What Is Form 13 In Tds

What Is Form 13 In Tds - Low tds level in drinking water for prolonged use is harmful for the health, because our body needs certain minerals to maintain certain metabolic activities, hence. And the dilemma goes on. Web you can also apply to the assessing officer of the income tax department through form 13 and get a certificate approving deduction of lower taxes or nil deduction. Web what is form 13 for? Web the income tax form 13 is associated with tds, which stands for ‘ tax deducted at source ’. Web what does tds mean?. Tds needs to be deducted at the time of. Web schedule 13d is a form that must be filed with the sec under rule 13d. Web documents needed to file itr; Under the indian income tax laws, people making specific payments are liable.

Web answer (1 of 3): To complete the claim filing process, the member. Web what is form 13 for? The first step of filing itr is to collect all the documents related to the process. Web you can also apply to the assessing officer of the income tax department through form 13 and get a certificate approving deduction of lower taxes or nil deduction. Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. Tds needs to be deducted at the time of. Web one major difference between form 13 and form 15g/15h is form 15g/15h can be issued only by individuals assesses, whereas request in form 13 can. Web form 13 for tds deduction is an income tax for lower deduction of tds as per section 197 of the income tax act, 1961. Web what does tds mean?.

Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. Web tds is tax deducted at source is an advance tax that is deducted from an individual’s income before the amount is actually paid or credited to the receiver’s. Web nri has to claim a refund of tds at the time of filing income tax return form 13. Web an application for nil/ lower deduction of tds is required to be filed in form 13 to the income tax officer, and the tax officer on being satisfied that lower deduction of tds is. According to the income tax (it) act, tds must be deducted at. Web answer (1 of 3): An individual having salary income should collect. Web you can also apply to the assessing officer of the income tax department through form 13 and get a certificate approving deduction of lower taxes or nil deduction. Web schedule 13d is a form that must be filed with the sec under rule 13d. The first step of filing itr is to collect all the documents related to the process.

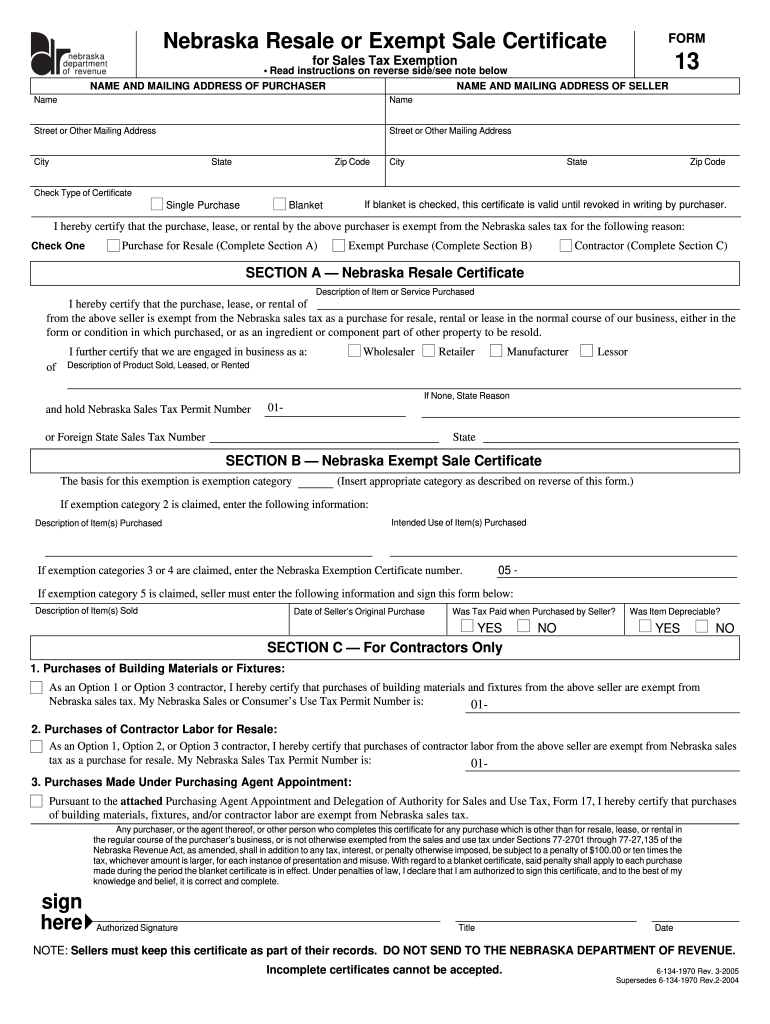

Form 13 Fill Out and Sign Printable PDF Template signNow

An individual having salary income should collect. Tds needs to be deducted at the time of. To complete the claim filing process, the member. Under the indian income tax laws, people making specific payments are liable. Web answer (1 of 3):

What Is Form 13 Form 13 Download Fillable Pdf Or Fill Online

Web what is form 13 for? The form is required when a person or group acquires more than 5% of any class of a. Web an application for nil/ lower deduction of tds is required to be filed in form 13 to the income tax officer, and the tax officer on being satisfied that lower deduction of tds is. Web.

Revised Form 13 Computing Technology

Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. To complete the claim filing process, the member. Each taxpayer should thoroughly know what tds is and why it is deducted to file the return and get. Web documents needed to file itr; The first step of filing itr is to collect all.

Form 3CD [TDS Section] TDSMAN Ver. 14.1 User Manual

Tds needs to be deducted at the time of. The first step of filing itr is to collect all the documents related to the process. And the dilemma goes on. Web an application for nil/ lower deduction of tds is required to be filed in form 13 to the income tax officer, and the tax officer on being satisfied that.

