W9 Form 2022 Washington State

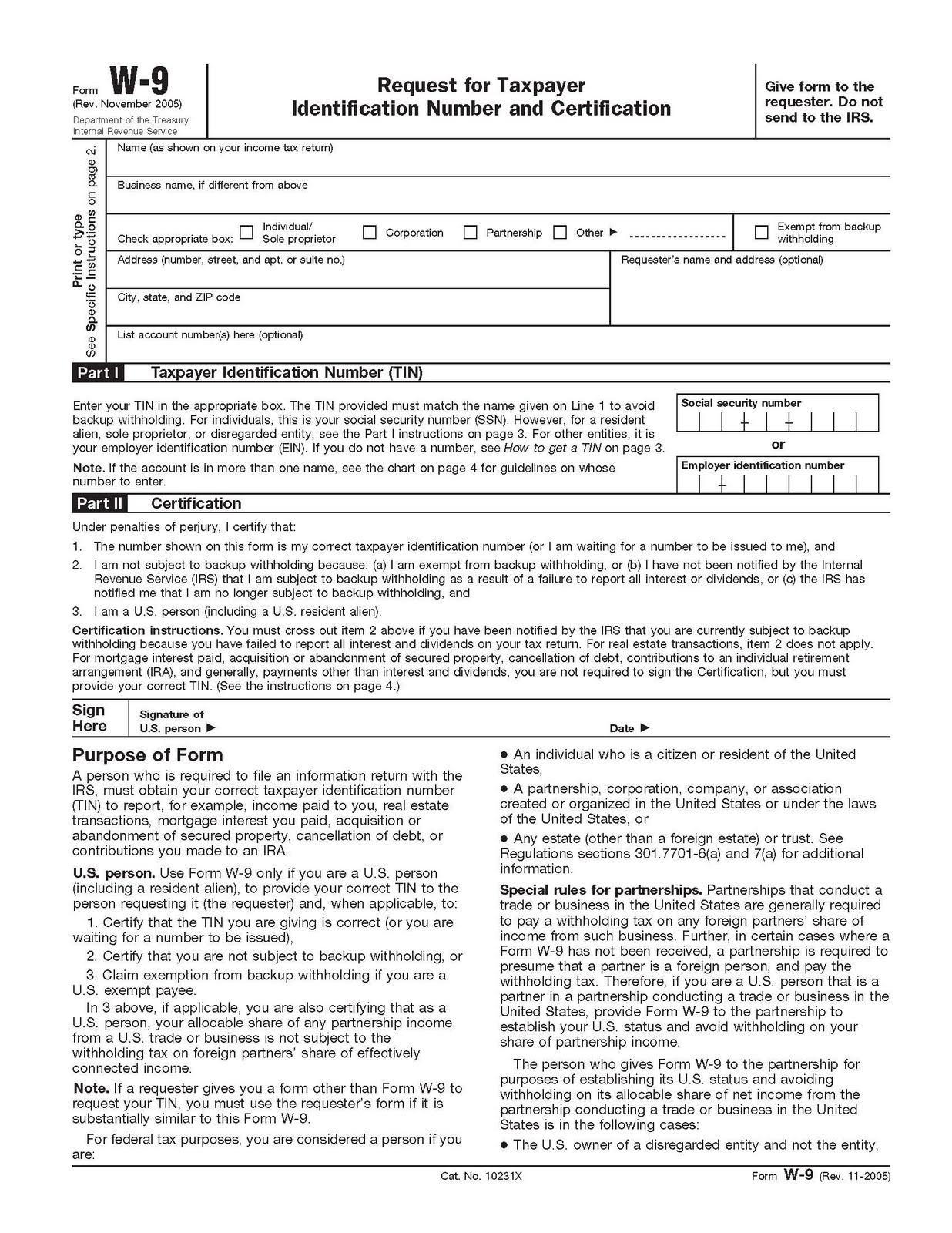

W9 Form 2022 Washington State - This form is for income earned in tax year 2022, with tax returns due in april 2023. Ad access irs tax forms. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. ©2023 washington university in st. Web july 7, 2022 by printw9. A single ticket won in california. According to its website , here are. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. The irs has issued new regulations governing how we report payments and calculate withholding. Web july 7, 2022 by printw9.

Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. Web $2.04 billion, powerball, nov. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. Web irs form w9 printable 2022 is a certain form that a person uses in order to provide a taxpayer identification number, also known as tin, to an individual who needs to file a. This form is for income earned in tax year 2022, with tax returns due in april 2023. ©2023 washington university in st. What are the top 10 largest mega millions jackpots ever? Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example:

©2023 washington university in st. Web $2.04 billion, powerball, nov. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Web july 7, 2022 by printw9. Ad access irs tax forms. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april 2023. What are the top 10 largest mega millions jackpots ever? The irs has issued new regulations governing how we report payments and calculate withholding. Verifying the information on this form and.

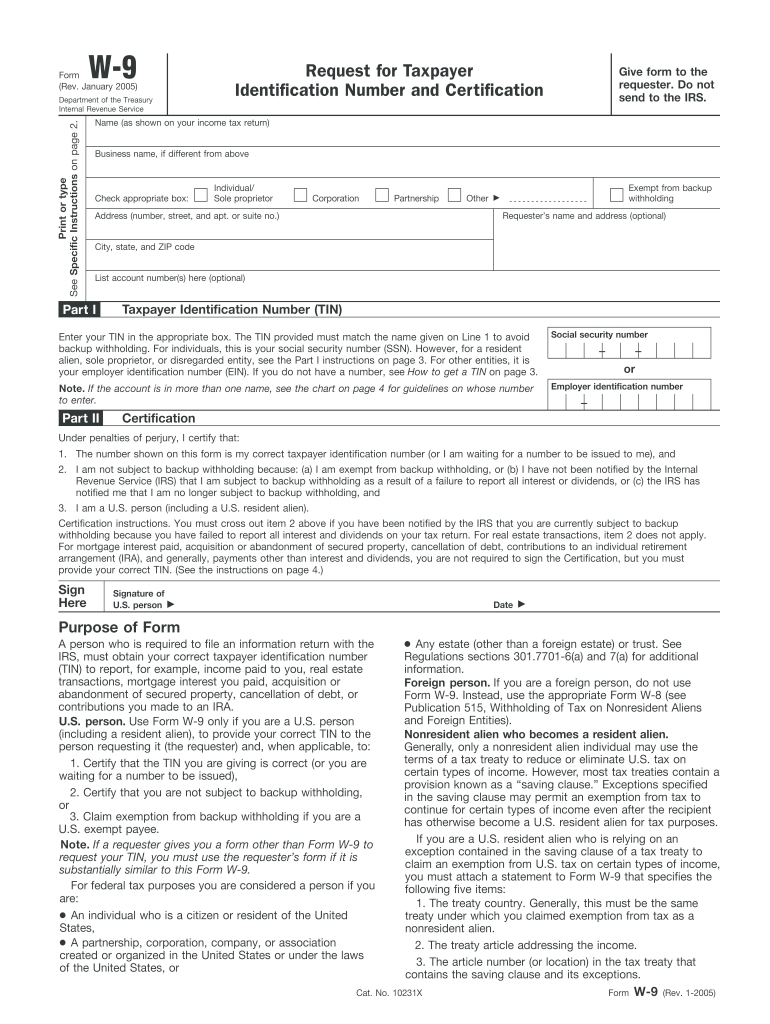

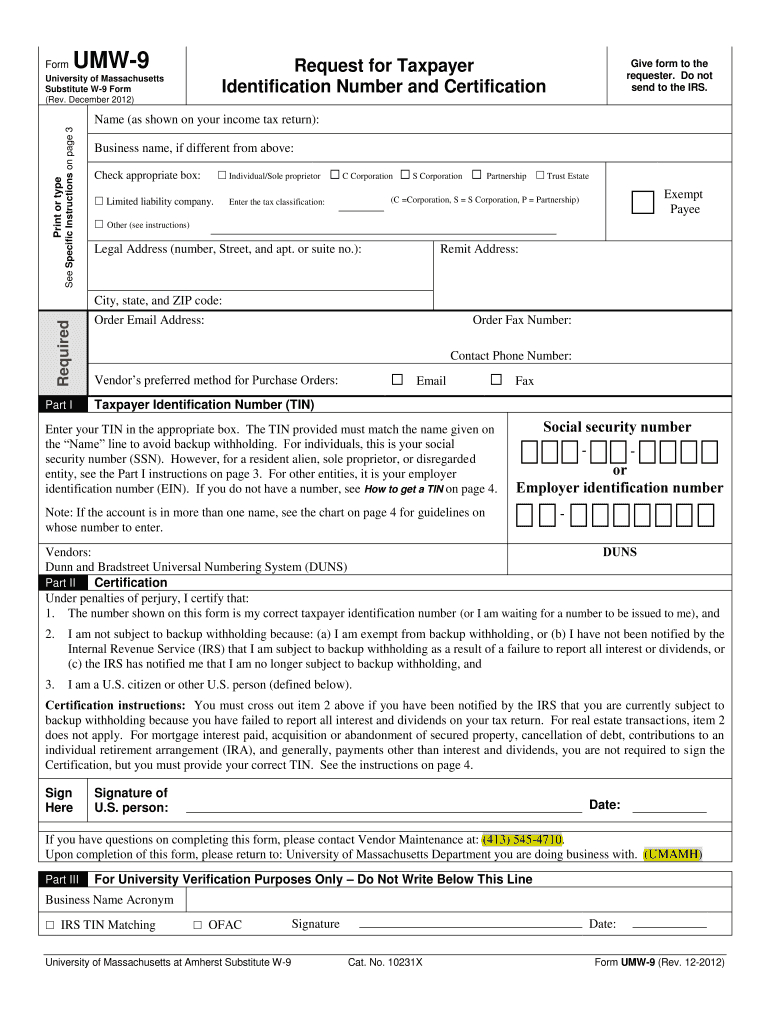

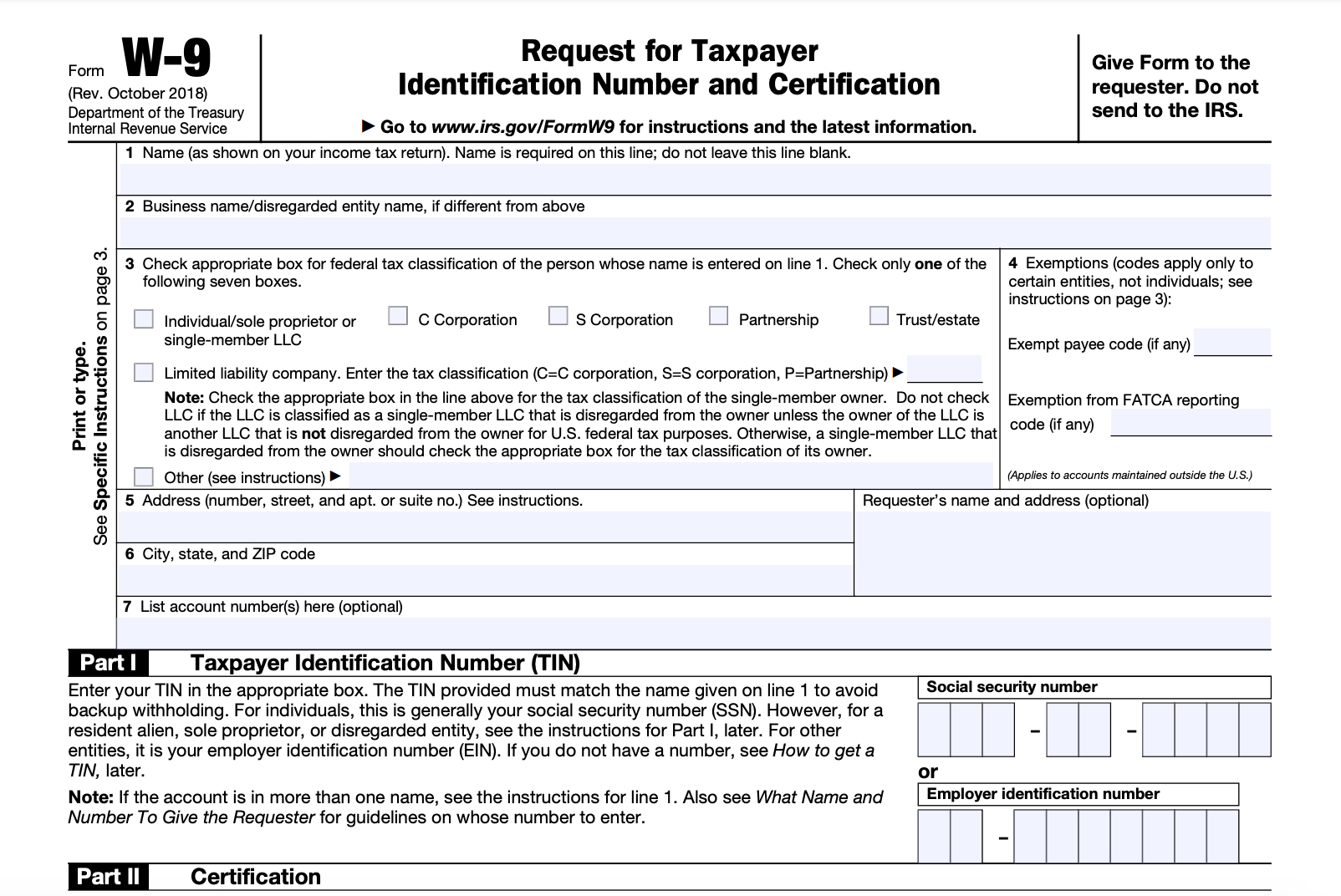

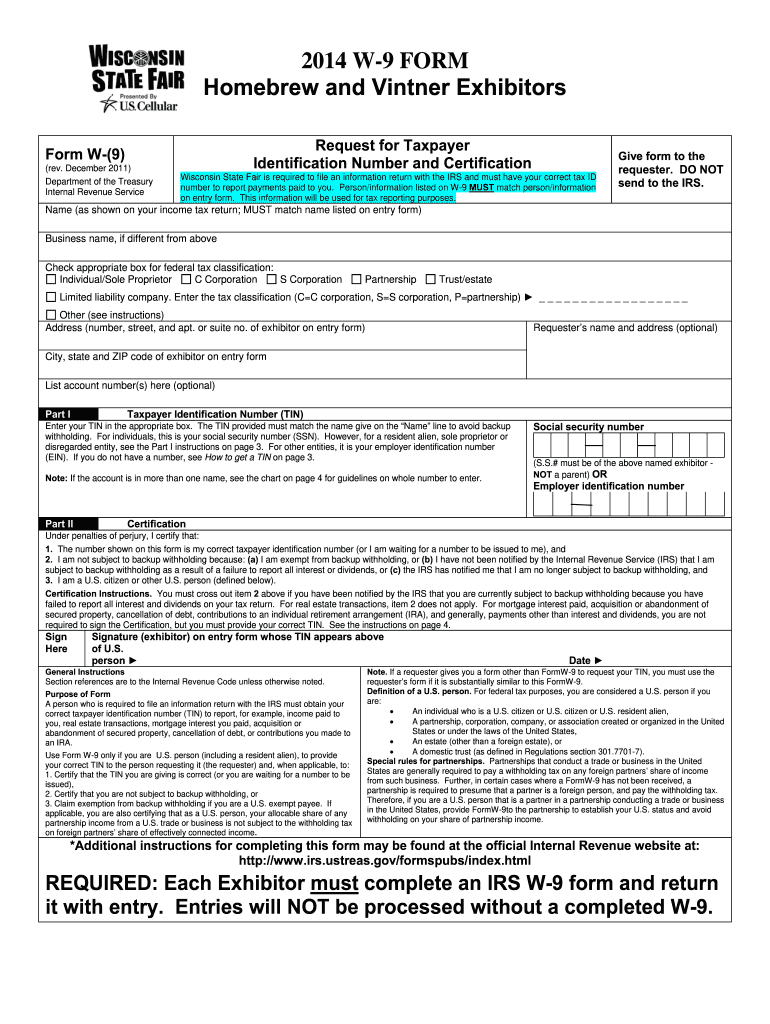

W9 Forms 2021 Printable Free Calendar Printable Free

