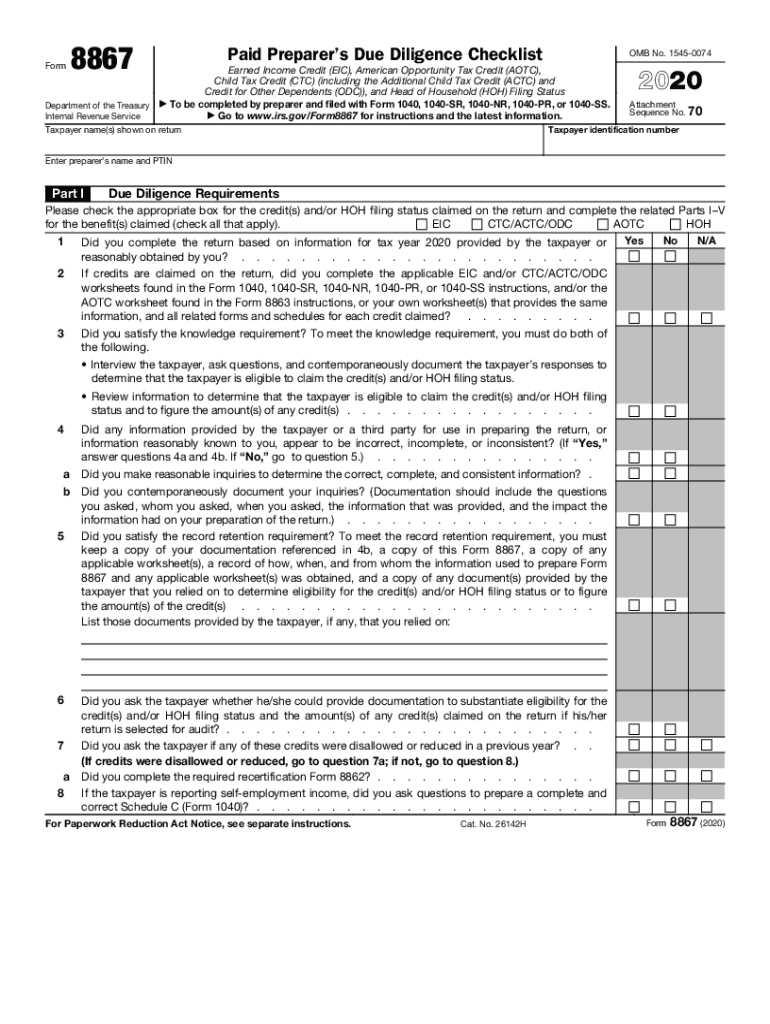

What Is Form 8867

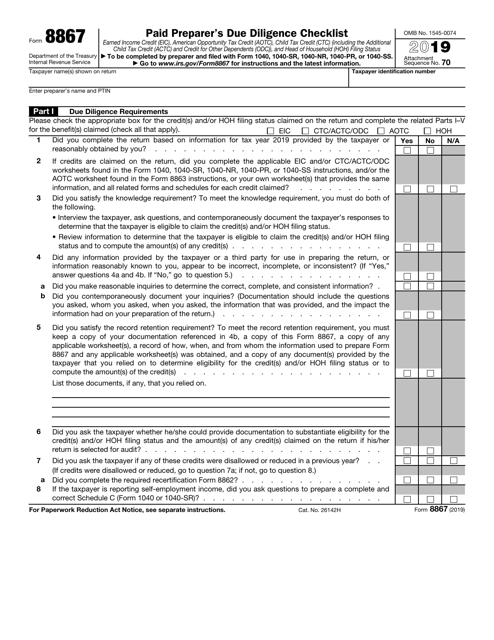

What Is Form 8867 - Web what is form 8867? Due diligence on the go! Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing. Web form 8867 must be submitted with the taxpayer’s return. Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. December 2021) department of the treasury internal revenue service. However, checking off boxes is not enough to satisfy the due diligence requirements. Download or email irs 8867 & more fillable forms, register and subscribe now! Web complete form 8867 truthfully and accurately and complete the actions described on form 8867 for each credit claimed for which a person is the paid tax return preparer. Try it for free now!

