2018 Form 8995

2018 Form 8995 - Web form 8995 is the simplified form and is used if all of the following are true: Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. Web what is form 8995? Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: • you have qbi, qualified reit dividends, or qualified ptp income or loss. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. When attached to the esbt tax. Form 8995 and form 8995a. Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to. Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing.

Web for the 2018 tax year, taxpayers must calculate the deduction amount on a worksheet, filed separately from the taxpayer’s return. On april 15, 2019, the irs. Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. Web in 2018, qbid was calculated on worksheets in publication 535, but beginning in 2019 qbid is calculated on two tax forms: Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. When attached to the esbt tax. Web form 8995 department of the treasury. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041.

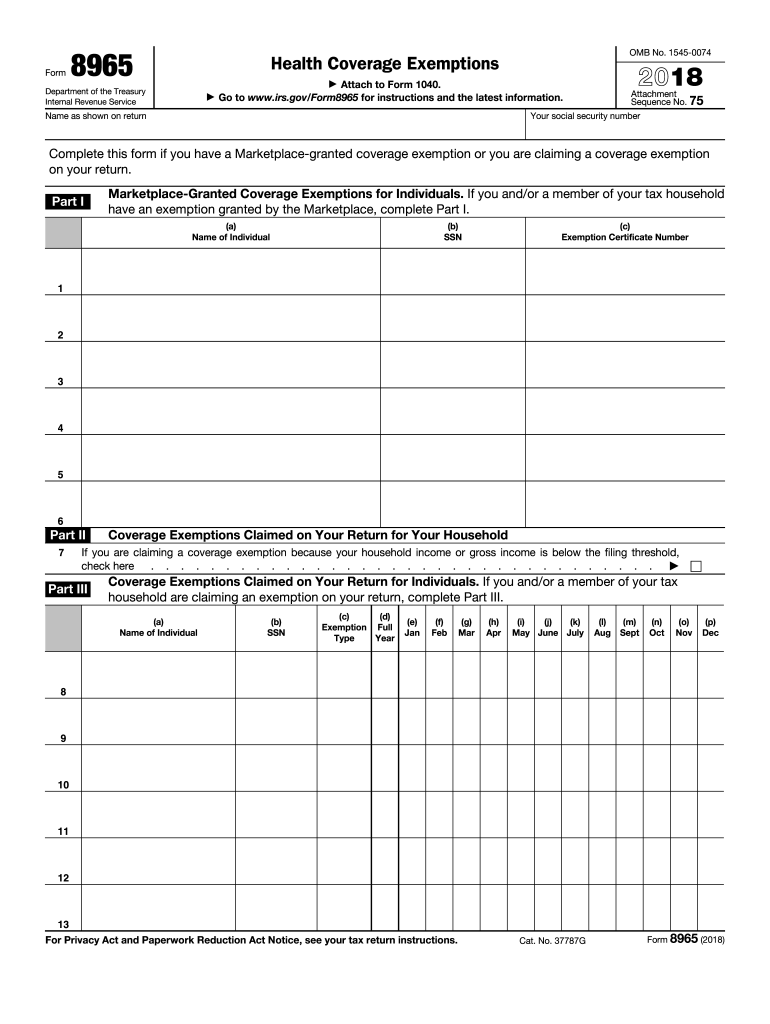

Click to expand the qualified business deduction (qbi) the qualified business income deduction, also know as the section 199a deduction,. Form 8995 and form 8995a. Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. On april 15, 2019, the irs. Web in 2018, qbid was calculated on worksheets in publication 535, but beginning in 2019 qbid is calculated on two tax forms: Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing. How you can fill out the irs 8965 2018 on the internet: • you have qbi, qualified reit dividends, or qualified ptp income or loss.

Kings Norton Sixth Form Students Exceed Targets at Top Grades Kings

Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. On april.

Solved Rob Wriggle operates a small plumbing supplies business as a

Click to expand the qualified business deduction (qbi) the qualified business income deduction, also know as the section 199a deduction,. On april 15, 2019, the irs. Web form 8995 is the simplified form and is used if all of the following are true: Web in 2018, qbid was calculated on worksheets in publication 535, but beginning in 2019 qbid is.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Web form 8995 department of the treasury. Click to expand the qualified business deduction (qbi) the qualified business income deduction, also know as the section 199a deduction,. Web form 8995 is the simplified form and is used if all of the following are true: Web in 2018, qbid was calculated on worksheets in publication 535, but beginning in 2019 qbid.

