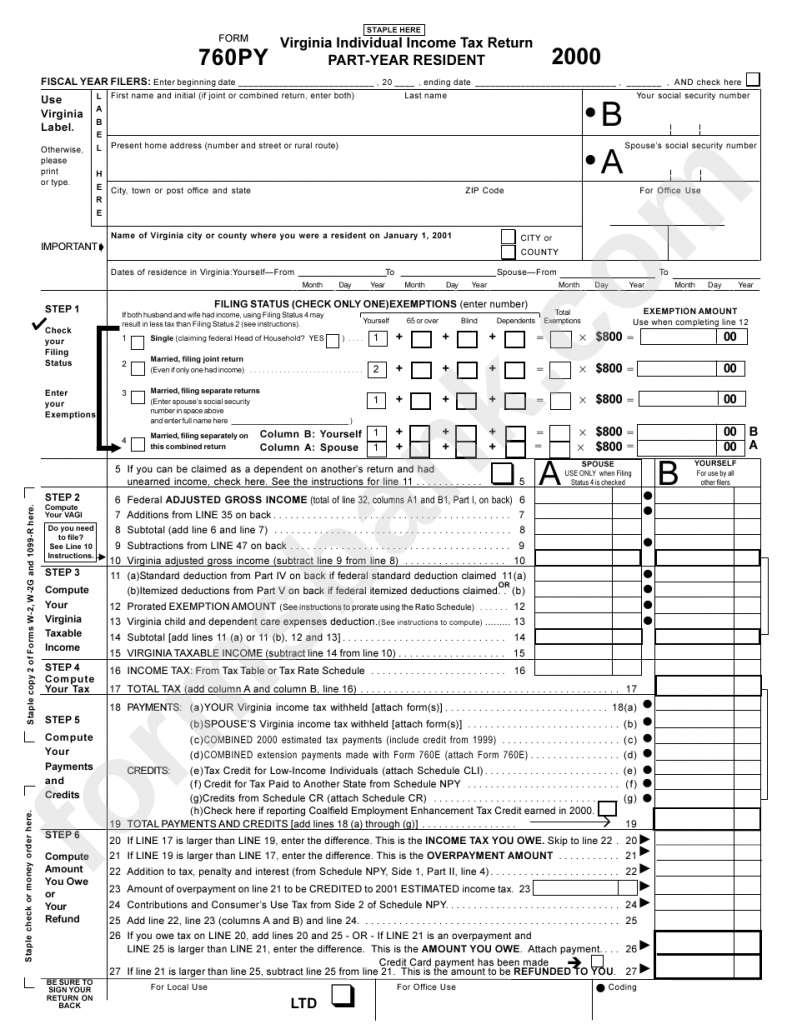

Virginia Form 760Cg

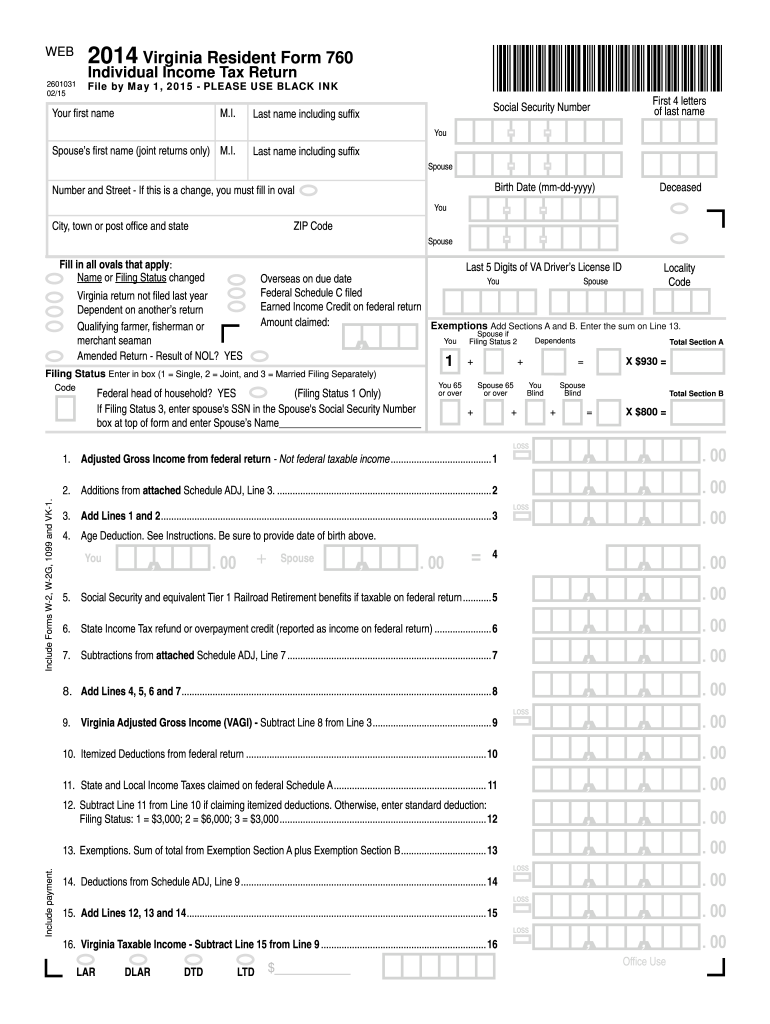

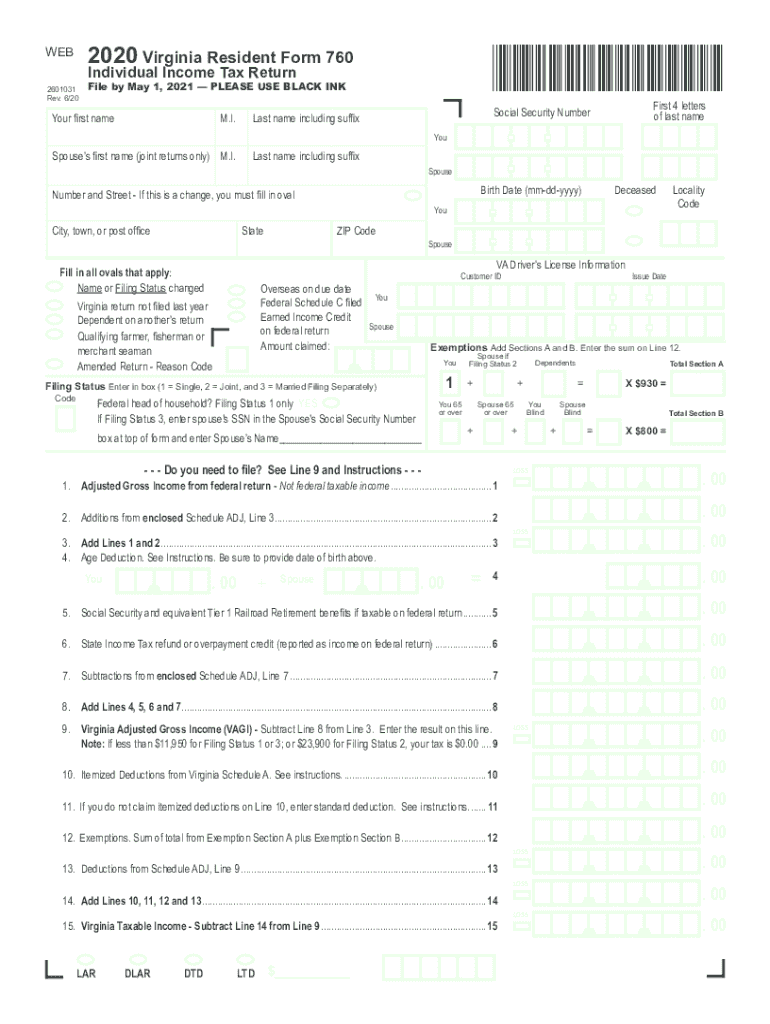

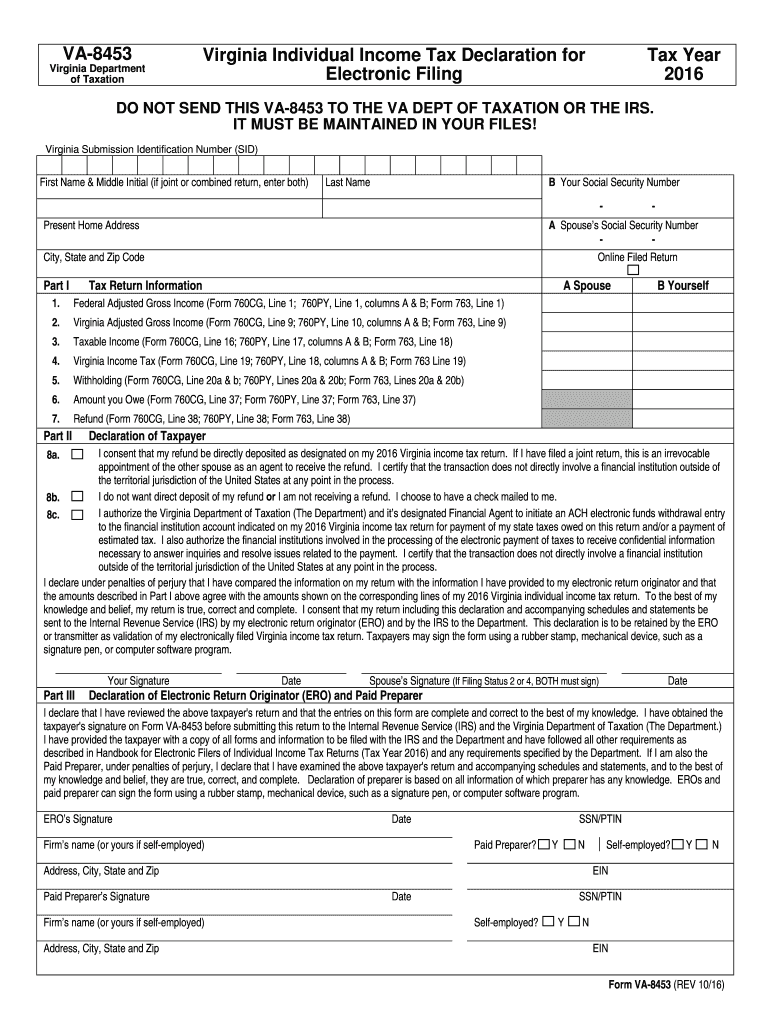

Virginia Form 760Cg - Web form 760 is the general income tax return for virginia residents; Web up to $40 cash back va form 760cg is the virginia resident income tax return for individuals. Web what is virginia tax form 760cg? (a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). Form 760 is a form used. Web am i required to complete form 760c, underpayment of virginia estimated tax? Spec documents for individual income, fiduciary,. Sign it in a few clicks draw. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Web form 760c is a virginia individual income tax form.

Web 37 votes how to fill out and sign aampp online? If the amount on line 9 is less than the amount shown below for your filing. Web virginia resident form 760 *va0760120888* individual income tax return. Web form 760c is a virginia individual income tax form. Web up to $40 cash back va form 760cg is the virginia resident income tax return for individuals. Web form 760es/cg—virginia estimated income tax payment voucher form 760f—underpayment of virginia estimated tax by farmers, fishermen and merchant. Web virginia form 760 *va0760122888* resident income tax return. Get your online template and fill it in using progressive features. Web am i required to complete form 760c, underpayment of virginia estimated tax? It must include information such as:

Form 760 is a form used. Web virginia resident form 760 *va0760120888* individual income tax return. Web virginia form 760 *va0760122888* resident income tax return. Web what is a va760cg form?? Enjoy smart fillable fields and interactivity. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. It was printed as part of my return online topics: Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). It must include information such as: Web up to $40 cash back va form 760cg is the virginia resident income tax return for individuals.

