1099 Rent Form

1099 Rent Form - If you have not already entered the applicable. Ad discover a wide selection of 1099 tax forms at staples®. Too early may result in a balance due. Services performed by someone who is not your employee. The taxpayer first act of 2019, enacted. Web instructions for recipient recipient’s taxpayer identification number (tin). Wait to file this claim until all statements are received. We have reduced the height of the form so it can accommodate 3 forms on a page. The basics of form 1099 for landlords. Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy.

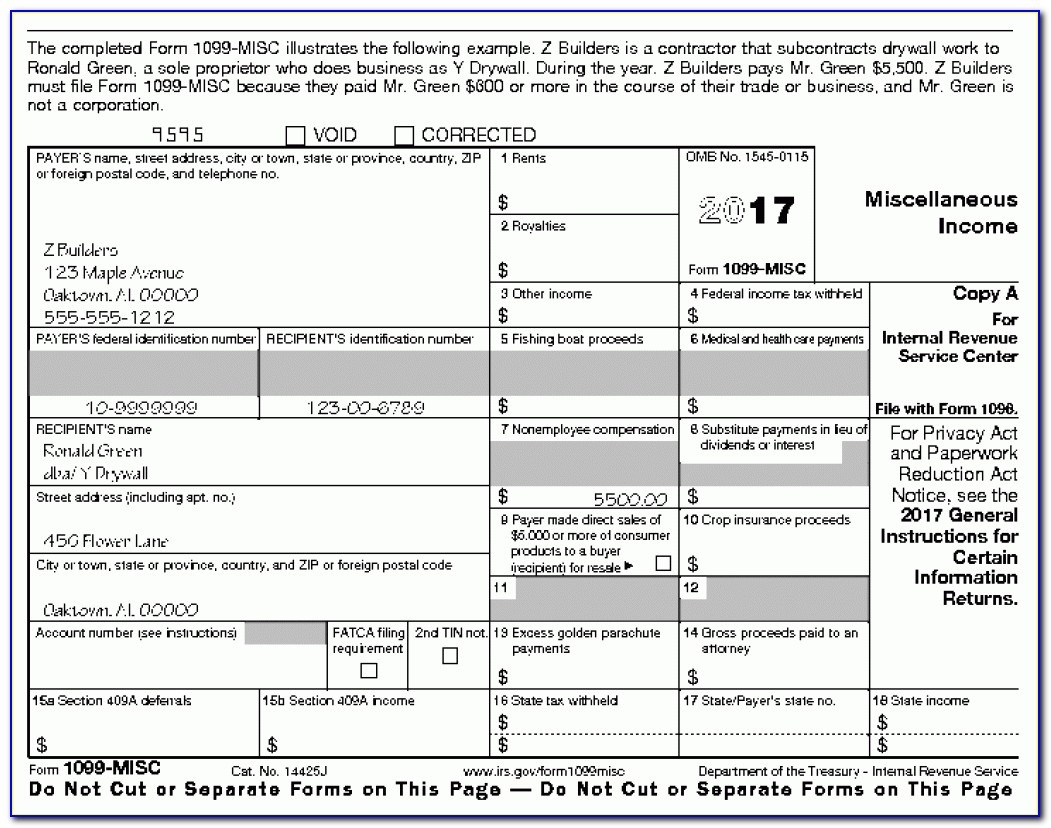

The basics of form 1099 for landlords. Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. You will then receive a form 1099 form reporting the. Ad discover a wide selection of 1099 tax forms at staples®. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. File the state copy of form 1099 with the missouri taxation. Web instructions for recipient recipient’s taxpayer identification number (tin). Web according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. The taxpayer first act of 2019, enacted. Landlords need to submit a 1099 if they hire an independent contractor and pay them more than $600 over the course of the.

Landlords need to submit a 1099 if they hire an independent contractor and pay them more than $600 over the course of the. The pse may have contracted with an electronic payment. What tenants and landlords need to know #general #taxes david maina updated on: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web file the following forms with the state of missouri: Ad get ready for tax season deadlines by completing any required tax forms today. The taxpayer first act of 2019, enacted. If you have not already entered the applicable. Web according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. For your protection, this form may show only the last four digits of your social security number.

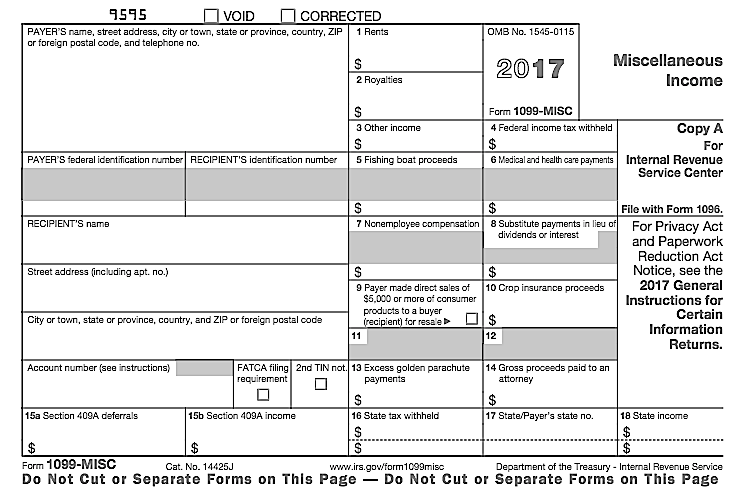

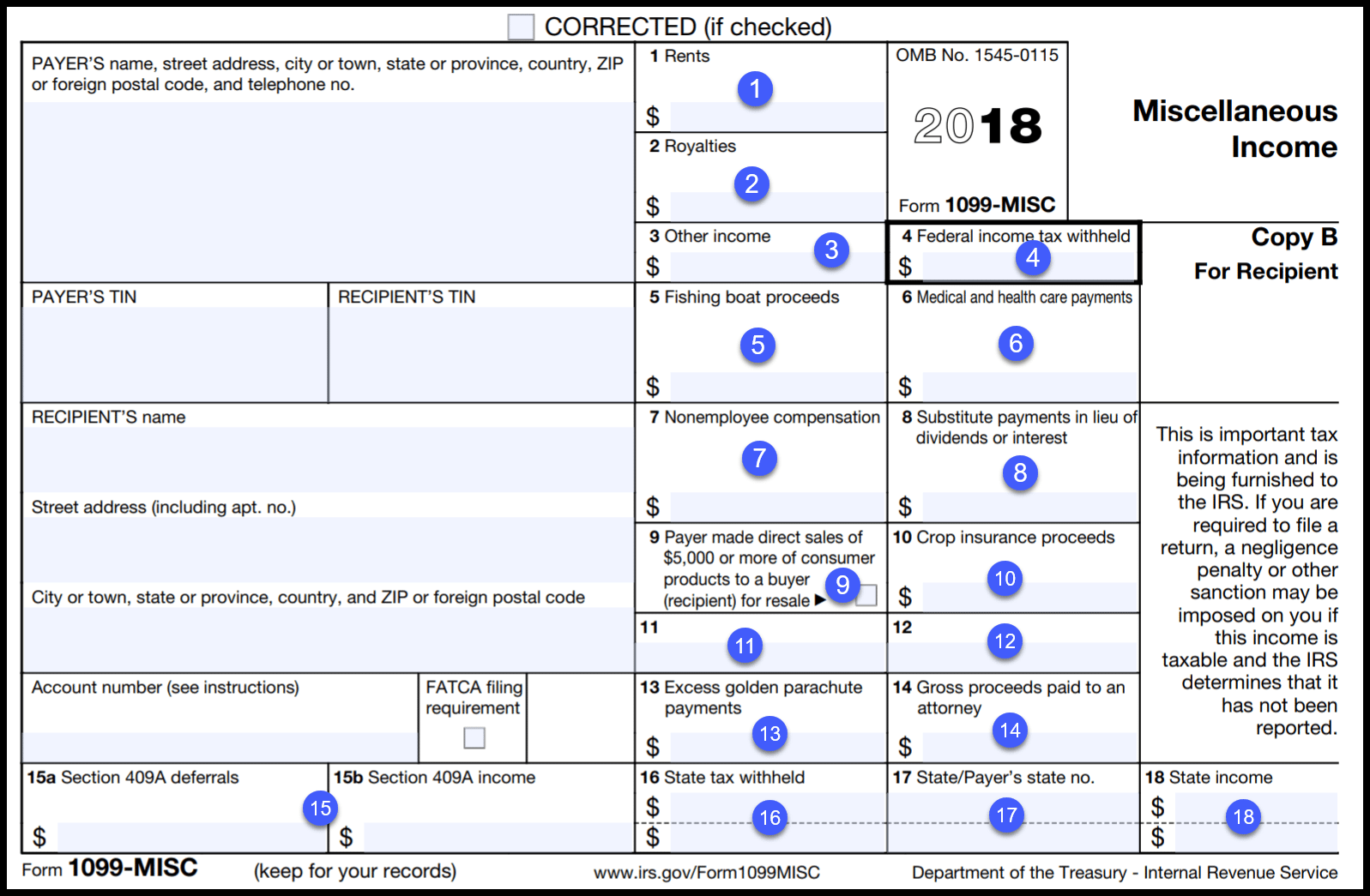

1099 Misc Template klauuuudia

In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. July 25, 2023 you can always count on.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

We have reduced the height of the form so it can accommodate 3 forms on a page. Web file the following forms with the state of missouri: The pse may have contracted with an electronic payment. The taxpayer first act of 2019, enacted. Web the 1040 form is the official tax return that taxpayers have to file with the irs.

1099MISC forms The what, when & how Buildium

Web file the following forms with the state of missouri: Ad discover a wide selection of 1099 tax forms at staples®. July 25, 2023 you can always count on the internal revenue service. Web form 1099 for rent: The basics of form 1099 for landlords.

IRS Form 1099 Reporting for Small Business Owners

In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Web according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Enter the total amount of wages, pensions, annuities, dividends,. Ad discover a wide selection of 1099 tax forms at staples®. What.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

Web according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions. Complete, edit or print tax forms instantly. Too early may result in a balance due. Web instructions for recipient recipient’s taxpayer identification number (tin). What tenants and landlords need to know #general #taxes david maina updated on:

Prepare for the Extended Tax Season With Your Rental Property These

The taxpayer first act of 2019, enacted. You will then receive a form 1099 form reporting the. Ad get ready for tax season deadlines by completing any required tax forms today. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. The pse may have contracted with an electronic payment.

Tax Form 1099MISC Copy A Federal (5110) Mines Press

Web instructions for recipient recipient’s taxpayer identification number (tin). Services performed by someone who is not your employee. Wait to file this claim until all statements are received. Too early may result in a balance due. The basics of form 1099 for landlords.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

Web form 1099 for rent: You will then receive a form 1099 form reporting the. Services performed by someone who is not your employee. If you have not already entered the applicable. The basics of form 1099 for landlords.

11 Common Misconceptions About Irs Form 11 Form Information Free

Wait to file this claim until all statements are received. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Web instructions for recipient recipient’s taxpayer identification number (tin). You will then receive a form 1099 form reporting the. Web the 1040 form is the official tax return that taxpayers have.

Efile Form 1099MISC Online How to File 1099 MISC for 2019

Too early may result in a balance due. If you have not already entered the applicable. July 25, 2023 you can always count on the internal revenue service. Wait to file this claim until all statements are received. For your protection, this form may show only the last four digits of your social security number.

Web The 1040 Form Is The Official Tax Return That Taxpayers Have To File With The Irs Each Year To Report Taxable Income And Calculate Their Taxes Due.

Wait to file this claim until all statements are received. Web file the following forms with the state of missouri: Shop a wide variety of 1099 tax forms from top brands at staples®. Ad discover a wide selection of 1099 tax forms at staples®.

If You Have Not Already Entered The Applicable.

The pse may have contracted with an electronic payment. You will then receive a form 1099 form reporting the. Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Web instructions for recipient recipient’s taxpayer identification number (tin).

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web form 1099 for rent: If you rent out your property for $1,000/month. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Complete, edit or print tax forms instantly.

Landlords Need To Submit A 1099 If They Hire An Independent Contractor And Pay Them More Than $600 Over The Course Of The.

Enter the total amount of wages, pensions, annuities, dividends,. Services performed by someone who is not your employee. What tenants and landlords need to know #general #taxes david maina updated on: Web according to the irs, a taxpayer must report all rental income when preparing rental property taxes with few exceptions.