Verifying the information on this form and. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. Ad access irs tax forms. Web july 7, 2022 by printw9. Web the primary purpose of the w 9 form 2022 printable is to.

Blank W 9 Form 2021 Fillable Printable Calendar Template Printable

Web july 7, 2022 by printw9. A single ticket won in california. What are the top 10 largest mega millions jackpots ever? Verifying the information on this form and. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example:

W9 Form 2021 Printable Pdf

The irs has issued new regulations governing how we report payments and calculate withholding. Web july 7, 2022 by printw9. Verifying the information on this form and. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: A single.

2021 W9 Form Blank Calendar Template Printable

The irs has issued new regulations governing how we report payments and calculate withholding. According to its website , here are. Complete, edit or print tax forms instantly. Web irs form w9 printable 2022 is a certain form that a person uses in order to provide a taxpayer identification number, also known as tin, to an individual who needs to.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W pertaining

©2023 washington university in st. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: What are the top 10 largest mega millions jackpots ever? Verifying the information on this form and. Web the primary purpose of the w.

General w9 copy by Katie Price Issuu

Web $2.04 billion, powerball, nov. A single ticket won in california. The irs has issued new regulations governing how we report payments and calculate withholding. Web july 7, 2022 by printw9. According to its website , here are.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

©2023 washington university in st. The irs has issued new regulations governing how we report payments and calculate withholding. Ad access irs tax forms. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Verifying the information on this.

Blank W9 Form Fill Online, Printable, Fillable, Blank with regard to

©2023 washington university in st. Complete, edit or print tax forms instantly. The irs has issued new regulations governing how we report payments and calculate withholding. Web july 7, 2022 by printw9. Web this form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to.

2021 W9 TaxFree Printable Form Calendar Template Printable

A single ticket won in california. Web july 7, 2022 by printw9. Ad access irs tax forms. Web $2.04 billion, powerball, nov. Complete, edit or print tax forms instantly.

Order Blank W9 Forms Calendar Template Printable

The irs has issued new regulations governing how we report payments and calculate withholding. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. Web irs form w9 printable 2022 is a certain form that a person uses in order to.

Web July 7, 2022 By Printw9.

©2023 washington university in st. Verifying the information on this form and. Web july 7, 2022 by printw9. Ad access irs tax forms.

Web The Primary Purpose Of The W 9 Form 2022 Printable Is To Provide An Employer With Such Crucial Information About The Individual Contractor As Name, Address, And Tin.

The irs has issued new regulations governing how we report payments and calculate withholding. According to its website , here are. What are the top 10 largest mega millions jackpots ever? A single ticket won in california.

Web Irs Form W9 Printable 2022 Is A Certain Form That A Person Uses In Order To Provide A Taxpayer Identification Number, Also Known As Tin, To An Individual Who Needs To File A.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. Web $2.04 billion, powerball, nov. Complete, edit or print tax forms instantly.