What Is Form 6252

What Is Form 6252 - Form 6252 to report income from an installment sale on the installment method. The form is used to report the sale in the year it takes place and to report payments received. Federal section income less common income installment sale income 6252 what is an installment sale? Web what is form 6252? Upload, modify or create forms. An installment sale is one that allows the buyer to pay for a property over time. Installment sale income is an irs form used to report income from a sale of real or personal property coming from an installment sale. Web generally, use form 6252 to report income from casual sales during this tax year of real or personal property (other than inventory) if you will receive any payments in a tax year. Instead, report the entire sale on form 4797, sales of. Complete, edit or print tax forms instantly.

A separate form should be filed for each asset you sell using this method. Web what is form 6252? The form is used to report the sale in the year it takes place and to report payments received. Web use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after the year of sale. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web a form one files with the irs to report income in the current year from an installment sale made in a previous year. Web form 6252 is a document used by the internal revenue service (irs) in the united states. Ad complete irs tax forms online or print government tax documents. For the seller, it allows.

For the seller, it allows. Form 6252 to report income from an installment sale on the installment method. Web to locate form 6252, installment sale income in the program go to: Web generally, use form 6252 to report income from casual sales during this tax year of real or personal property (other than inventory) if you will receive any payments in a tax year. Generally, an installment sale is a disposition of property where at. Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. For example, if one sells a truck in october for $1,000 and. Federal section income less common income installment sale income 6252 what is an installment sale? Form 6252 is used for installment sales. Try it for free now!

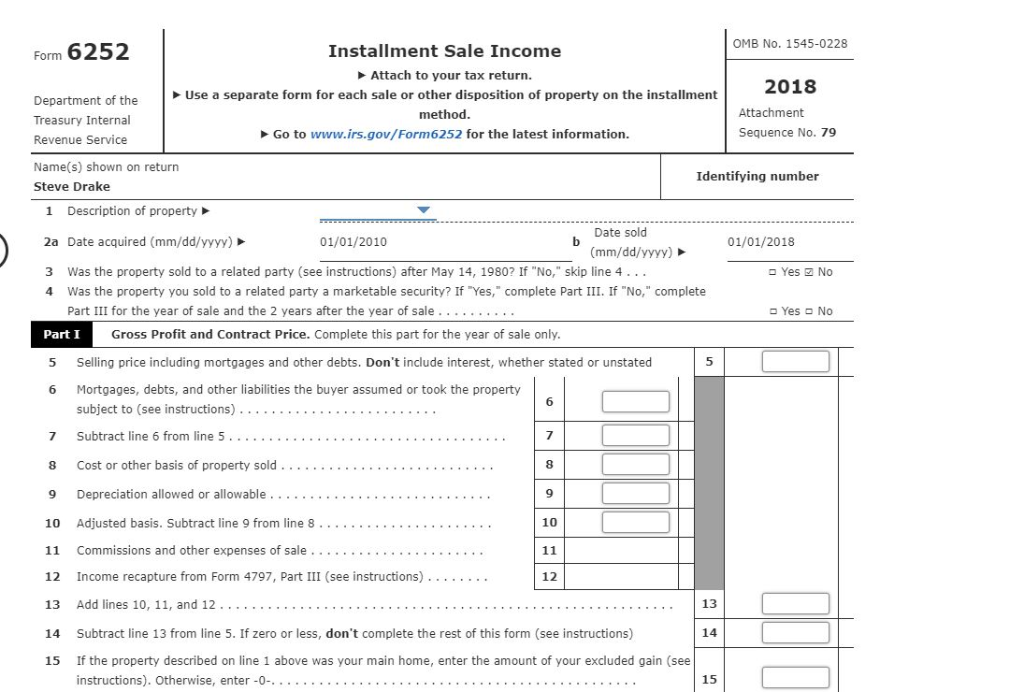

IRS Form 6252 2018 2019 Fillable and Editable PDF Template

Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you. Web form 6252 is a document used by the internal revenue service (irs) in the united states. Web what is form 6252? Upload, modify or create forms. For the seller, it allows.

Calculation of Gain or Loss, Installment Sales (LO

It’s required to report income from an installment sale, which is a sale of property where. Web taxpayers must use form 6252 (installment sale income) to report income from installment sales of real or personal property. Installment sale income is an irs form used to report income from a sale of real or personal property coming from an installment sale..

Form 6252 Installment Sale (2015) Free Download

It’s required to report income from an installment sale, which is a sale of property where. Form 6252 to report income from an installment sale on the installment method. Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. Installment sale income is an irs form used to report income from a sale.

What is IRS Form 6252 Installment Sale TurboTax Tax Tips & Videos

Generally, an installment sale is a disposition of property where at. Instead, report the entire sale on form 4797, sales of. An installment sale is one that allows the buyer to pay for a property over time. Installment sale income is an irs form used to report income from a sale of real or personal property coming from an installment.

