Wage Garnishment Hardship Form

Wage Garnishment Hardship Form - There are four direct ways you can take action to stop a wage garnishment: Web what if a levy on my wages, bank, or other account is causing a hardship? Web contains legal forms that deal with garnishment including discharge, debt and more in all 50 states. Take control of your legal actions. A garnishment modification does not change the total amount you owe, rather, it changes. How to claim exemptions from garnishment and lien. Create a legal form in minutes. At a minimum, your written objection to the garnishment should include the following information: Ad developed by legal professionals. I am the sole provider for a family of 4 and i make 21,000 a year.

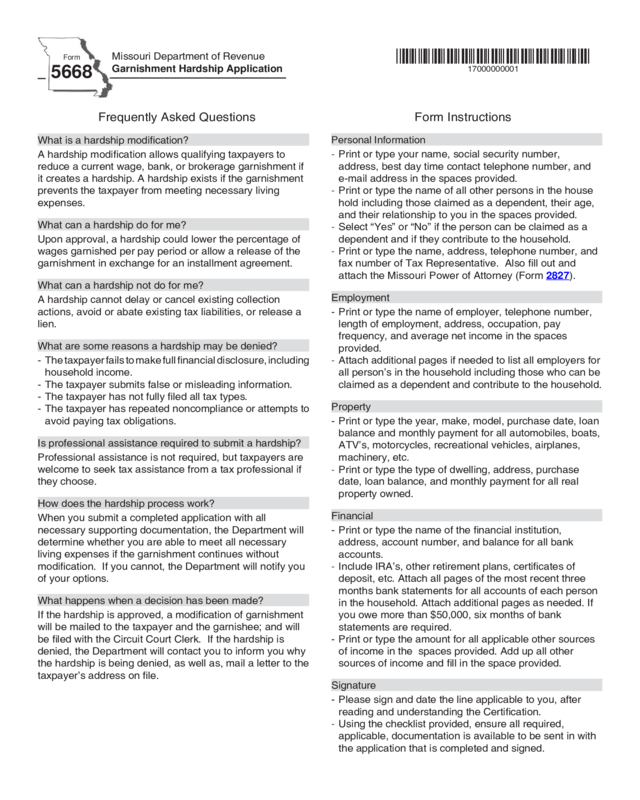

Web a hardship modification allows qualifying taxpayers to reduce a current wage, bank, or brokerage garnishment if. Web in kansas, the most a creditor can garnish from your wages is either 25% of your disposable earnings per workweek or the amount of your disposable earnings per. Application for writ of continuing garnishment. Web in a nutshell. What can a hardship do for me? Application for writ of execution. Under federal law, a federal agency may, without first obtaining a court order, order an employer to withhold. Web is there a hardship form that can stop a wage garnishment?? Web up to 25% cash back contents of the written objection. Ad developed by legal professionals.

Wage garnishment is a legal. Web in kansas, the most a creditor can garnish from your wages is either 25% of your disposable earnings per workweek or the amount of your disposable earnings per. Web the edd issues an earnings withholding order to your employer on debts with a summary judgment. To request an accommodation review, submit the following. Web up to 25% cash back contents of the written objection. Web what is administrative wage garnishment (awg)? Application for writ of continuing garnishment. A person or institution that owes a sum of money. Your employer may withhold up to 25 percent of your wages to submit to the. Web contains legal forms that deal with garnishment including discharge, debt and more in all 50 states.

What To Do If The IRS Wage Garnishment Is Causing Hardship

Web the wage garnishment provisions of the consumer credit protection act (ccpa) protect employees from discharge by their employers because their wages have been garnished. Create a legal form in minutes. Get access to the largest online library of legal forms for any state. Application for writ of continuing garnishment. Web if you can’t afford the garnishment you may qualify.

