What Is Form 8829

What Is Form 8829 - Complete, edit or print tax forms instantly. Calculate the part of the home used for business purposes, usually. Web form 8829 is one page long and contains four parts. Web what is form 8829? Get ready for tax season deadlines by completing any required tax forms today. Web the irs form 8829 that you must fill out to apply for your home office deduction comes in four parts: Luckily, you can deduct many of. Web irs form 8829 is the form used to deduct expenses for your home business space. use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040). To get your business percentage, simply.

Luckily, you can deduct many of. Web department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Web table of contents some workers and business owners may be able to deduct home office and related expenses on their annual tax returns. Web irs form 8829 is the form used to deduct expenses for your home business space. Get ready for tax season deadlines by completing any required tax forms today. Business owners use irs form 8829 to claim tax deductions for the. You are claiming expenses for business use of your home as an employee or a partner, or you. The irs determines the eligibility of an allowable home business space using two. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Get ready for tax season deadlines by completing any required tax forms today.

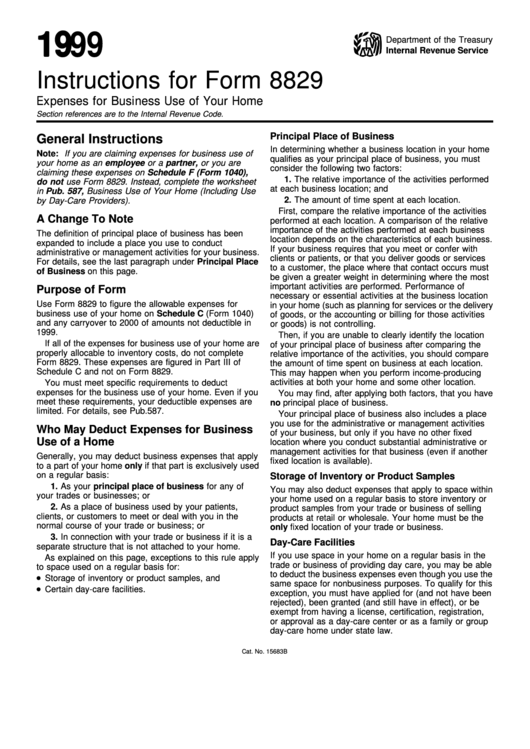

Use a separate form 8829 for each. Web the government instructions for form 8829 state: Web who cannot use form 8829. Web what is form 8829? The irs form 8829 helps. Calculate the part of the home used for business purposes, usually. Web what is irs form 8829 and why should you file it? Form 4684 (see instructions) 35: As a small business owner, your operating expenses can add up. The irs determines the eligibility of an allowable home business space using two.

