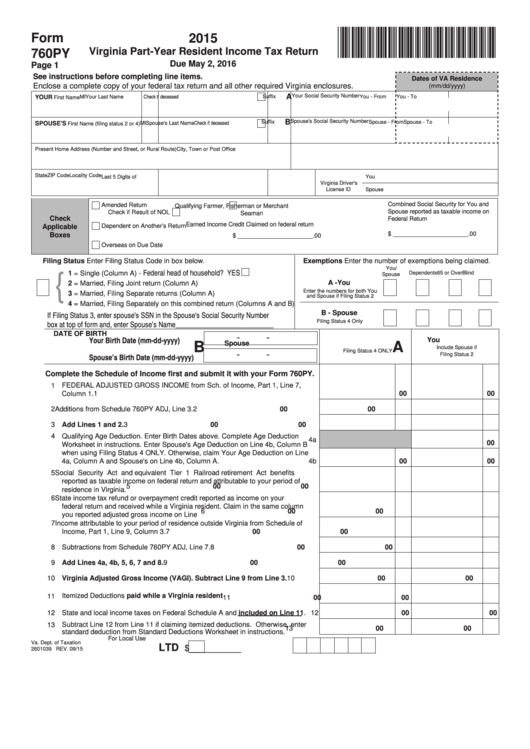

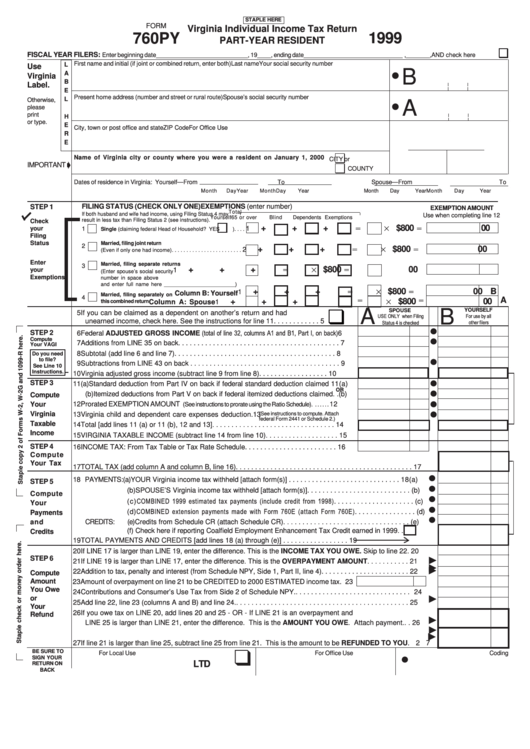

Virginia Tax Form 760Py

Virginia Tax Form 760Py - Web find forms & instructions by category. Web virginia form 760py p. Complete, edit or print tax forms instantly. Line 16 (virginia taxable income) on my form is just over $3,200. Here are the instructions on how to set up the program so it. Web we last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of schedule cr, fully updated for tax year. Web video instructions and help with filling out and completing va form 760py. Register and subscribe now to work on your va 760py instructions & more fillable forms. Web what form should i file | 760py. Web 6 state income tax refund or overpayment credit reported as income on your federal return and received while a virginia resident.

Web 6 state income tax refund or overpayment credit reported as income on your federal return and received while a virginia resident. Complete, edit or print tax forms instantly. Web i actually live in virginia. Web what form should i file | 760py. Register and subscribe now to work on your va 760py instructions & more fillable forms. Here are the instructions on how to set up the program so it. Corporation and pass through entity tax. Web we last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of schedule cr, fully updated for tax year. Claim in the same column you reported adjusted. Learn more get this form now!

Web i don't believe line 17 is calculating correctly on the 2021 virginia form 760py. Web 6 state income tax refund or overpayment credit reported as income on your federal return and received while a virginia resident. Here are the instructions on how to set up the program so it. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web form 760, schedule adj and schedule cr, federal schedule e and f (if necessary). Register and subscribe now to work on your va 760py instructions & more fillable forms. Web we last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of schedule cr, fully updated for tax year. Learn more get this form now! An instruction booklet with return mailing address is.

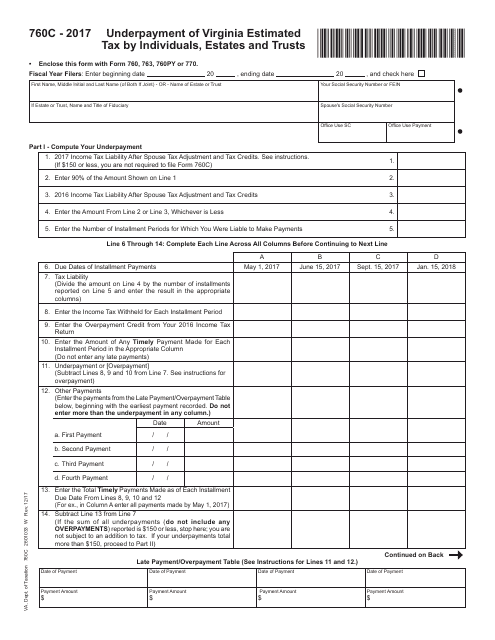

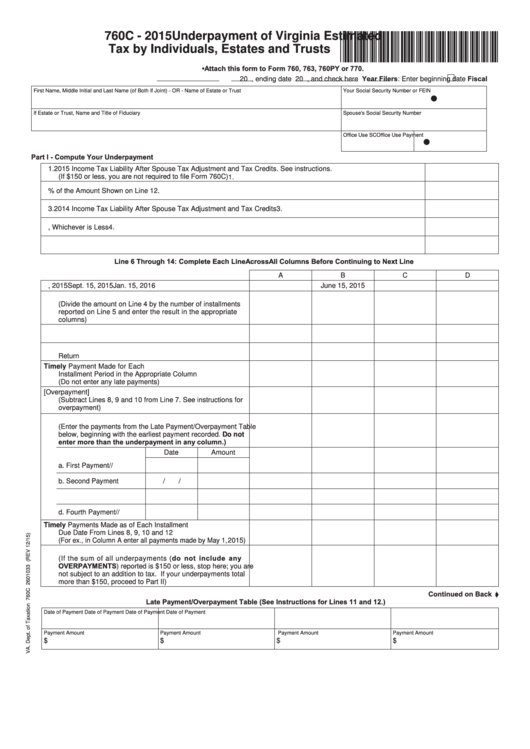

Form 760C Download Fillable PDF or Fill Online Underpayment of Virginia

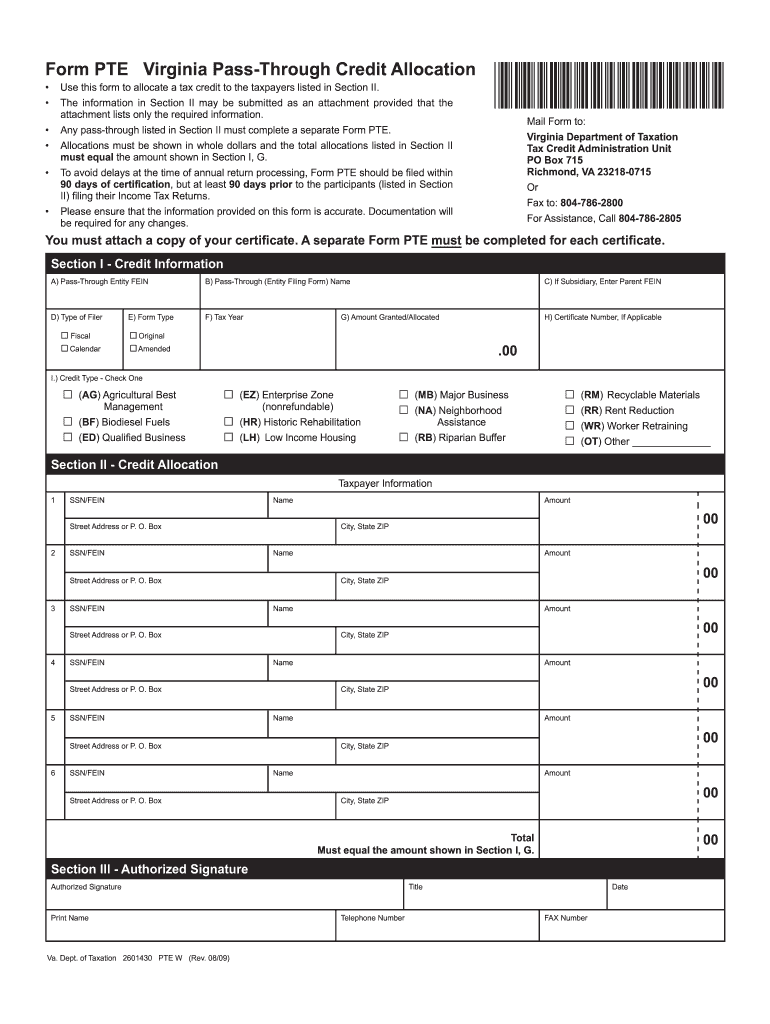

Corporation and pass through entity tax. Complete, edit or print tax forms instantly. Web what form should i file | 760py. Complete, edit or print tax forms instantly. Claim in the same column you reported adjusted.

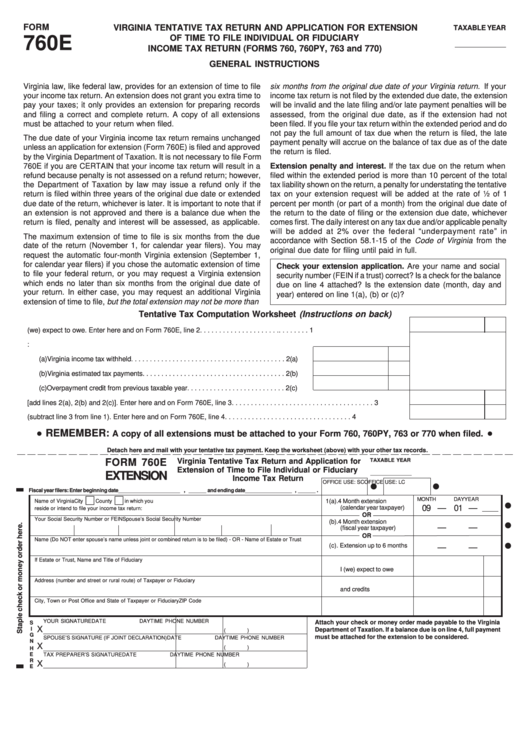

Form 760e Virginia Tentative Tax Return And Application For Extension

Learn more about how to complete va 760py rapidly and easily. Web virginia form 760py p. Web form 760, schedule adj and schedule cr, federal schedule e and f (if necessary). Web what form should i file | 760py. An instruction booklet with return mailing address is.

Top 22 Virginia Form 760 Templates free to download in PDF format

Web 6 state income tax refund or overpayment credit reported as income on your federal return and received while a virginia resident. Register and subscribe now to work on your va 760py instructions & more fillable forms. Web i actually live in virginia. Line 16 (virginia taxable income) on my form is just over $3,200. Web we last updated the.

Fillable Form 760py Virginia PartYear Resident Tax Return

Web what form should i file | 760py. Here are the instructions on how to set up the program so it. Corporation and pass through entity tax. The py stands for part year instead of just the standard 760 resident form. We all have roles to play in.

Form 760py Virginia Individual Tax Return PartYear Resident

Download this form print this form more. Web we last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of schedule cr, fully updated for tax year. We all have roles to play in. Learn more get this form now! Register and subscribe now to work on your.

Virginia Form Pte Fill Out and Sign Printable PDF Template signNow

Claim in the same column you reported adjusted. Web video instructions and help with filling out and completing va form 760py. Here are the instructions on how to set up the program so it. Web virginia form 760py p. Register and subscribe now to work on your va 760py instructions & more fillable forms.

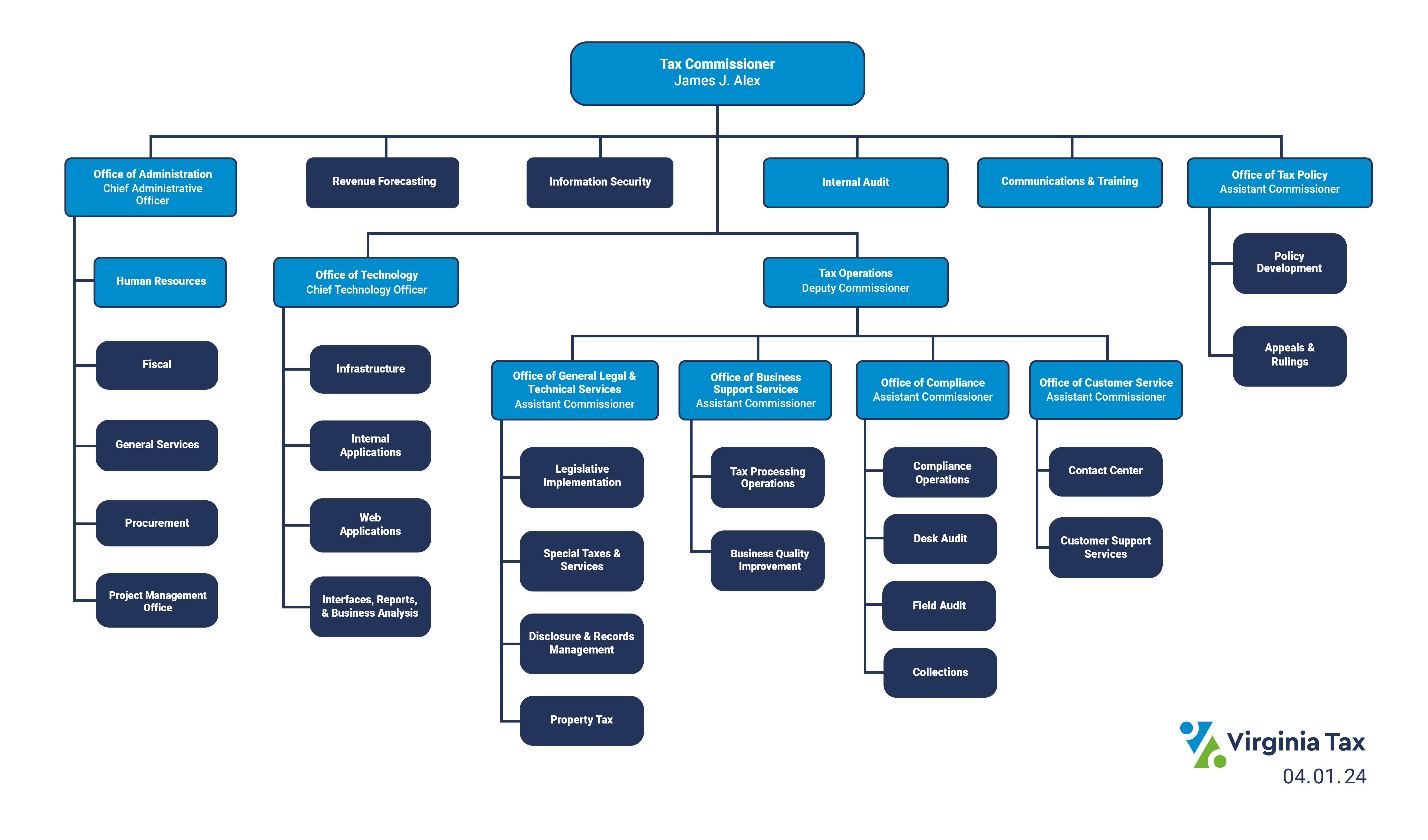

Who We Are Virginia Tax

Web i don't believe line 17 is calculating correctly on the 2021 virginia form 760py. Register and subscribe now to work on your va 760py instructions & more fillable forms. We all have roles to play in. Here are the instructions on how to set up the program so it. Web we last updated the credit computation schedule for forms.

