Weak Form Efficiency

Weak Form Efficiency - Web what is weak form market efficiency? It also holds that stock price movements. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. Web weak form efficiency, also known as the random walk theory, states that future securities' prices are random and not influenced by past events. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. They make rational investment decisions by correct calculation of the net present values of the cash flows one will earn in the future from the stock or security. In a weak form efficient market, asset prices already account for all available information, and no active trading strategy can earn excess returns from forecasting future price movements. Advocates of weak form efficiency believe all. Thus, past prices cannot predict future prices.

Web advocates for the weak form efficiency theory believe that if the fundamental analysis is used, undervalued and overvalued stocks can be determined, and investors can research companies'. Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. Thus, past prices cannot predict future prices. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web what is weak form market efficiency? Web weak form efficiency. Advocates of weak form efficiency believe all. Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. In other words, linear models and technical analyses may be clueless for predicting future returns. In a weak form efficient market, asset prices already account for all available information, and no active trading strategy can earn excess returns from forecasting future price movements.

In a weak form efficient market, asset prices already account for all available information, and no active trading strategy can earn excess returns from forecasting future price movements. It also holds that stock price movements. Web weak form efficiency. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. They make rational investment decisions by correct calculation of the net present values of the cash flows one will earn in the future from the stock or security. Thus, past prices cannot predict future prices. Web advocates for the weak form efficiency theory believe that if the fundamental analysis is used, undervalued and overvalued stocks can be determined, and investors can research companies'. In other words, linear models and technical analyses may be clueless for predicting future returns. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis.

(PDF) A Test of Weak Form Efficiency for the Botswana Stock Exchange

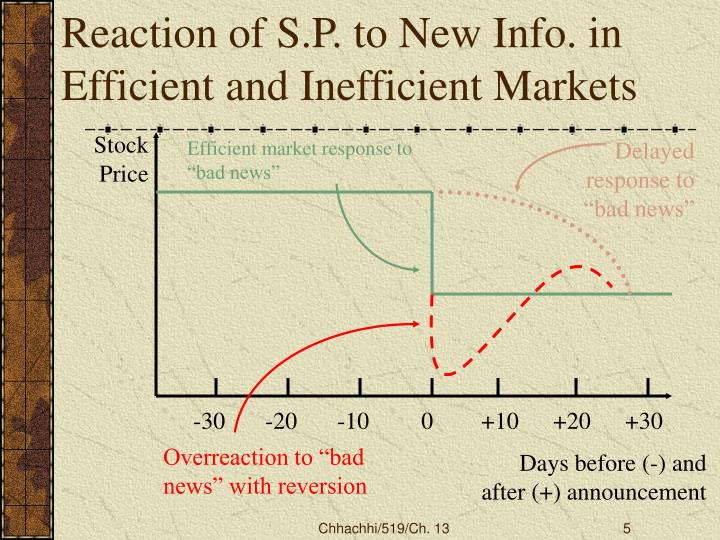

This hypothesis suggests that price changes in securities are independent and identically distributed. It also holds that stock price movements. Web what is weak form market efficiency? The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web weak form efficiency.

PPT CHAPTER ONE PowerPoint Presentation, free download ID1960979

This hypothesis suggests that price changes in securities are independent and identically distributed. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. Web the weak form efficiency is one of.

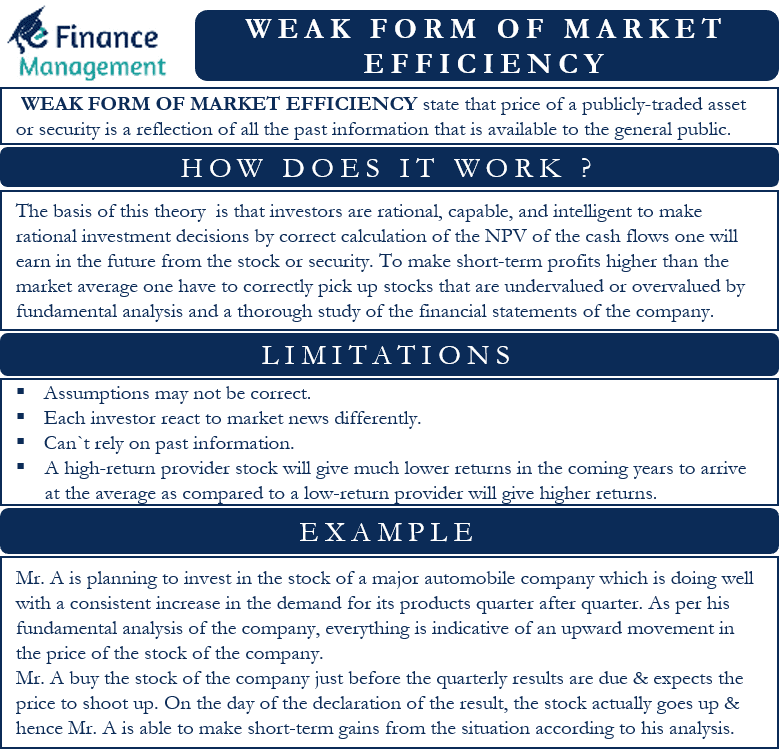

Weak Form of Market Efficiency Meaning, Usage, Limitations

Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web weak form efficiency. Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. In other words, linear models and technical analyses may be clueless.

(PDF) Testing weak form efficiency in the South African market

Thus, past prices cannot predict future prices. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. This hypothesis suggests that price changes in securities are independent and identically distributed. Advocates of weak form efficiency believe all. Web the basis of the theory of a weak.

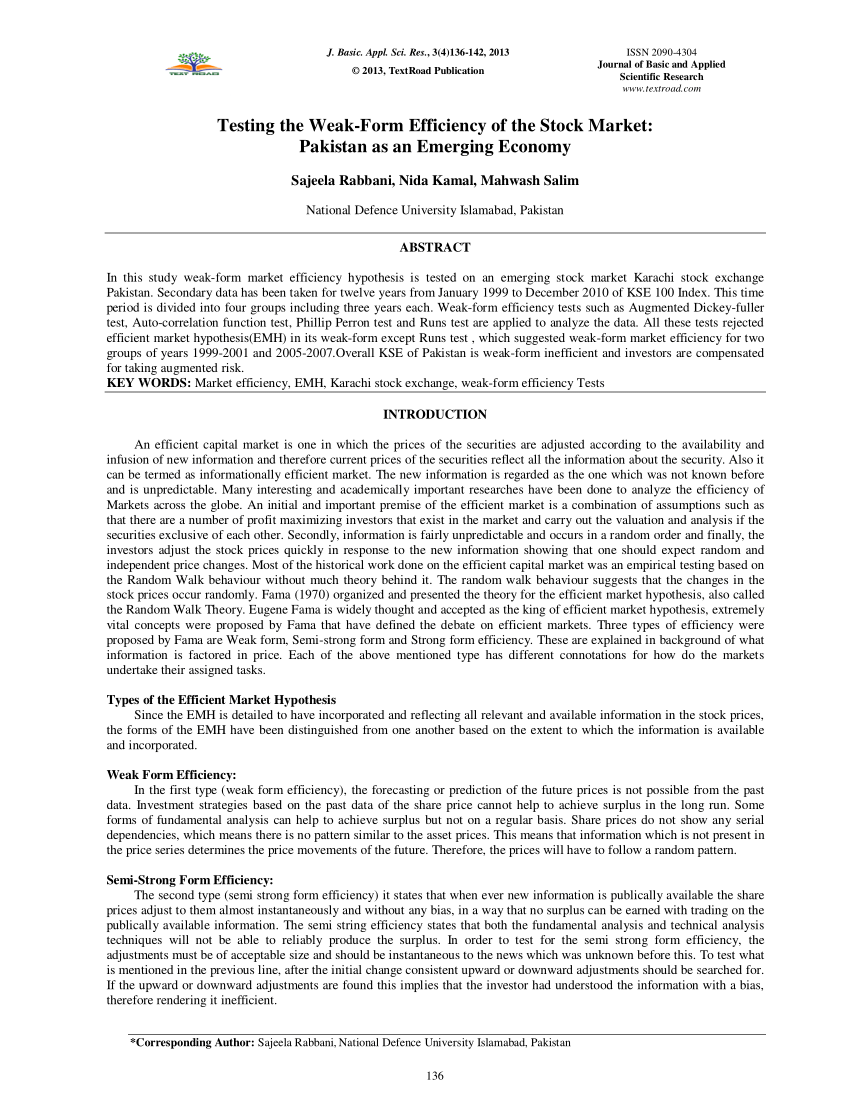

(PDF) Testing the WeakForm Efficiency of the Stock Market Pakistan as

Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web what is weak form market efficiency? Advocates of weak form efficiency believe all..

(PDF) WeakForm Efficiency of Foreign Exchange Market in the

In a weak form efficient market, asset prices already account for all available information, and no active trading strategy can earn excess returns from forecasting future price movements. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web what is weak form market efficiency? It also holds that.

Weak form efficiency indian stock markets and with it work at home

Thus, past prices cannot predict future prices. Web weak form efficiency, also known as the random walk theory, states that future securities' prices are random and not influenced by past events. This hypothesis suggests that price changes in securities are independent and identically distributed. In other words, linear models and technical analyses may be clueless for predicting future returns. Web.

(PDF) Testing the weakform efficiency in African stock markets

Web weak form efficiency. Thus, past prices cannot predict future prices. Web the weak form efficiency theory, as established by economist eugene fama in the 1960s, is built on the premise of the random walk hypothesis. In a weak form efficient market, asset prices already account for all available information, and no active trading strategy can earn excess returns from.

Weak Form Efficiency Tests by Bj??rn Schubert (English) Paperback Book

Web what is weak form market efficiency? Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Web the weak form efficiency theory, as established.

(PDF) The Weakform Efficiency of Chinese Stock Markets Thin Trading

Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. This hypothesis suggests that price changes in securities are independent and identically distributed. Web the weak form efficiency.

Web The Weak Form Efficiency Theory, As Established By Economist Eugene Fama In The 1960S, Is Built On The Premise Of The Random Walk Hypothesis.

They make rational investment decisions by correct calculation of the net present values of the cash flows one will earn in the future from the stock or security. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web what is weak form market efficiency? Web the weak form efficiency is one of the three types of the efficient market hypothesis (emh) as defined by eugene fama in 1970.

Web Weak Form Efficiency, Also Known As The Random Walk Theory, States That Future Securities' Prices Are Random And Not Influenced By Past Events.

Web advocates for the weak form efficiency theory believe that if the fundamental analysis is used, undervalued and overvalued stocks can be determined, and investors can research companies'. Web weak form efficiency. It also holds that stock price movements. Weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis.

In Other Words, Linear Models And Technical Analyses May Be Clueless For Predicting Future Returns.

This hypothesis suggests that price changes in securities are independent and identically distributed. Advocates of weak form efficiency believe all. Web the basis of the theory of a weak form of market efficiency is that investors are rational, capable, and intelligent. Thus, past prices cannot predict future prices.