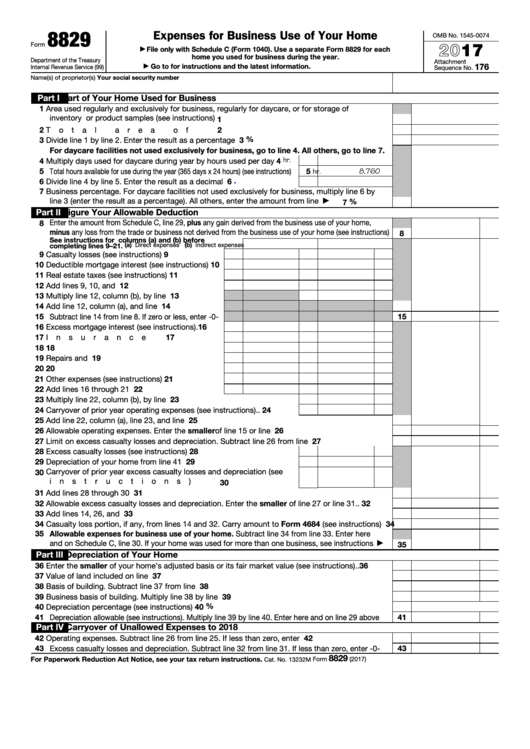

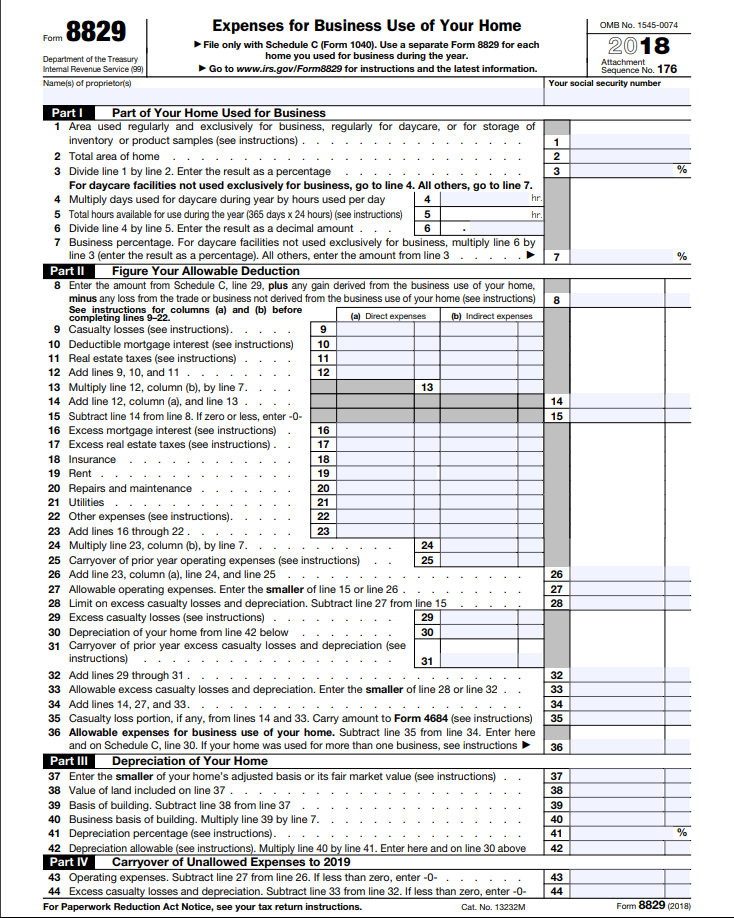

Fillable IRS Form 8829 2018 2019 Online PDF Template

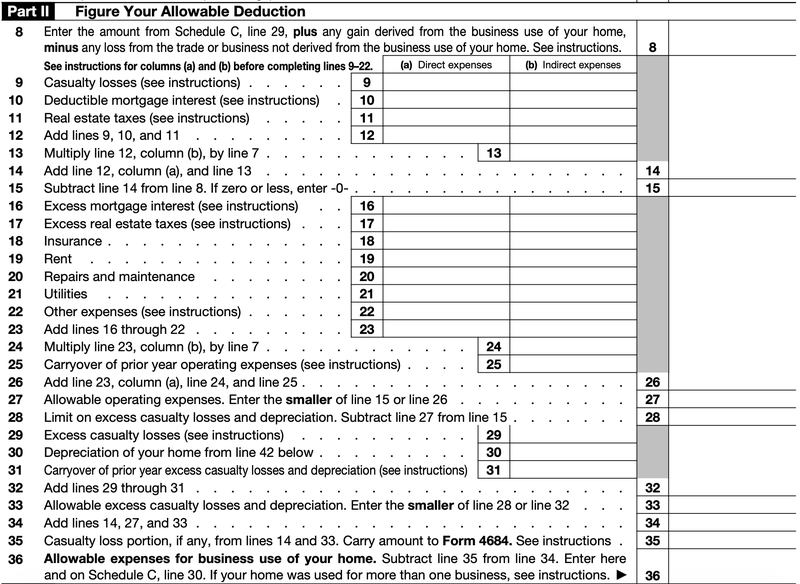

Ad access irs tax forms. Web form 8829 is one page long and contains four parts. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. To get your business percentage, simply. Luckily, you can deduct many of.

U.S. Tax Form 8829—Expenses for Business Use of Your Home FreshBooks Blog

Web department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Use a separate form 8829 for each. Form 4684 (see instructions) 35: Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023.

Form 8829Expenses for Business Use of Your Home

Web form 8829 is one page long and contains four parts. Web irs form 8829 is the form used to deduct expenses for your home business space. Form 8829 is an irs tax form that sole proprietors can file with schedule c (form 1040) to claim a tax deduction on home office expenses. Web what is form 8829? Use a.

Fillable Form 8829 Expenses For Business Use Of Your Home 2017

As a small business owner, your operating expenses can add up. Web the irs form 8829 that you must fill out to apply for your home office deduction comes in four parts: Complete, edit or print tax forms instantly. Form 4684 (see instructions) 35: Part i is used to calculate the percentage of your home used for business.

Form 8829 Instructions Your Complete Guide to Expense Your Home Office

To get your business percentage, simply. The irs determines the eligibility of an allowable home business space using two. Web the irs form 8829 that you must fill out to apply for your home office deduction comes in four parts: Web the government instructions for form 8829 state: Web who cannot use form 8829.

Instructions For Form 8829 Expenses For Business Use Of Your Home

Web the irs form 8829 that you must fill out to apply for your home office deduction comes in four parts: As a small business owner, your operating expenses can add up. Do not use form 8829 in the following situations. Web irs form 8829 is the form used to deduct expenses for your home business space. Use a separate.

Form 8829 for the Home Office Deduction Credit Karma

You are claiming expenses for business use of your home as an employee or a partner, or you. Ad access irs tax forms. Calculate the part of the home used for business purposes, usually. Get ready for tax season deadlines by completing any required tax forms today. Web the irs form 8829 that you must fill out to apply for.

2019 2020 IRS Instructions 8829 Fill Out Digital PDF Sample

Web what is irs form 8829 and why should you file it? Web the irs form 8829 that you must fill out to apply for your home office deduction comes in four parts: Get ready for tax season deadlines by completing any required tax forms today. Web department of the treasury internal revenue service (99) expenses for business use of.

Instructions For Form 8829 Expenses For Business Use Of Your Home

Luckily, you can deduct many of. The irs form 8829 helps. Web who cannot use form 8829. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Web form 8829 is one page long and contains four parts.

How to Complete and File IRS Form 8829 The Blueprint

Web the government instructions for form 8829 state: Complete, edit or print tax forms instantly. Web department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). Use a separate form 8829 for each. The irs form 8829 helps.

Complete, Edit Or Print Tax Forms Instantly.

Web form 8829 is one page long and contains four parts. Web department of the treasury internal revenue service (99) expenses for business use of your home file only with schedule c (form 1040). What is irs form 8829? Web the irs form 8829 that you must fill out to apply for your home office deduction comes in four parts:

Complete, Edit Or Print Tax Forms Instantly.

Get ready for tax season deadlines by completing any required tax forms today. You are claiming expenses for business use of your home as an employee or a partner, or you. Web what is form 8829? Calculate the part of the home used for business purposes, usually.

To Get Your Business Percentage, Simply.

Web the government instructions for form 8829 state: The irs form 8829 helps. Web table of contents some workers and business owners may be able to deduct home office and related expenses on their annual tax returns. Do not use form 8829 in the following situations.

Web What Is Irs Form 8829 And Why Should You File It?

Get ready for tax season deadlines by completing any required tax forms today. Form 4684 (see instructions) 35: Part i is used to calculate the percentage of your home used for business. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes.