W4 Form Oregon

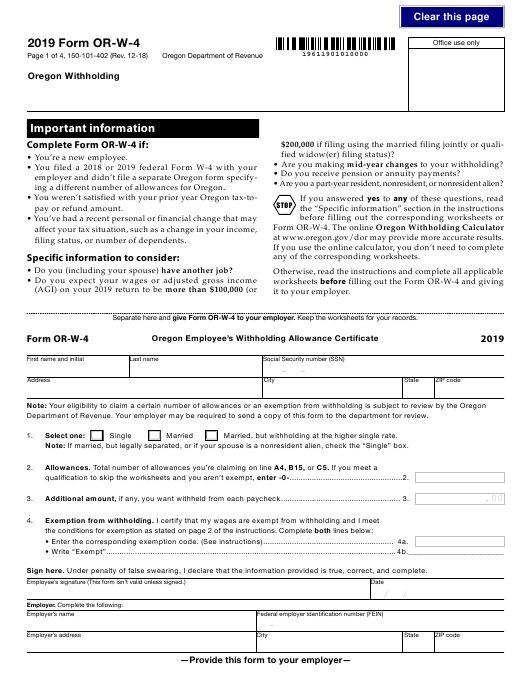

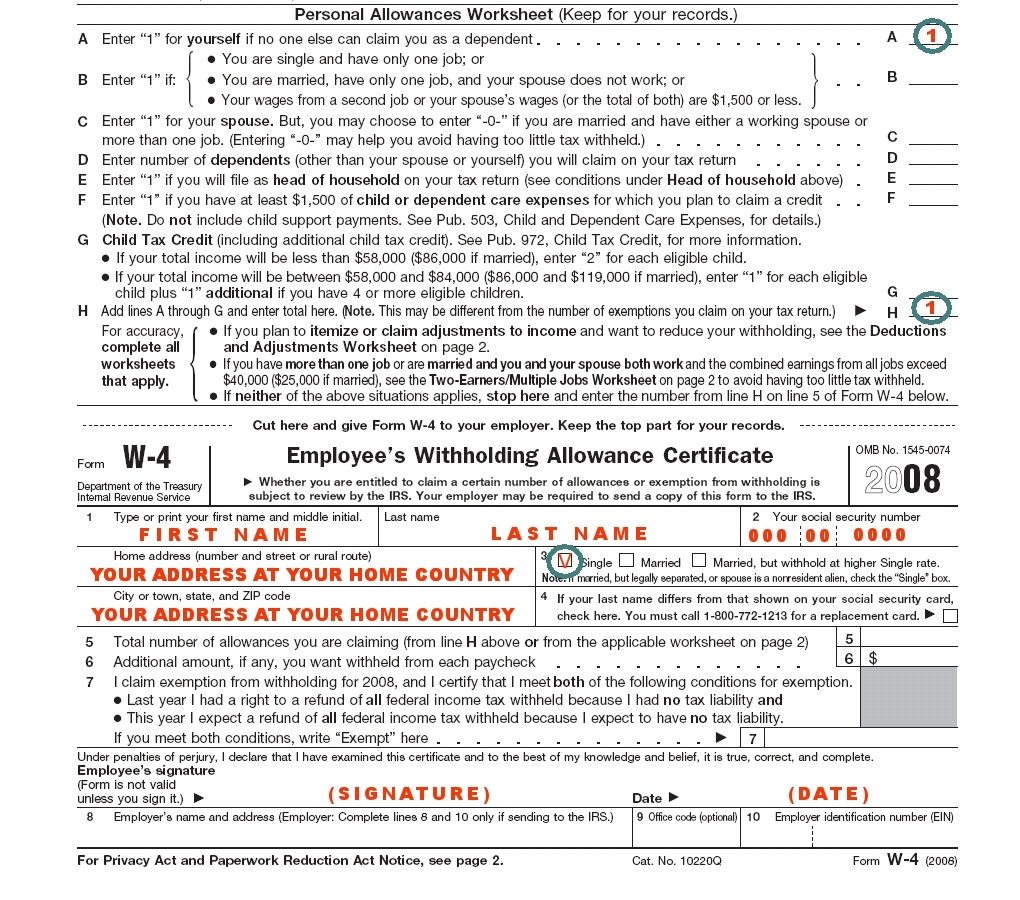

W4 Form Oregon - • use the oregon withholding tax tables if: 01) office use only oregon department of revenue 19612301010000 oregon withholding statement and exemption certificate note: 01) oregon department of revenue 19612101010000 office use only oregon employee’s withholding statement and exemption certificate To calculate the amount of tax to withhold from an employee’s wages: Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of. 01) office use only oregon department of revenue 19612301010000 oregon withholding statement and exemption certificate note: 01) oregon department of revenue office use only oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip. Your employer may be required to send a copy of this form to the department for review. If too much is withheld, you will generally be due a refund. Web federal form no longer calculates oregon withholding correctly.

01) office use only oregon department of revenue 19612301010000 oregon withholding statement and exemption certificate note: Drug deaths nationwide hit a record 109,680 in 2022, according to. If too much is withheld, you will generally be due a refund. Your withholding is subject to review by the irs. If too much is withheld, you will generally be due a refund. Click the arrow with the inscription next to move on from field to field. Withhold as if the payments were wages. The completed forms are required for each employee who receives pay from the university according to the internal revenue laws of. 01) oregon department of revenue 19612101010000 office use only oregon employee’s withholding statement and exemption certificate You must withhold $10 or more per employee or payee.

However, due to federal tax law changes, the federal form no longer calculates the correct number of oregon allowances. 01) oregon department of revenue office use only oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip. If too much is withheld, you will generally be due a refund. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of. Web the hearing was particularly timely, because the u.s. You must withhold $10 or more per employee or payee. The completed forms are required for each employee who receives pay from the university according to the internal revenue laws of. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Form cf 0 1 0 580. Is facing intensifying urgency to stop the worsening fentanyl epidemic.

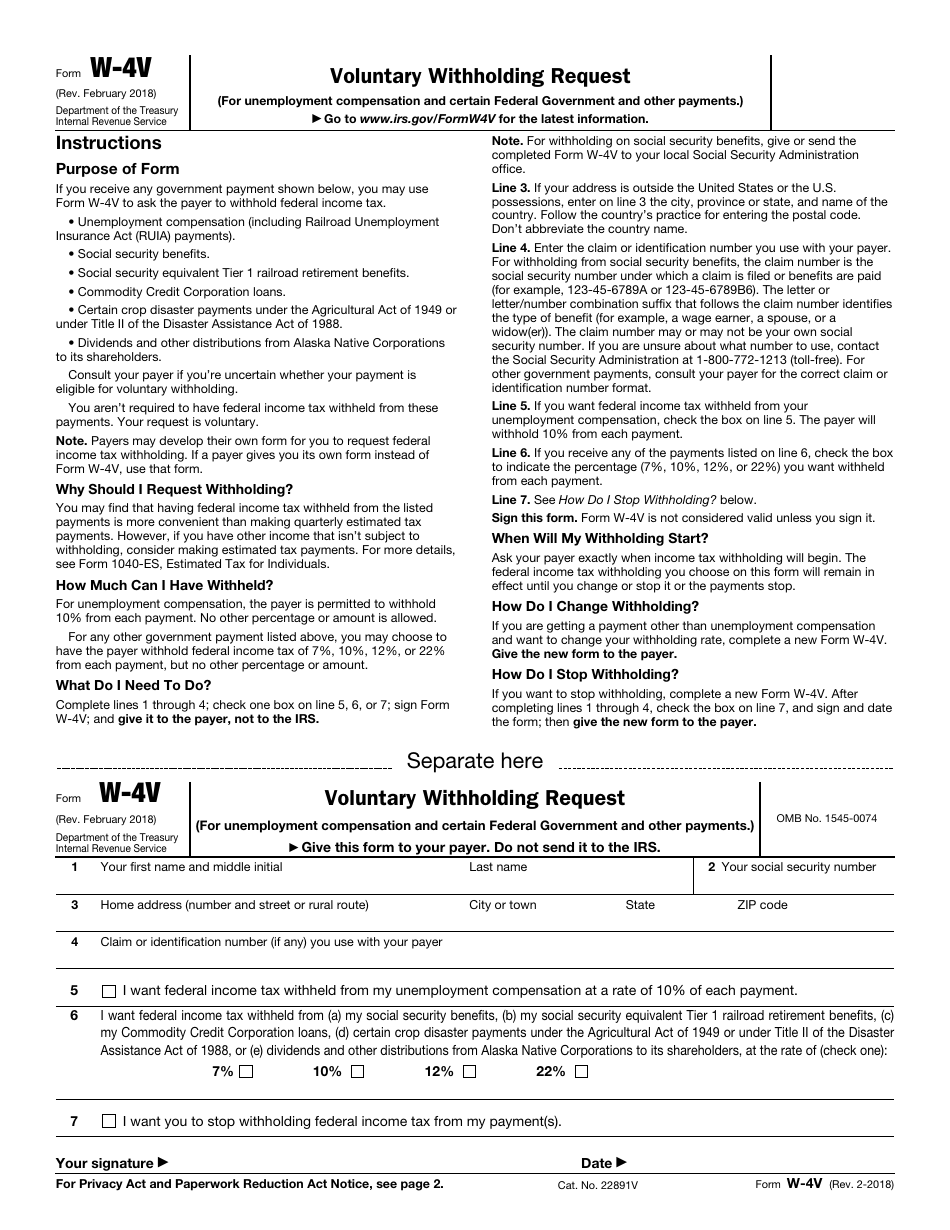

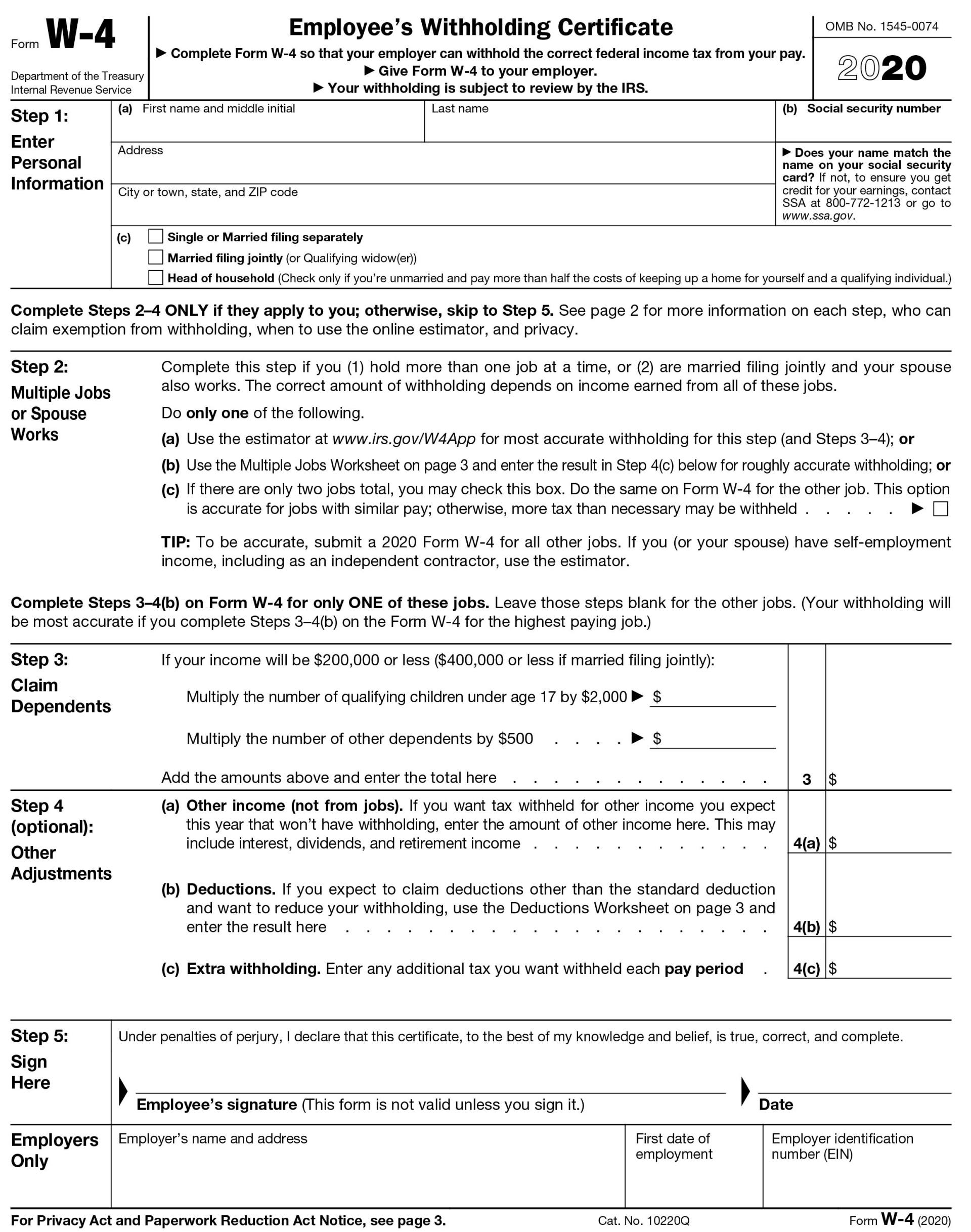

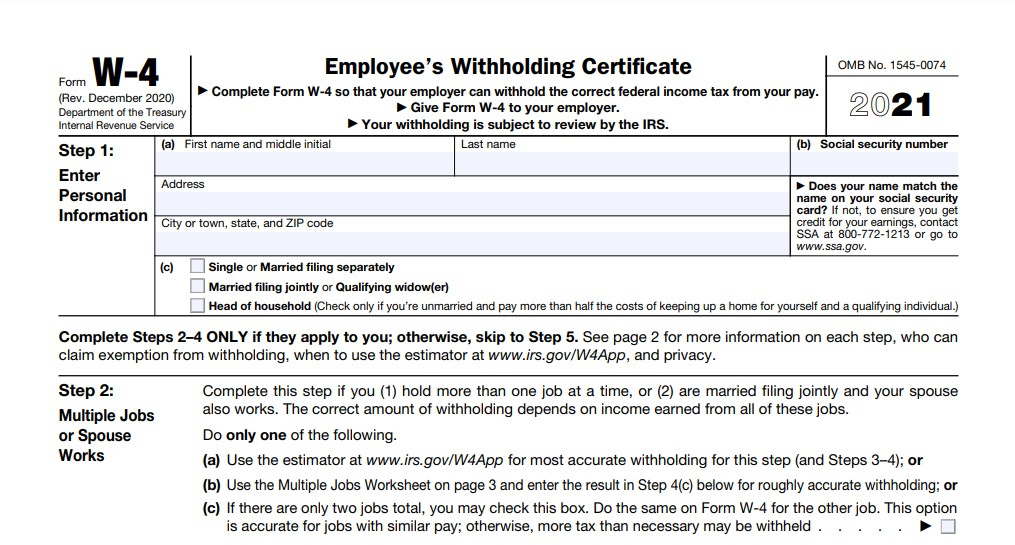

Irs Form W4V Printable W4 Form Printable 2020 W4 Form 2021 Printable

If too much is withheld, you will generally be due a refund. You must withhold $10 or more per employee or payee. Web oregon department of revenue. To calculate the amount of tax to withhold from an employee’s wages: Drug deaths nationwide hit a record 109,680 in 2022, according to.

