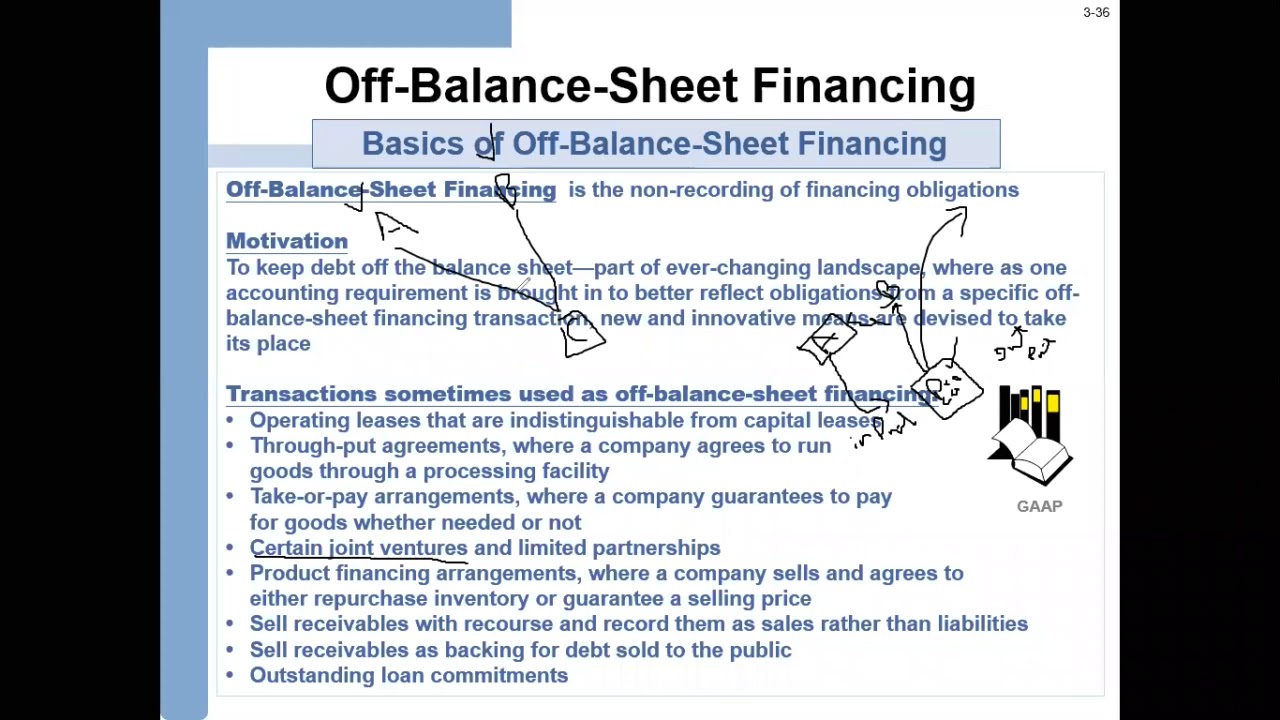

What Is Off Balance Sheet Financing

What Is Off Balance Sheet Financing - It is used to impact a company’s level of debt and. This practice helps companies keep. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. While not recorded on the balance sheet itself, these items. Through off balance sheet financing, both international and domestic.

Through off balance sheet financing, both international and domestic. It is used to impact a company’s level of debt and. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. This practice helps companies keep. While not recorded on the balance sheet itself, these items.

Through off balance sheet financing, both international and domestic. While not recorded on the balance sheet itself, these items. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. This practice helps companies keep. It is used to impact a company’s level of debt and.

