What Is A Form Ss-8

What Is A Form Ss-8 - It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or as an independent contractor. Complete, edit or print tax forms instantly. The questionnaire has vague and complicated questions which companies simply don’t know how to answer. Either party can start the inquiry. This form will provide information about the worker to aid the irs in determining the correct classification. August social security checks are getting disbursed this week for recipients who've received social security payments since. An appointment is not required, but if you. The business is asked to complete and return it to the irs, which will render a classification decision. Generally, under the common law rules a worker is an employee if the. July 29, 2023 5:00 a.m.

The business is asked to complete and return it to the irs, which will render a classification decision. You can then use our decision to correctly file your federal income tax and employment tax returns. Complete, edit or print tax forms instantly. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or as an independent contractor. August social security checks are getting disbursed this week for recipients who've received social security payments since. Either party can start the inquiry. The questionnaire has vague and complicated questions which companies simply don’t know how to answer. Learn more from the experts at h&r block. An appointment is not required, but if you. July 29, 2023 5:00 a.m.

An appointment is not required, but if you. Complete, edit or print tax forms instantly. July 29, 2023 5:00 a.m. The business is asked to complete and return it to the irs, which will render a classification decision. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or as an independent contractor. Generally, under the common law rules a worker is an employee if the. The questionnaire has vague and complicated questions which companies simply don’t know how to answer. Either party can start the inquiry. This form will provide information about the worker to aid the irs in determining the correct classification. You can then use our decision to correctly file your federal income tax and employment tax returns.

form ss8 Employee or Independent Contractor?

August social security checks are getting disbursed this week for recipients who've received social security payments since. Either party can start the inquiry. Generally, under the common law rules a worker is an employee if the. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or.