IRS Form W4V Fill Out, Sign Online and Download Fillable PDF

O the employee’s wages are less than $50,000 annually, 01) office use only oregon department of revenue 19612201010000 oregon withholding statement and exemption certificate note: Withhold as if the payments were wages. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of. To calculate the amount.

Oregon W 4 Form Printable 2022 W4 Form

The completed forms are required for each employee who receives pay from the university according to the internal revenue laws of. Is facing intensifying urgency to stop the worsening fentanyl epidemic. However, due to federal tax law and form changes, the federal form no longer calculates oregon withholding correctly. To calculate the amount of tax to withhold from an employee’s.

Irs Form W4V Printable / W 4 V W I T H H O L D I N G F O R M Zonealarm

Oregon withholding isn't required for a rollover from one qualifying plan to another. 01) oregon department of revenue 19612101010000 office use only oregon employee’s withholding statement and exemption certificate The completed forms are required for each employee who receives pay from the university according to the internal revenue laws of. Web federal form no longer calculates oregon withholding correctly. If.

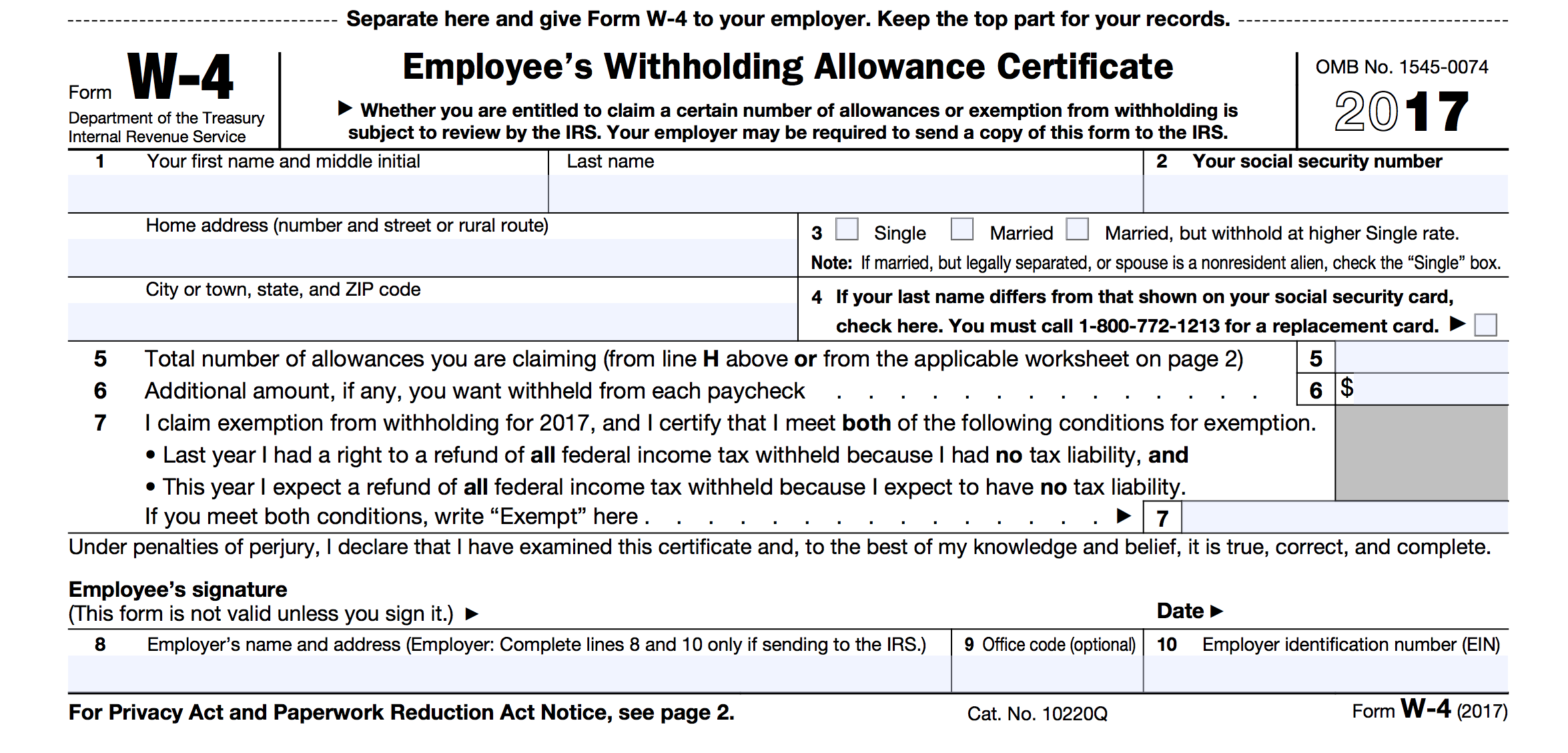

Sample W 4 Form W4 Form 2021 Printable

Single married married, but withholding at the higher single rate. How do i calculate withholding tax? Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of. 01) office use only oregon department of revenue 19612201010000 oregon withholding statement and exemption certificate note: Your employer may be.

Forms & Worksheets Storms & Alpaugh PLLC Victoria MN

• use the oregon withholding tax tables if: If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund. Click the arrow with the inscription next to move on from field to field. To calculate the amount of.

W4 Forms 2021 2022 Zrivo

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. To calculate the amount of tax to withhold from an employee’s wages: Withhold as if the payments were wages. Click the arrow with the inscription next to move on from field to field. • use the oregon withholding tax.

Download Oregon Form W4 (2014) for Free FormTemplate

