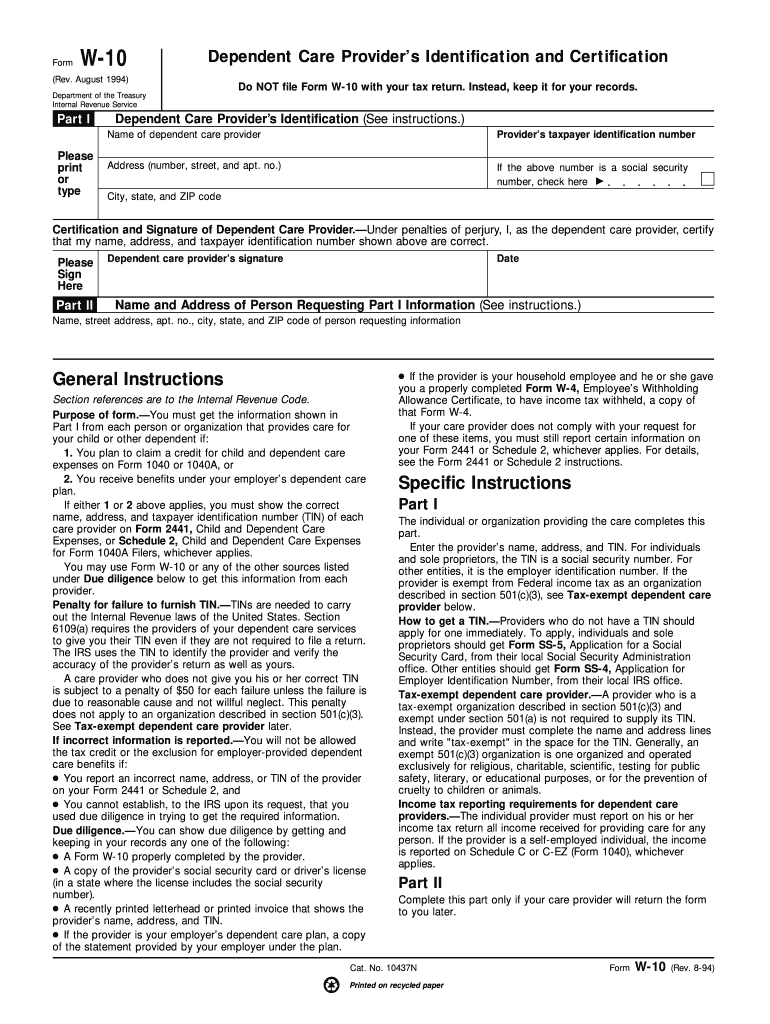

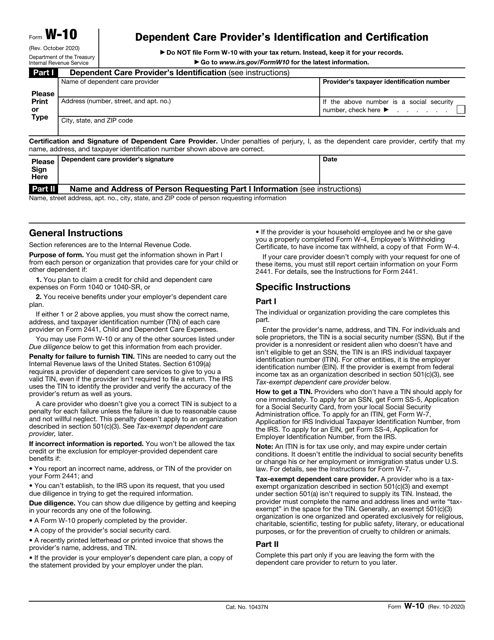

W-10 Form 2022

W-10 Form 2022 - See instructions on page 3): The form can be filled by the parent of the child or relative or just the person who has a. Web 212 votes what makes the w 10 form legally valid? Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. 2022 w 10th st is located in gravesend, brooklyn. Make changes to your 2022 tax. Web get federal tax return forms and file by mail. Exempt payee code (if any). There is not any necessity to. Complete, edit or print tax forms instantly.

Individual income tax return 2022 department of the treasury—internal revenue service omb no. Do not send to the irs. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Web 2022 form 1040 form 1040 u.s. Ad upload, modify or create forms. 2022 tax returns are due on april 18, 2023. 2022 w 10th st is located in gravesend, brooklyn. 4 exemptions (codes apply only to certain entities, not individuals; If too little is withheld, you will generally owe tax when you file. Make changes to your 2022 tax.

Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number. Web irs income tax forms, schedules and publications for tax year 2022: Web 2022 form 1040 form 1040 u.s. Exempt payee code (if any). As the society takes a step away from office work, the completion of documents more and more takes place electronically. Do not send to the irs. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. 2022 tax returns are due on april 18, 2023. If too little is withheld, you will generally owe tax when you file. See instructions on page 3):

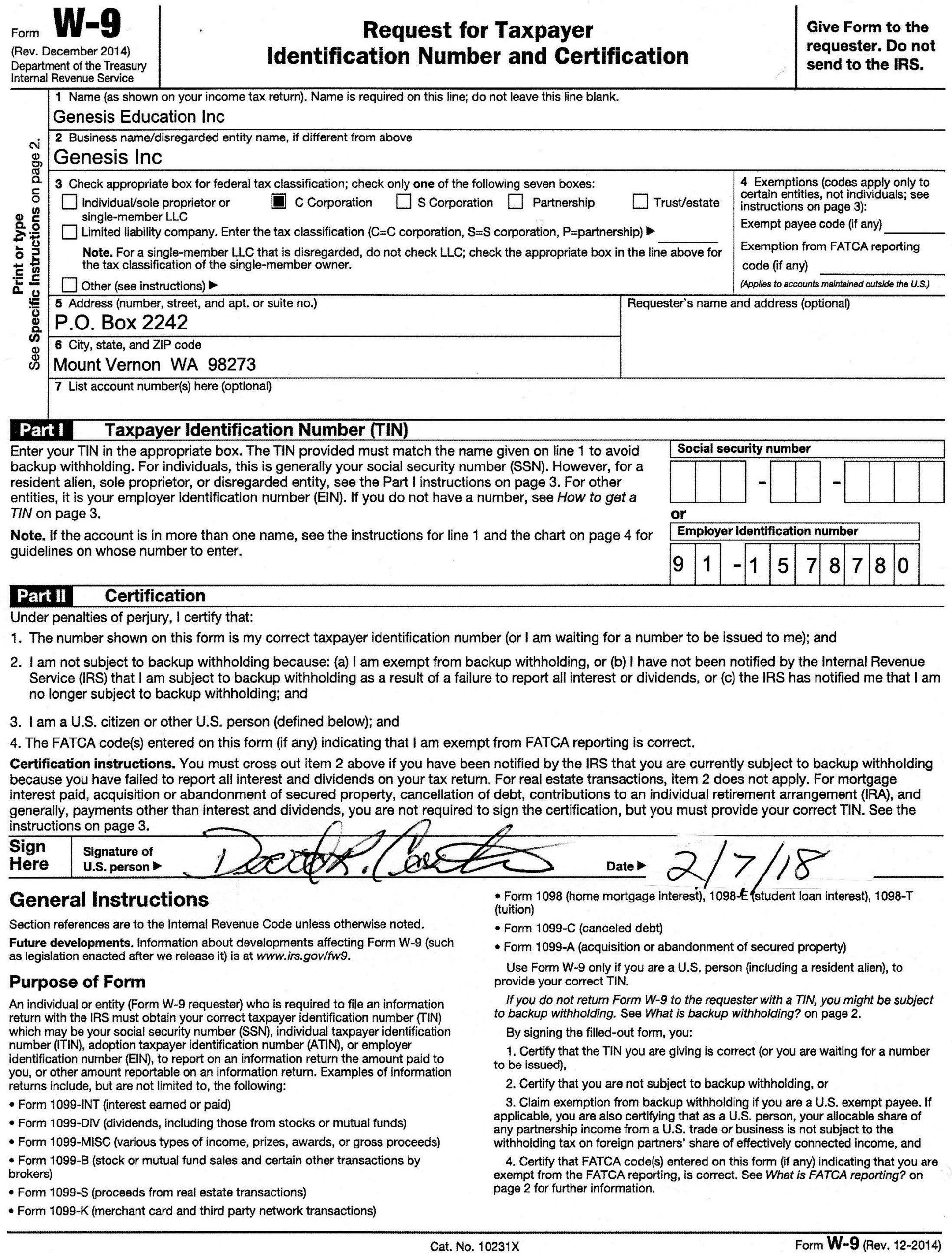

Blank W 9 Form 2021 Calendar Template Printable

Web 212 votes what makes the w 10 form legally valid? Try it for free now! Web give form to the requester. 2022 w 10th st is located in gravesend, brooklyn. Make changes to your 2022 tax.

