Turbotax Disclosure Consent Form

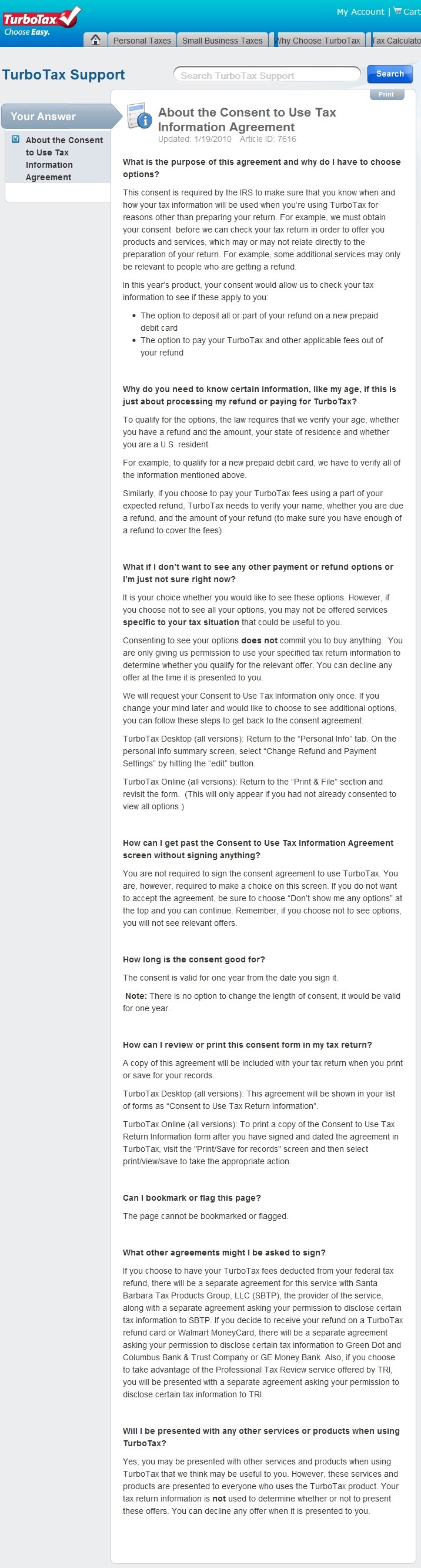

Turbotax Disclosure Consent Form - Current revision form 8275 pdf instructions for form 8275 ( print version pdf) recent developments none at this time other items you may find useful all form 8275. Web the commissioner, or his or her authorized delegate, may disclose company’s: Web that q and a was very informative. Web taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties. It may seem silly, but turbotax can't offer you those services unless you officially give it permission to know about your tax refund status. Each tax preparer should read regs. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Clearly, it is not illegal for them to ask for our consent. Web 1 best answer.

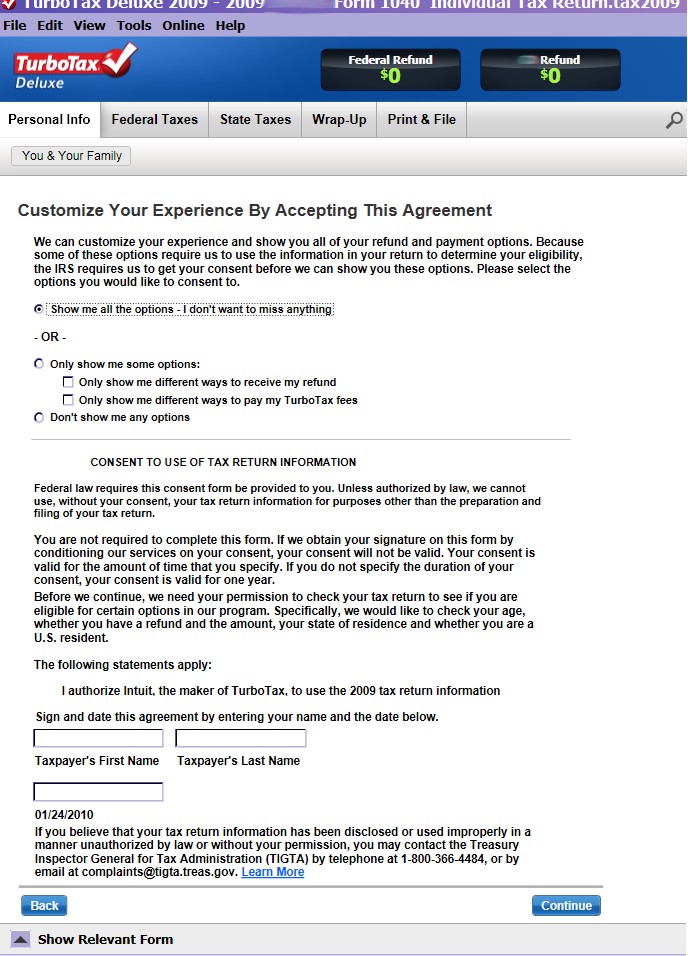

Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. Web that q and a was very informative. Clearly, it is not illegal for them to ask for our consent. Web taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties. 2.1k views 1 year ago. Web the commissioner, or his or her authorized delegate, may disclose company’s: When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are also sharing with intuit. Each tax preparer should read regs. (a) legal name, (b) principal place of business, (c) country of residence for income tax treaty purposes, (d) effective date of the agreement, (e) failure to timely recertify company’s entitlement to treaty benefits in accordance with the terms of its closing agreement. Web 1 best answer.

Web that q and a was very informative. It may seem silly, but turbotax can't offer you those services unless you officially give it permission to know about your tax refund status. 2.1k views 1 year ago. (a) legal name, (b) principal place of business, (c) country of residence for income tax treaty purposes, (d) effective date of the agreement, (e) failure to timely recertify company’s entitlement to treaty benefits in accordance with the terms of its closing agreement. Web 1 best answer. Current revision form 8275 pdf instructions for form 8275 ( print version pdf) recent developments none at this time other items you may find useful all form 8275. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. But how they are asking is deceiving. Clearly, it is not illegal for them to ask for our consent. Web taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties.

Turbotax Consent To Disclosure Of Tax Return Information? The 6 Correct

This agreement wants me to consent to sharing my personal information/tax return information with credit karma tax's parent company credit karma until dec. Web the commissioner, or his or her authorized delegate, may disclose company’s: 2.1k views 1 year ago. Each tax preparer should read regs. The consent form is just to be offered certain services later, like getting your.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

2.1k views 1 year ago. (a) legal name, (b) principal place of business, (c) country of residence for income tax treaty purposes, (d) effective date of the agreement, (e) failure to timely recertify company’s entitlement to treaty benefits in accordance with the terms of its closing agreement. Current revision form 8275 pdf instructions for form 8275 ( print version pdf).