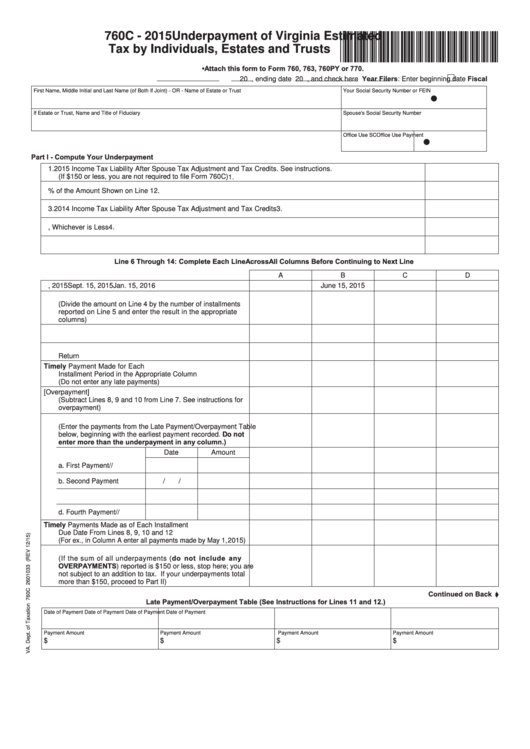

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Posted june 4, 2019 10:14 pm. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). It must include information such as: Web virginia form 760 *va0760122888* resident income tax return. 760cg / schedule fed comparison.

760 virginia tax form 2014 Fill out & sign online DocHub

(a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Web what is virginia form 760cg? We last updated the resident individual income tax return in january 2023, so. Web form 760c.

2014 Form VA DoT 760ES Fill Online, Printable, Fillable, Blank pdfFiller

Spec documents for individual income, fiduciary,. Sign it in a few clicks draw. Web am i required to complete form 760c, underpayment of virginia estimated tax? Web if you need to change or amend an accepted virginia state income tax return for the current or previous tax year you need to complete form 760. Web up to $40 cash back.

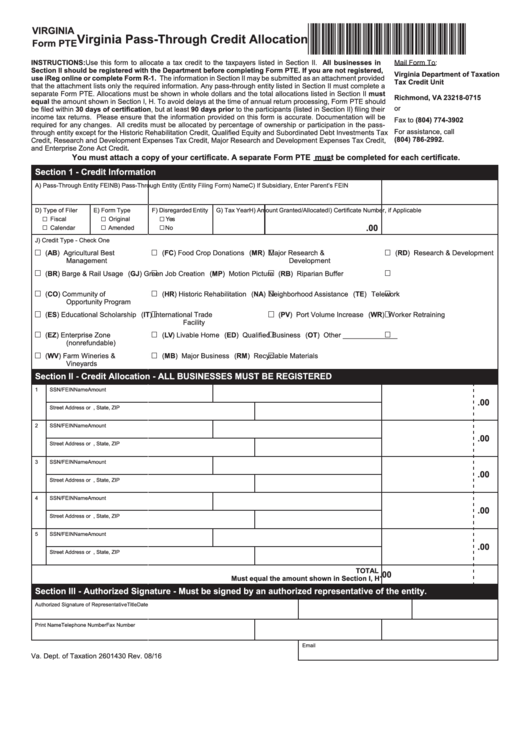

Fillable Virginia Form Pte Virginia PassThrough Credit Allocation

Spec documents for individual income, fiduciary,. Get your online template and fill it in using progressive features. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. If the amount on line 9 is less than the amount shown below for your filing. We last updated the resident individual income tax return in.

Virginia State 760 Form Fill Out and Sign Printable PDF Template

File by may 1, 2023 — use black ink. Web form 760c is a virginia individual income tax form. Web form 760 is the general income tax return for virginia residents; It was printed as part of my return online topics: If the amount on line 9 is less than the amount shown below for your filing.

Free Printable Virginia State Tax Forms Printable Form 2023

Web what is virginia tax form 760cg? Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Web what is virginia form 760cg? We last updated the resident individual income tax return in january 2023, so. (a person is considered a resident if they have been living in virginia for more than 183 days.