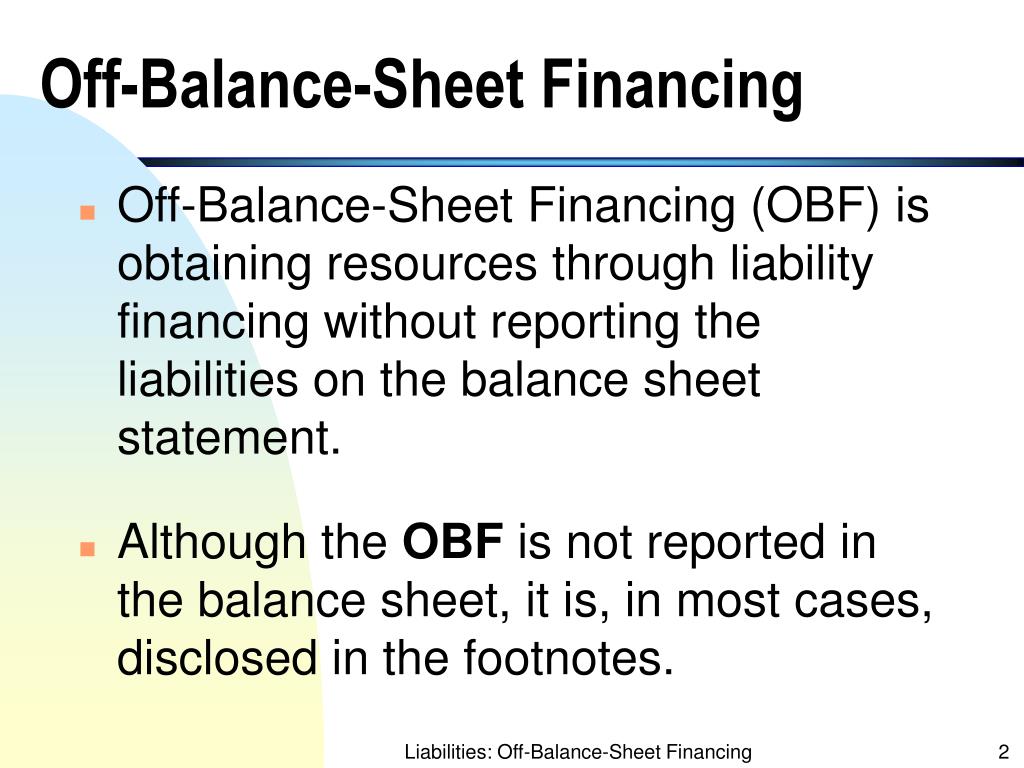

Off Balance Sheet Financing OffBalance Sheet Financing (Definition

Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. While not recorded on the balance sheet itself, these items. Through off balance sheet financing, both international and domestic. This practice helps companies keep. It is used to impact a company’s level of debt and.

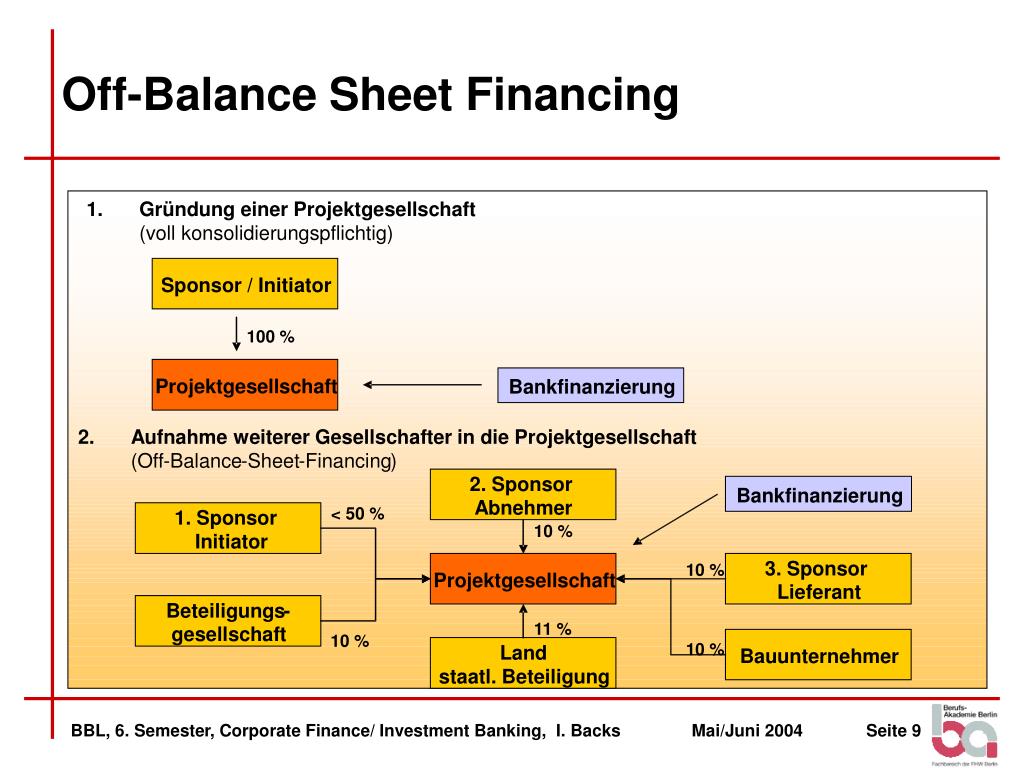

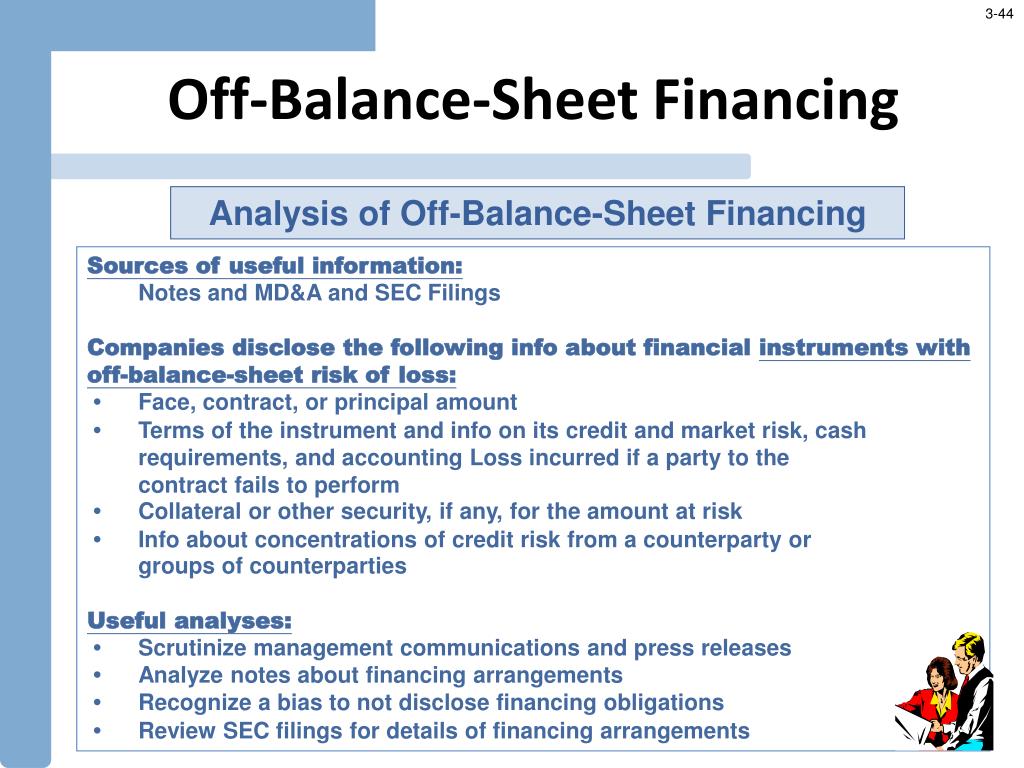

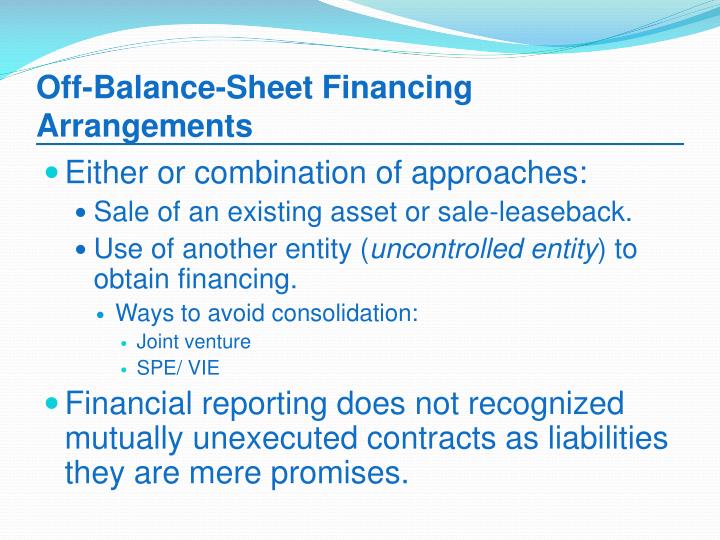

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

This practice helps companies keep. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. Through off balance sheet financing, both international and domestic. While not recorded on the balance sheet itself, these items. It is used to impact a company’s level of debt and.

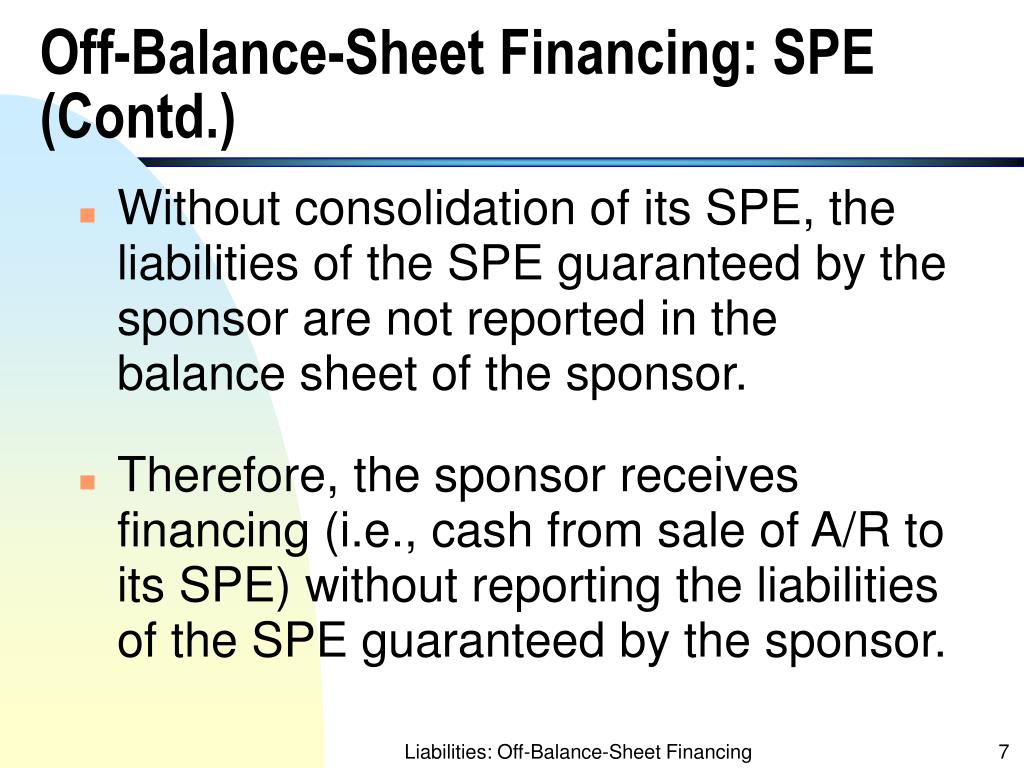

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

Through off balance sheet financing, both international and domestic. This practice helps companies keep. It is used to impact a company’s level of debt and. While not recorded on the balance sheet itself, these items. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors.