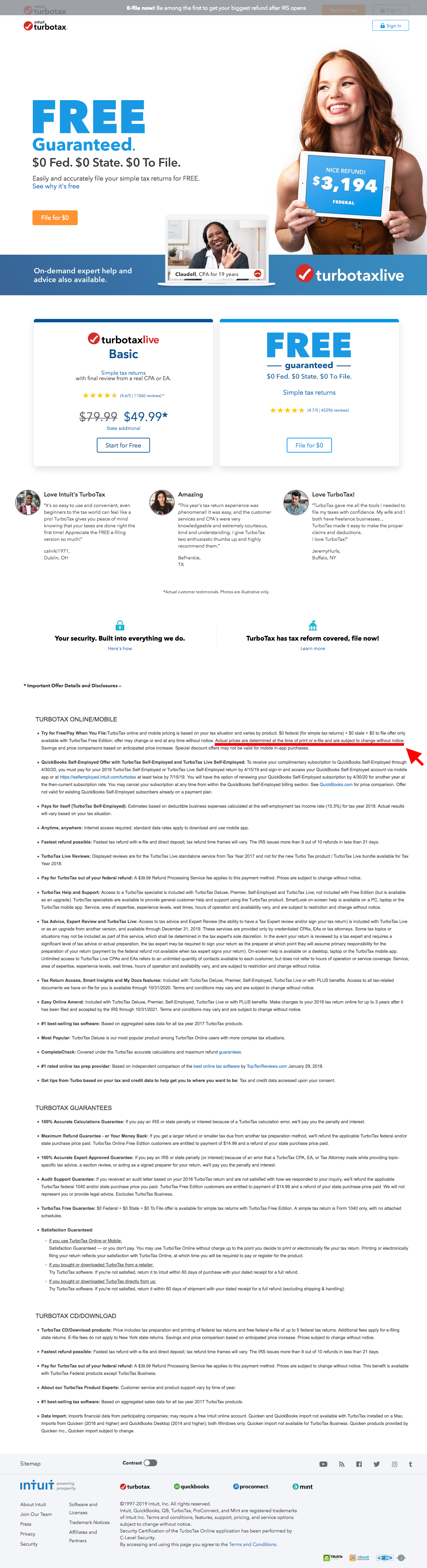

How TurboTax turns a dreadful user experience into a delightful one

Each tax preparer should read regs. 2.1k views 1 year ago. Clearly, it is not illegal for them to ask for our consent. When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are also sharing with intuit. (a) legal name, (b) principal place of business, (c).

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

2.1k views 1 year ago. Web that q and a was very informative. But how they are asking is deceiving. This agreement wants me to consent to sharing my personal information/tax return information with credit karma tax's parent company credit karma until dec. Web this year's scam is a bogus consent form at the start of the process that looks.

form 2106 turbotax Fill Online, Printable, Fillable Blank

This agreement wants me to consent to sharing my personal information/tax return information with credit karma tax's parent company credit karma until dec. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. 2.1k views 1 year ago. Web that q and a was very informative. Web this year's scam is a bogus consent.

TurboTax Review 2022 Is It Really That Easy?

The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. When you go through the screens, it looks like you are just providing a signature early for your tax form and yes you are also sharing with intuit. Web taxpayers and tax return preparers use.

Example Of Informed Consent For Therapy slide share

(a) legal name, (b) principal place of business, (c) country of residence for income tax treaty purposes, (d) effective date of the agreement, (e) failure to timely recertify company’s entitlement to treaty benefits in accordance with the terms of its closing agreement. 2.1k views 1 year ago. When you go through the screens, it looks like you are just providing.

Adoptive Child Worksheet Turbotax Worksheet Resume Examples

The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. Current revision form 8275 pdf instructions for form 8275 ( print version pdf) recent developments none at this time.

TurboTax Free Truth In Advertising

Clearly, it is not illegal for them to ask for our consent. Web the appropriate consent forms for one accounting firm may not be suitable for another firm. Web 1 best answer. But how they are asking is deceiving. This agreement wants me to consent to sharing my personal information/tax return information with credit karma tax's parent company credit karma.

Disclosure, Consent, Acknowledgment and Agreement Doc Template pdfFiller

Web that q and a was very informative. Web 1 best answer. Web the commissioner, or his or her authorized delegate, may disclose company’s: Current revision form 8275 pdf instructions for form 8275 ( print version pdf) recent developments none at this time other items you may find useful all form 8275. But how they are asking is deceiving.

Current Revision Form 8275 Pdf Instructions For Form 8275 ( Print Version Pdf) Recent Developments None At This Time Other Items You May Find Useful All Form 8275.

Each tax preparer should read regs. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. Clearly, it is not illegal for them to ask for our consent. This agreement wants me to consent to sharing my personal information/tax return information with credit karma tax's parent company credit karma until dec.

Web The Appropriate Consent Forms For One Accounting Firm May Not Be Suitable For Another Firm.

Web the commissioner, or his or her authorized delegate, may disclose company’s: Web 1 best answer. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. It may seem silly, but turbotax can't offer you those services unless you officially give it permission to know about your tax refund status.

When You Go Through The Screens, It Looks Like You Are Just Providing A Signature Early For Your Tax Form And Yes You Are Also Sharing With Intuit.

(a) legal name, (b) principal place of business, (c) country of residence for income tax treaty purposes, (d) effective date of the agreement, (e) failure to timely recertify company’s entitlement to treaty benefits in accordance with the terms of its closing agreement. Web that q and a was very informative. Web taxpayers and tax return preparers use this form to disclose items or positions that are not otherwise adequately disclosed on a tax return to avoid certain penalties. 2.1k views 1 year ago.