Form cf 0 1 0 580. 01) oregon department of revenue office use only oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip. If too much is withheld, you will generally be due a refund. Oregon withholding isn't required for a rollover from one qualifying plan to another. However,.

Oregon W4 2021 Form Printable 2022 W4 Form

Single married married, but withholding at the higher single rate. O the employee’s wages are less than $50,000 annually, 01) oregon department of revenue office use only oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip. Oregon withholding isn't required for a rollover from one qualifying plan to another..

Did the W4 Form Just Get More Complicated? GoCo.io

Web federal form no longer calculates oregon withholding correctly. Select a heading to view its forms, then u se the search feature to locate a form or publication by its name, form number, year, or type. To calculate the amount of tax to withhold from an employee’s wages: 01) oregon department of revenue office use only oregon withholding statement and.

01) Office Use Only Oregon Department Of Revenue 19612301010000 Oregon Withholding Statement And Exemption Certificate Note:

Oregon withholding isn't required for a rollover from one qualifying plan to another. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the oregon department of. 01) oregon department of revenue office use only oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip. O the employee’s wages are less than $50,000 annually,

Form Cf 0 1 0 580.

Withhold as if the payments were wages. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. The completed forms are required for each employee who receives pay from the university according to the internal revenue laws of. You must withhold $10 or more per employee or payee.

• Do You Expect Your Wages Or Your Total.

Your employer may be required to send a copy of this form to the department for review. Web view all of the current year's forms and publications by popularity or program area. If too much is withheld, you will generally be due a refund. However, due to federal tax law and form changes, the federal form no longer calculates oregon withholding correctly.

• Do You (Including Your Spouse) Have More Than One Job?

• use the oregon withholding tax tables if: Web federal form no longer calculates oregon withholding correctly. Web the hearing was particularly timely, because the u.s. Is facing intensifying urgency to stop the worsening fentanyl epidemic.