Form W 10 Fill Out and Sign Printable PDF Template signNow

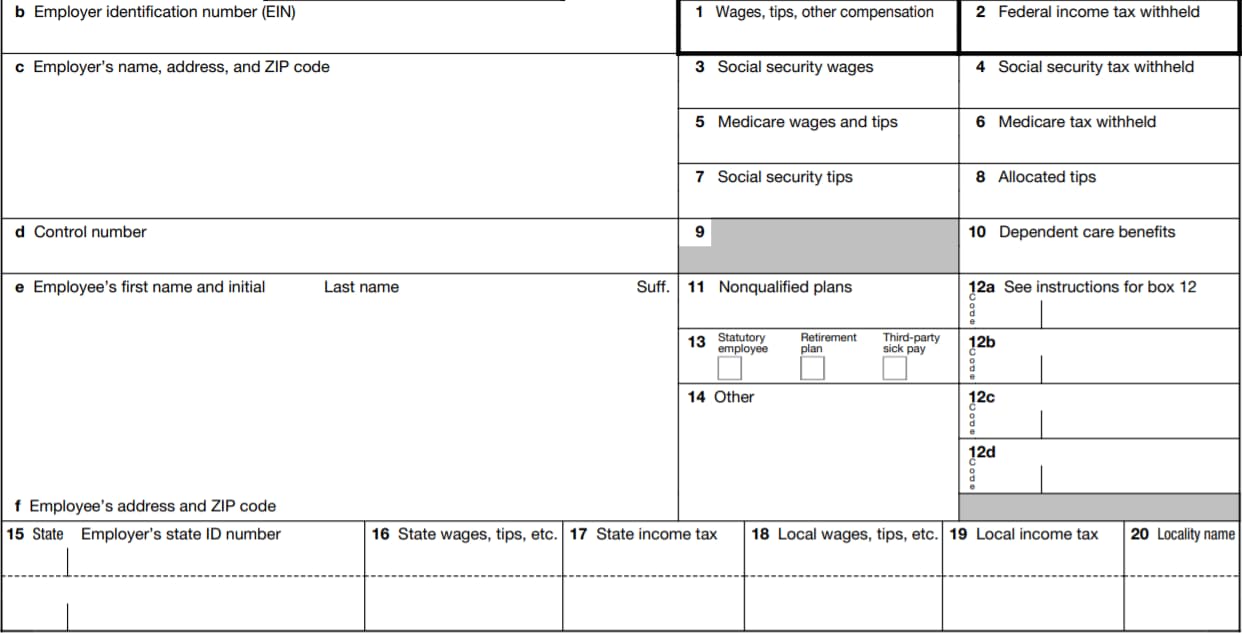

Individual income tax return 2022 department of the treasury—internal revenue service omb no. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): 4 exemptions (codes apply only to certain entities, not individuals; Web 2022 form 1040 form 1040 u.s. Complete, edit or print tax forms instantly.

W2 Form 2022 Fillable PDF

The form can be filled by the parent of the child or relative or just the person who has a. The form is simple to fill out, requiring only the provider’s. As the society takes a step away from office work, the completion of documents more and more takes place electronically. There is not any necessity to. Web 212 votes.

W2 Form 2022 Instructions W2 Forms TaxUni

Ad upload, modify or create forms. Do not send to the irs. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): 2022 tax returns are due on april 18, 2023. The form can be filled by the parent of the child or relative or just the person who has a.

W10 Form 2023

Make changes to your 2022 tax. If too little is withheld, you will generally owe tax when you file. Web get federal tax return forms and file by mail. Do not send to the irs. Complete, edit or print tax forms instantly.