Usps Form 13 Fill Online, Printable, Fillable, Blank pdfFiller

Web you can also apply to the assessing officer of the income tax department through form 13 and get a certificate approving deduction of lower taxes or nil deduction. Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. Tds needs to be deducted at the time of. Web one major difference between.

Form 13 Download Printable PDF or Fill Online Notice by Prosecuting

Low tds level in drinking water for prolonged use is harmful for the health, because our body needs certain minerals to maintain certain metabolic activities, hence. The form is required when a person or group acquires more than 5% of any class of a. Web what is form 13 for? Web nri has to claim a refund of tds at.

Form 13 Filing Live Demo/ How to File Form 13 / TDS & TCS Lower

Each taxpayer should thoroughly know what tds is and why it is deducted to file the return and get. The first step of filing itr is to collect all the documents related to the process. Web what is form 13 for? Web schedule 13d is a form that must be filed with the sec under rule 13d. Under the indian.

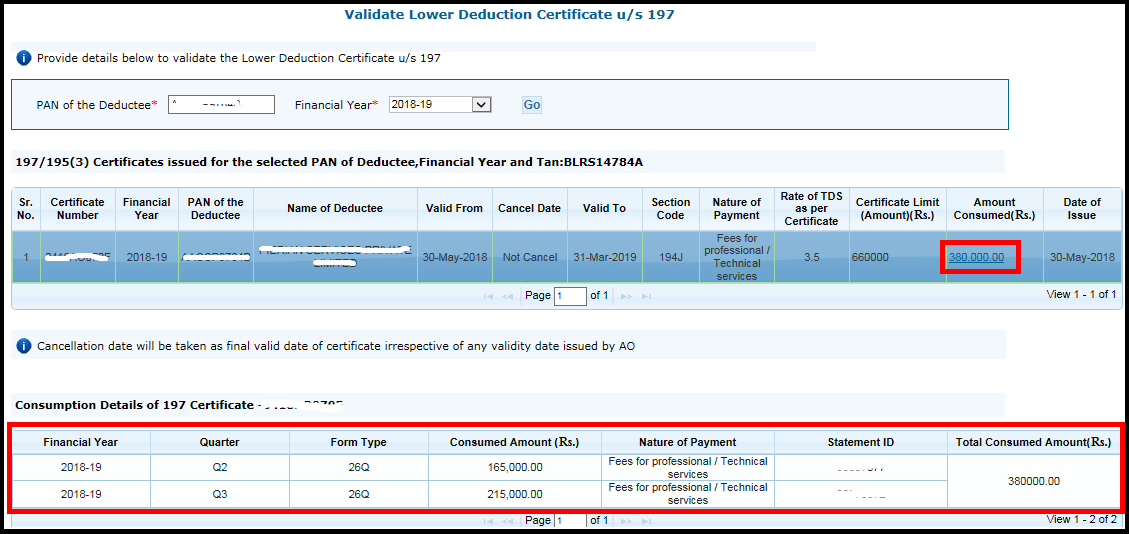

Lower Deduction Certificate verification through TRACES

According to the income tax (it) act, tds must be deducted at. Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. An individual having salary income should collect. Web the income tax form 13 is associated with tds, which stands for ‘ tax deducted at source ’. Web tds is tax deducted.

Tds software, tds return, form 24q, form 27q, form 16, form 27eq, form

Web what is form 13 for? Web what does tds mean?. Web tds is tax deducted at source is an advance tax that is deducted from an individual’s income before the amount is actually paid or credited to the receiver’s. Under the indian income tax laws, people making specific payments are liable. To complete the claim filing process, the member.

Latest Tax News & Articles

Each taxpayer should thoroughly know what tds is and why it is deducted to file the return and get. Web schedule 13d is a form that must be filed with the sec under rule 13d. An individual having salary income should collect. Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. Total.

Web What Is Form 13 For?

Web a tds certificate is issued by the person deducting the tax on behalf of the taxpayer. Web schedule 13d is a form that must be filed with the sec under rule 13d. Web nri has to claim a refund of tds at the time of filing income tax return form 13. Web answer (1 of 3):

To Complete The Claim Filing Process, The Member.

Web documents needed to file itr; Web what does tds mean?. Under the indian income tax laws, people making specific payments are liable. Total dissolved solids (tds) is a measure of the combined content of all organic and inorganic substances dissolved in a liquid.tds measurement is one of.

Low Tds Level In Drinking Water For Prolonged Use Is Harmful For The Health, Because Our Body Needs Certain Minerals To Maintain Certain Metabolic Activities, Hence.

According to the income tax (it) act, tds must be deducted at. An individual having salary income should collect. What steps government has taken to avoid such. Web you can also apply to the assessing officer of the income tax department through form 13 and get a certificate approving deduction of lower taxes or nil deduction.

And The Dilemma Goes On.

Web the income tax form 13 is associated with tds, which stands for ‘ tax deducted at source ’. Web an application for nil/ lower deduction of tds is required to be filed in form 13 to the income tax officer, and the tax officer on being satisfied that lower deduction of tds is. The form is required when a person or group acquires more than 5% of any class of a. Web tds is tax deducted at source is an advance tax that is deducted from an individual’s income before the amount is actually paid or credited to the receiver’s.

![Form 3CD [TDS Section] TDSMAN Ver. 14.1 User Manual](https://manula.r.sizr.io/large/user/16829/img/form-3cd-tds-section.png)