W8 Form Vs W9

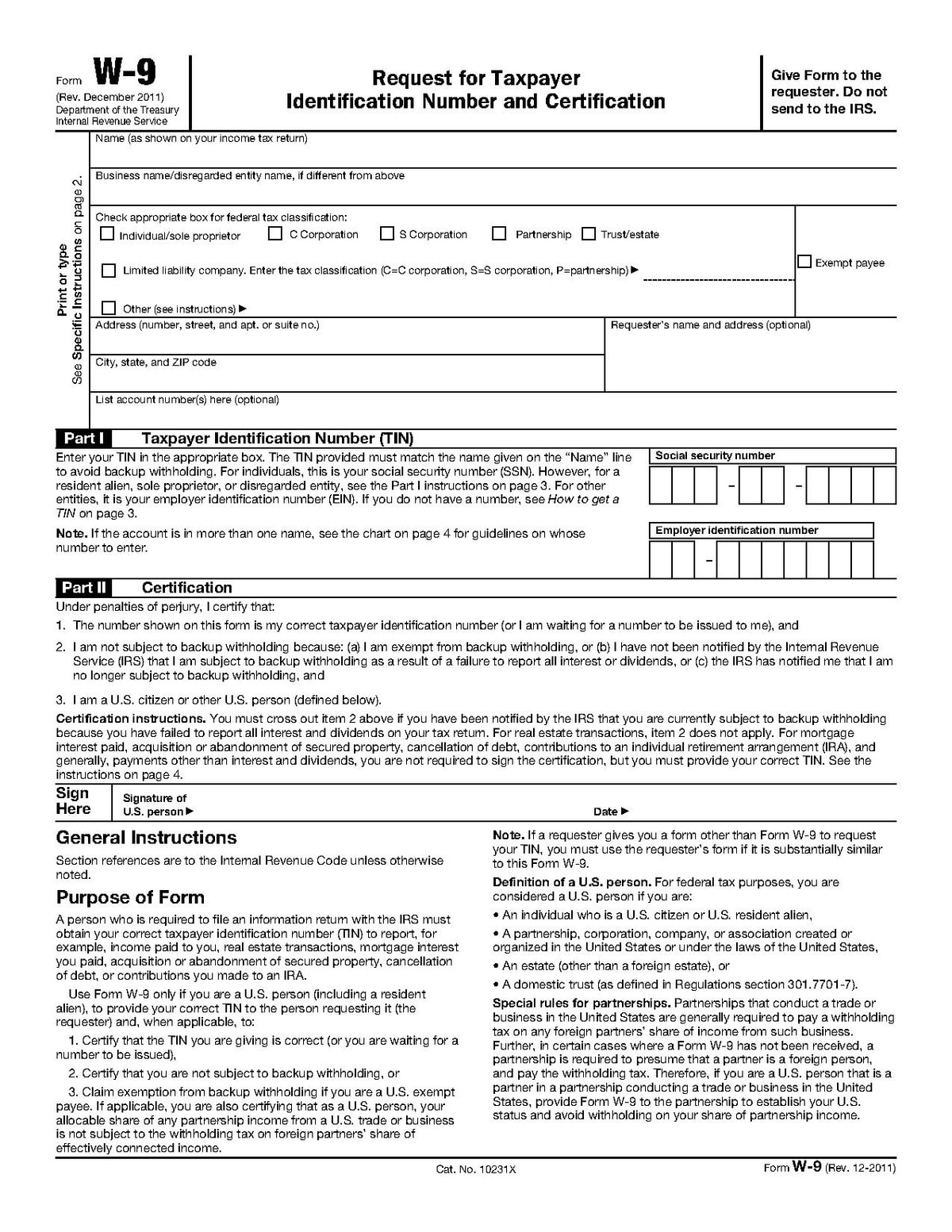

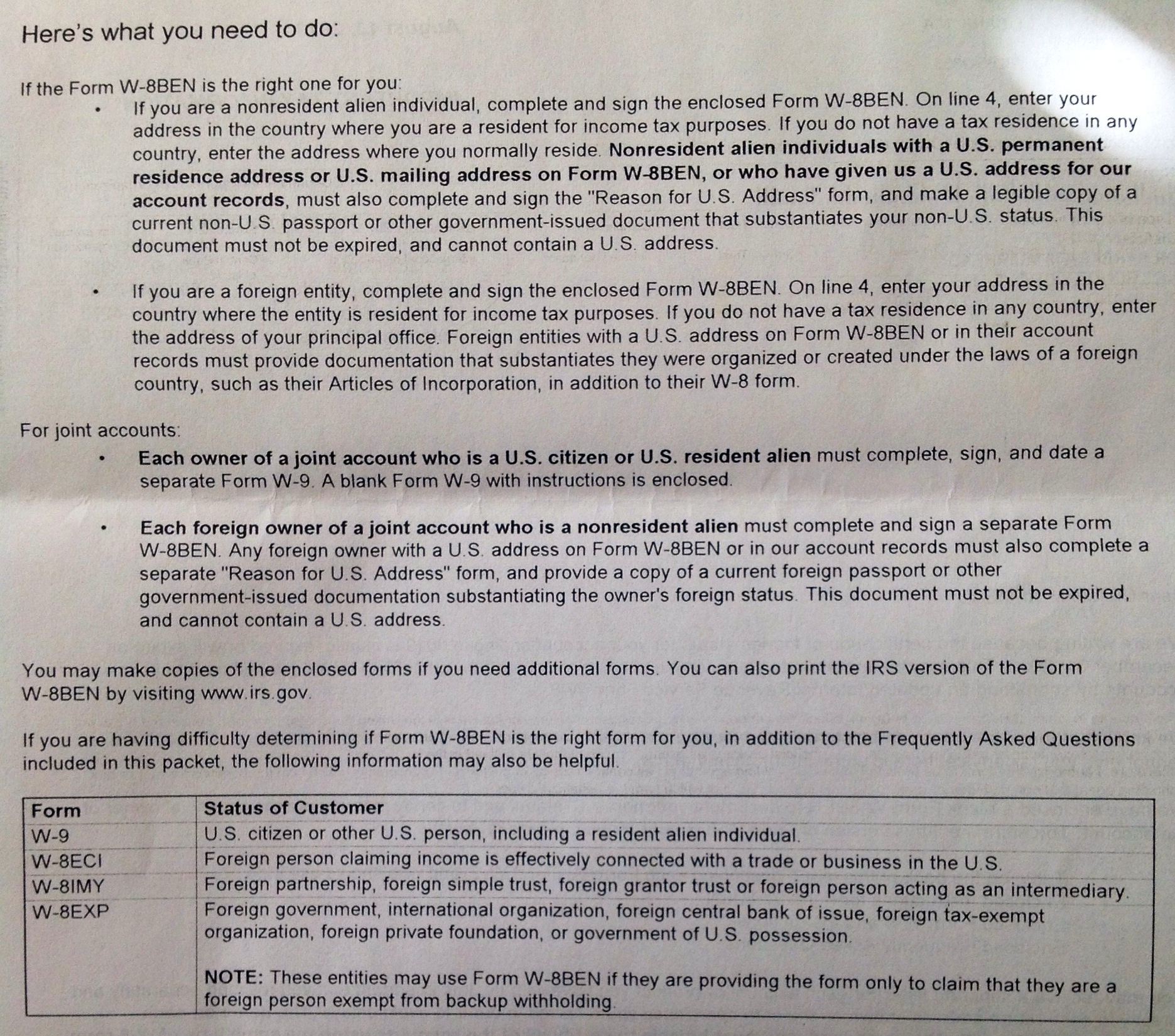

W8 Form Vs W9 - Web here’s when to use each one. Complete, edit or print tax forms instantly. They sort of leave out what happens if their determination is different. Web two of the most common ones to know about are w8 or w9 tax forms. Web w8 vs w9 form: W9 form is a question that most businesses should have answered, especially because it can save yo. This form confirms your name, address and taxpayer identification number (tin). Which is the best for us company?the w8 vs. Understanding the difference between w8 and w9 is important as it helps in compliant payroll taxation for. Web w9 is used if you are a us citizen or other us person including a resident alien individual.