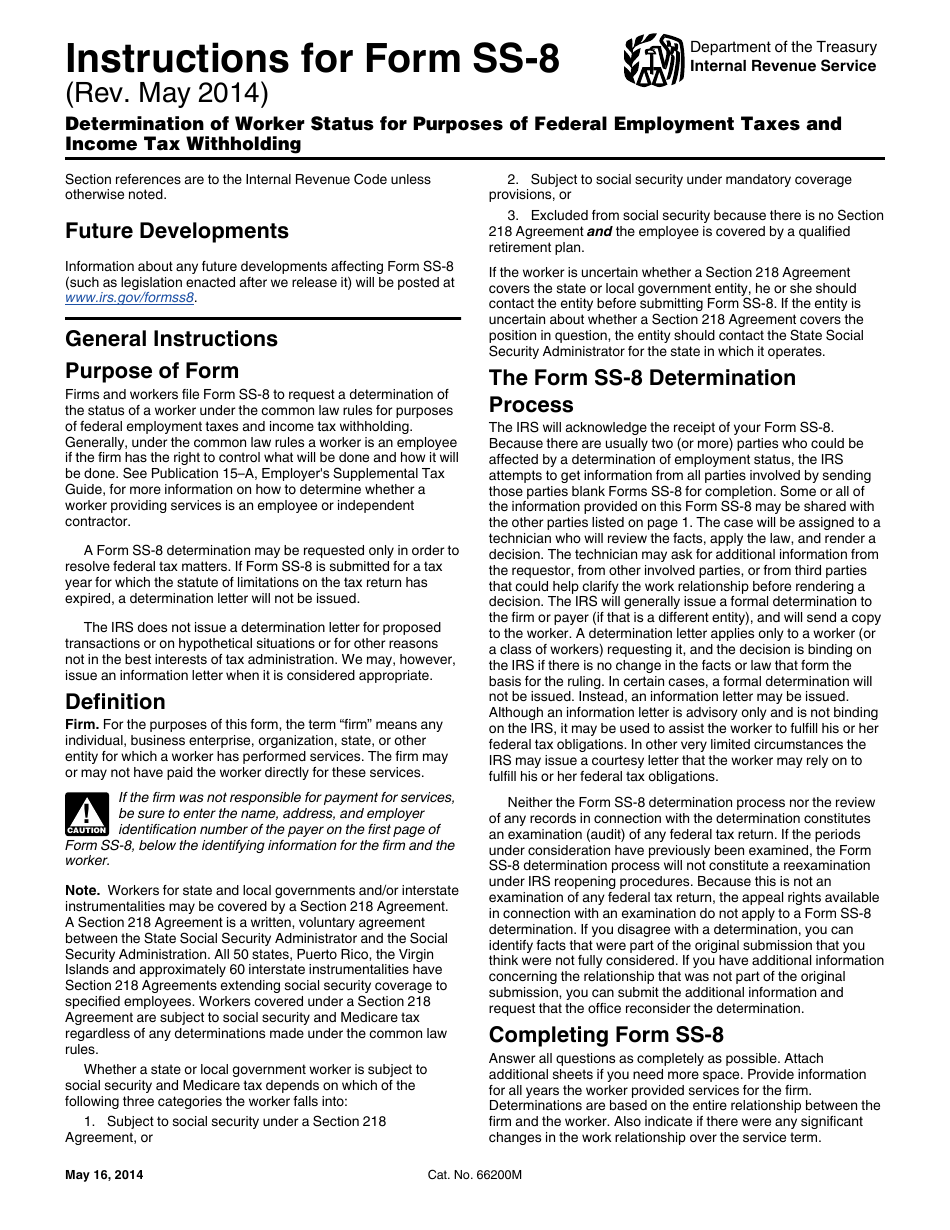

IRS Form SS8 Fill Out With the Best Form Filler

July 29, 2023 5:00 a.m. Generally, under the common law rules a worker is an employee if the. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or as an independent contractor. The questionnaire has vague and complicated questions which companies simply don’t know how to.

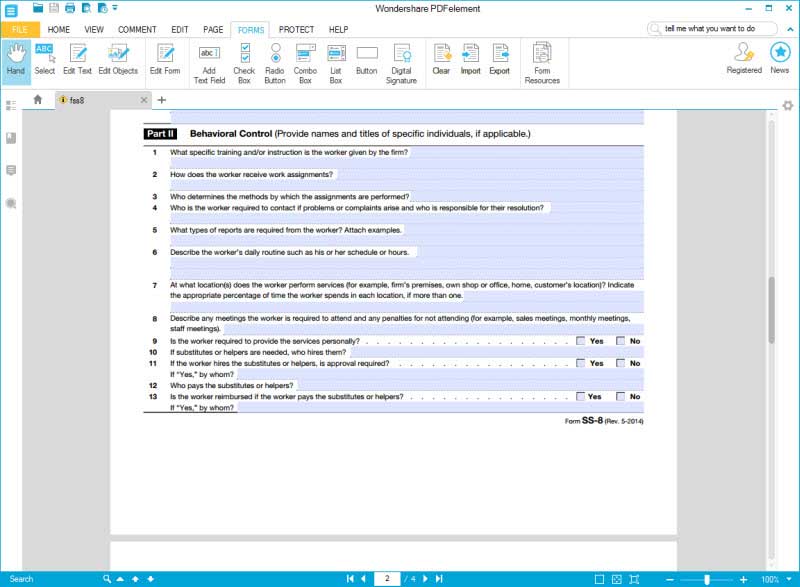

PPT Worker Classification Getting It Right The 1 st Time PowerPoint

The questionnaire has vague and complicated questions which companies simply don’t know how to answer. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or as an independent contractor. July 29, 2023 5:00 a.m. Complete, edit or print tax forms instantly. An appointment is not required,.

