Virginia Form 502 Instructions 2021

Virginia Form 502 Instructions 2021 - Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Web s corporations, partnerships, and limited liability companies. Use get form or simply click on the template preview to open it in the editor. Web follow the simple instructions below: Web individual tax forms and instructions we offer several ways for you to obtain maryland tax forms, booklets and instructions: Web 4.7 satisfied 239 votes what makes the va form 502 instructions 2022 legally binding? Not filed contact us 502ez. If form 502 is filed more than 6 months after the due date or more. Web who must file virginia form 502? You can download tax forms using.

Web 4.7 satisfied 239 votes what makes the va form 502 instructions 2022 legally binding? Income allocated to virginia (owner's share from pte's schedule. More about the virginia form 502 tax return we last. Total taxable income amounts 2. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Web follow the simple instructions below: A copy should be given to each owner, and a copy included with the entity’s virginia return of income. Tax form filling out can turn into a significant challenge and extreme headache if no appropriate assistance provided. Total deductions allocation and apportionment 4. You can download or print.

S corporations, partnerships, and limited liability companies. Total deductions allocation and apportionment 4. Web s corporations, partnerships, and limited liability companies. Use get form or simply click on the template preview to open it in the editor. Web electronically file a form 502 for each taxable year. Income allocated to virginia (owner's share from pte's schedule. You can download or print. Not filed contact us 502ez. A copy should be given to each owner, and a copy included with the entity’s virginia return of income. You can download tax forms using.

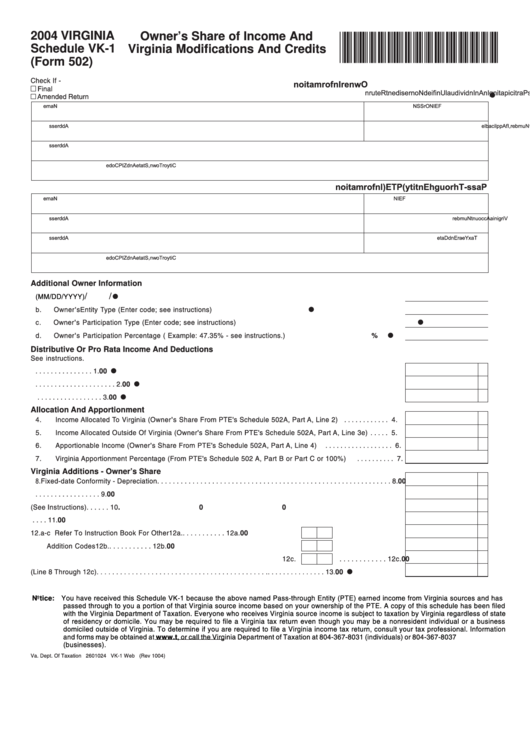

Form 502 Virginia Schedule Vk1 Owner'S Share Of And

You can download or print. Web follow the simple instructions below: Web 4.7 satisfied 239 votes what makes the va form 502 instructions 2022 legally binding? Web individual tax forms and instructions we offer several ways for you to obtain maryland tax forms, booklets and instructions: S corporations, partnerships, and limited liability companies.

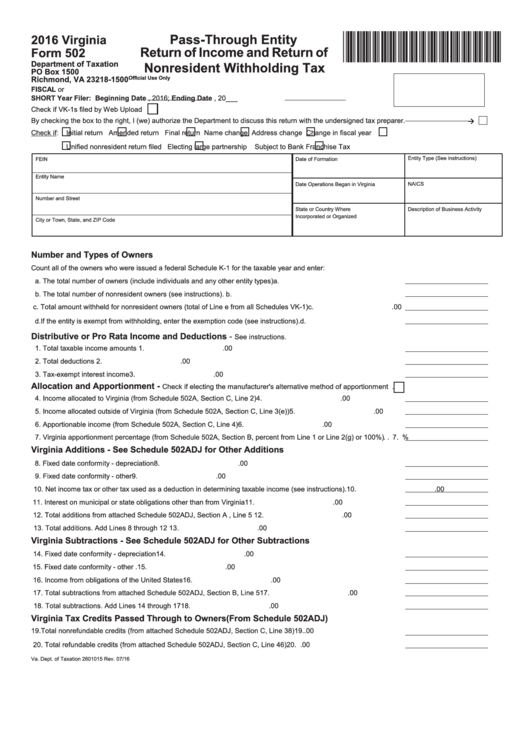

Fillable Virginia Form 502 PassThrough Entity Return Of And

Previously s corporations were required to file their virginia income tax return on form 500s. Total deductions allocation and apportionment 4. Web who must file virginia form 502? You can download or print. S corporations, partnerships, and limited liability companies.

