What 1099 Form Do I Use For Lawyers

What 1099 Form Do I Use For Lawyers - Ad success starts with the right supplies. Web since 1997, most payments to lawyers must be reported on a form 1099. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Do payments to law firms require 1099? Web from understanding tax deductions to filing quarterly taxes to understanding the new 1099 rules, attorneys should incorporate these tax rules into their overall. This form is used to report all non employee. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Employment authorization document issued by the department of homeland. The law provides various dollar amounts under which no form 1099 reporting requirement is imposed. The form reports the interest income you.

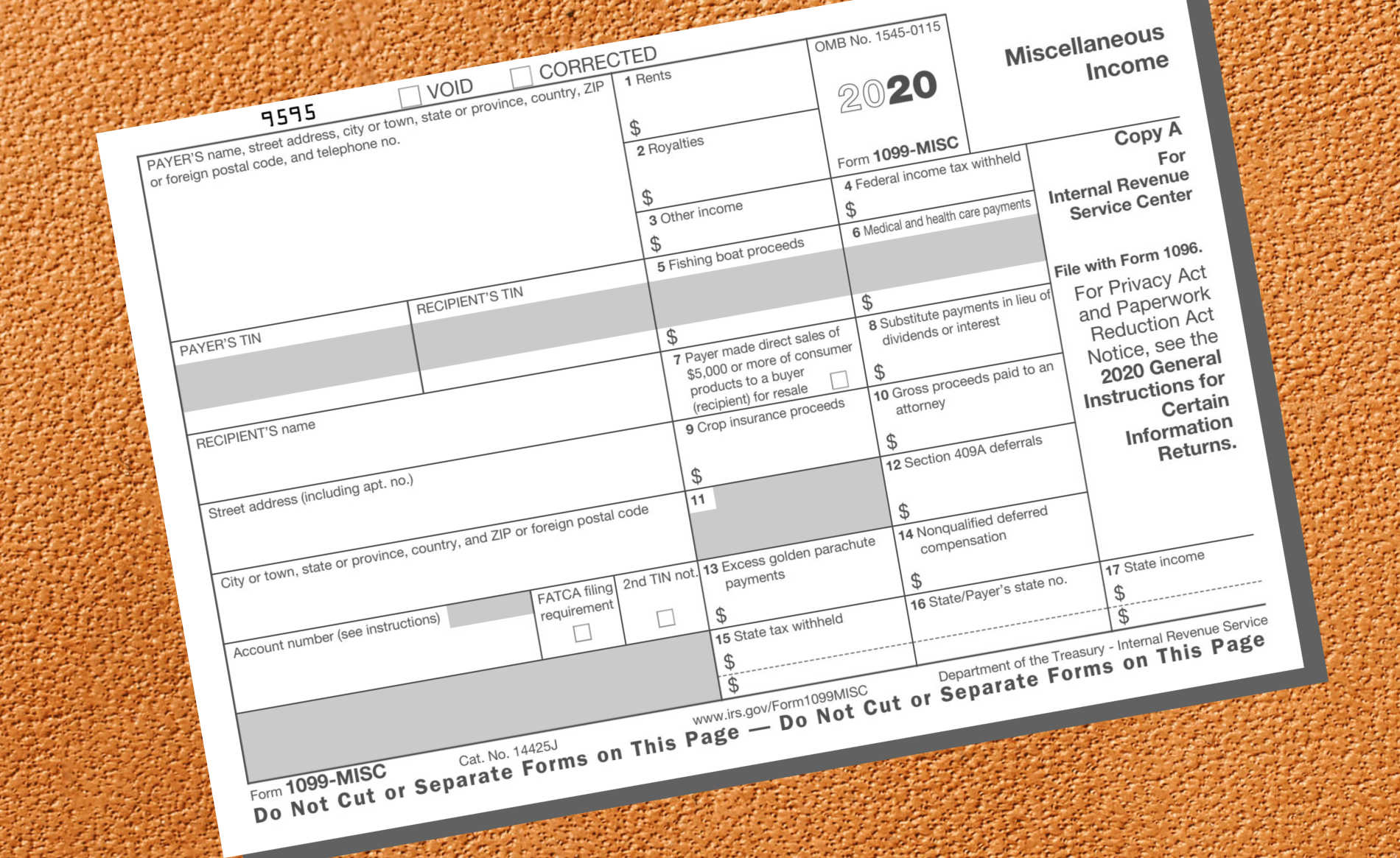

Ad find deals on 1099 tax forms on amazon. Web since 1997, most payments to lawyers must be reported on a form 1099. Web form 1099 is one of several irs tax forms. The payer fills out the 1099 form and sends copies to you and. The law provides various dollar amounts under which no form 1099 reporting requirement is imposed. This form is used to report all non employee. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Browse & discover thousands of brands. If you paid someone who is not your employee, such as a. Thus, any payment for services of $600 or more to a lawyer or law firm must be the subject of a form 1099.

