Where To Mail Form 966

Where To Mail Form 966 - Get information on coronavirus relief for. Recalcitrant account holders with u.s. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Web are you going to dissolve your corporation during the tax year? Web here's how it works 02. 2 part v pooled reporting type 1 check applicable pooled reporting type (check only one): Web file form 966 with the internal revenue service center at the address where the corporation (or cooperative) files its income tax return. Where to mail form 966. Web however, you can make an election to be taxed as a c corporation (i.e., an llc for legal purposes that is taxed as a c corporation for tax purposes). Q&a asked in los angeles, ca | dec 12, 2011 save am i required to send a 966 form to the irs?

Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. 2 part v pooled reporting type 1 check applicable pooled reporting type (check only one): Recalcitrant account holders with u.s. Q&a asked in los angeles, ca | dec 12, 2011 save am i required to send a 966 form to the irs? Web include all information required by form 966 that was not given in the earlier form. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Share your form with others send it. Check the box labeled print form 966. Web file form 966 with the internal revenue service center at the address where the corporation (or cooperative) files its income tax return.

Share your form with others send it. Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. Web where to file file form 966 with the internal revenue service center at the applicable address shown below: Where to file file form 966 with the internal revenue service center at the address where the. Go to screen 51, corp.dissolution/liquidation (966). Web file form 966 with the internal revenue service center at the address where the corporation (or cooperative) files its income tax return. Sign online button or tick the preview image of the blank. 2 part v pooled reporting type 1 check applicable pooled reporting type (check only one): Web form 8966 (2022) page. Web here's how it works 02.

Fill Free fillable Corporate Dissolution or Liquidation Form 966 PDF form

Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. Get information on coronavirus relief for. Web here's how it works 02. Web however, you can make an election to be taxed as a c corporation (i.e., an llc for legal purposes that is taxed as.