Top 11 Virginia Form 502 Templates free to download in PDF format

More about the virginia form 502 tax return we last. Web who must file virginia form 502? Web 4.7 satisfied 239 votes what makes the va form 502 instructions 2022 legally binding? Total deductions allocation and apportionment 4. You can download or print.

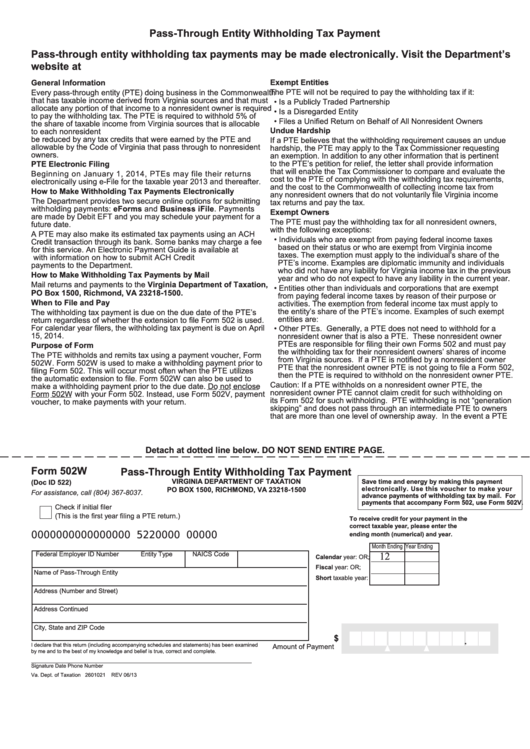

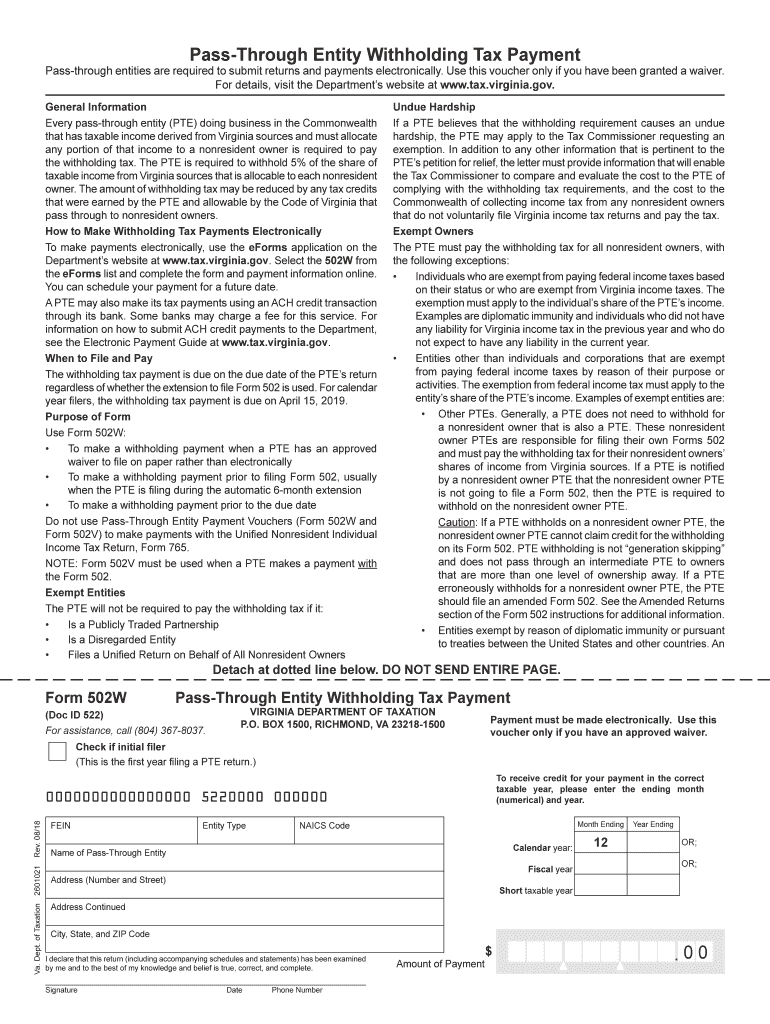

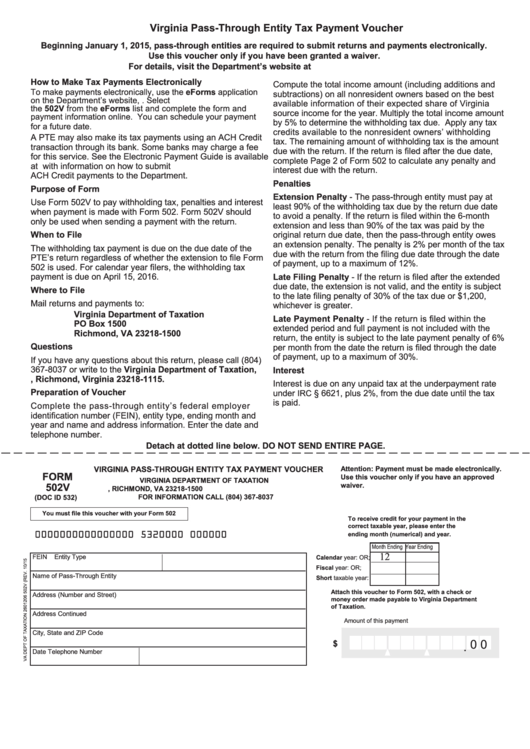

Va 502W Fill Out and Sign Printable PDF Template signNow

Web 4.7 satisfied 239 votes what makes the va form 502 instructions 2022 legally binding? Web individual tax forms and instructions we offer several ways for you to obtain maryland tax forms, booklets and instructions: Tax form filling out can turn into a significant challenge and extreme headache if no appropriate assistance provided. Total taxable income amounts 2. A copy.

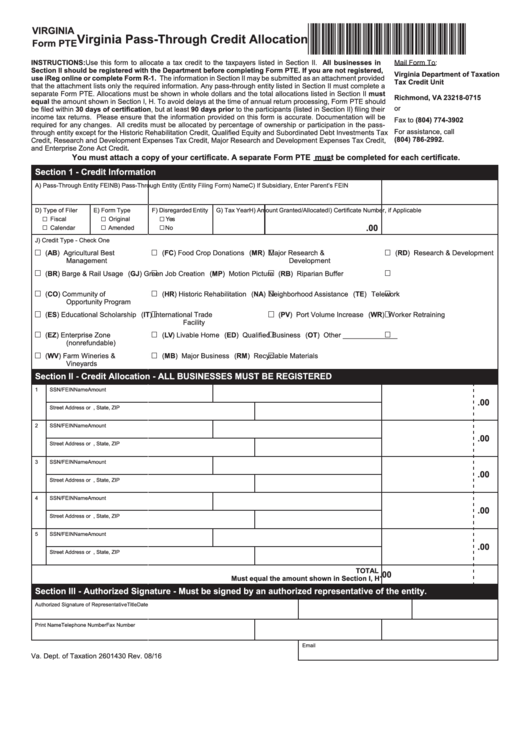

Fillable Virginia Form Pte Virginia PassThrough Credit Allocation

A copy should be given to each owner, and a copy included with the entity’s virginia return of income. You can download tax forms using. Previously s corporations were required to file their virginia income tax return on form 500s. Total taxable income amounts 2. Web s corporations, partnerships, and limited liability companies.

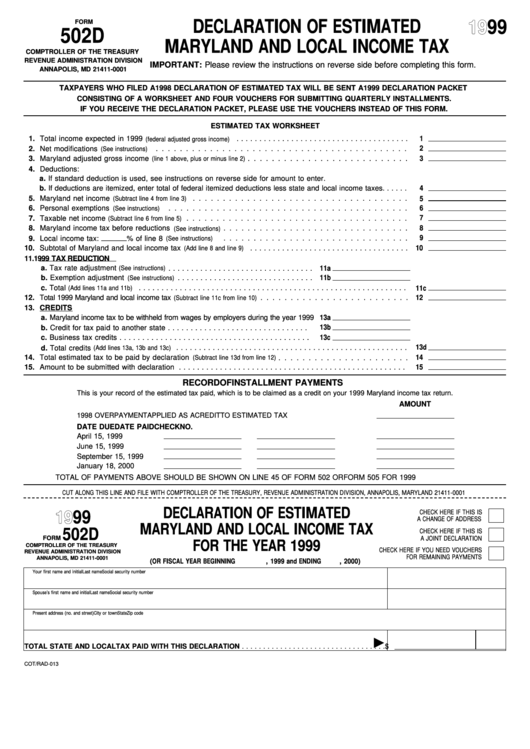

Fillable Form 502 D Declaration Of Estimated Maryland And Local

Previously s corporations were required to file their virginia income tax return on form 500s. Web individual tax forms and instructions we offer several ways for you to obtain maryland tax forms, booklets and instructions: You can download or print. S corporations, partnerships, and limited liability companies. More about the virginia form 502 tax return we last.

