2022 1099-Nec Form

2022 1099-Nec Form - Irs forms 1099 arrived around the end of january 2023 for 2022 payments. The amount of the fine depends on the number of returns and. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. What you need employer identification number (ein) iris transmitter control code (tcc). Current general instructions for certain information returns. Web instructions for recipient recipient’s taxpayer identification number (tin). Api client id (a2a filers only) sign in to iris for system availability, check iris status. 1099 nec form 2022 is required to be filed by any individual who is an independent worker. Department of the treasury, u.s. For internal revenue service center.

Both the forms and instructions will be updated as needed. Current general instructions for certain information returns. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. 1099 nec form 2022 is required to be filed by any individual who is an independent worker. This enhancements you can find in sap business bydesign 22.11 release. Irs forms 1099 arrived around the end of january 2023 for 2022 payments. Department of the treasury, u.s. Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported.

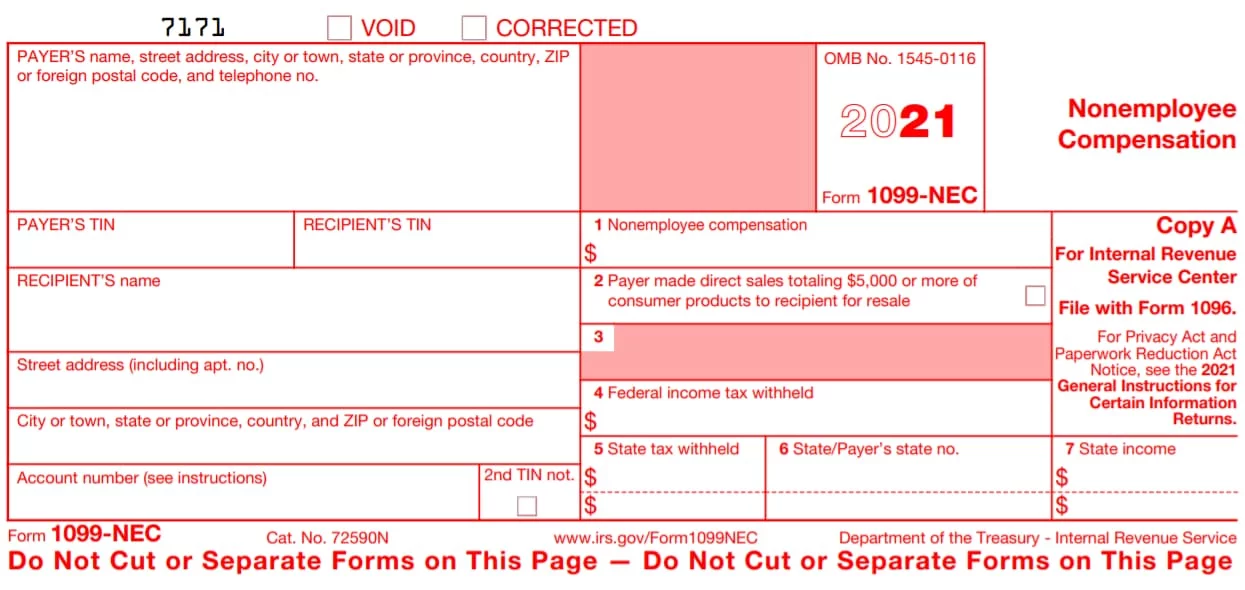

Api client id (a2a filers only) sign in to iris for system availability, check iris status. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Fill out the nonemployee compensation online and print it out for free. Copy a of the form is in red; Irs forms 1099 arrived around the end of january 2023 for 2022 payments. Department of the treasury, u.s. Current general instructions for certain information returns. Web what is the 1099 nec form? What you need employer identification number (ein) iris transmitter control code (tcc). For internal revenue service center.

1099 MISC Form 2022 1099 Forms TaxUni

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Irs forms 1099 arrived around the end of january 2023 for 2022 payments. This enhancements you can find in sap business bydesign 22.11 release. Web instructions for.

1099 NEC Form 2022

The amount of the fine depends on the number of returns and. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. The report of payments was separated by internal revenue service. This enhancements you can find in.

1099 Nec Form 2021 Fill and Sign Printable Template Online US Legal

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. For internal revenue service.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

The amount of the fine depends on the number of returns and. It is for informational purposes and internal revenue service use only. Fill out the nonemployee compensation online and print it out for free. Department of the treasury, u.s. What you need employer identification number (ein) iris transmitter control code (tcc).

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). Both the forms and instructions will be updated as needed. Web what is the 1099 nec form? Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. The.

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

The amount of the fine depends on the number of returns and. Current general instructions for certain information returns. What you need employer identification number (ein) iris transmitter control code (tcc). Web what is the 1099 nec form? Both the forms and instructions will be updated as needed.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

It is for informational purposes and internal revenue service use only. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Current general instructions for certain information returns. The amount of the fine depends on the number of returns and. Copy a of the form is in.

2021 Form 1099NEC Explained YouTube

Web what is the 1099 nec form? What you need employer identification number (ein) iris transmitter control code (tcc). This enhancements you can find in sap business bydesign 22.11 release. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Irs forms 1099 arrived around the end of january 2023 for 2022 payments.

1099NEC vs 1099MISC Do You Need to File Both?

Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. The amount of the fine depends on the number of returns and. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web what is the 1099 nec form? Api client id (a2a filers only) sign in.

1099 Form Independent Contractor Pdf Form 1099 Nec Form Pros / Some

Both the forms and instructions will be updated as needed. Irs forms 1099 arrived around the end of january 2023 for 2022 payments. Web instructions for recipient recipient’s taxpayer identification number (tin). Department of the treasury, u.s. The amount of the fine depends on the number of returns and.

Both The Forms And Instructions Will Be Updated As Needed.

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. It is for informational purposes and internal revenue service use only. Copy a of the form is in red; Web what is the 1099 nec form?

Api Client Id (A2A Filers Only) Sign In To Iris For System Availability, Check Iris Status.

Web electronically file any form 1099 for tax year 2022 and later with the information returns intake system (iris). What you need employer identification number (ein) iris transmitter control code (tcc). Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes. Box 1 will not be used for reporting under section 6050r, regarding cash payments for the purchase of fish for resale purposes.

The Report Of Payments Was Separated By Internal Revenue Service.

Department of the treasury, u.s. This enhancements you can find in sap business bydesign 22.11 release. White form has a scannable red ink copy a and 1096 required by the irs for paper filing. The amount of the fine depends on the number of returns and.

1099 Nec Form 2022 Is Required To Be Filed By Any Individual Who Is An Independent Worker.

Fill out the nonemployee compensation online and print it out for free. Irs forms 1099 arrived around the end of january 2023 for 2022 payments. Web instructions for recipient recipient’s taxpayer identification number (tin). For internal revenue service center.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://static.wixstatic.com/media/9fe6e6_c02527d741474d7e88dbd9fa3595b59f~mv2.png/v1/fit/w_1000%2Ch_853%2Cal_c%2Cq_80/file.jpg)