OffBalanceSheet Financing Meaning, Methods, Example & More eFM

While not recorded on the balance sheet itself, these items. Through off balance sheet financing, both international and domestic. It is used to impact a company’s level of debt and. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. This practice helps companies keep.

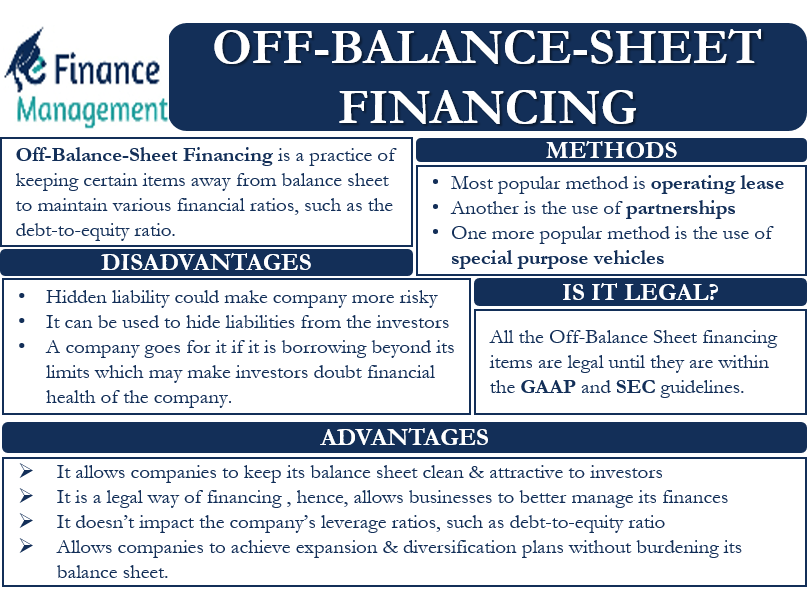

Off Balance Sheet Financing OffBalance Sheet Financing (Definition

Through off balance sheet financing, both international and domestic. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. It is used to impact a company’s level of debt and. This practice helps companies keep. While not recorded on the balance sheet itself, these items.

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

Through off balance sheet financing, both international and domestic. It is used to impact a company’s level of debt and. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. This practice helps companies keep. While not recorded on the balance sheet itself, these items.

Off Balance Sheet Financing Is OffBalance Sheet Financing Legal?

It is used to impact a company’s level of debt and. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. While not recorded on the balance sheet itself, these items. This practice helps companies keep. Through off balance sheet financing, both international and domestic.

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

This practice helps companies keep. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. While not recorded on the balance sheet itself, these items. Through off balance sheet financing, both international and domestic. It is used to impact a company’s level of debt and.

Off Balance Sheet Financing 021 Accounting Principles Initial

Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. While not recorded on the balance sheet itself, these items. This practice helps companies keep. Through off balance sheet financing, both international and domestic. It is used to impact a company’s level of debt and.

Off Balance Sheet Financing OffBalance Sheet Financing (Definition

Through off balance sheet financing, both international and domestic. This practice helps companies keep. While not recorded on the balance sheet itself, these items. It is used to impact a company’s level of debt and. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors.

Through Off Balance Sheet Financing, Both International And Domestic.

This practice helps companies keep. While not recorded on the balance sheet itself, these items. Web off balance sheet financing is used by many businesses as an accounting tool and for raising additional capital from investors. It is used to impact a company’s level of debt and.