Understanding the difference between w8 and w9 is important as it helps in compliant payroll taxation for. Web two of the most common ones to know about are w8 or w9 tax forms. The irs leaves it up to you, the w8 recipient to determine the bona fide of the documentation. Form w9 is intended for us residents. Complete, edit or print tax forms instantly. Among the most commonly encountered yet misunderstood forms are. The w9 is pretty straightforward, especially since as a us tax resident.you're probably used to the challenges of us tax forms. Branches for united states tax withholding and. Web here’s when to use each one. The primary difference between the 1099 form and the w9 form is that the 1099 form is used to report payments made only to an.

Web 20 july 2023 the world of taxation can often feel like a maze of letters and numbers. Among the most commonly encountered yet misunderstood forms are. Get ready for tax season deadlines by completing any required tax forms today. Which is the best for us company?the w8 vs. The irs leaves it up to you, the w8 recipient to determine the bona fide of the documentation. Web here’s when to use each one. They sort of leave out what happens if their determination is different. Web what happens if i’m asked to complete form w9 and i’m not from the usa? Form w9 is intended for us residents. This form confirms your name, address and taxpayer identification number (tin).

April « 2014 « TaxExpatriation

Ad get ready for tax season deadlines by completing any required tax forms today. The primary difference between the 1099 form and the w9 form is that the 1099 form is used to report payments made only to an. Other items you may find useful. The w9 is pretty straightforward, especially since as a us tax resident.you're probably used to.

Form W8 Instructions & Information about IRS Tax Form W8

The primary difference between the 1099 form and the w9 form is that the 1099 form is used to report payments made only to an. Web two of the most common ones to know about are w8 or w9 tax forms. They sort of leave out what happens if their determination is different. Form w9 is intended for us residents..

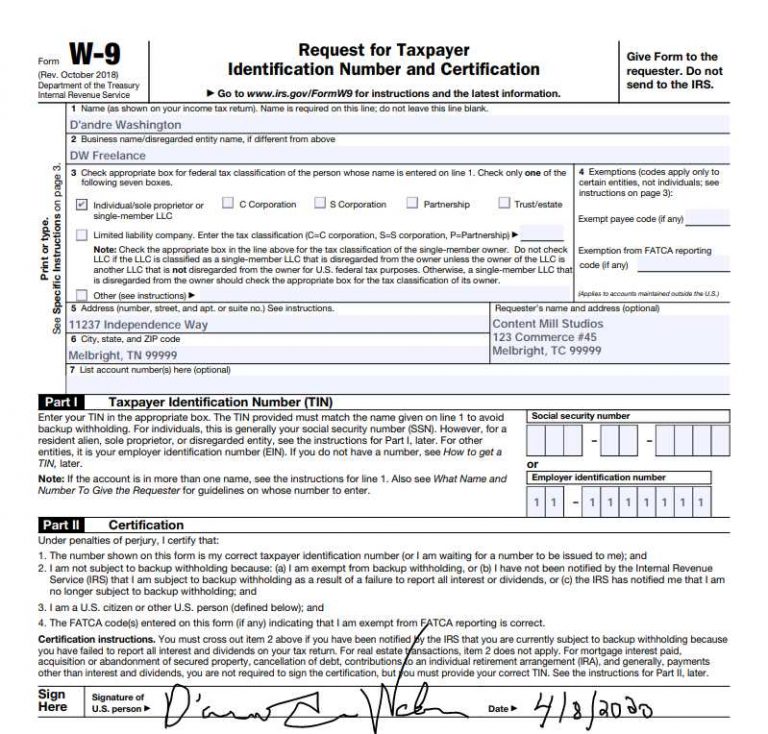

What Is a W9 Form & How to Fill It Out

The primary difference between the 1099 form and the w9 form is that the 1099 form is used to report payments made only to an. The irs leaves it up to you, the w8 recipient to determine the bona fide of the documentation. Ad get ready for tax season deadlines by completing any required tax forms today. Form w9 is.