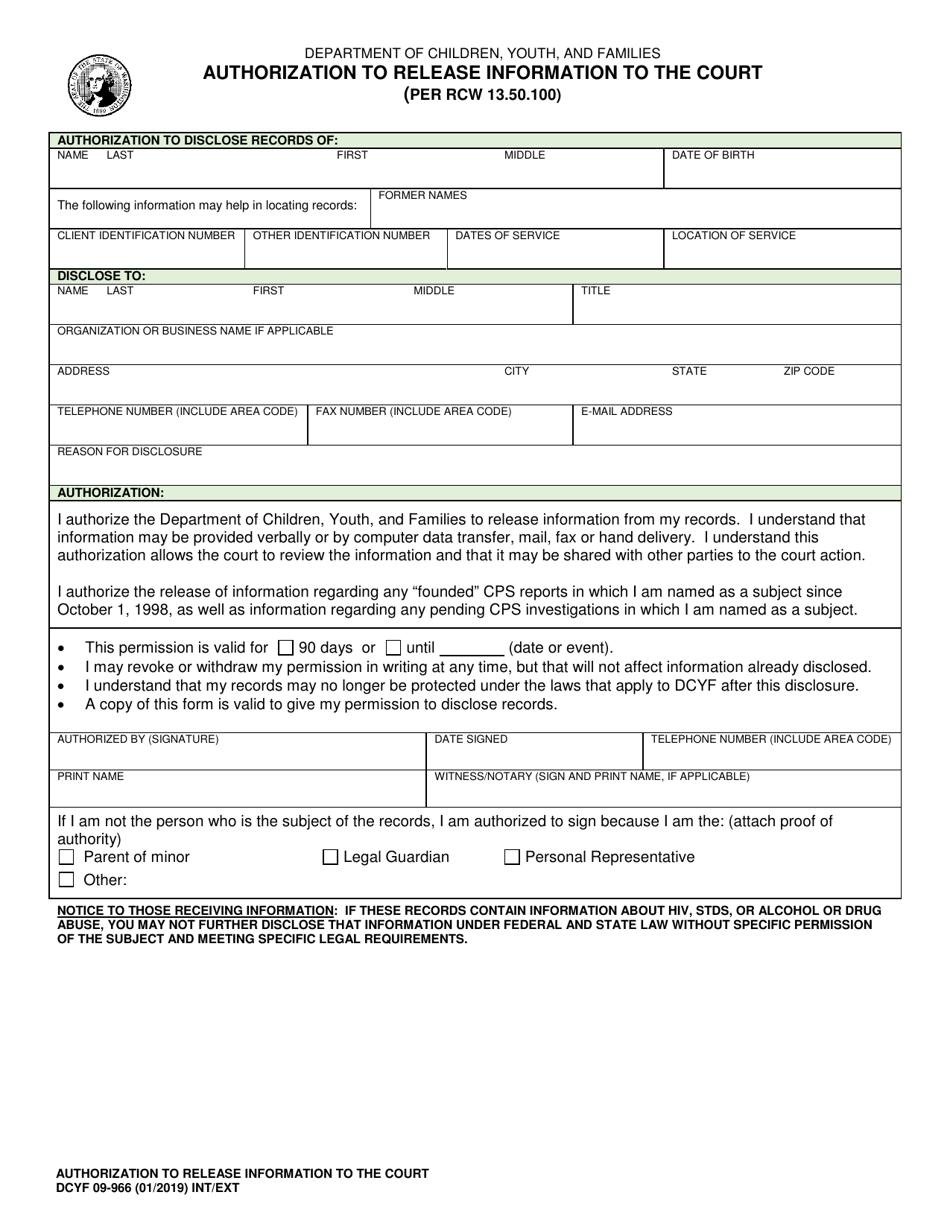

DCYF Form 09966 Download Fillable PDF or Fill Online Authorization to

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Recalcitrant account holders with u.s. Web here's how it works 02. Web are you.

How to Complete IRS Form 966 Bizfluent

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Share your form with others send it. Where to mail form 966. Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. Web.

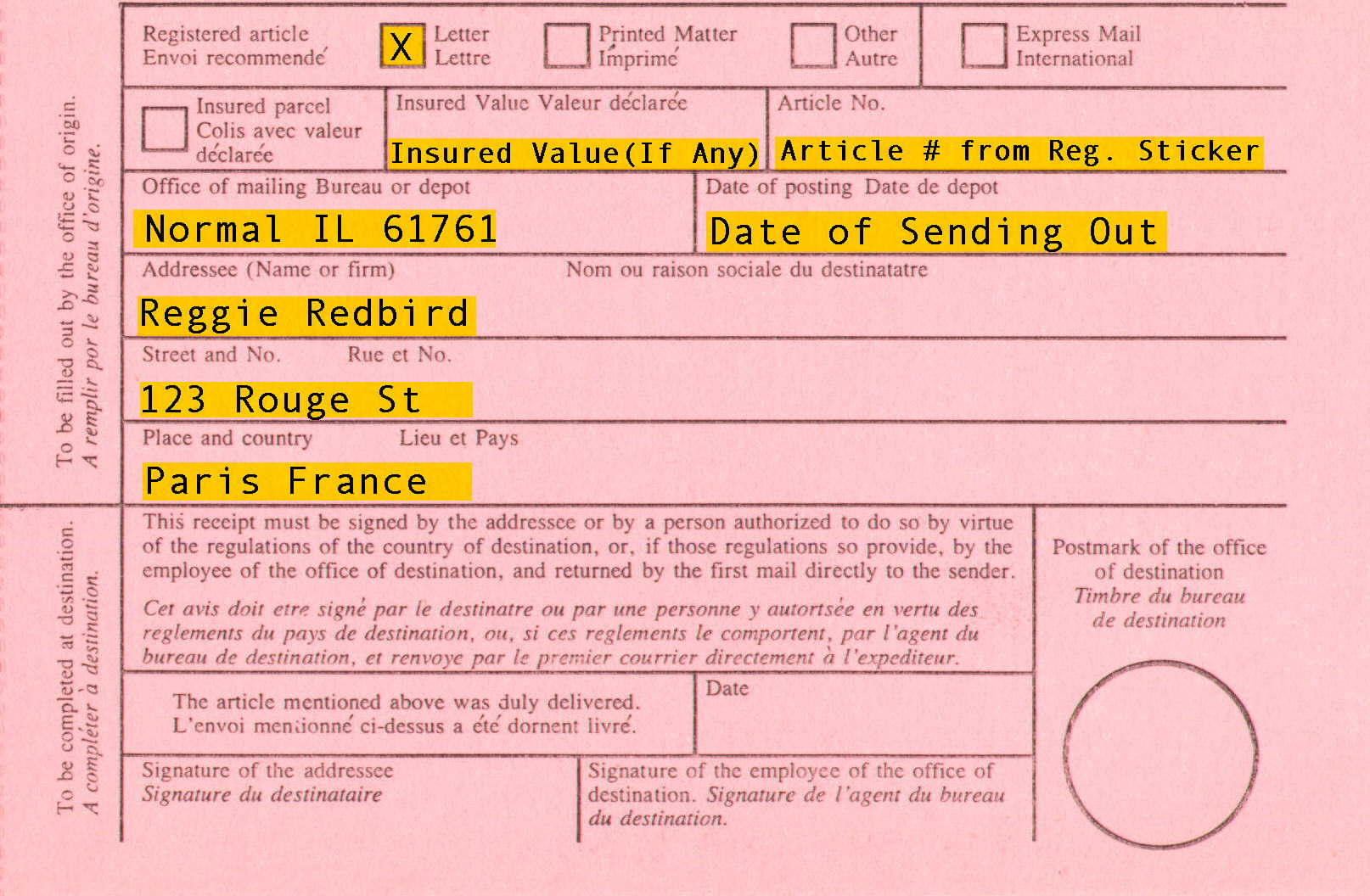

Registered Mail Information

Web however, you can make an election to be taxed as a c corporation (i.e., an llc for legal purposes that is taxed as a c corporation for tax purposes). 2 part v pooled reporting type 1 check applicable pooled reporting type (check only one): Web file form 966 with the internal revenue service center at the address where the.

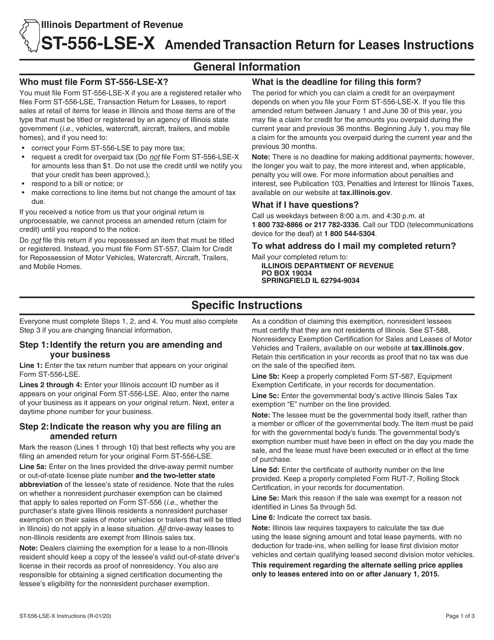

Download Instructions for Form ST556LSEX, 966 Amended Transaction

To get started on the document, utilize the fill camp; Go to screen 51, corp.dissolution/liquidation (966). Web here's how it works 02. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Share your form with others send irs.

Form 966 (Rev PDF Tax Return (United States) S Corporation

Recalcitrant account holders with u.s. Sign online button or tick the preview image of the blank. Web form 8966 (2022) page. Share your form with others send it. Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate.