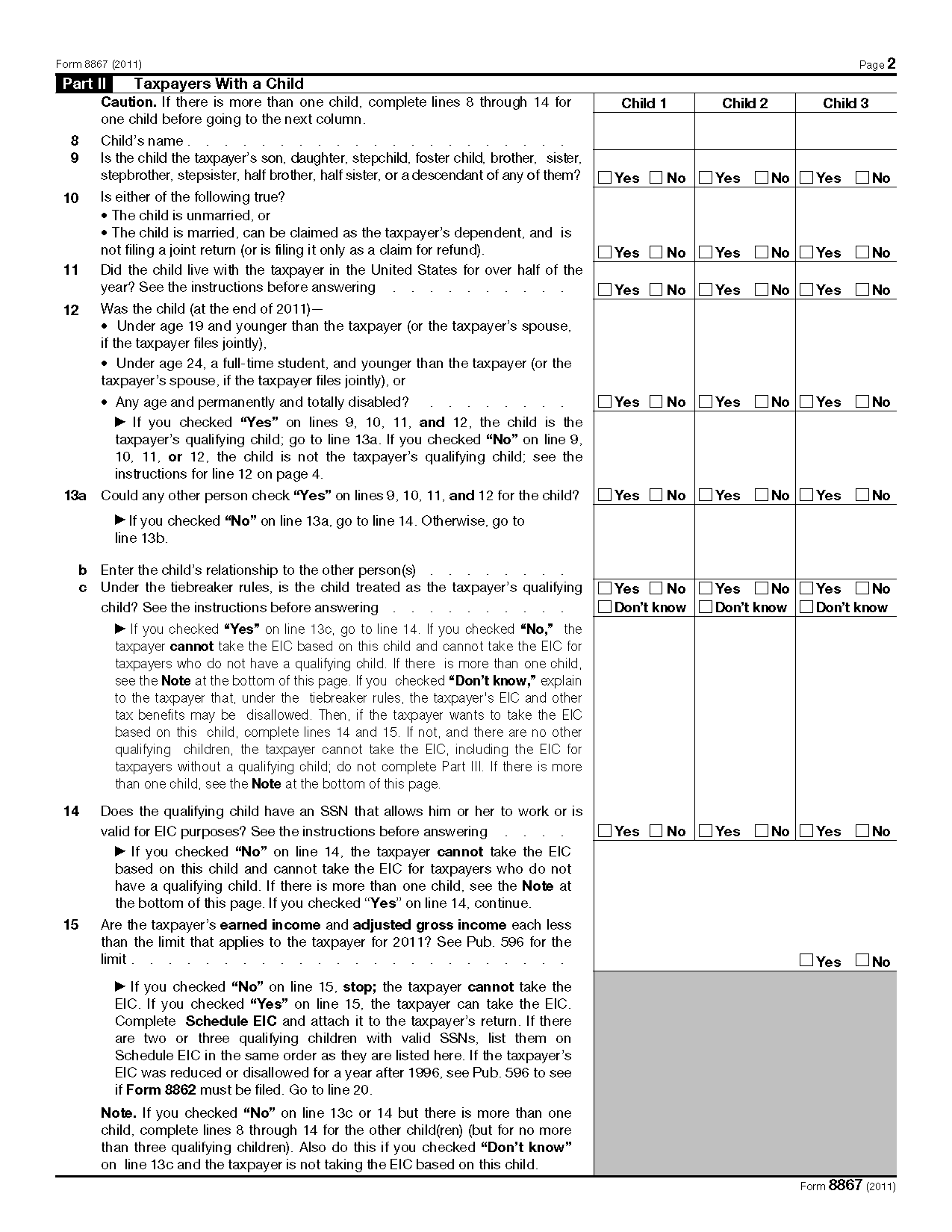

Web what is form 8867? Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Publication 4687 pdf , paid preparer due. December 2021) department of the treasury internal revenue service. Earned income credit (eic), american. Web what is form 8867? Web due diligence required under the final regulations promulgated under section 6695 on november 5, 2018, completing form 8867 (based on information. Web instructions for form 8867 department of the treasury internal revenue service (rev. So what is new is that form 8867, which is the paid preparer's due diligence checklist, now has a. Web complete form 8867 truthfully and accurately and complete the actions described on form 8867 for each credit claimed for which a person is the paid tax return preparer.

Web what is form 8867? Consequences of failing to meet your due diligence So what is new is that form 8867, which is the paid preparer's due diligence checklist, now has a. Publication 4687 pdf, paid preparer due. Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing. Due diligence on the go! Try it for free now! Web due diligence required under the final regulations promulgated under section 6695 on november 5, 2018, completing form 8867 (based on information. Ad upload, modify or create forms. Due diligence on the go!

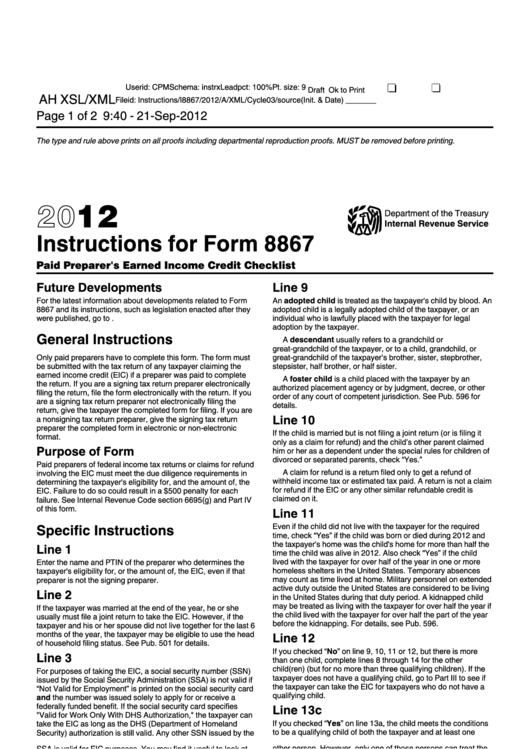

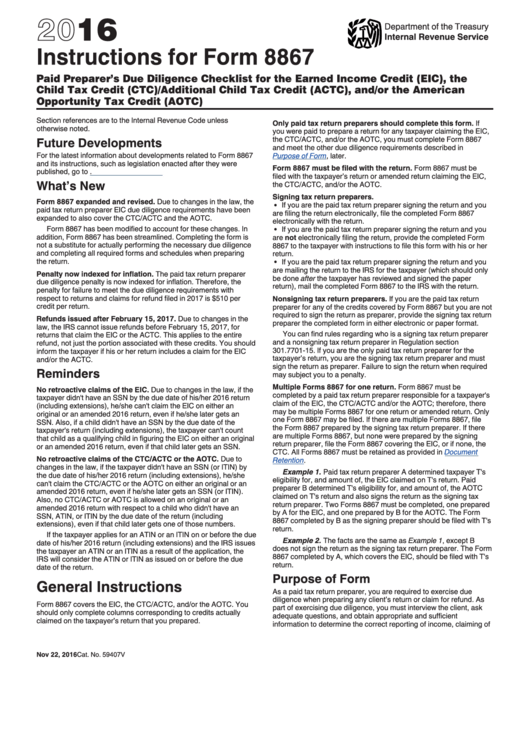