W8 vs. W9 Engines What are the major differences? Moparts Forums

Form w9 is intended for us residents. Web two of the most common ones to know about are w8 or w9 tax forms. Web w8 vs w9 form: Web what happens if i’m asked to complete form w9 and i’m not from the usa? Among the most commonly encountered yet misunderstood forms are.

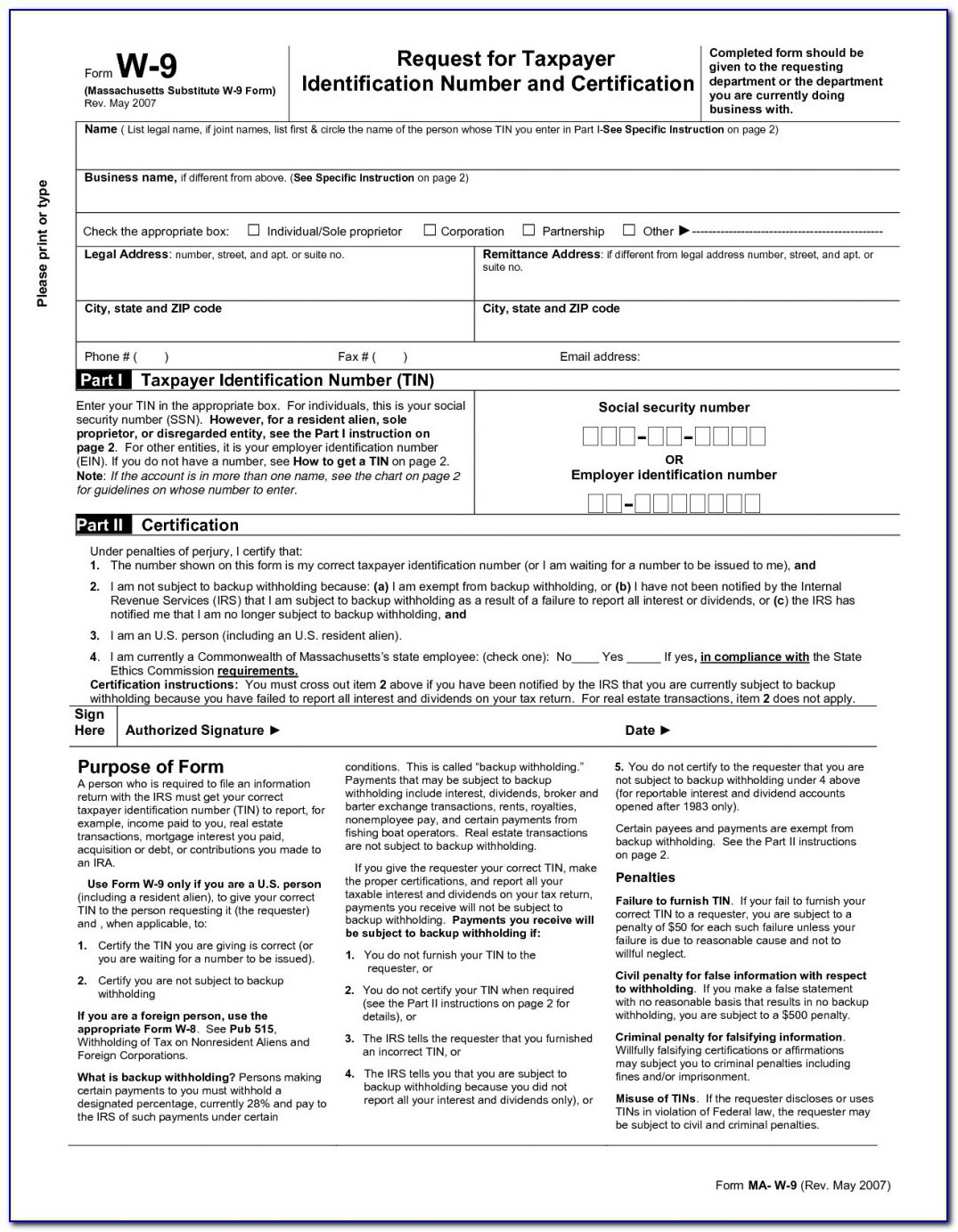

Printable Blank W9 Form Calendar Template Printable

Web two of the most common ones to know about are w8 or w9 tax forms. Web here’s when to use each one. Partners to overcome a presumption of foreign status and to avoid withholding on the partner's. Other items you may find useful. The primary difference between the 1099 form and the w9 form is that the 1099 form.

Top 10 FATCA Explanations You Need to Read Alacra, Inc. an Opus

Web w8 vs w9 form: Understanding the difference between w8 and w9 is important as it helps in compliant payroll taxation for. The primary difference between the 1099 form and the w9 form is that the 1099 form is used to report payments made only to an. Complete, edit or print tax forms instantly. Web here’s when to use each.

Electronic W8/W9 YouTube

Among the most commonly encountered yet misunderstood forms are. Web w9 is used if you are a us citizen or other us person including a resident alien individual. W9 form is a question that most businesses should have answered, especially because it can save yo. Web two of the most common ones to know about are w8 or w9 tax.

W8 vs. W9 Engines What are the major differences? Moparts Forums

Complete, edit or print tax forms instantly. W9 form is a question that most businesses should have answered, especially because it can save yo. Understanding the difference between w8 and w9 is important as it helps in compliant payroll taxation for. Web here’s when to use each one. Partners to overcome a presumption of foreign status and to avoid withholding.

What is a W9 Form and How to Get One Shared Economy Tax