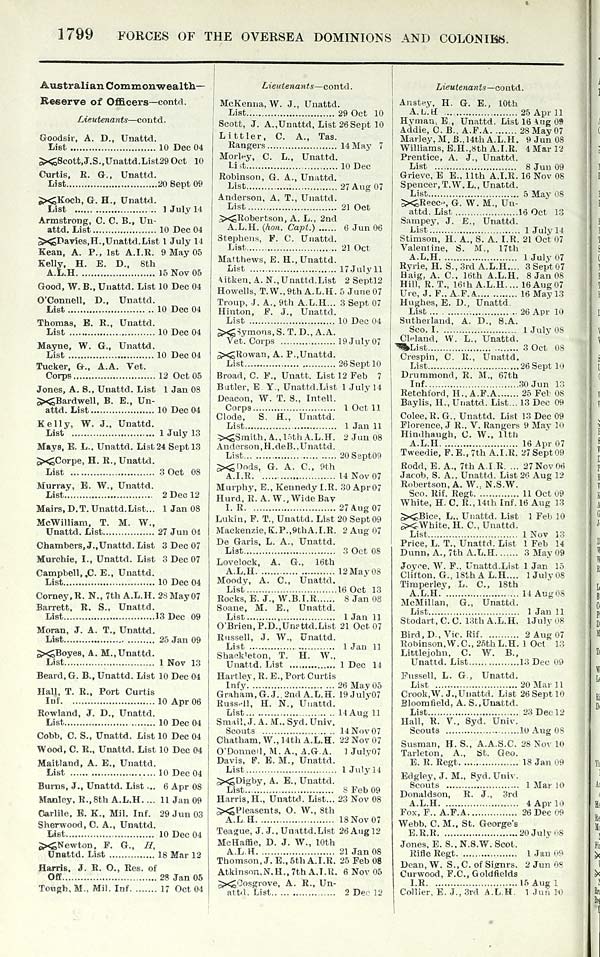

(966) Army lists > Quarterly Army Lists (First Series) 18791922

To get started on the document, utilize the fill camp; The specific mailing address depends on the state where your corporation is based. Web are you going to dissolve your corporation during the tax year? Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. Recalcitrant.

(966) Army lists > Hart's Army Lists > Hart's annual army list

2 part v pooled reporting type 1 check applicable pooled reporting type (check only one): Web are you going to dissolve your corporation during the tax year? Check the box labeled print form 966. Web form 8966 (2022) page. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation.

Closing a Corporation Do I File IRS Form 966

Where to file file form 966 with the internal revenue service center at the address where the. Web where to file file form 966 with the internal revenue service center at the applicable address shown below: Check the box labeled print form 966. To get started on the document, utilize the fill camp; Sign it in a few clicks draw.

Where To Mail Form 966 Fill Out and Sign Printable PDF Template signNow

Web if you want to notify us by submitting the form, download and fill out an intent to file a claim for compensation and/or pension, or survivors pension and/or dic. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Make sure to file irs form 966.

Sign It In A Few Clicks Draw Your Signature, Type It, Upload Its Image, Or Use Your Mobile Device As A Signature Pad.

Web if you want to notify us by submitting the form, download and fill out an intent to file a claim for compensation and/or pension, or survivors pension and/or dic. Where to mail form 966. 2 part v pooled reporting type 1 check applicable pooled reporting type (check only one): To get started on the document, utilize the fill camp;

Web Are You Going To Dissolve Your Corporation During The Tax Year?

Share your form with others send it. Check the box labeled print form 966. Web form 966 is filed with the internal revenue service center at the address where the corporation or cooperative files its income tax return. Web here's how it works 02.

Q&A Asked In Los Angeles, Ca | Dec 12, 2011 Save Am I Required To Send A 966 Form To The Irs?

Get information on coronavirus relief for. Web form 8966 (2022) page. Go to screen 51, corp.dissolution/liquidation (966). Where to file file form 966 with the internal revenue service center at the address where the.

Web File Form 966 With The Internal Revenue Service Center At The Address Where The Corporation (Or Cooperative) Files Its Income Tax Return.

Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Web include all information required by form 966 that was not given in the earlier form. Web however, you can make an election to be taxed as a c corporation (i.e., an llc for legal purposes that is taxed as a c corporation for tax purposes). Web where to file file form 966 with the internal revenue service center at the applicable address shown below: