Where To Send Ss4 Form

Where To Send Ss4 Form - Neff whether you’re launching a new business or seeking financing for. Application for employer identification number (for use by employers, corporations,. Web answer an ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Get it printed out on paper. To apply using this online portal you must have a business address in the u.s. August social security checks are getting disbursed this week for recipients who've. Web application for a social security card. Authorization to disclose information to the social. Web if you don’t have an ein by the time a tax deposit is due, send your payment to the internal revenue service center for your filing area as shown in the instructions. Web where you mail the completed irs for 941 form depends on what state you live in, whether you are including a payment, and other factors.

Web answer an ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Web download the ss4 form from irs.gov. Authorization to disclose information to the social. Check the content again and put the. Web if you don’t have an ein by the time a tax deposit is due, send your payment to the internal revenue service center for your filing area as shown in the instructions. December 2001) (for use by employers, corporations, partnerships, trusts, estates, churches, government. Web application for a social security card. In some areas, you may request a replacement social security card online. Web are businesses required to obtain the taxpayer identification number (tin) from vendors and keep it somewhere on file? Get it printed out on paper.

Check the content again and put the. Web answer an ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Fill out the form seriously according to the specific instructions. December 2001) (for use by employers, corporations, partnerships, trusts, estates, churches, government. Changes in responsible parties must be reported to the irs within 60 days. August social security checks are getting disbursed this week for recipients who've. Neff whether you’re launching a new business or seeking financing for. Web application for a social security card. Web if you don’t have an ein by the time a tax deposit is due, send your payment to the internal revenue service center for your filing area as shown in the instructions. Web we would like to show you a description here but the site won’t allow us.

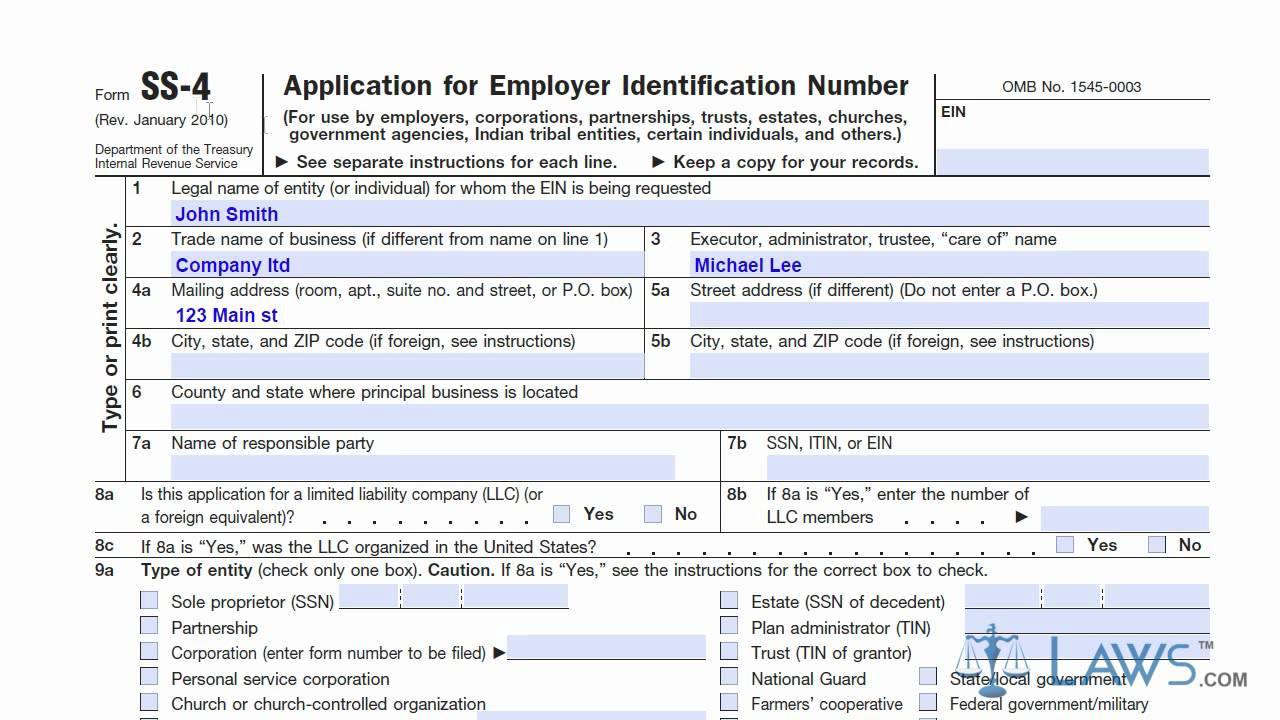

Ss4 Form Application For Employer Identification Number Stock Photo

In some areas, you may request a replacement social security card online. Get it printed out on paper. Web are businesses required to obtain the taxpayer identification number (tin) from vendors and keep it somewhere on file? July 29, 2023 5:00 a.m. The irs no longer issues eins by.

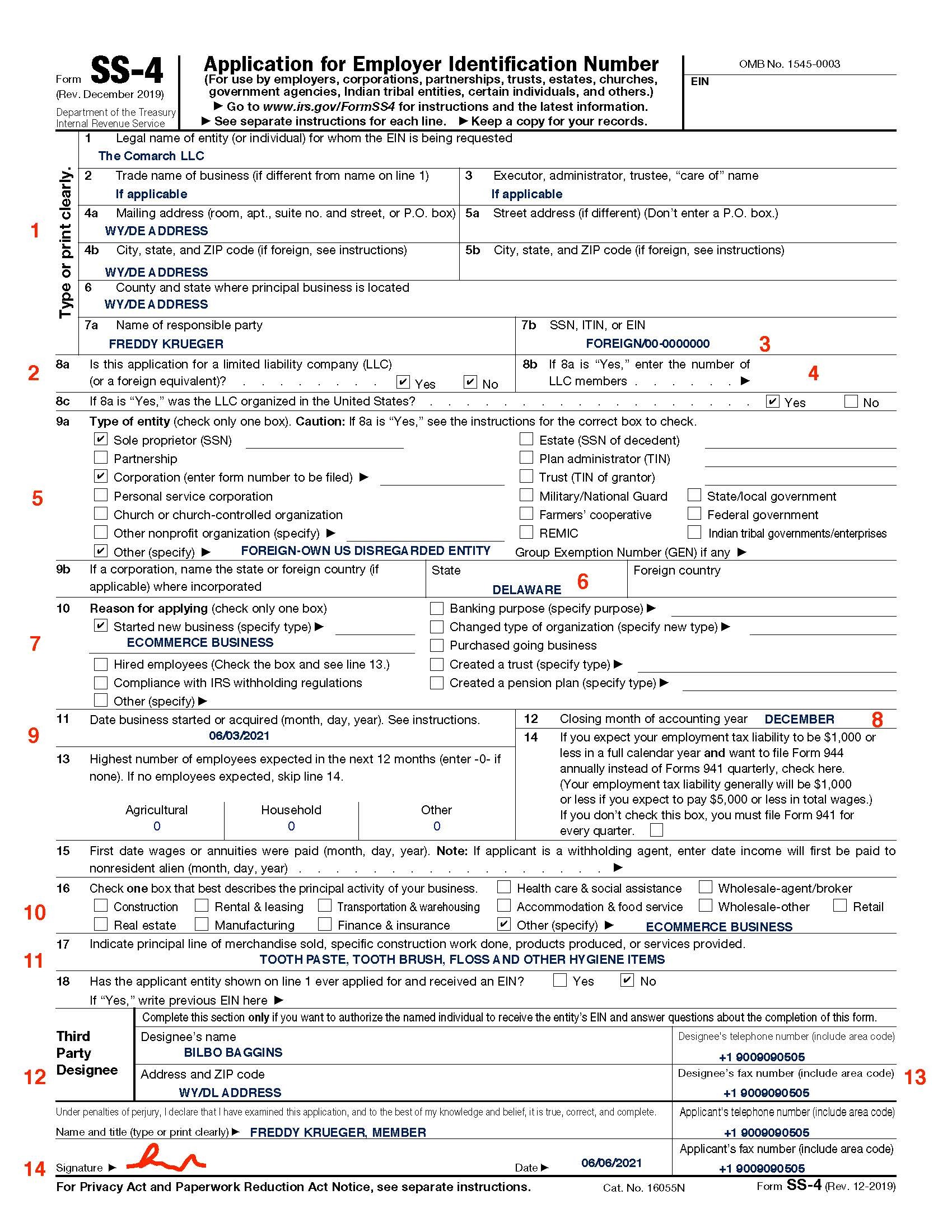

Sample EIN SS4 Application Form 2009

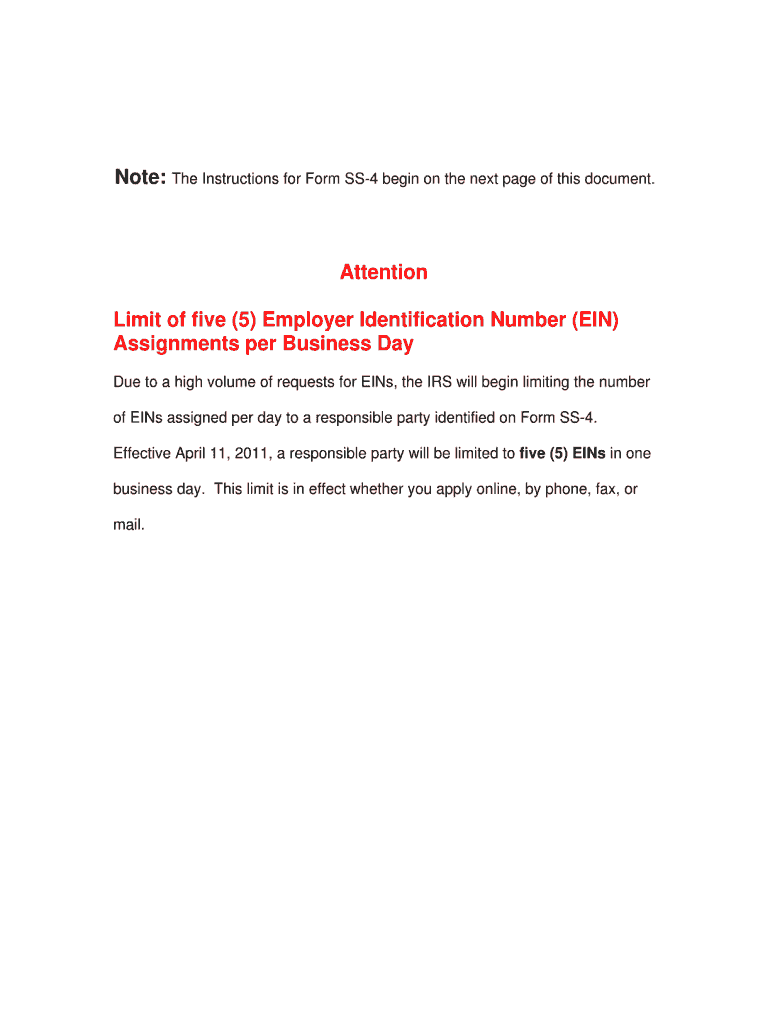

Changes in responsible parties must be reported to the irs within 60 days. Web where you mail the completed irs for 941 form depends on what state you live in, whether you are including a payment, and other factors. Application for employer identification number (for use by employers, corporations,. December 2001) (for use by employers, corporations, partnerships, trusts, estates, churches,.

Learn How to Fill the Form SS 4 Application for EIN YouTube

To apply using this online portal you must have a business address in the u.s. Changes in responsible parties must be reported to the irs within 60 days. Neff whether you’re launching a new business or seeking financing for. August social security checks are getting disbursed this week for recipients who've. December 2001) (for use by employers, corporations, partnerships, trusts,.

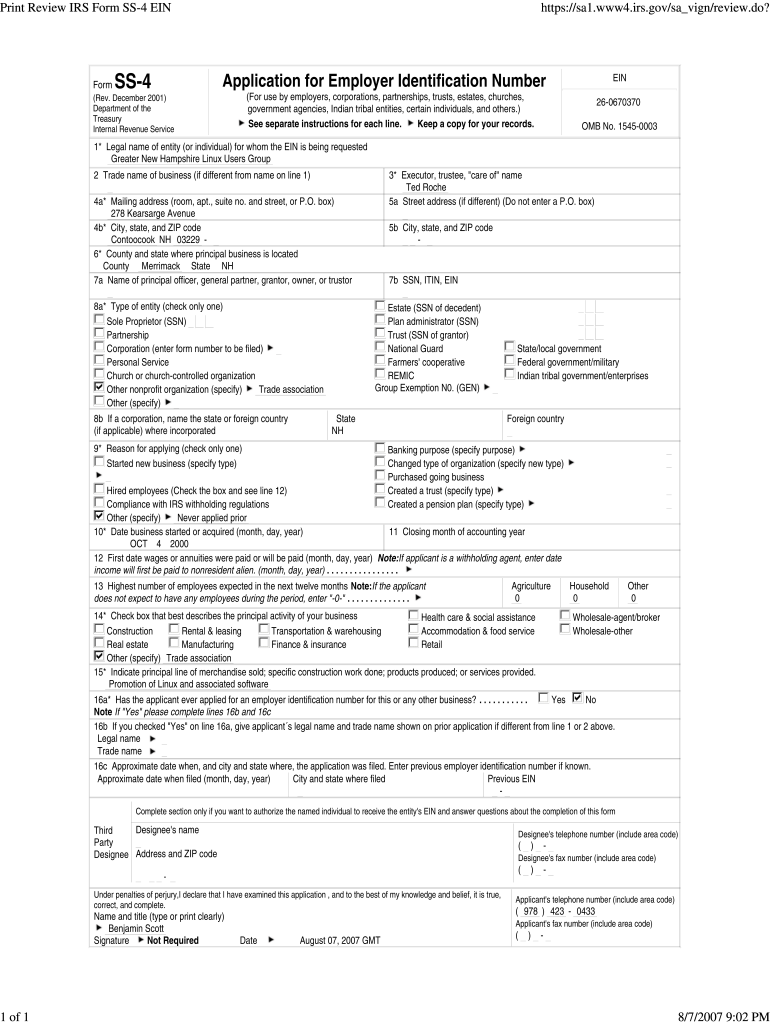

form ss4 instructions Fill Online, Printable, Fillable Blank form

Web we would like to show you a description here but the site won’t allow us. In some areas, you may request a replacement social security card online. For details of where you. December 2001) (for use by employers, corporations, partnerships, trusts, estates, churches, government. Web answer an ein, also known as a federal taxpayer identification number, is a type.

Understanding the SS4 form Firstbase.io

Web we would like to show you a description here but the site won’t allow us. Fill out the form seriously according to the specific instructions. Changes in responsible parties must be reported to the irs within 60 days. If you choose to fax in your form, you can send it to the fax number (855) 641. Web answer an.

Instructions For Form Ss4 Fill Out and Sign Printable PDF Template

August social security checks are getting disbursed this week for recipients who've. Web we would like to show you a description here but the site won’t allow us. Web are businesses required to obtain the taxpayer identification number (tin) from vendors and keep it somewhere on file? Web download the ss4 form from irs.gov. Application for employer identification number (for.

Irs.gov Form Ss4 Online MBM Legal

In some areas, you may request a replacement social security card online. Web if you don’t have an ein by the time a tax deposit is due, send your payment to the internal revenue service center for your filing area as shown in the instructions. Changes in responsible parties must be reported to the irs within 60 days. For details.

Ein Ss4 Fillable Form 2020 Fill and Sign Printable Template Online

Web application for a social security card. Web answer an ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Application for employer identification number (for use by employers, corporations,. July 29, 2023 5:00 a.m. The irs no longer issues eins by.

Form SS4 Example Demo YouTube

Web are businesses required to obtain the taxpayer identification number (tin) from vendors and keep it somewhere on file? The irs no longer issues eins by. Web if you don’t have an ein by the time a tax deposit is due, send your payment to the internal revenue service center for your filing area as shown in the instructions. In.

Fill Out The SS4 For Opening An LLC Sailing and Open Seas

Check the content again and put the. Neff whether you’re launching a new business or seeking financing for. Changes in responsible parties must be reported to the irs within 60 days. Authorization to disclose information to the social. Web answer an ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business.

Application For Employer Identification Number (For Use By Employers, Corporations,.

August social security checks are getting disbursed this week for recipients who've. Web are businesses required to obtain the taxpayer identification number (tin) from vendors and keep it somewhere on file? December 2001) (for use by employers, corporations, partnerships, trusts, estates, churches, government. Get it printed out on paper.

Web Where You Mail The Completed Irs For 941 Form Depends On What State You Live In, Whether You Are Including A Payment, And Other Factors.

Web answer an ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Changes in responsible parties must be reported to the irs within 60 days. In some areas, you may request a replacement social security card online. If you choose to fax in your form, you can send it to the fax number (855) 641.

Web We Would Like To Show You A Description Here But The Site Won’t Allow Us.

Fill out the form seriously according to the specific instructions. December 2019) department of the treasury internal revenue service. Neff whether you’re launching a new business or seeking financing for. The irs no longer issues eins by.

Check The Content Again And Put The.

To apply using this online portal you must have a business address in the u.s. Web application for a social security card. July 29, 2023 5:00 a.m. Web if you don’t have an ein by the time a tax deposit is due, send your payment to the internal revenue service center for your filing area as shown in the instructions.