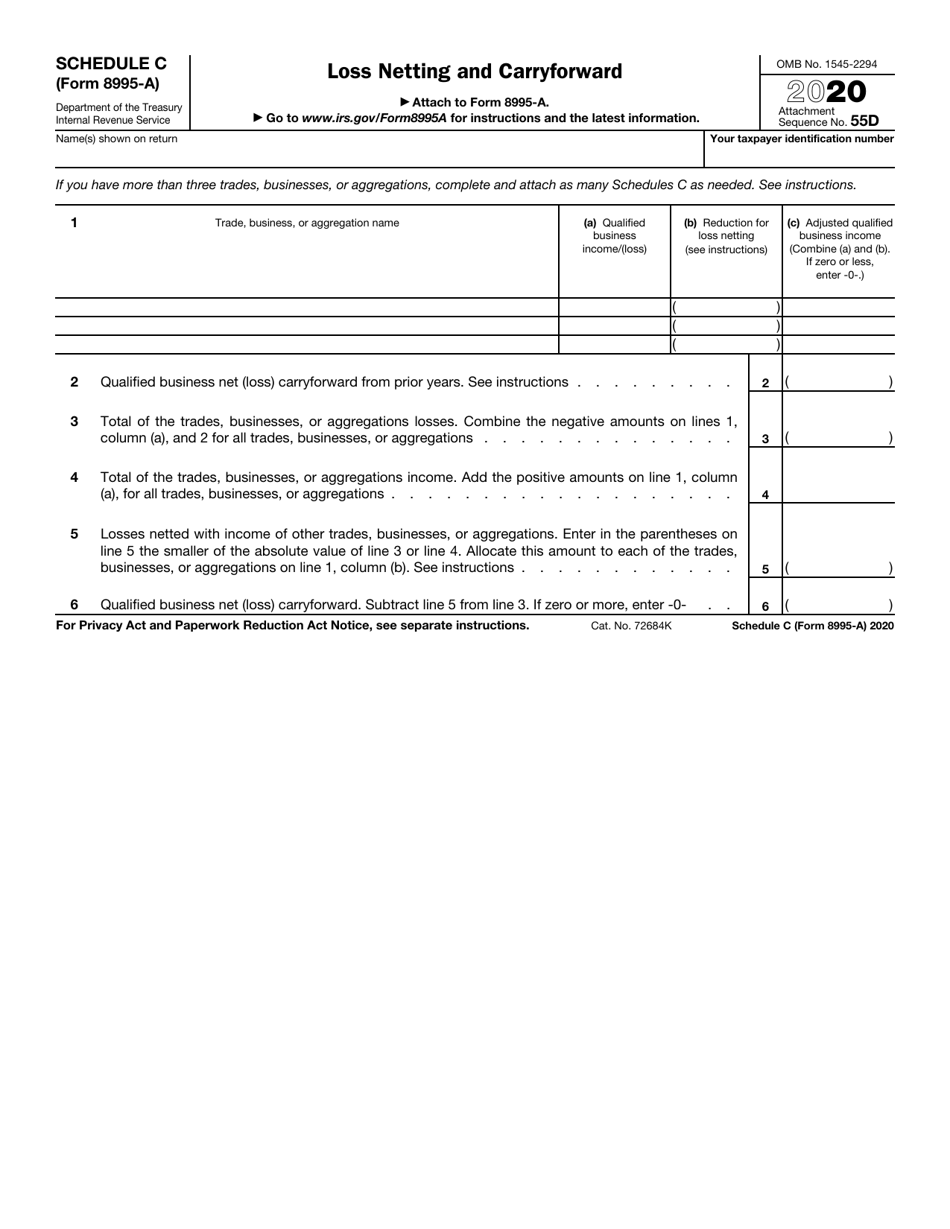

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

Form 8995 and form 8995a. Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. How you can fill out the irs 8965 2018 on the.

IRS Form 8995 Instructions Your Simplified QBI Deduction

Web form 8995 department of the treasury. Web what is form 8995? Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing. When attached to the esbt tax. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax.

20182023 Form IRS 8965 Fill Online, Printable, Fillable, Blank pdfFiller

Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing. Web for the 2018 tax year, taxpayers.

8995 Instructions 2022 2023 IRS Forms Zrivo

Web form 8995 department of the treasury. On april 15, 2019, the irs. Web form 8995 is the simplified form and is used if all of the following are true: Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web • if you own, are a partner in, or are.

Fill Free fillable Form 8995 Qualified Business Deduction

On april 15, 2019, the irs. Web form 8995 department of the treasury. Web in 2018, qbid was calculated on worksheets in publication 535, but beginning in 2019 qbid is calculated on two tax forms: Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for.

What Is Qualified Business For Form 8995 Leah Beachum's Template

Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041. • you have qbi, qualified reit dividends, or qualified ptp income or loss. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. How you can fill out.

WHERE DO WE ENTER FORM 8995 QUALIFIED BUSINESS DEDUCTION LOSS

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. When attached to the esbt tax. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the.

Web Form 8995 Department Of The Treasury.

Web in 2018, qbid was calculated on worksheets in publication 535, but beginning in 2019 qbid is calculated on two tax forms: Web form 8995 is the simplified form and is used if all of the following are true: On april 15, 2019, the irs. Click to expand the qualified business deduction (qbi) the qualified business income deduction, also know as the section 199a deduction,.

Web • If You Own, Are A Partner In, Or Are A Shareholder Of A Sole Proprietorship, Partnership, Or Limited Liability Company (Llcs), You Need To File Form 8995 Or Form.

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. • you have qbi, qualified reit dividends, or qualified ptp income or loss. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web the form 8995 used to compute the s portion’s qbi deduction must be attached as a pdf to the esbt tax worksheet filed with form 1041.

When Attached To The Esbt Tax.

Web what is form 8995? Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any. Web for the 2018 tax year, taxpayers must calculate the deduction amount on a worksheet, filed separately from the taxpayer’s return. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if:

Use This Form If Your Taxable Income, Before Your Qualified Business Income Deduction, Is At Or Below $163,300 ($326,600 If Married Filing.

Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to. Form 8995 and form 8995a. How you can fill out the irs 8965 2018 on the internet: Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022.