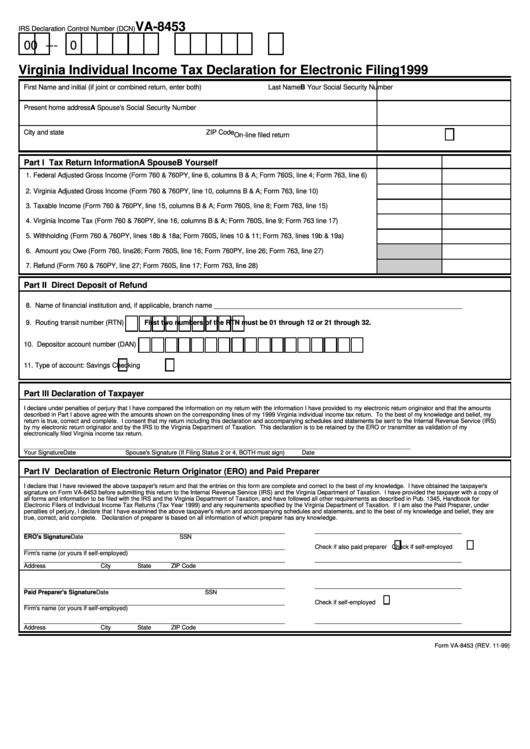

Form Va8453 Virginia Individual Tax Declaration For

Web find forms & instructions by category. Claim in the same column you reported adjusted. Learn more get this form now! Web 6 state income tax refund or overpayment credit reported as income on your federal return and received while a virginia resident. Web i don't believe line 17 is calculating correctly on the 2021 virginia form 760py.

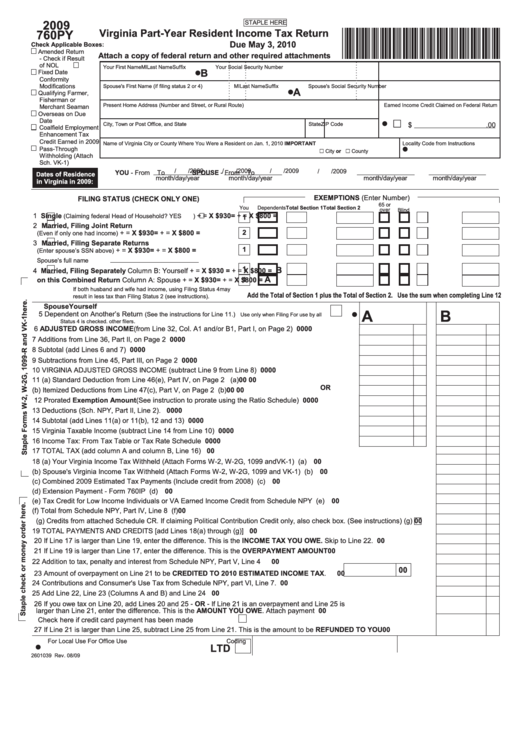

Form 760py 2009 Virginia PartYear Resident Tax Return 2010

Learn more get this form now! Complete, edit or print tax forms instantly. Web 6 state income tax refund or overpayment credit reported as income on your federal return and received while a virginia resident. An instruction booklet with return mailing address is. Register and subscribe now to work on your va 760py instructions & more fillable forms.

Register And Subscribe Now To Work On Your Va 760Py Instructions & More Fillable Forms.

Web 6 state income tax refund or overpayment credit reported as income on your federal return and received while a virginia resident. Web i actually live in virginia. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Web We Last Updated The Credit Computation Schedule For Forms 760, 760Py, 763 And 765 In January 2023, So This Is The Latest Version Of Schedule Cr, Fully Updated For Tax Year.

Register and subscribe now to work on your va 760py instructions & more fillable forms. Web what form should i file | 760py. The py stands for part year instead of just the standard 760 resident form. Here are the instructions on how to set up the program so it.

Web Video Instructions And Help With Filling Out And Completing Va Form 760Py.

Corporation and pass through entity tax. Web i don't believe line 17 is calculating correctly on the 2021 virginia form 760py. An instruction booklet with return mailing address is. Line 16 (virginia taxable income) on my form is just over $3,200.

Learn More About How To Complete Va 760Py Rapidly And Easily.

Web form 760, schedule adj and schedule cr, federal schedule e and f (if necessary). Claim in the same column you reported adjusted. Learn more get this form now! Web find forms & instructions by category.