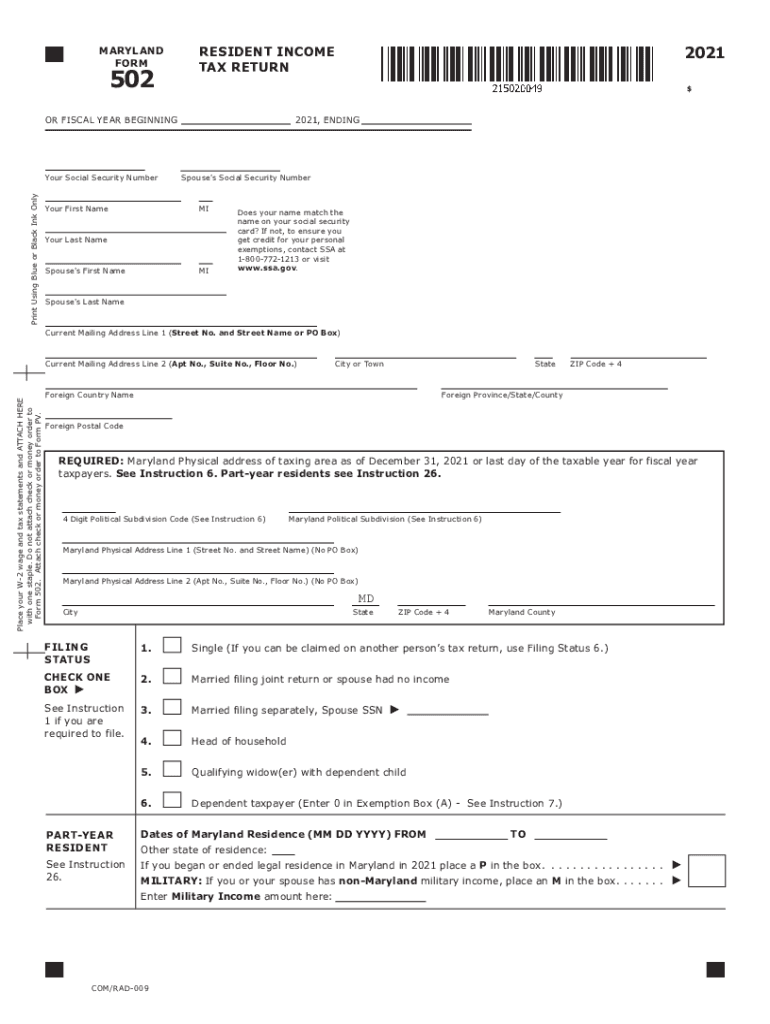

2021 Form MD Comptroller 502 Fill Online, Printable, Fillable, Blank

S corporations, partnerships, and limited liability companies. Web s corporations, partnerships, and limited liability companies. Use get form or simply click on the template preview to open it in the editor. More about the virginia form 502 tax return we last. Not filed contact us 502ez.

Top 11 Virginia Form 502 Templates free to download in PDF format

Use get form or simply click on the template preview to open it in the editor. S corporations, partnerships, and limited liability companies. Total deductions allocation and apportionment 4. Web 4.7 satisfied 239 votes what makes the va form 502 instructions 2022 legally binding? Web individual tax forms and instructions we offer several ways for you to obtain maryland tax.

Maryland Form 502 Instructions ESmart Tax Fill Out and Sign Printable

Web 4.7 satisfied 239 votes what makes the va form 502 instructions 2022 legally binding? Income allocated to virginia (owner's share from pte's schedule. Web individual tax forms and instructions we offer several ways for you to obtain maryland tax forms, booklets and instructions: Tax form filling out can turn into a significant challenge and extreme headache if no appropriate.

Ckht 502 Form 2019 / CA Olympic Archery In Schools New School

Previously s corporations were required to file their virginia income tax return on form 500s. Total deductions allocation and apportionment 4. Total taxable income amounts 2. S corporations, partnerships, and limited liability companies. Web individual tax forms and instructions we offer several ways for you to obtain maryland tax forms, booklets and instructions:

A Copy Should Be Given To Each Owner, And A Copy Included With The Entity’s Virginia Return Of Income.

Tax form filling out can turn into a significant challenge and extreme headache if no appropriate assistance provided. If form 502 is filed more than 6 months after the due date or more. Not filed contact us 502ez. Web individual tax forms and instructions we offer several ways for you to obtain maryland tax forms, booklets and instructions:

S Corporations, Partnerships, And Limited Liability Companies.

Income allocated to virginia (owner's share from pte's schedule. Previously s corporations were required to file their virginia income tax return on form 500s. You can download tax forms using. Use get form or simply click on the template preview to open it in the editor.

Web The Form 502 Should (1) Report Nonresident Withholding Only For Income Attributable To Ineligible Owners Who Are Also Nonresident Owners Subject To The Withholding.

Total deductions allocation and apportionment 4. Web who must file virginia form 502? You can download or print. Web follow the simple instructions below:

Total Taxable Income Amounts 2.

Web electronically file a form 502 for each taxable year. Web 4.7 satisfied 239 votes what makes the va form 502 instructions 2022 legally binding? More about the virginia form 502 tax return we last. Web s corporations, partnerships, and limited liability companies.