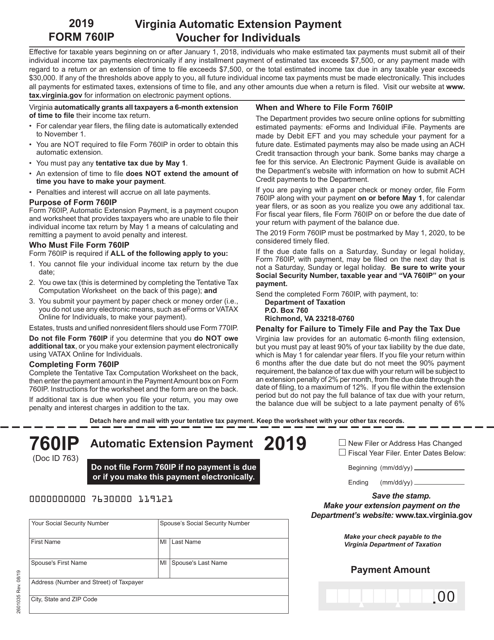

Form 760IP Download Fillable PDF or Fill Online Virginia Automatic

(a person is considered a resident if they have been living in virginia for more than 183 days in a calendar year). If the amount on line 9 is less than the amount shown below for your filing. Sign it in a few clicks draw. Web 37 votes how to fill out and sign aampp online? File by may 1,.

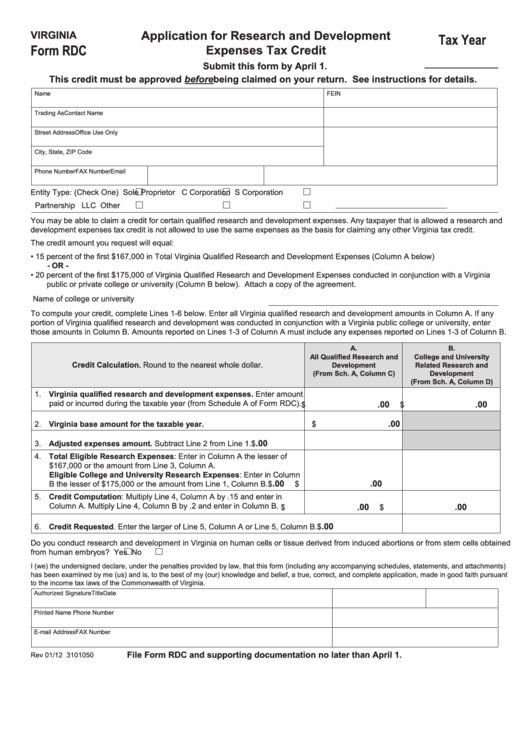

Virginia Form Rdc Application For Research And Development Expenses

Web 37 votes how to fill out and sign aampp online? Web am i required to complete form 760c, underpayment of virginia estimated tax? Web virginia resident form 760 *va0760120888* individual income tax return. 760cg / schedule fed comparison. Form 760 is a form used.

Form 760Cg Fill Out and Sign Printable PDF Template signNow

Spec documents for individual income, fiduciary,. File by may 1, 2023 — use black ink. Web up to $40 cash back va form 760cg is the virginia resident income tax return for individuals. Web form 760c is a virginia individual income tax form. If the amount on line 9 is less than the amount shown below for your filing.

760cg Fill Online, Printable, Fillable, Blank pdfFiller

Spec documents for individual income, fiduciary,. 1d barcode documents full size forms. Tax by individuals, estates and trusts. Enjoy smart fillable fields and interactivity. Web form 760 is the general income tax return for virginia residents;

Web Residents Of Virginia Must File A Form 760.

Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Web am i required to complete form 760c, underpayment of virginia estimated tax? Spec documents for individual income, fiduciary,. It must include information such as:

Web If You Need To Change Or Amend An Accepted Virginia State Income Tax Return For The Current Or Previous Tax Year You Need To Complete Form 760.

Web up to $40 cash back va form 760cg is the virginia resident income tax return for individuals. If the amount on line 9 is less than the amount shown below for your filing. Web form 760 is the general income tax return for virginia residents; Enjoy smart fillable fields and interactivity.

Web Virginia Form 760 *Va0760122888* Resident Income Tax Return.

Web virginia resident form 760 *va0760120888* individual income tax return. Web form 760c is a virginia individual income tax form. We last updated the resident individual income tax return in january 2023, so. Get your online template and fill it in using progressive features.

1D Barcode Documents Full Size Forms.

Web form 760es/cg—virginia estimated income tax payment voucher form 760f—underpayment of virginia estimated tax by farmers, fishermen and merchant. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. It was printed as part of my return online topics: File by may 1, 2023 — use black ink.