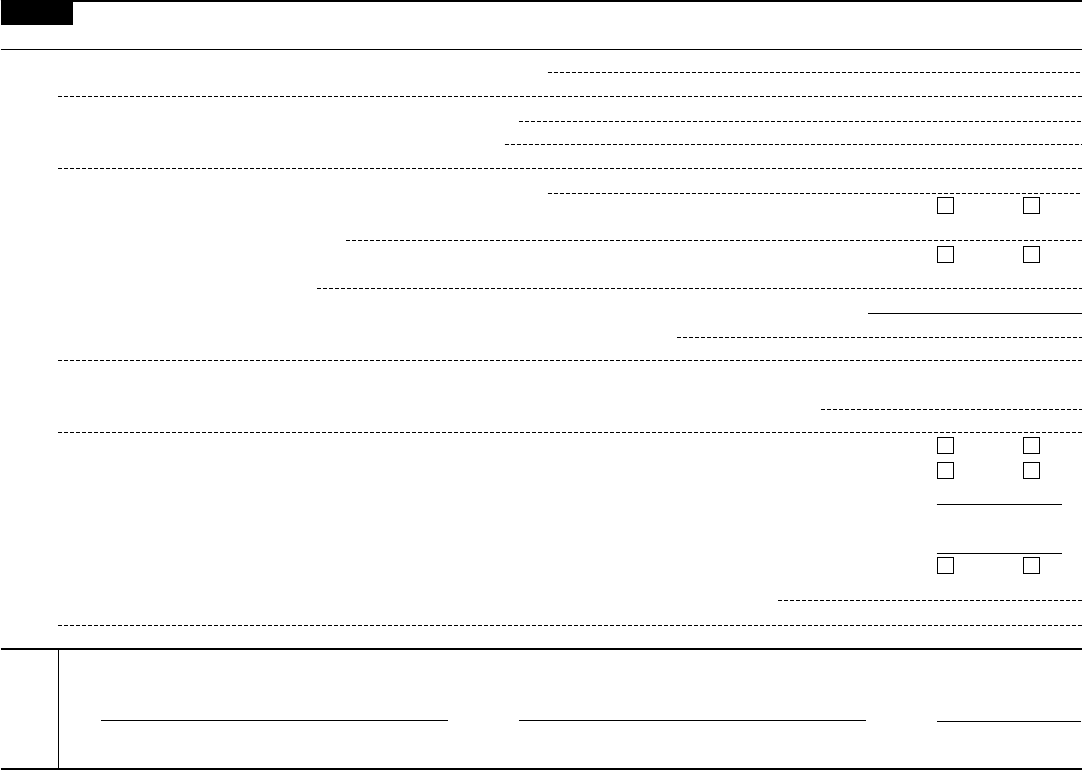

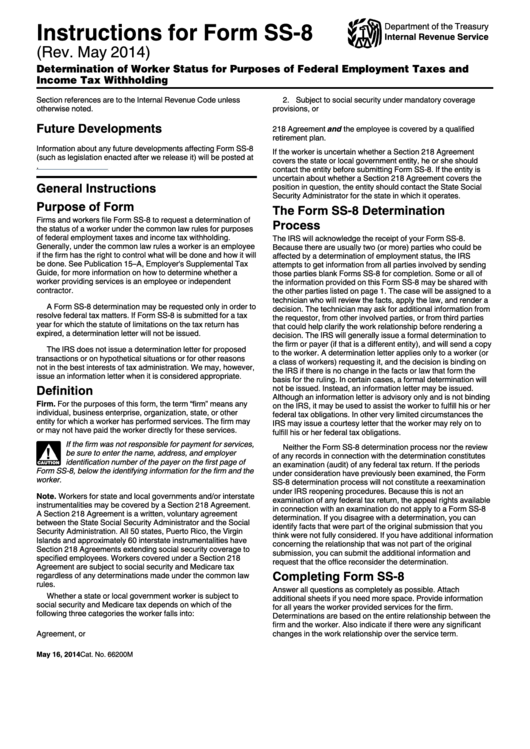

Instructions For Form Ss8 Determination Of Worker Status For

An appointment is not required, but if you. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or as an independent contractor. August social security checks are getting disbursed this week for recipients who've received social security payments since. Generally, under the common law rules a.

IRS Form SS8 What Is It?

Either party can start the inquiry. Learn more from the experts at h&r block. Generally, under the common law rules a worker is an employee if the. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or as an independent contractor. This form will provide information.

20142021 Form IRS SS8 Fill Online, Printable, Fillable, Blank pdfFiller

You can then use our decision to correctly file your federal income tax and employment tax returns. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or as an independent contractor. An appointment is not required, but if you. The business is asked to complete and.

2021 IRS Form SS8 instructions + PDF download

July 29, 2023 5:00 a.m. This form will provide information about the worker to aid the irs in determining the correct classification. The questionnaire has vague and complicated questions which companies simply don’t know how to answer. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee,.

Ss 8 Fillable Form Printable Forms Free Online

Either party can start the inquiry. The questionnaire has vague and complicated questions which companies simply don’t know how to answer. July 29, 2023 5:00 a.m. The business is asked to complete and return it to the irs, which will render a classification decision. Learn more from the experts at h&r block.

Form SS8 Edit, Fill, Sign Online Handypdf

Learn more from the experts at h&r block. It’s used to help determine the status of a current worker for federal employment taxes and income tax withholding as either an employee, or as an independent contractor. July 29, 2023 5:00 a.m. August social security checks are getting disbursed this week for recipients who've received social security payments since. The questionnaire.

Download Instructions for IRS Form SS8 Determination of Worker Status

You can then use our decision to correctly file your federal income tax and employment tax returns. This form will provide information about the worker to aid the irs in determining the correct classification. Either party can start the inquiry. August social security checks are getting disbursed this week for recipients who've received social security payments since. July 29, 2023.

The Business Is Asked To Complete And Return It To The Irs, Which Will Render A Classification Decision.

The questionnaire has vague and complicated questions which companies simply don’t know how to answer. This form will provide information about the worker to aid the irs in determining the correct classification. Either party can start the inquiry. Generally, under the common law rules a worker is an employee if the.

It’s Used To Help Determine The Status Of A Current Worker For Federal Employment Taxes And Income Tax Withholding As Either An Employee, Or As An Independent Contractor.

Complete, edit or print tax forms instantly. July 29, 2023 5:00 a.m. An appointment is not required, but if you. You can then use our decision to correctly file your federal income tax and employment tax returns.

Learn More From The Experts At H&R Block.

August social security checks are getting disbursed this week for recipients who've received social security payments since.

:max_bytes(150000):strip_icc()/Screenshot76-6bdc4f074be3478d864d3e9960c5ab65.png)