What Is Form 8814 Used For

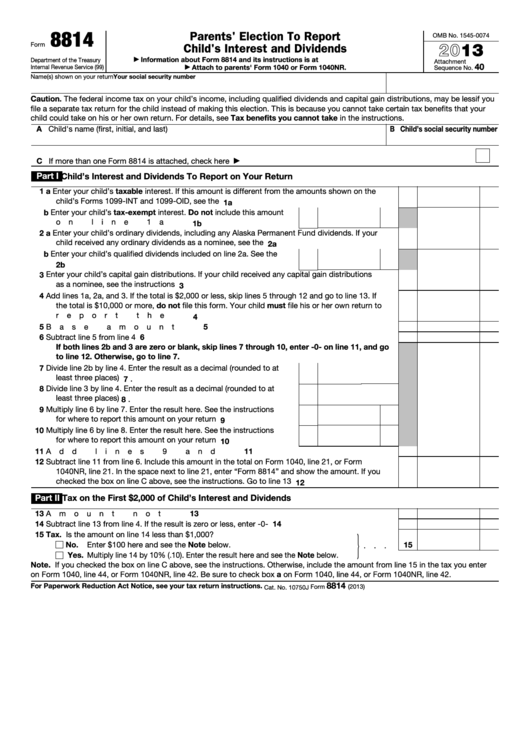

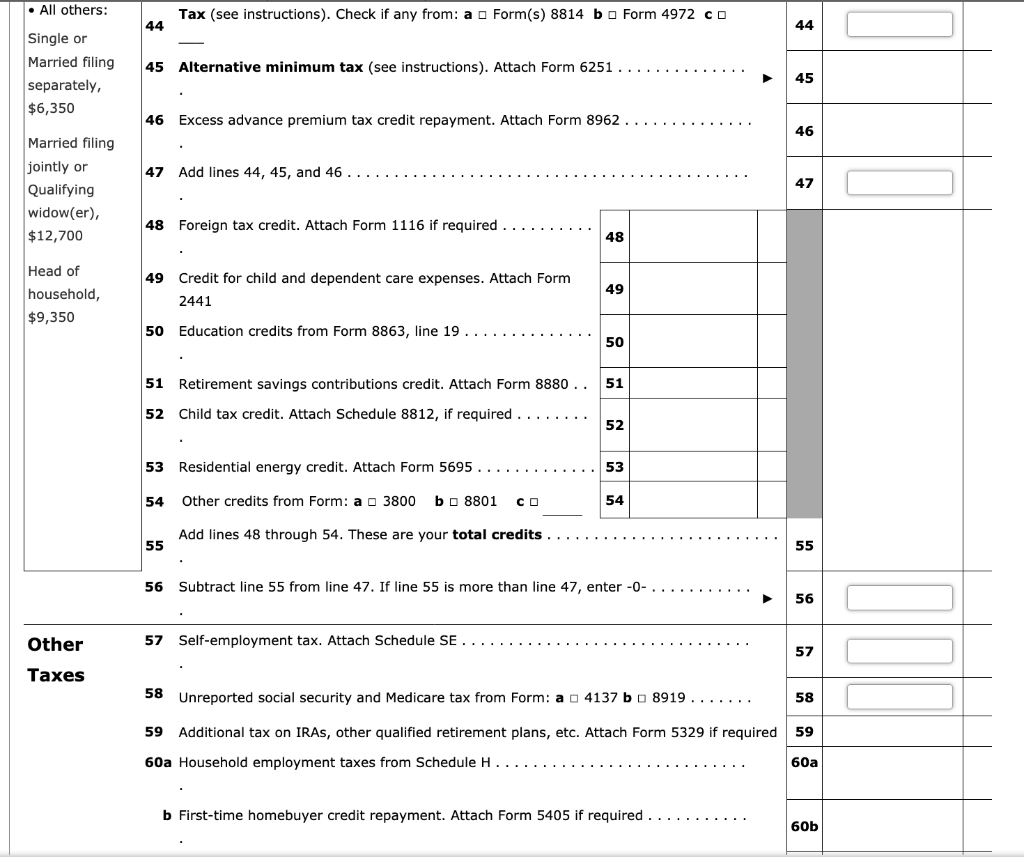

What Is Form 8814 Used For - Web to enter information for the parents' return (form 8814): You can make this election if your child meets all of the. Multiply results of lines 6 and 7 and enter the number in line 9. A separate form 8814 must be filed for. Web form 8814 department of the treasury internal revenue service (99) parents’ election to report child’s interest and dividends go to www.irs.gov/form8814 for the latest. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web use this form if you elect to report your child’s income on your return. From within your taxact return ( online or desktop), click federal. Web click taxes in the middle of the screen to expand the category. This includes their name, address, employer identification number (ein),.