Stop Wage Garnishments from the California Franchise Tax Board

The case number and case. Web the edd issues an earnings withholding order to your employer on debts with a summary judgment. Web is there a hardship form that can stop a wage garnishment?? I am the sole provider for a family of 4 and i make 21,000 a year. At a minimum, your written objection to the garnishment should.

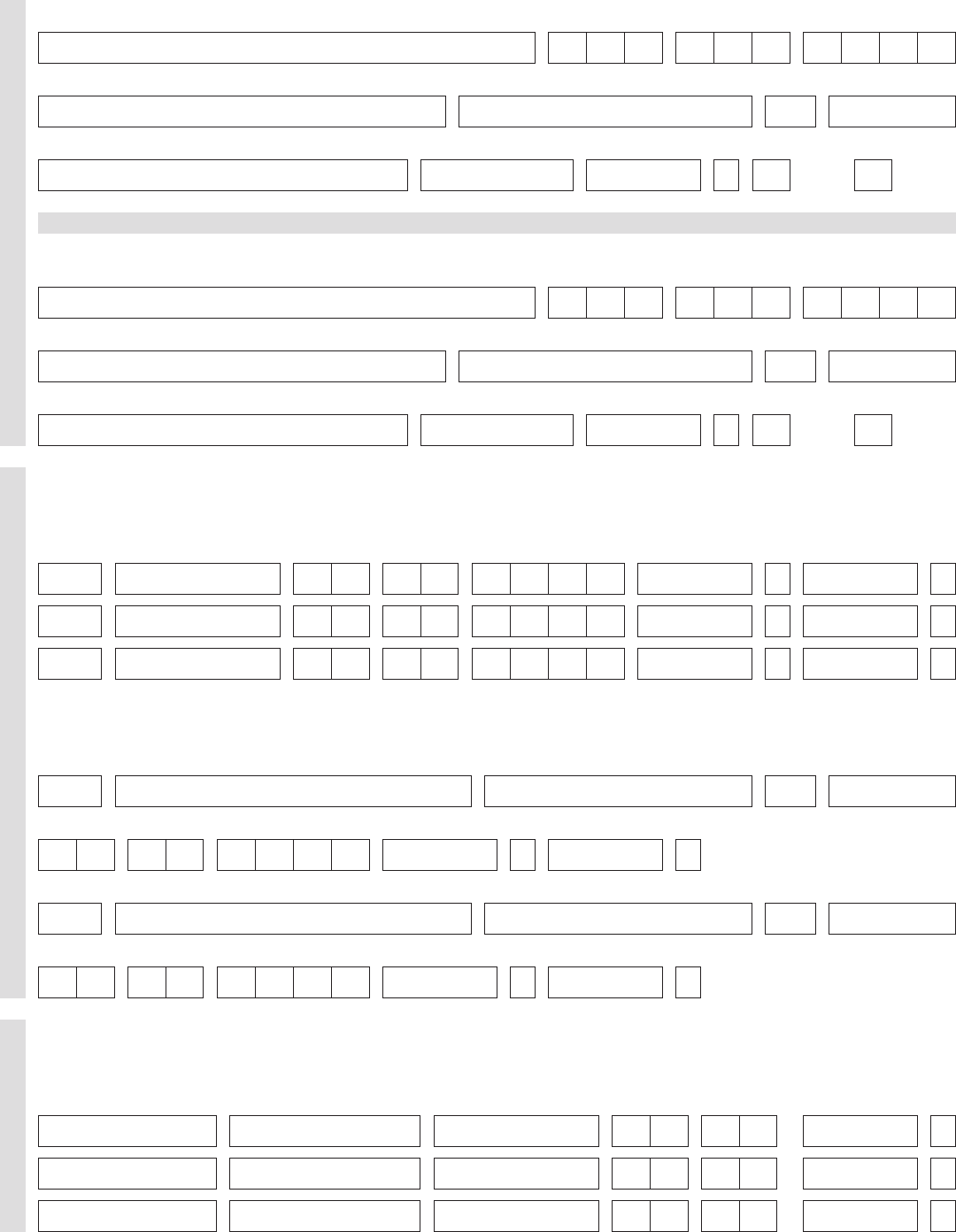

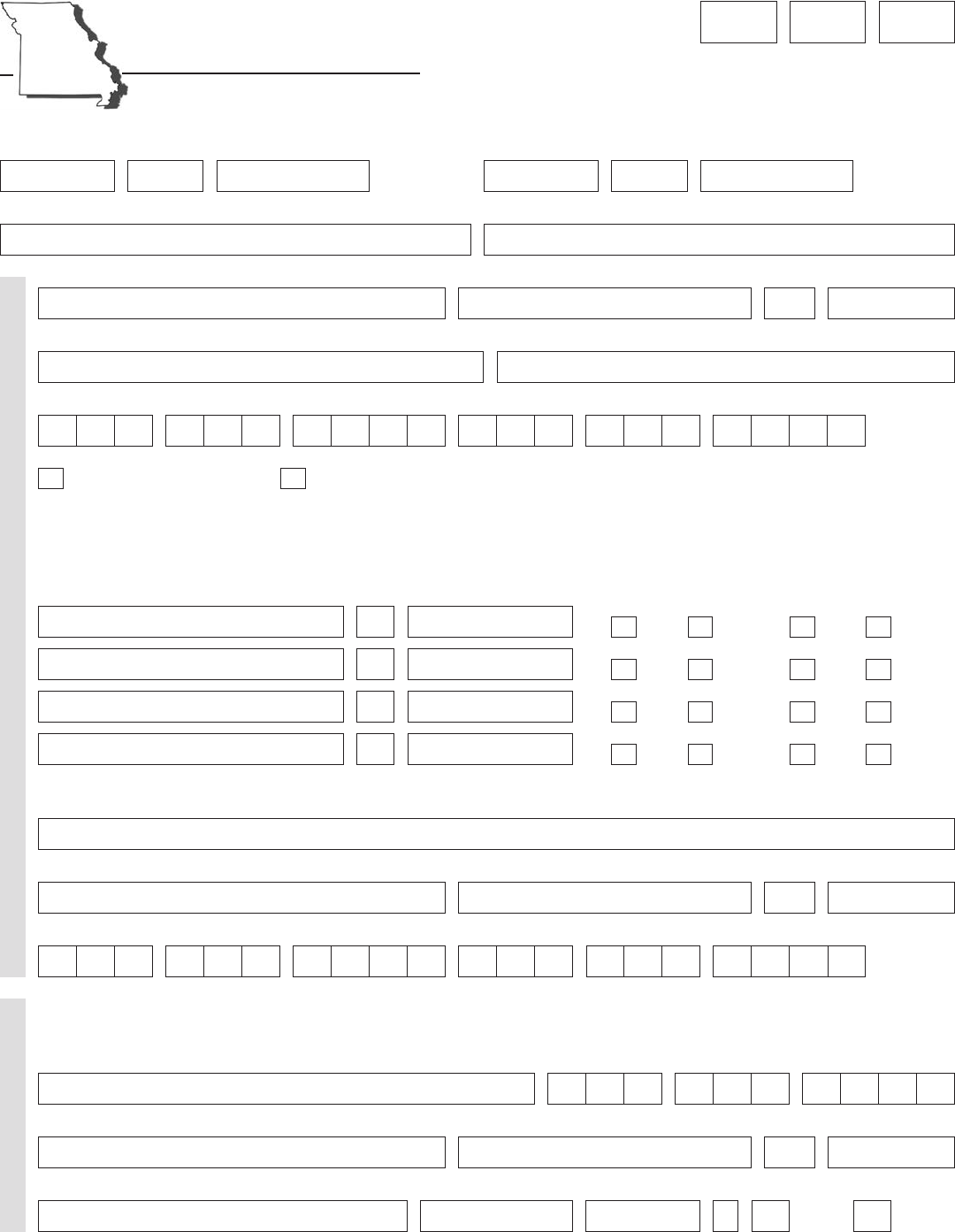

Form 5668 Garnishment Hardship Application Edit, Fill, Sign Online

Create a legal form in minutes. Try to negotiate a payment plan with your creditor (s) or settle your. We offer thousands of garnishment forms. Contact the irs at the telephone number on the levy or correspondence immediately. Web in a nutshell.

What To Do If The IRS Wage Garnishment Is Causing Hardship

I previously paid on a garnishment. Ad developed by legal professionals. Web in a nutshell. Create a legal form in minutes. Under federal law, a federal agency may, without first obtaining a court order, order an employer to withhold.

Writing A Hardship Letter Wage Garnishment Sample Hardship Letter

Web is there a hardship form that can stop a wage garnishment?? Try to negotiate a payment plan with your creditor (s) or settle your. Web contains legal forms that deal with garnishment including discharge, debt and more in all 50 states. Web if you can’t afford the garnishment you may qualify for garnishment modification. Take control of your legal.

Form 5668 Garnishment Hardship Application Edit, Fill, Sign Online

Application for writ of garnishment. Web click for administrative wage garnishment information for employers or for federal agencies.) you may request a hearing if you believe that you do not owe the. Take control of your legal actions. Trusted by millions of users like you. Web what is administrative wage garnishment (awg)?

Form 5668 Garnishment Hardship Application Edit, Fill, Sign Online

What can a hardship do for me? Web contains legal forms that deal with garnishment including discharge, debt and more in all 50 states. A person or institution that owes a sum of money. Some of the forms offered are listed by area below. Try to negotiate a payment plan with your creditor (s) or settle your.

Request For Wage Garnishment Form Fill Online, Printable, Fillable

To request an accommodation review, submit the following. Try to negotiate a payment plan with your creditor (s) or settle your. What can a hardship do for me? Web make a claim of exemption for wage garnishment. A garnishment modification does not change the total amount you owe, rather, it changes.

Form To Stop Wage Garnishment Form Resume Examples jP8JpxJKVd

Your employer may withhold up to 25 percent of your wages to submit to the. Web a ewot is a wage garnishment of employees who owe a state tax liability or a debt. We offer thousands of garnishment forms. Trusted by millions of users like you. Web the wage garnishment provisions of the consumer credit protection act (ccpa) protect employees.

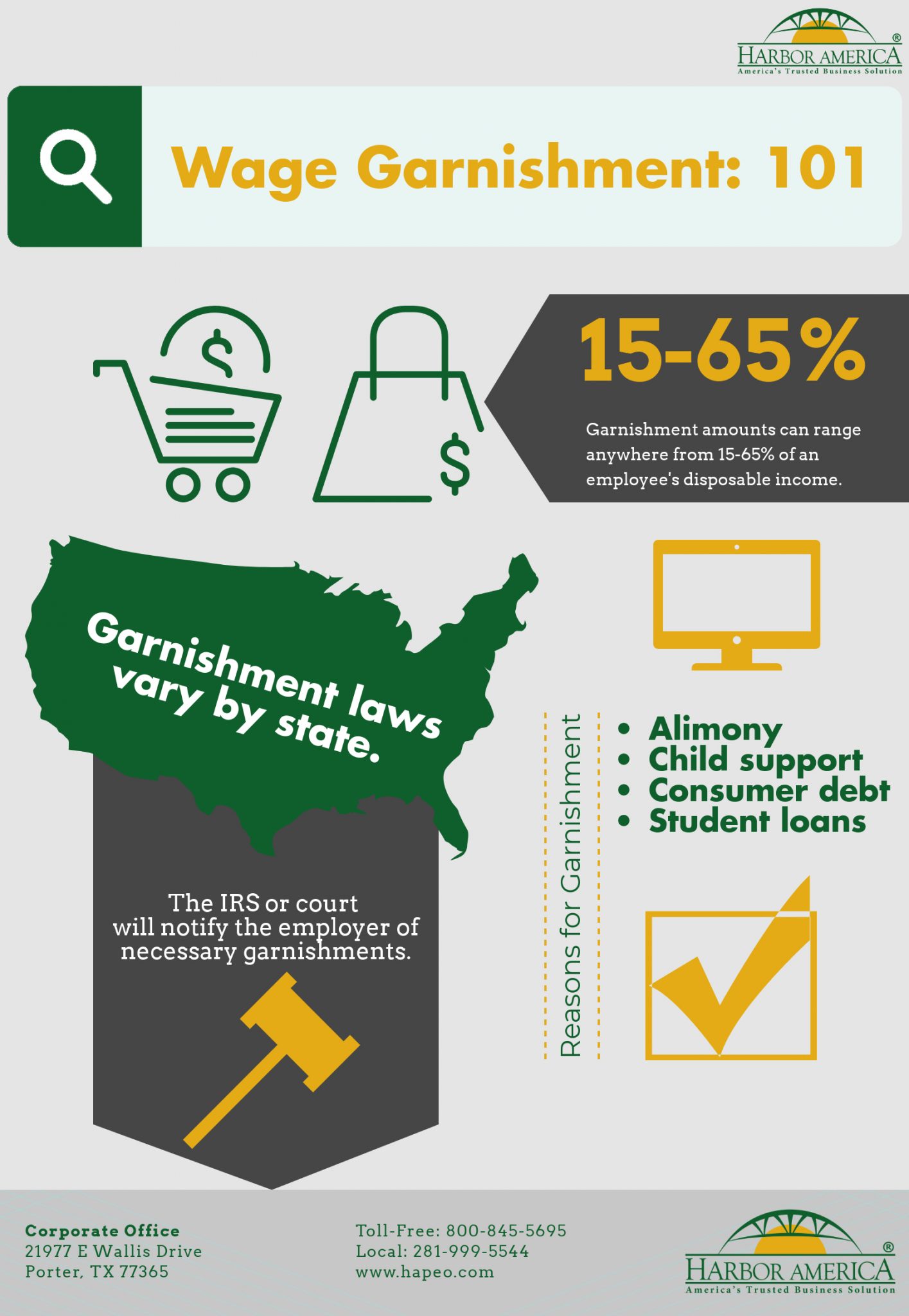

Wage Garnishment 101

Application for writ of continuing garnishment. Application for writ of garnishment. Under federal law, a federal agency may, without first obtaining a court order, order an employer to withhold. Ad developed by legal professionals. There are four direct ways you can take action to stop a wage garnishment:

There Are Four Direct Ways You Can Take Action To Stop A Wage Garnishment:

To request an accommodation review, submit the following. Web if your wage garnishment causes you financial hardship, you may request a reasonable accommodation. Create a legal form in minutes. Contact the irs at the telephone number on the levy or correspondence immediately.

Web What If A Levy On My Wages, Bank, Or Other Account Is Causing A Hardship?

Web a hardship modification allows qualifying taxpayers to reduce a current wage, bank, or brokerage garnishment if. Get access to the largest online library of legal forms for any state. Ad developed by legal professionals. Web contains legal forms that deal with garnishment including discharge, debt and more in all 50 states.

Web In Kansas, The Most A Creditor Can Garnish From Your Wages Is Either 25% Of Your Disposable Earnings Per Workweek Or The Amount Of Your Disposable Earnings Per.

Web the edd issues an earnings withholding order to your employer on debts with a summary judgment. Web make a claim of exemption for wage garnishment. I am the sole provider for a family of 4 and i make 21,000 a year. How to claim exemptions from garnishment and lien.

Some Of The Forms Offered Are Listed By Area Below.

Web if you can’t afford the garnishment you may qualify for garnishment modification. I previously paid on a garnishment. At a minimum, your written objection to the garnishment should include the following information: Wage garnishment is a legal.