Among the most commonly encountered yet misunderstood forms are. Get ready for tax season deadlines by completing any required tax forms today. Which is the best for us company?the w8 vs. W9 form is a question that most businesses should have answered, especially because it can save yo. Understanding the difference between w8 and w9 is important as it helps.

W9 or W8BEN British Expats

Among the most commonly encountered yet misunderstood forms are. Partners to overcome a presumption of foreign status and to avoid withholding on the partner's. Web w9 is used if you are a us citizen or other us person including a resident alien individual. Web two of the most common ones to know about are w8 or w9 tax forms. Which.

Web Here’s When To Use Each One.

W9 form is a question that most businesses should have answered, especially because it can save yo. They sort of leave out what happens if their determination is different. Web w8 vs w9 form: Ad get ready for tax season deadlines by completing any required tax forms today.

Branches For United States Tax Withholding And.

Other items you may find useful. The irs leaves it up to you, the w8 recipient to determine the bona fide of the documentation. The primary difference between the 1099 form and the w9 form is that the 1099 form is used to report payments made only to an. Web what happens if i’m asked to complete form w9 and i’m not from the usa?

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web two of the most common ones to know about are w8 or w9 tax forms. This form confirms your name, address and taxpayer identification number (tin). Among the most commonly encountered yet misunderstood forms are. The w9 is pretty straightforward, especially since as a us tax resident.you're probably used to the challenges of us tax forms.

Web 20 July 2023 The World Of Taxation Can Often Feel Like A Maze Of Letters And Numbers.

Form w9 is intended for us residents. Web w9 is used if you are a us citizen or other us person including a resident alien individual. Complete, edit or print tax forms instantly. Partners to overcome a presumption of foreign status and to avoid withholding on the partner's.