What Is Form 8959

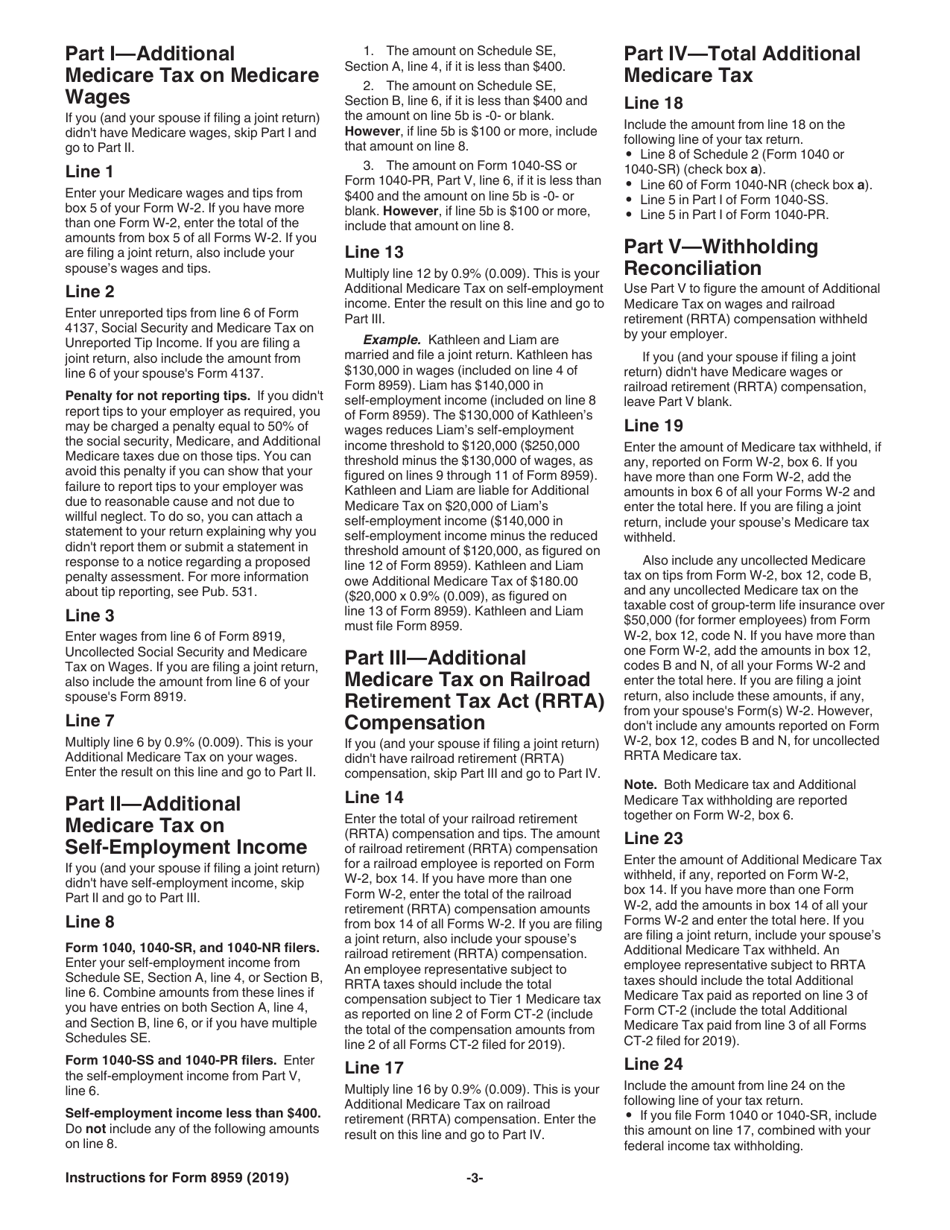

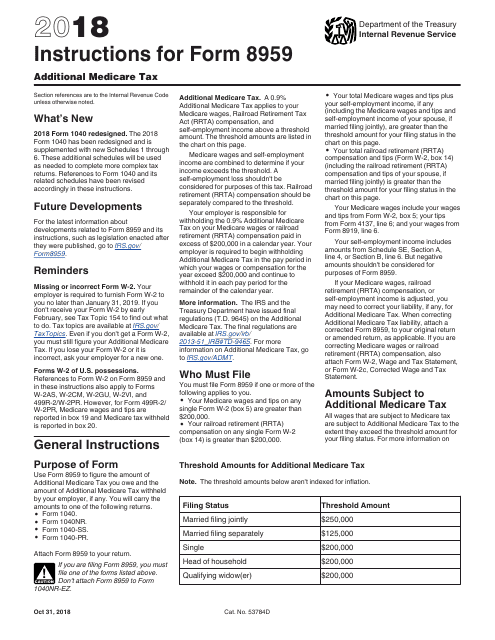

What Is Form 8959 - Web underpayment of estimated tax. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. For more on this, please call. If you had too little tax withheld, or did not pay enough estimated tax, you may owe an estimated tax penalty. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Use this form to figure the amount. Web what is irs form 8959?

If filing jointly, you’ll need to add medicare wages,. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers. Web what is the additional medicare tax? This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Web the 8959 form is an application that is used to calculate additional medicare tax. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Use this form to figure the amount. Form 8959 is a tax form used to calculate and report the additional medicare tax owed by certain. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Web underpayment of estimated tax.

For more on this, please call. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. The 0.9 percent additional medicare tax applies to. Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. It needs to be completed only by those whose medicare wages are over the established threshold. Form 8959 is a tax form used to calculate and report the additional medicare tax owed by certain. Web the 8959 form is an application that is used to calculate additional medicare tax. If filing jointly, you’ll need to add medicare wages,. Web what is irs form 8959?

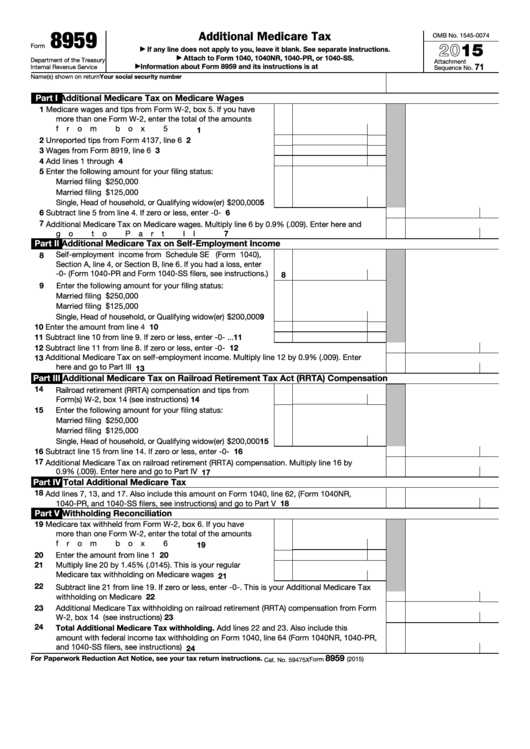

Form 8959 Additional Medicare Tax (2014) Free Download

Web underpayment of estimated tax. Web irs form 8959, additional medicare tax, is the federal form that high earners must file with their income tax return to reconcile the following: Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Use form 8959.

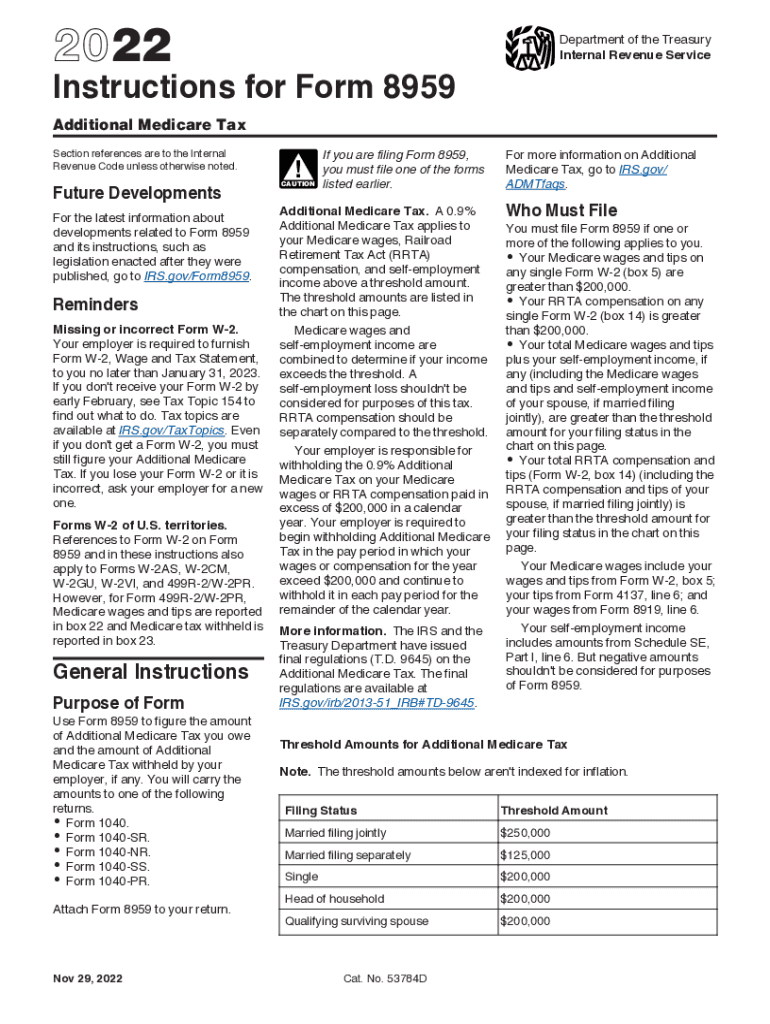

2022 Form IRS 8959 Instructions Fill Online, Printable, Fillable

Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web the 8959 form is an application that is used to calculate additional medicare tax. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Use this form.

1099 Misc Fillable Form Free amulette

You will carry the amounts to. Web form 8959 department of the treasury internal revenue service. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Form 8959 is a tax form used to calculate and report the additional medicare tax owed by certain. Use form 8959 to figure the amount of additional medicare tax you.

Fillable Form 8959 Additional Medicare Tax 2015 printable pdf download

It needs to be completed only by those whose medicare wages are over the established threshold. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Use form 8959 to figure the amount of additional medicare tax you owe and the amount of.

Form 8109 Fill Out and Sign Printable PDF Template signNow

Web the 8959 form is an application that is used to calculate additional medicare tax. Web what is the additional medicare tax? Web purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web beginning with the 2013 tax year, you.

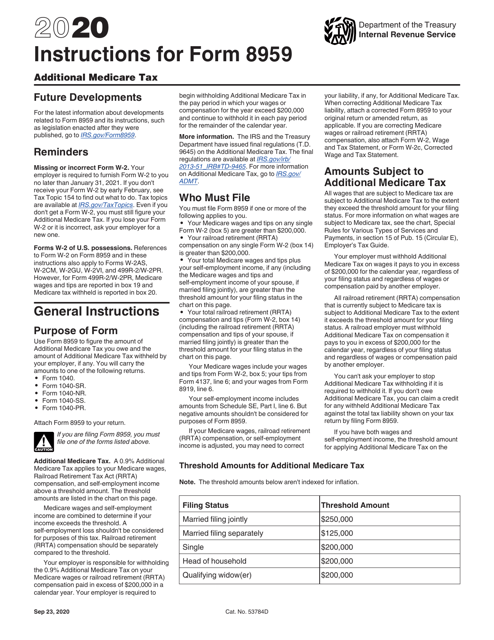

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Get ready for tax season deadlines by completing any required tax forms today. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web what is irs form 8959?.

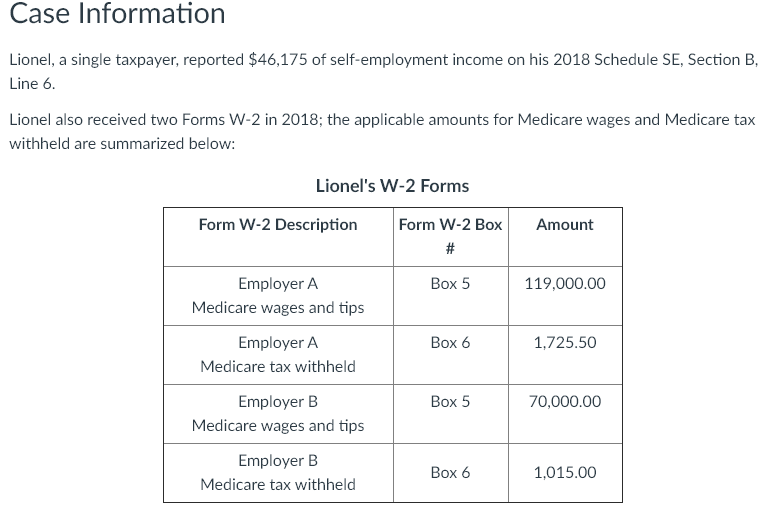

Solved Case Information Lionel, a single taxpayer, reported

Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web the 8959 form is an application that is used to calculate additional medicare tax. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Web what is irs.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Try it for free now! Web what is the form 8959? The 0.9 percent additional medicare tax applies to. Form 8959 is a tax form used to calculate and report the additional medicare tax owed by certain. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file.

수질배출시설 및 방지시설의가동개시신고 샘플, 양식 다운로드

Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web what is the additional medicare tax? Web underpayment of estimated tax. Web use form.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 8959 & more fillable forms, register and subscribe now! Web form 8959 department of the treasury internal revenue service. Web the 8959 form is an application that is used to calculate additional medicare tax. If you had too little tax withheld, or.

Use This Form To Figure The Amount.

Web what is the form 8959? Upload, modify or create forms. For more on this, please call. Form 8959 is a tax form used to calculate and report the additional medicare tax owed by certain.

If Filing Jointly, You’ll Need To Add Medicare Wages,.

The 0.9 percent additional medicare tax applies to. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web the 8959 form is an application that is used to calculate additional medicare tax. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any.

Web Beginning With The 2013 Tax Year, You Have To File Form 8959 If The Medicare Wages Or Rrta Reported Exceed $200,000 For Single Filers Or $250,000 For Joint Filers.

Web what is the additional medicare tax? It needs to be completed only by those whose medicare wages are over the established threshold. This tax became effective in 2013 and is reported on form 8959, additional medicare tax. Get ready for tax season deadlines by completing any required tax forms today.

Web Irs Form 8959, Additional Medicare Tax, Is The Federal Form That High Earners Must File With Their Income Tax Return To Reconcile The Following:

If you had too little tax withheld, or did not pay enough estimated tax, you may owe an estimated tax penalty. Web what is irs form 8959? Web it’s calculated on form 8959 to determining how much additional medicare tax must be withheld by your employer, if any at all. Ad download or email irs 8959 & more fillable forms, register and subscribe now!