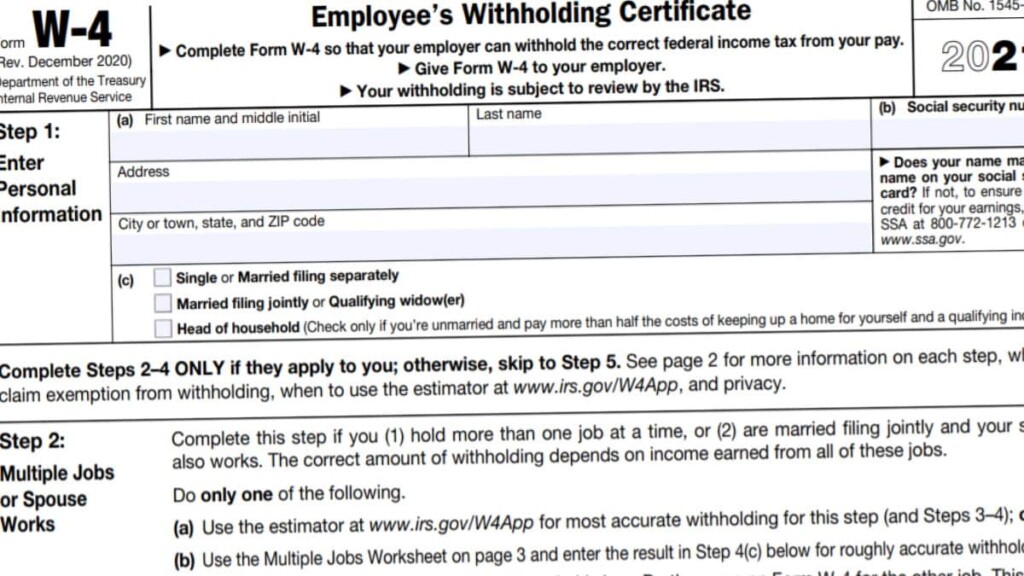

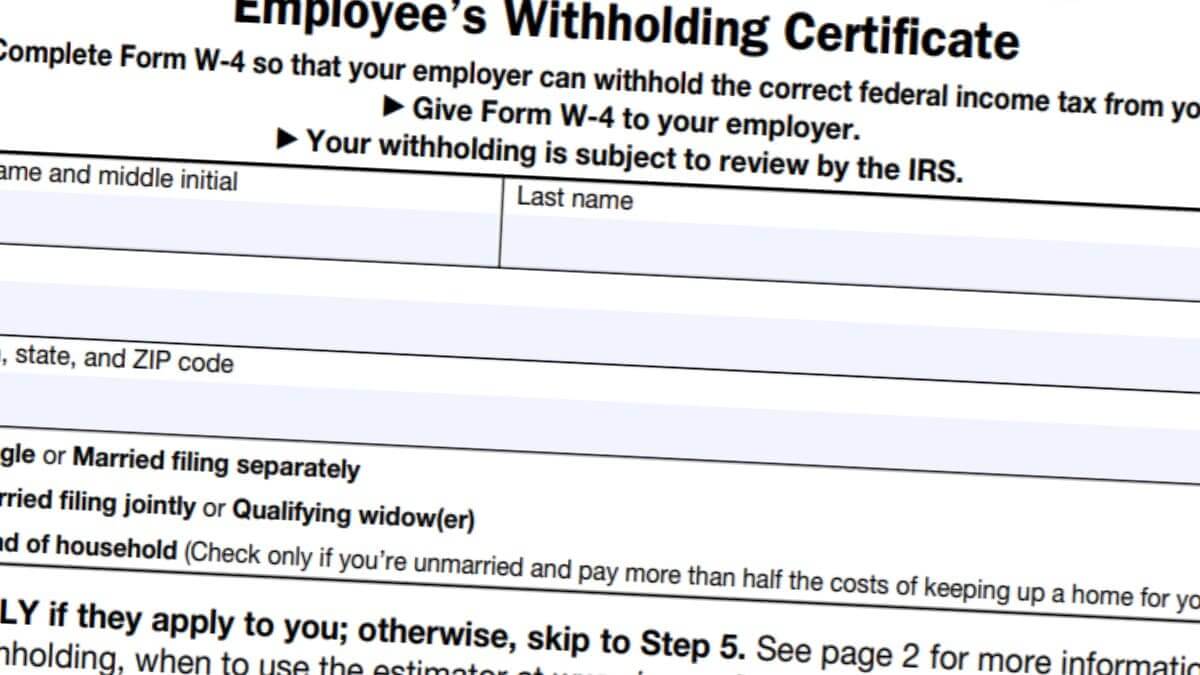

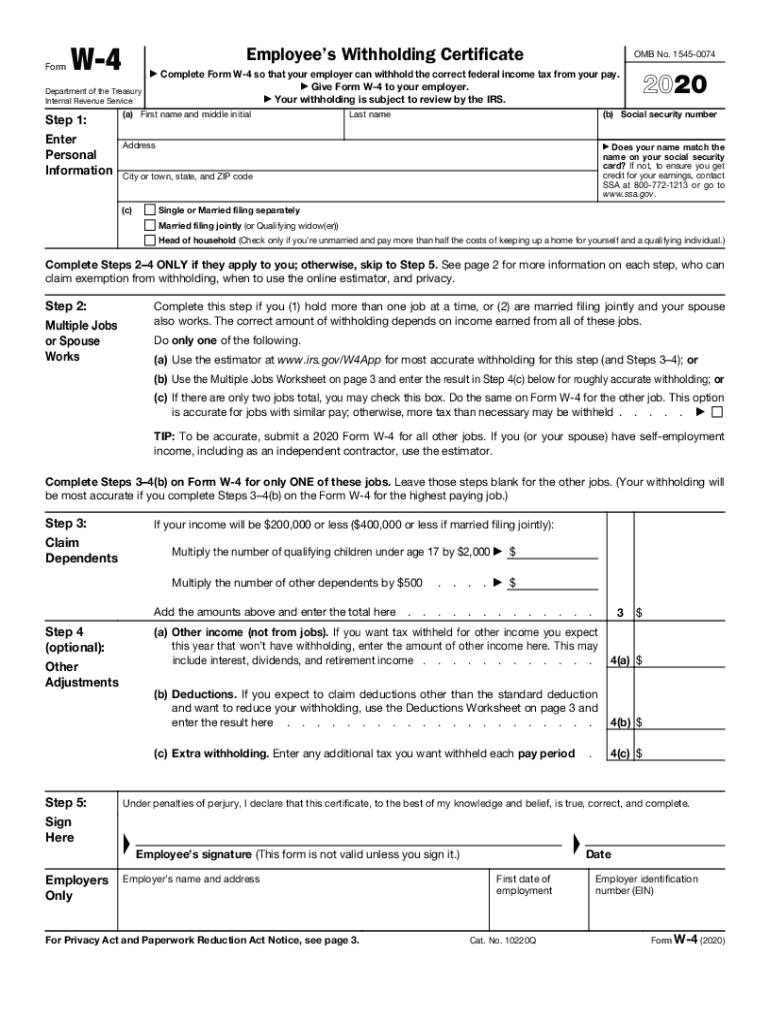

W4 Form 2022 Instructions W4 Forms TaxUni

As the society takes a step away from office work, the completion of documents more and more takes place electronically. Make changes to your 2022 tax. 2022 tax returns are due on april 18, 2023. 4 exemptions (codes apply only to certain entities, not individuals; Get paper copies of federal and state tax forms, their instructions, and the address for.

Example Of A W4 Filled 2022 Calendar Template 2022

The form is simple to fill out, requiring only the provider’s. Make changes to your 2022 tax. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Web irs income tax forms, schedules and publications for tax year 2022: Complete, edit or print tax forms instantly.

IRS Form W10 Download Fillable PDF or Fill Online Dependent Care

Try it for free now! Individual income tax return 2022 department of the treasury—internal revenue service omb no. Complete, edit or print tax forms instantly. Exempt payee code (if any). Web irs income tax forms, schedules and publications for tax year 2022:

42 INFO W 4 HOW TO CLAIM 2019 Claim

Web irs income tax forms, schedules and publications for tax year 2022: Web give form to the requester. Web 2022 form 1040 form 1040 u.s. 2022 tax returns are due on april 18, 2023. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

IRS W4 20202022 Fill and Sign Printable Template Online US Legal

Complete, edit or print tax forms instantly. As the society takes a step away from office work, the completion of documents more and more takes place electronically. Web irs income tax forms, schedules and publications for tax year 2022: 2022 w 10th st is located in gravesend, brooklyn. The form can be filled by the parent of the child or.

Multiply The Number Of Qualifying Children Under Age 17 By $2,000 $ Multiply The Number.

Try it for free now! 2022 tax returns are due on april 18, 2023. If too little is withheld, you will generally owe tax when you file. Web give form to the requester.

The Form Is Simple To Fill Out, Requiring Only The Provider’s.

Web get federal tax return forms and file by mail. Web 2022 form 1040 form 1040 u.s. Ad upload, modify or create forms. Web irs income tax forms, schedules and publications for tax year 2022:

Make Changes To Your 2022 Tax.

As the society takes a step away from office work, the completion of documents more and more takes place electronically. Complete, edit or print tax forms instantly. Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

See Instructions On Page 3):

Exempt payee code (if any). Do not send to the irs. 4 exemptions (codes apply only to certain entities, not individuals; Individual income tax return 2022 department of the treasury—internal revenue service omb no.