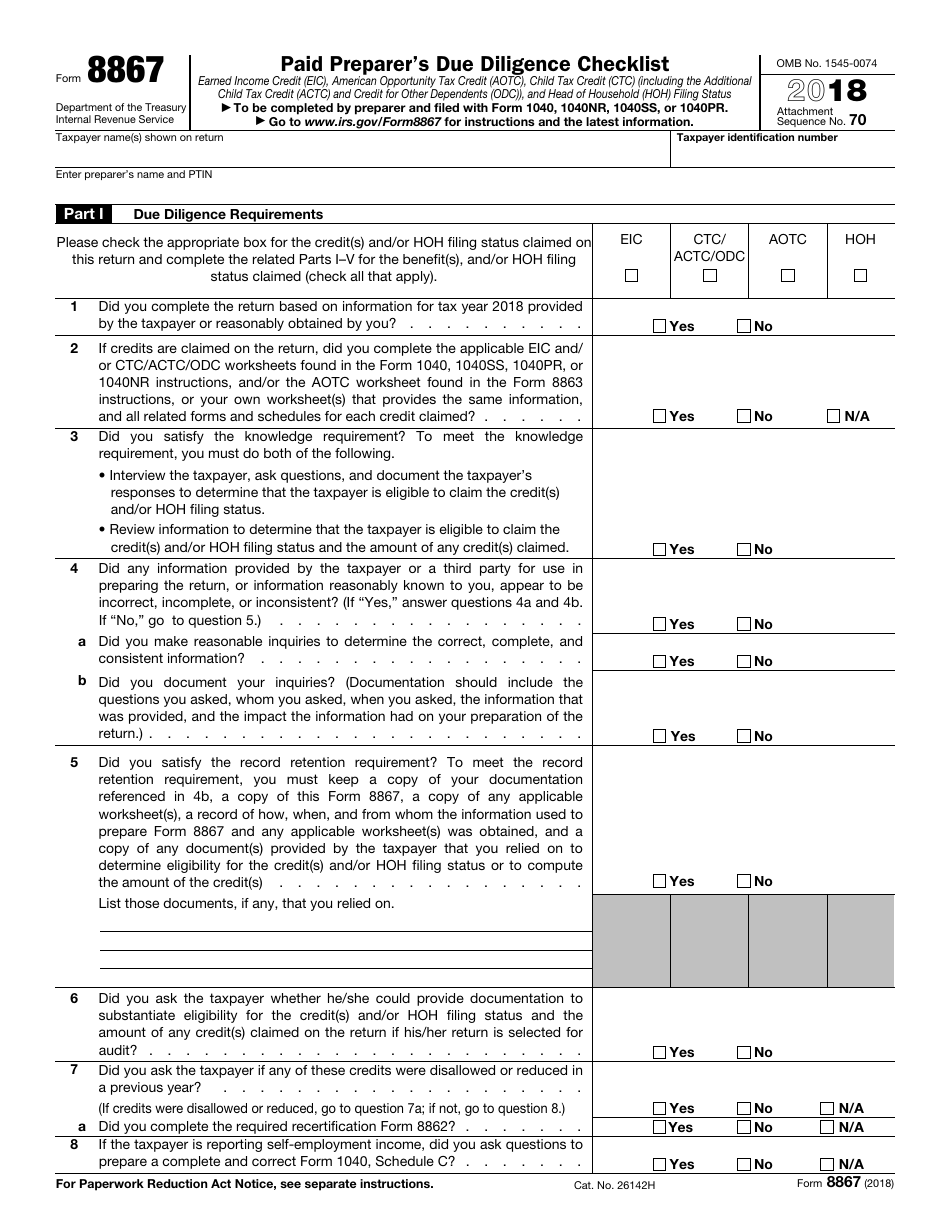

Instructions For Form 8867 Paid Preparer'S Earned Credit

Web what is form 8867? Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and hoh filing status, if claimed;. Web form 4868, also known as an “application for automatic extension of time to file u.s. Due diligence on the go! Due diligence on the go!

Form 8867 amulette

Web the purpose of form 8867 is to ensure that the tax preparer has considered all applicable eic eligibility requirements for each prepared tax return. Web what is form 8867? Publication 4687 pdf, paid preparer due. Ad upload, modify or create forms. Due diligence on the go!

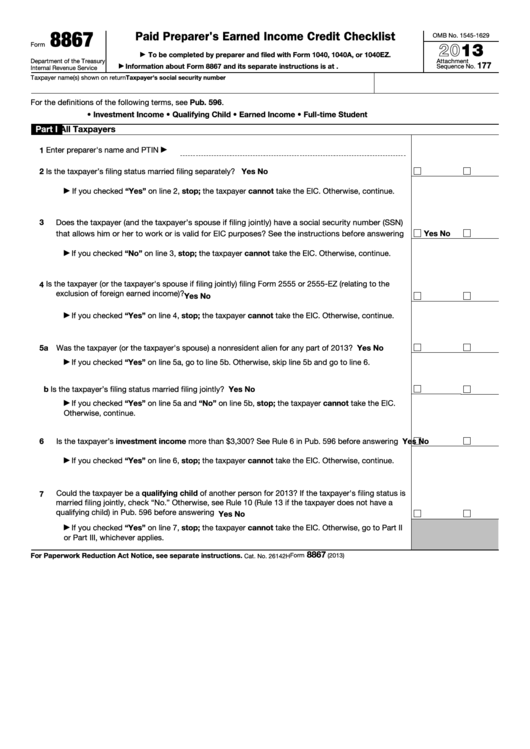

Form 8867 Paid Preparer's Earned Credit Checklist (2014) Free

Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing. Web form 4868, also known as an “application for automatic extension of time to file u.s. So what is new is that form 8867, which is the paid preparer's due diligence checklist, now has a. November 2022) paid.

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Web what is form 8867? Web the purpose of form 8867 is to ensure that the tax preparer has considered all applicable eic eligibility requirements for each prepared tax return. Web this checklist is a comprehensive tool to use when preparing form 8867, paid preparer’s due diligence checklist, that is associated with claiming the earned income tax credit,. Web what.

Form 8867 Paid Preparer's Earned Credit Checklist (2014) Free

Ad upload, modify or create forms. Individual income tax return,” is a form that taxpayers can file with the irs if. Consequences of failing to meet your due diligence Ad upload, modify or create forms. Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing.

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

Download or email irs 8867 & more fillable forms, register and subscribe now! Web instructions for form 8867 department of the treasury internal revenue service (rev. Paid preparer’s due diligence checklist. Publication 4687 pdf , paid preparer due. Web what is form 8867?

2020 Form IRS 8867 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing. Try it for free now! Web instructions for form 8867 department of the treasury internal revenue service (rev. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web what is form.

Instructions For Form 8867 Paid Preparer'S Due Diligence Checklist

Ad upload, modify or create forms. Web form 8867 must be submitted with the taxpayer’s return. Web what is form 8867? So what is new is that form 8867, which is the paid preparer's due diligence checklist, now has a. Publication 4687 pdf, paid preparer due.

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Web what is form 8867? Publication 4687 pdf , paid preparer due. Web what is form 8867? Web as a tax preparer your due diligence requirements were expanded by tcja. Consequences of failing to meet your due diligence

Form 8867 Paid Preparer`s Due Diligence Checklist Editorial Stock Photo

Web due diligence required under the final regulations promulgated under section 6695 on november 5, 2018, completing form 8867 (based on information. Publication 4687 pdf, paid preparer due. Paid preparer’s due diligence checklist. Individual income tax return,” is a form that taxpayers can file with the irs if. December 2021) department of the treasury internal revenue service.

Web Form 8867 Must Be Filed With The Return.

Earned income credit (eic), american. Individual income tax return,” is a form that taxpayers can file with the irs if. Web complete form 8867 truthfully and accurately and complete the actions described on form 8867 for each credit claimed for which a person is the paid tax return preparer. Web the purpose of form 8867 is to ensure that the tax preparer has considered all applicable eic eligibility requirements for each prepared tax return.

Web Form 4868, Also Known As An “Application For Automatic Extension Of Time To File U.s.

Web form 8867 must be filed with the return. Try it for free now! The preparer can inquire about possible documents the client may have or can get to support claiming the children for. Due diligence on the go!

Ad Upload, Modify Or Create Forms.

Web what is form 8867? Download or email irs 8867 & more fillable forms, register and subscribe now! Web what is form 8867? Web due diligence required under the final regulations promulgated under section 6695 on november 5, 2018, completing form 8867 (based on information.

Web Form 8867 Must Be Submitted With The Taxpayer’s Return.

Web as a tax preparer your due diligence requirements were expanded by tcja. However, checking off boxes is not enough to satisfy the due diligence requirements. Due diligence on the go! Web this checklist is a comprehensive tool to use when preparing form 8867, paid preparer’s due diligence checklist, that is associated with claiming the earned income tax credit,.