Ad find deals on 1099 tax forms on amazon. Find them all in one convenient place. The payer fills out the 1099 form and sends copies to you and. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Web during the past tax year. Web since 1997, most payments to lawyers must be reported on a form 1099. Simply answer a few question to instantly download, print & share your form. Do payments to law firms require 1099? 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to. If you paid someone who is not your employee, such as a.

Free Printable 1099 Misc Forms Free Printable

Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Thus, any payment for services of $600 or more to a lawyer or law firm must be the subject of a form 1099. Web form 1099 is.

Florida 1099 Form Online Universal Network

Web since 1997, most payments to lawyers must be reported on a form 1099. Find them all in one convenient place. This form is used to report all non employee. The payer fills out the 1099 form and sends copies to you and. Thus, any payment for services of $600 or more to a lawyer or law firm must be.

6 mustknow basics form 1099MISC for independent contractors Bonsai

Employment authorization document issued by the department of homeland. This form is used to report all non employee. The law provides various dollar amounts under which no form 1099 reporting requirement is imposed. Web form 1099 is one of several irs tax forms. Ad success starts with the right supplies.

DoItYourself 1099s, Done Right Moxie Bookkeeping and Coaching Inc.

Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Web during the past tax year. Ad success starts with the right supplies. Web form 1099 is one of several irs tax forms. Web from understanding tax.

Form 1099MISC Requirements, Deadlines, and Penalties eFile360

The payer fills out the 1099 form and sends copies to you and. Ad success starts with the right supplies. If you paid someone who is not your employee, such as a. Web from understanding tax deductions to filing quarterly taxes to understanding the new 1099 rules, attorneys should incorporate these tax rules into their overall. Web during the past.

Which 1099 Form Do I Use for Rent

The form reports the interest income you. Find them all in one convenient place. Web since 1997, most payments to lawyers must be reported on a form 1099. Read customer reviews & find best sellers 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

For some variants of form. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Employment authorization document issued by the department of homeland. The payer fills out the 1099 form.

How To File Form 1099NEC For Contractors You Employ VacationLord

This form is used to report all non employee. Web from understanding tax deductions to filing quarterly taxes to understanding the new 1099 rules, attorneys should incorporate these tax rules into their overall. Find them all in one convenient place. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. From the.

1099 Int Form Bank Of America Universal Network

Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. If you paid someone who is not your employee, such as a. From the latest tech to workspace faves, find just what you need at office depot®! Web issue 131 this article explains why attorneys might receive a form.

Irs Printable 1099 Form Printable Form 2022

Web since 1997, most payments to lawyers must be reported on a form 1099. Web form 1099 is one of several irs tax forms. Thus, any payment for services of $600 or more to a lawyer or law firm must be the subject of a form 1099. Simply answer a few question to instantly download, print & share your form..

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Web form 1099 is one of several irs tax forms. For some variants of form. Read customer reviews & find best sellers Thus, any payment for services of $600 or more to a lawyer or law firm must be the subject of a form 1099.

Web A Simple Rule Of Thumb For Payments Made To Lawyers Is That (I) If The Payment Is For Legal Services Rendered To You In Connection With Your Trade Or Business, File Irs.

The law provides various dollar amounts under which no form 1099 reporting requirement is imposed. Web during the past tax year. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to. The payer fills out the 1099 form and sends copies to you and.

This Form Is Used To Report All Non Employee.

The form reports the interest income you. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Simply answer a few question to instantly download, print & share your form. Web since 1997, most payments to lawyers must be reported on a form 1099.

Ad Success Starts With The Right Supplies.

From the latest tech to workspace faves, find just what you need at office depot®! Web from understanding tax deductions to filing quarterly taxes to understanding the new 1099 rules, attorneys should incorporate these tax rules into their overall. Web issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.” what is a. Ad find deals on 1099 tax forms on amazon.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)