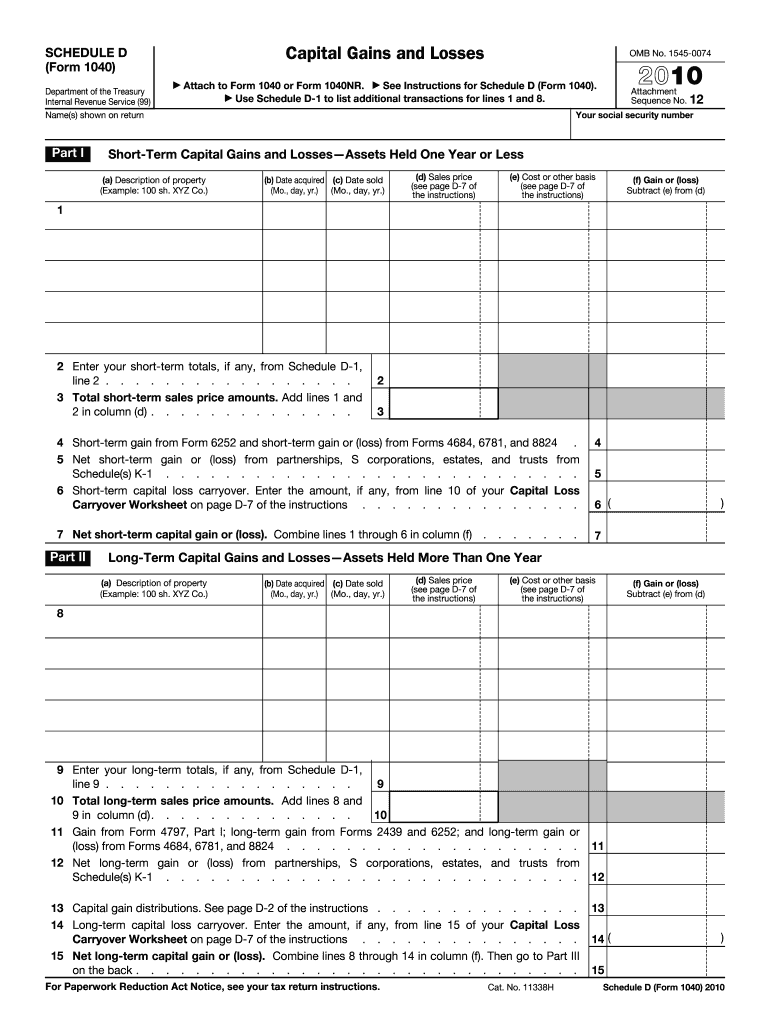

Schedule D Form Fill Out and Sign Printable PDF Template signNow

It’s required to report income from an installment sale, which is a sale of property where. Form 6252 is used for installment sales. Installment sales occur when at least one payment is. A separate form should be filed for each asset you sell using this method. Form 6252 is a tax form that is used to report the sale of.

Schedule D

Use form 6252 to report a sale of property on the installment method. Web taxpayers must use form 6252 (installment sale income) to report income from installment sales of real or personal property. Web use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax.

Form 6252 Installment Sale (2015) Free Download

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Form 6252 is a tax form that is used to report the sale of property that was either received in an installment sale or was sold under the installment method. Ad complete irs tax forms online or print government tax documents. Web taxpayers must use form.

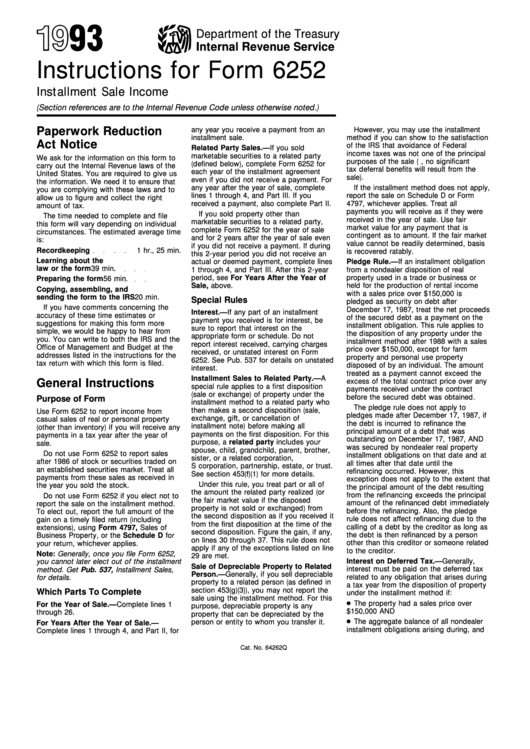

Irs Instructions For Form 6252 1993 printable pdf download

For the seller, it allows. A separate form should be filed for each asset you sell using this method. Web what is the form used for? An installment sale is one that allows the buyer to pay for a property over time. Complete, edit or print tax forms instantly.

8 IRS Business Forms Every Business Owner Should Know About Silver

Web what is form 6252? Complete, edit or print tax forms instantly. Web a form one files with the irs to report income in the current year from an installment sale made in a previous year. Web taxpayers must use form 6252 (installment sale income) to report income from installment sales of real or personal property. Upload, modify or create.

IRS 4797 2020 Fill out Tax Template Online US Legal Forms

Web don’t file form 6252 for sales that don’t result in a gain, even if you will receive a payment in a tax year after the year of sale. Federal section income less common income installment sale income 6252 what is an installment sale? Generally, an installment sale is a disposition of property where at. Web taxpayers must use form.

Try It For Free Now!

Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you. Web a form one files with the irs to report income in the current year from an installment sale made in a previous year. Form 6252 is used for installment sales. Web use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after the year of sale.

Use Form 6252 To Report A Sale Of Property On The Installment Method.

Form 6252 is a tax form that is used to report the sale of property that was either received in an installment sale or was sold under the installment method. Instead, report the entire sale on form 4797, sales of. Web what is form 6252? Complete, edit or print tax forms instantly.

Complete, Edit Or Print Tax Forms Instantly.

Web form 6252 is a document used by the internal revenue service (irs) in the united states. Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. The form is used to report the sale in the year it takes place and to report payments received. Web taxpayers must use form 6252 (installment sale income) to report income from installment sales of real or personal property.

Generally, An Installment Sale Is A Disposition Of Property Where At.

Upload, modify or create forms. Form 6252 to report income from an installment sale on the installment method. For the seller, it allows. A separate form should be filed for each asset you sell using this method.

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)