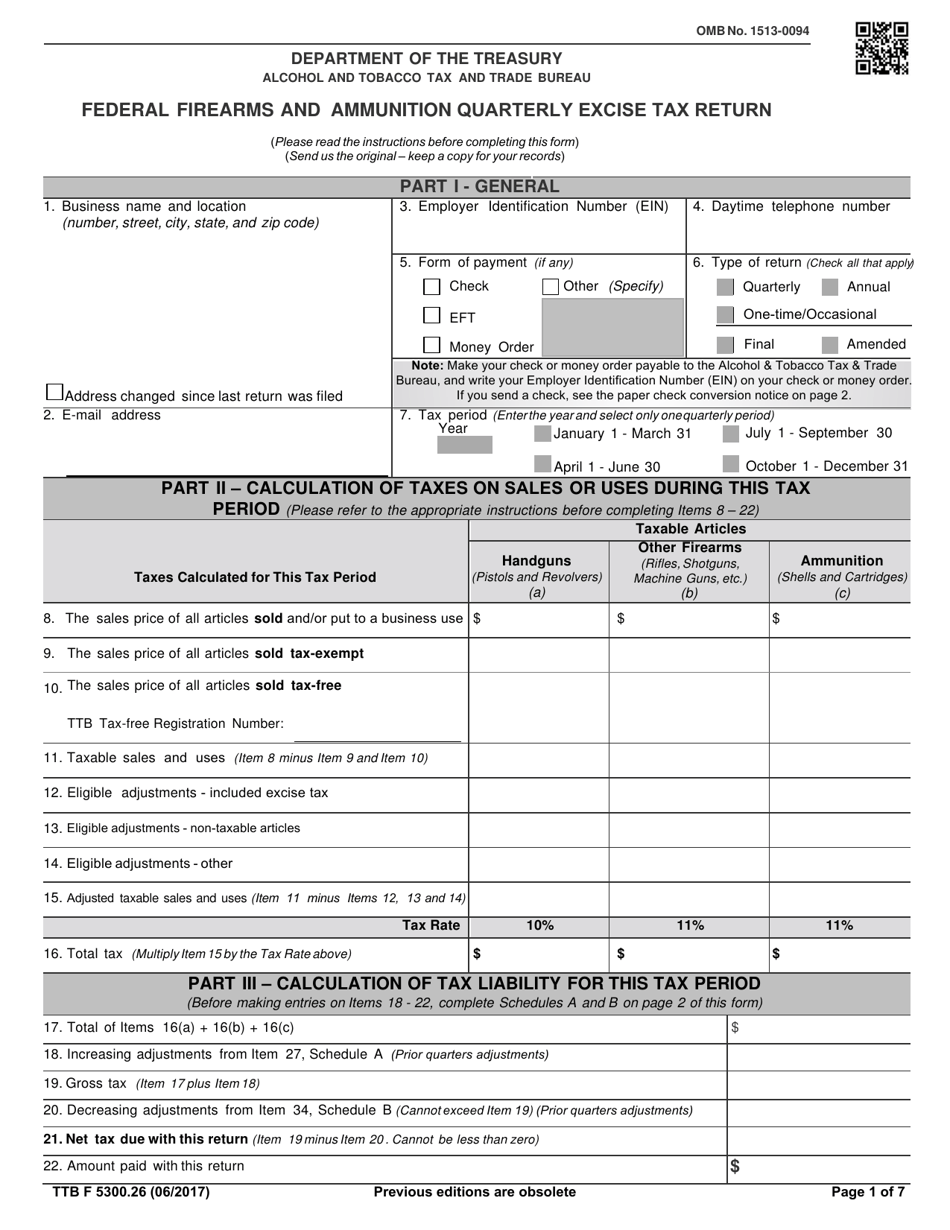

Industry updates & frequently asked questions; Try it for free now! Go to the location or drive (example: Web ttb form 5000.24 must be used as both a prepayment tax return and a deferred payment tax return. Power of attorney ttb now accepts this form through permits online: Web refer to atf form 5300.27, federal firearms ammunition excise tax deposit, for further information on when a deposit is required. Web excise tax return description: Web please note that large taxpayers (liable during any calendar year for $5 million or more in excise taxes) must pay excise taxes by electronic funds transfer (eft). Web helpful hints in preparing form 5000.24, excise tax return. Web in summary, the benefits of doing your ttb reporting as an ekos user include:

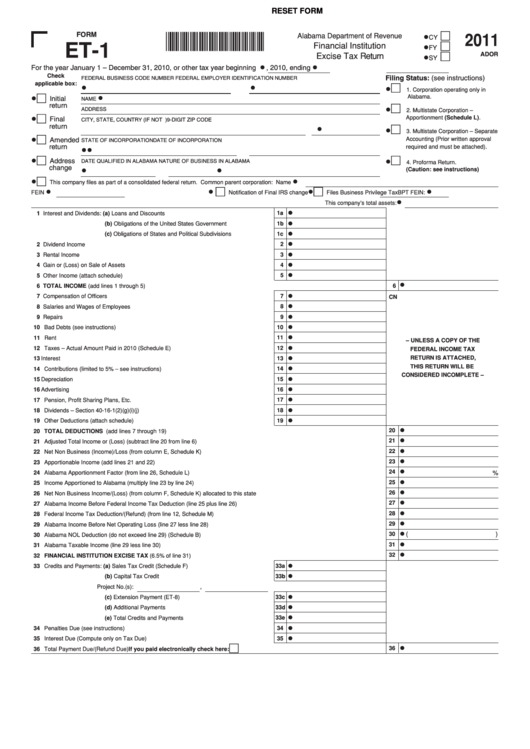

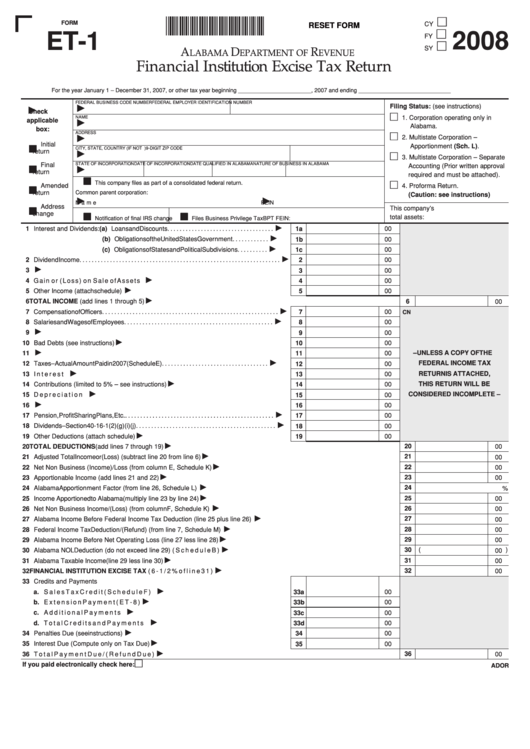

Fillable Form Et1 Financial Institution Excise Tax Return 2011

Try it for free now! Except as noted below, you must file ttb f 5000.24 for each tax return. My documents) where you saved the form. Web 20 rows ttb now accepts this form through permits online. Web due to a recent upgrade, users of the excise tax return, f 5000.24, will need to create a new form in lieu.

TTB Form 5300.26 Download Fillable PDF or Fill Online Federal Firearms

Web ttb form 5000.24 must be used as both a prepayment tax return and a deferred payment tax return. Except as noted below, you must file ttb f 5000.24 for each tax return. Try it for free now! Web in summary, the benefits of doing your ttb reporting as an ekos user include: Web new excise tax reporting guidance:

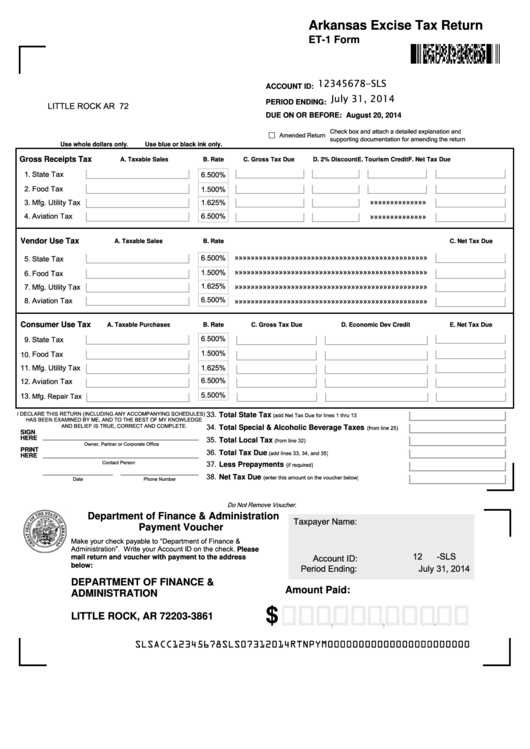

Fillable Form Et1 Arkansas Excise Tax Return printable pdf download

Franchise & excise tax returns and schedules for prior tax filing years. Web july 25, 2023│ office of communications. Except as noted below, you must file ttb f 5000.24 for each tax return. Web while you must have signing authority (ttb form 5100.1) or power of attorney (ttb form 5000.8) on file with ttb to submit federal excise tax returns..

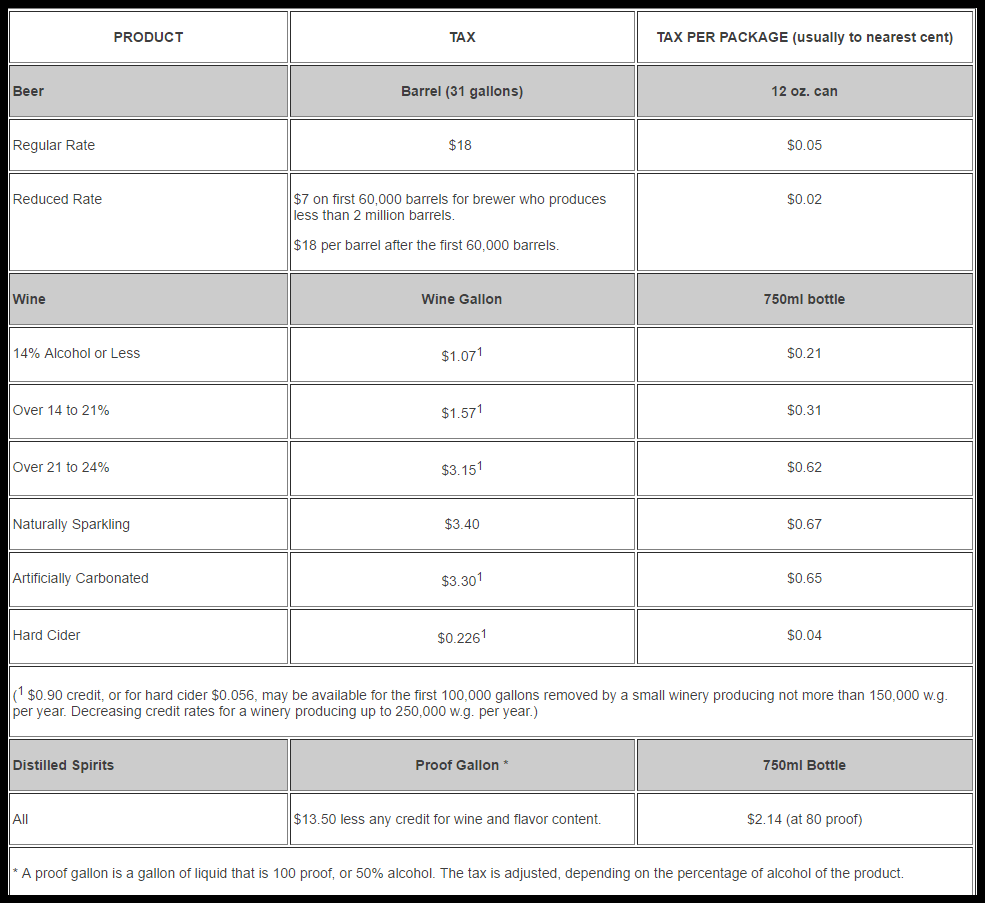

Excise Taxes A Guide for Small Businesses

Try it for free now! Web refer to atf form 5300.27, federal firearms ammunition excise tax deposit, for further information on when a deposit is required. Keg tag registration (postage has increased) regulations and statutes. Except as noted below, you must file ttb f 5000.24 for each tax return. The tax and trade bureau (ttb) has posted further information of.

Fillable Form Et1 Financial Institution Excise Tax Return 2008

Web ttb form 5000.24 must be used as both a prepayment tax return and a deferred payment tax return. Form of payment $ check money order eft. Use the links below to access official ttb forms and methods for downloading. Go to the location or drive (example: Web while you must have signing authority (ttb form 5100.1) or power of.

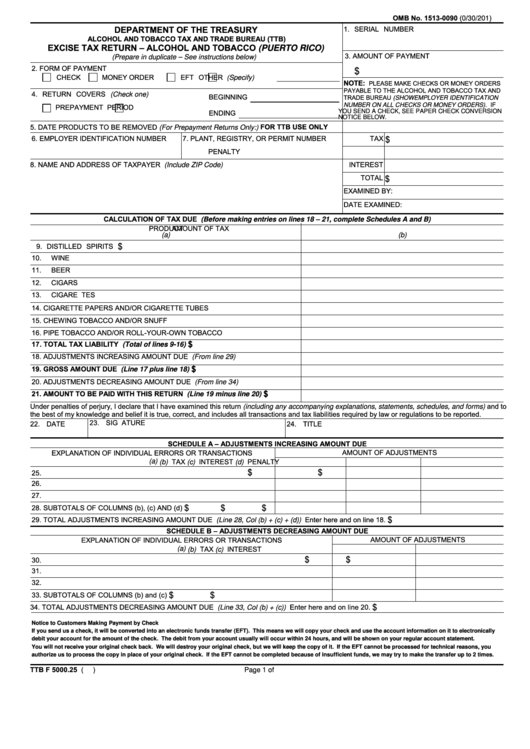

Fillable Form Ttb F 5000.25 Excise Tax Return Alcohol And Tobacco

Web 20 rows ttb now accepts this form through permits online. Use the links below to access official ttb forms and methods for downloading. Keg tag registration (postage has increased) regulations and statutes. Web refer to atf form 5300.27, federal firearms ammunition excise tax deposit, for further information on when a deposit is required. Web ttb form 5000.24 must be.

TTB Announces Three Month Excise Tax Postponement WineAmerica

Keg tag registration (postage has increased) regulations and statutes. Go to the location or drive (example: Web ttb excise tax form use a treasury excise tax template to make your document workflow more streamlined. Due to a recent upgrade, users of the excise tax return, f 5000.24, will need to create a new form in lieu of duplicating a previously.

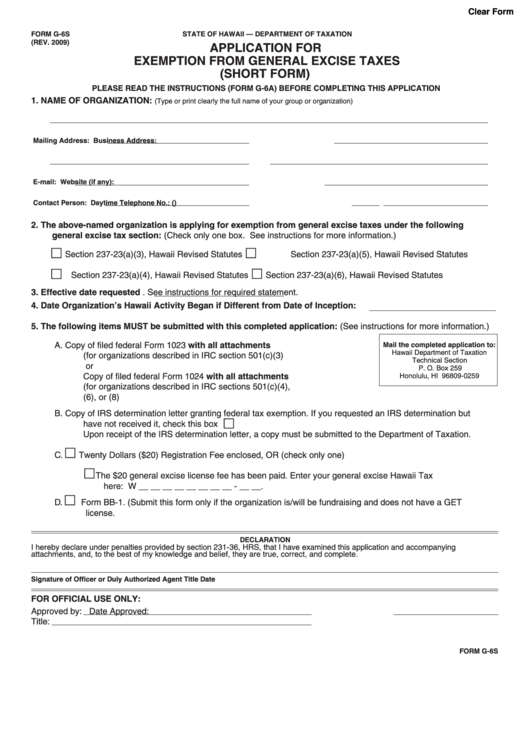

Fillable Form G6s Application For Exemption From General Excise

Form of payment $ check money order eft. Web new excise tax reporting guidance: Use the links below to access official ttb forms and methods for downloading. Web ttb form 5000.24 must be used as both a prepayment tax return and a deferred payment tax return. The tax and trade bureau (ttb) has posted further information of interest to brewers.

TTB Form 5000.24SM Fill Out, Sign Online and Download Fillable PDF

Ad upload, modify or create forms. Web please note that large taxpayers (liable during any calendar year for $5 million or more in excise taxes) must pay excise taxes by electronic funds transfer (eft). Use the links below to access official ttb forms and methods for downloading. Web ttb excise tax form use a treasury excise tax template to make.