This includes their name, address, employer identification number (ein),. Web parents use form 8814 to report a child’s income on their tax return, simplifying the tax filing process. If you choose this election, your child may not have to file a return. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Per the irs instructions, the following notes will appear at the top of printed versions of these forms: For the parents' return (form 8814), click. Web use this form if you elect to report your child’s income on your return. Web if you are completing the parents' return, do not enter the information for form 8615 (tax on child's investment income) but do complete form 8814 (child's interest and. Web we last updated the parents' election to report child's interest and dividends in january 2023, so this is the latest version of form 8814, fully updated for tax year 2022. If income is reported on a.

Multiply results of lines 6 and 7 and enter the number in line 9. You can make this election if your child meets all of the. However, it’s only applicable to certain types of. Web continue with the interview process to enter your information. Web to enter information for the parents' return (form 8814): A separate form 8814 must be filed for. Adds an extra layer of security and validates other parties' identities via additional means, such as a text message or phone call. For the child's return (form 8615), click tax on child's unearned income. Web click taxes in the middle of the screen to expand the category. If you choose this election, your child may not have to file a return.

Everything You Need to Know About Custodial Account Taxes

Web divide the number in line 3 by line 4 and enter rounded to three digits result in line 8. Web if you are completing the parents' return, do not enter the information for form 8615 (tax on child's investment income) but do complete form 8814 (child's interest and. You can make this election if your child meets all of.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

For the parents' return (form 8814), click. If you do, your child will not have to file a return. Parents use this form to report their child's. Web use this form if you elect to report your child’s income on your return. Enter the child's interest, dividends, and capital gains info in the menu lines provided.

8814 form Fill out & sign online DocHub

If you choose this election, your child may not have to file a return. However, it’s only applicable to certain types of. If income is reported on a. From within your taxact return ( online or desktop), click federal. Multiply results of lines 6 and 7 and enter the number in line 9.

Fillable Form 8814 Parents' Election To Report Child'S Interest And

Web we last updated the parents' election to report child's interest and dividends in january 2023, so this is the latest version of form 8814, fully updated for tax year 2022. Web form 8814 department of the treasury internal revenue service (99) parents’ election to report child’s interest and dividends go to www.irs.gov/form8814 for the latest. Web information about form.

Form 8814 Instructions 2010

Use this form if the parent elects to report their child’s income. Web continue with the interview process to enter your information. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Multiply numbers in lines 6 and 8. If you choose this election, your child.

Form 8814 Instructions 2010

If income is reported on a. Web parents use form 8814 to report a child’s income on their tax return, simplifying the tax filing process. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. If you choose this election, your child may not have to file a return. This includes.

Note This Problem Is For The 2017 Tax Year. Janic...

Web parents use form 8814 to report a child’s income on their tax return, simplifying the tax filing process. Web use this form if you elect to report your child’s income on your return. You can make this election if your child meets all of the. Multiply numbers in lines 6 and 8. Web to make the election, complete and.

Fuso 10Wh Dumptruck East Pacific Motors

Adds an extra layer of security and validates other parties' identities via additional means, such as a text message or phone call. If income is reported on a. You can make this election if your child meets all of the. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Multiply numbers in lines 6 and 8. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web to enter information for the parents' return (form 8814): Use this form if the parent elects to report their child’s income. Web continue with the interview process to.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. If you choose this election, your child may not have to file a return. However, it’s only applicable to certain types of. Web if you are completing the parents' return, do not enter the information for form 8615 (tax on child's.

If Income Is Reported On A.

Web click taxes in the middle of the screen to expand the category. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. For the parents' return (form 8814), click. Web divide the number in line 3 by line 4 and enter rounded to three digits result in line 8.

You Can Make This Election If Your Child Meets All Of The.

Web if you are completing the parents' return, do not enter the information for form 8615 (tax on child's investment income) but do complete form 8814 (child's interest and. However, it’s only applicable to certain types of. Use this form if the parent elects to report their child’s income. Web to enter information for the parents' return (form 8814):

Multiply Numbers In Lines 6 And 8.

What is the form used for? Parents use this form to report their child's. This includes their name, address, employer identification number (ein),. If you choose this election, your child may not have to file a return.

Multiply Results Of Lines 6 And 7 And Enter The Number In Line 9.

Web use this form if you elect to report your child’s income on your return. Web form 8814 department of the treasury internal revenue service (99) parents’ election to report child’s interest and dividends go to www.irs.gov/form8814 for the latest. Adds an extra layer of security and validates other parties' identities via additional means, such as a text message or phone call. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file.