When Is Form 8938 Required

When Is Form 8938 Required - Web go to screen 67, foreign reporting (114, 8938).; Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. The due date for fatca reporting is the date your tax return is due to be filed. Individuals who must file form 8938 include u.s. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain. Web 8938 form filing deadline. Web who must file? The standard penalty is a fine of $10,000 per year. Web you must file form 8938 if you must file an income tax return and:

Web see instructions for form 8938 (2019) (indicating that a failure to file form 8938 or to report a specified foreign financial asset required to be reported may cause. Web who must file? For individuals, the form 8938 due dates, include: Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets exceeded the. Select statement of foreign assets (8938) under foreign bank account (114) from the left panel.; If the irs notifies taxpayers that they are. Web definition irs form 8938 is a tax form used by some u.s. The standard penalty is a fine of $10,000 per year. Web go to screen 67, foreign reporting (114, 8938).; Owning the following types of assets also must be reported on form 8938 if your total foreign asset value exceeds.

Web must file form 8938 if you are a specified person (see specified person, later) that has an interest in specified foreign financial assets and the value of those assets is. It is due, therefore, on april 15. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. Web if you are required to file form 8938, you must report the specified foreign financial assets in which you have an interest even if none of the assets affects your tax. The due date for fatca reporting is the date your tax return is due to be filed. Select statement of foreign assets (8938) under foreign bank account (114) from the left panel.; Web who must file? Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. The form 8938 is filed as an attachment to the us person’s annual income tax return.

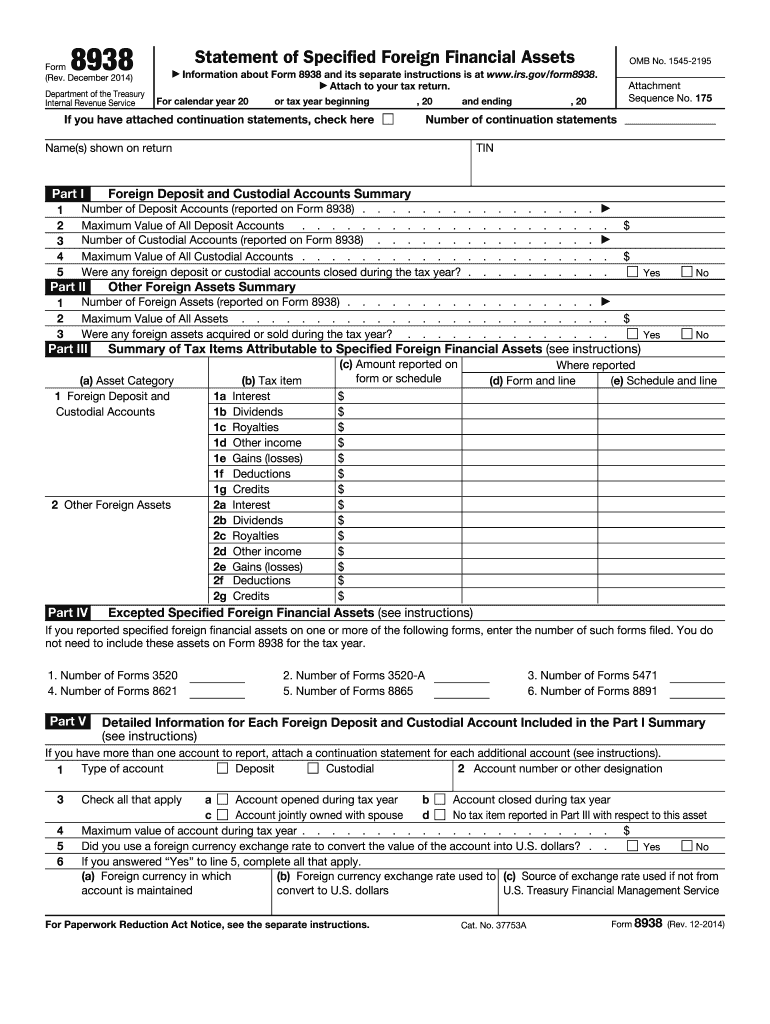

Form 8938 Fill Out and Sign Printable PDF Template signNow

It is due, therefore, on april 15. The due date for fatca reporting is the date your tax return is due to be filed. Web how do i file form 8938, statement of specified foreign financial assets? Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in.

Is Form 8938 Reporting Required for Foreign Pension Plans?

Web 8938 form filing deadline. Individuals who must file form 8938 include u.s. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. The form 8938 is filed as an attachment to the us person’s annual income tax.

The Counting Thread v2 (Page 298) EVGA Forums

Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain. The due date for fatca reporting is the date your tax return is due to be filed. For individuals, the form 8938 due dates, include: Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation.

USCs and LPRs residing outside the U.S. and IRS Form 8938 « Tax

Web on february 23, 2016, the irs issued final regulations under internal revenue code section 6038d that require certain domestic entities to report their foreign financial. Web must file form 8938 if you are a specified person (see specified person, later) that has an interest in specified foreign financial assets and the value of those assets is. Web if you.

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

For individuals, the form 8938 due dates, include: Web on february 23, 2016, the irs issued final regulations under internal revenue code section 6038d that require certain domestic entities to report their foreign financial. Web form 8938 deadline and form 8938 statute of limitations. Web 8938 form filing deadline. You are unmarried and the total value of your specified foreign.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

The due date for fatca reporting is the date your tax return is due to be filed. Web form 8938 deadline and form 8938 statute of limitations. Web if you are required to file form 8938, you must report the specified foreign financial assets in which you have an interest even if none of the assets affects your tax. Individuals.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Web bank and investment accounts must be reported. You are unmarried and the total value of your specified foreign financial assets is more than $50,000 on the last. Web you must file form 8938 if you must file an income tax return and: Web 8938 form filing deadline. Web definition irs form 8938 is a tax form used by some.

Form 8938, Statement of Specified Foreign Financial Assets YouTube

Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Web 8938 form filing deadline. Web you must file form 8938 if you must file an income tax return and: Web use form 8938 to report your specified foreign financial assets if the total.

IRS Reporting Requirements for Foreign Account Ownership and Trust

Web definition irs form 8938 is a tax form used by some u.s. If the irs notifies taxpayers that they are. The form 8938 is filed as an attachment to the us person’s annual income tax return. Select statement of foreign assets (8938) under foreign bank account (114) from the left panel.; The standard penalty is a fine of $10,000.

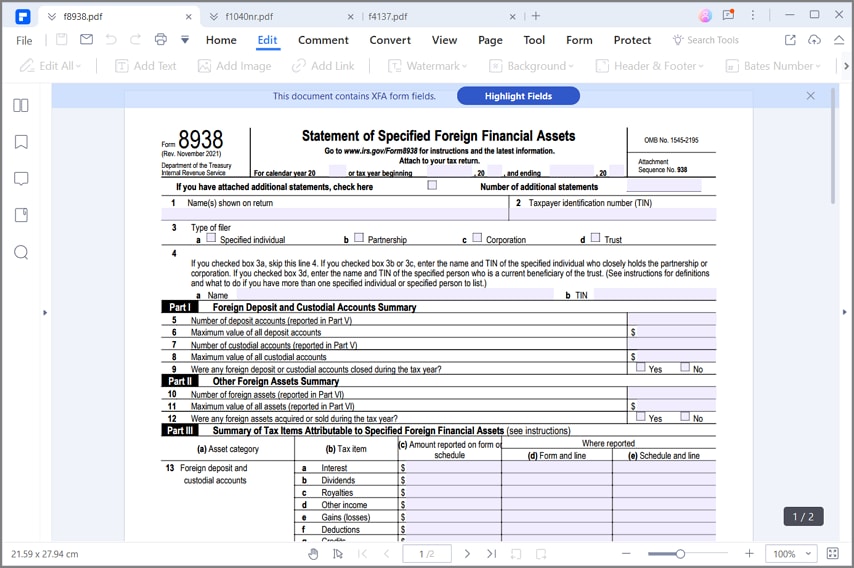

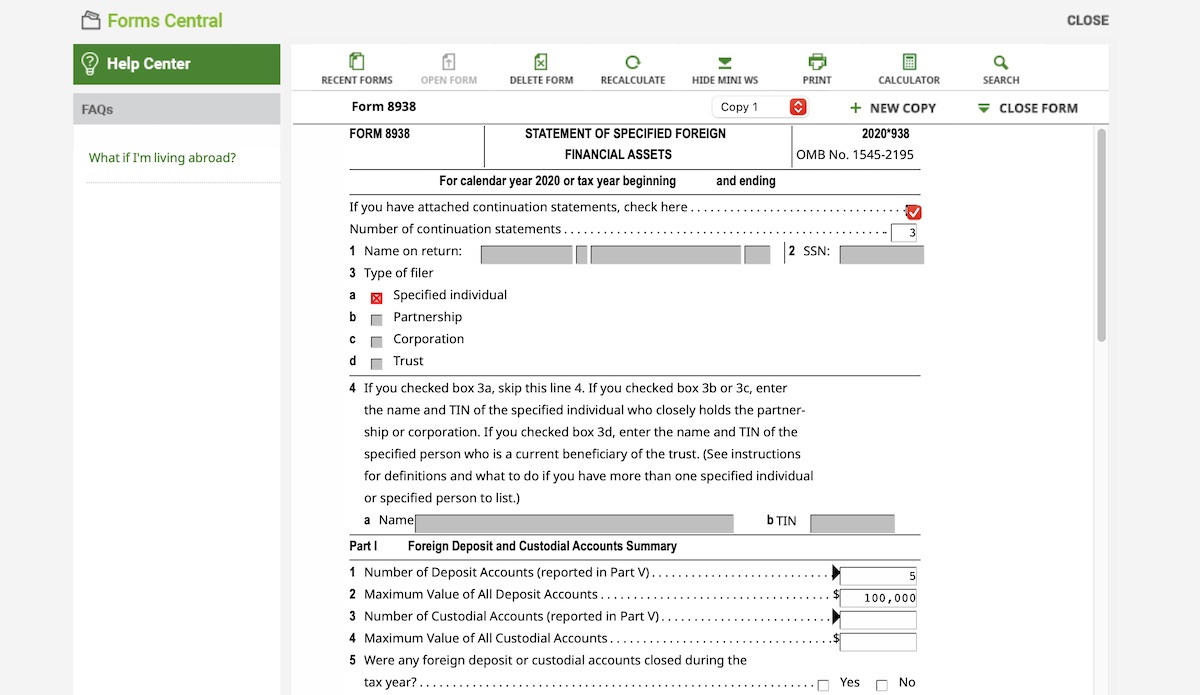

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. Web failing to file form 8938 when required can result in severe penalties. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. You are unmarried and the total.

Web Must File Form 8938 If You Are A Specified Person (See Specified Person, Later) That Has An Interest In Specified Foreign Financial Assets And The Value Of Those Assets Is.

Web see instructions for form 8938 (2019) (indicating that a failure to file form 8938 or to report a specified foreign financial asset required to be reported may cause. Web 8938 form filing deadline. You are unmarried and the total value of your specified foreign financial assets is more than $50,000 on the last. Web form 8938 deadline and form 8938 statute of limitations.

Web Under Prior Law, The Reporting Of Sffas On Form 8938 Solely Applied To Individuals, Provided That The Value Of The Reportable Foreign Assets Exceeded The.

Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. The due date for fatca reporting is the date your tax return is due to be filed. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets.

Owning The Following Types Of Assets Also Must Be Reported On Form 8938 If Your Total Foreign Asset Value Exceeds.

The standard penalty is a fine of $10,000 per year. Web definition irs form 8938 is a tax form used by some u.s. Select statement of foreign assets (8938) under foreign bank account (114) from the left panel.; It is due, therefore, on april 15.

Individuals Who Must File Form 8938 Include U.s.

Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Web who must file? The form 8938 is filed as an attachment to the us person’s annual income tax return. Taxpayers, corporations, partnerships, and trusts that hold foreign assets beyond a certain.