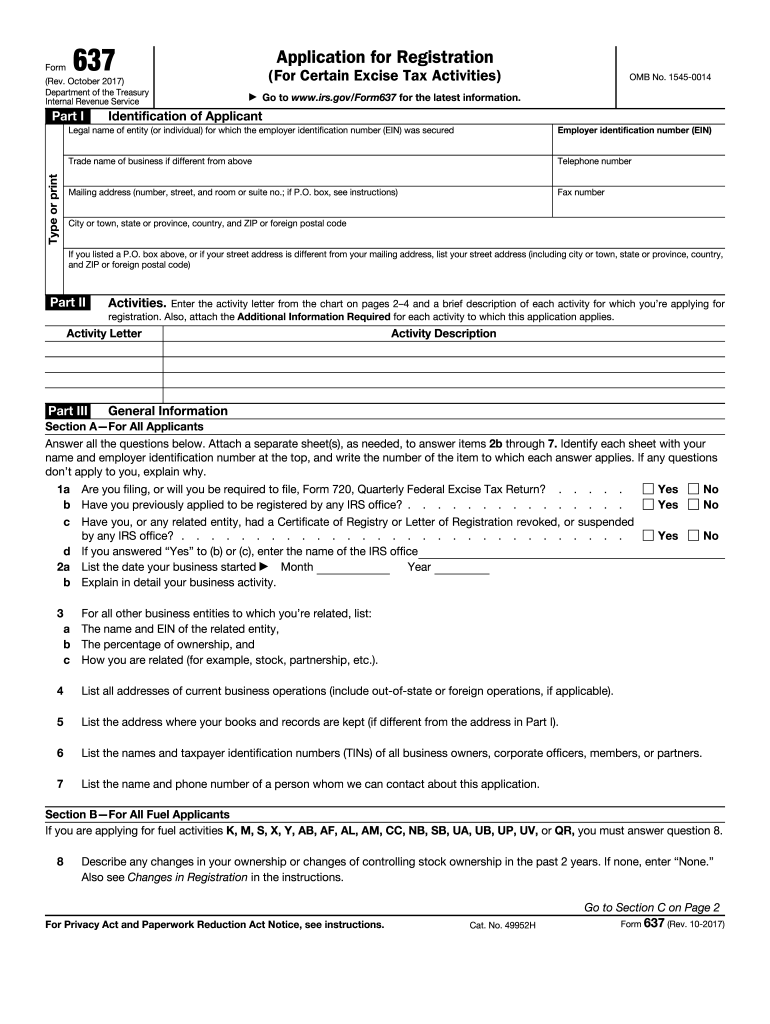

2017 Form IRS 637 Fill Online, Printable, Fillable, Blank pdfFiller

Try it for free now! Web july 25, 2023│ office of communications. Except as noted below, you must file ttb f 5000.24 for each tax return. Go to the location or drive (example: Web while you must have signing authority (ttb form 5100.1) or power of attorney (ttb form 5000.8) on file with ttb to submit federal excise tax returns.

Except As Noted Below, You Must File Ttb F 5000.24 For Each Tax Return.

Select and open the file. Form of payment $ check money order eft. Use the links below to access official ttb forms and methods for downloading. Web due to a recent upgrade, users of the excise tax return, f 5000.24, will need to create a new form in lieu of duplicating a previously submitted form.

Web New Excise Tax Reporting Guidance:

Web ttb excise tax form use a treasury excise tax template to make your document workflow more streamlined. Latest forms, documents, and supporting material all historical document collections Industry updates & frequently asked questions; Web refer to atf form 5300.27, federal firearms ammunition excise tax deposit, for further information on when a deposit is required.

Ad Upload, Modify Or Create Forms.

Web ttb form 5000.24 must be used as both a prepayment tax return and a deferred payment tax return. Keg tag registration (postage has increased) regulations and statutes. Franchise & excise tax returns and schedules for prior tax filing years. Except as noted below, you must file ttb f 5000.24 for each tax return.

Additionally, The Search Function Above Provides Basic And Advanced.

Web ttb form 5000.24 must be used as both a prepayment tax return and a deferred payment tax return. Web july 25, 2023│ office of communications. Web 20 rows ttb now accepts this form through permits online. Due to a recent upgrade, users of the excise tax return, f 5000.24, will need to create a new form in lieu of duplicating a previously submitted form.