2022 Form 1040 Social Security Worksheet

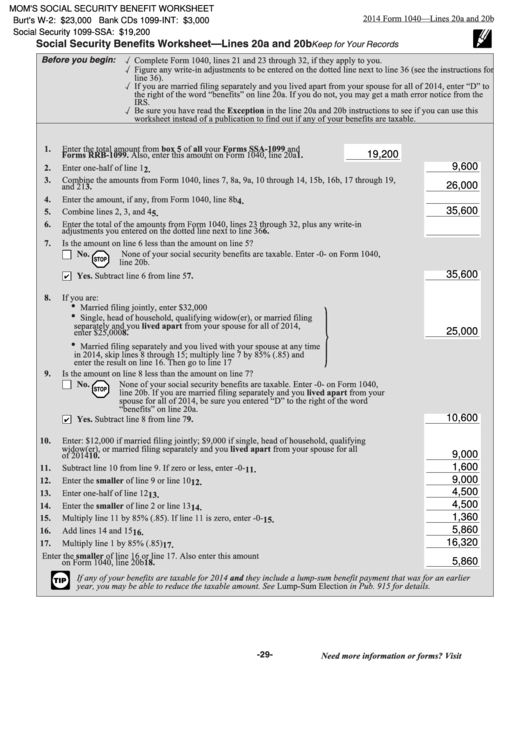

2022 Form 1040 Social Security Worksheet - Fill in lines a through e. Web income subject to social security tax is $147,000. 12 percent on income between $11,000 and $44,725. Web social security taxable benefits worksheet (2022) worksheet 1. Web application for a social security card. Calculating taxable benefits before filling out this worksheet: Tax return for seniors 2022. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. 22 percent for income above $44,725. According to the irs tax tables, a person with.

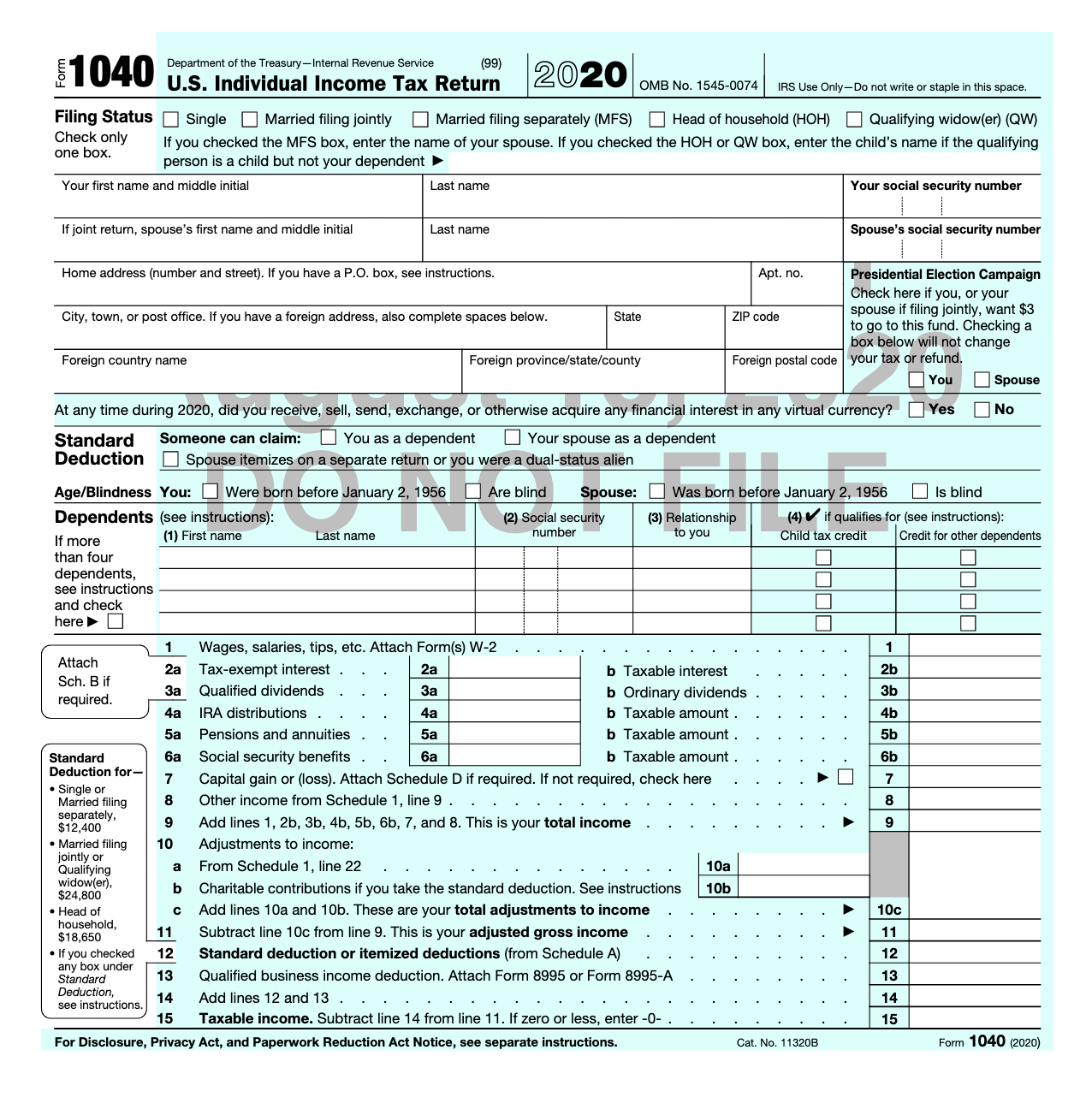

Click the print icon in the forms toolbar. Tax return for seniors 2022. If joint return, spouse’s first name and middle initial. Multiply line 1 by 50% (0.50) 2. Ask the taxpayer about the receipt of either of these benefits. Taxable amount of social security from federal. Web how to fill out and sign taxable social security worksheet 2022 online? Web we developed this worksheet for you to see if your benefits may be taxable for 2022. According to the irs tax tables, a person with. Web income subject to social security tax is $147,000.

22 percent for income above $44,725. If you are married filing separately and you lived apart. Get your online template and fill it in using progressive features. Web 2022 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. 12 percent on income between $11,000 and $44,725. Tax return for seniors 2022. Web modification for taxable social security income worksheet step 1: Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax. Web 10 percent on income up to $11,000. Do not use the worksheet below if any of the following apply to you;.

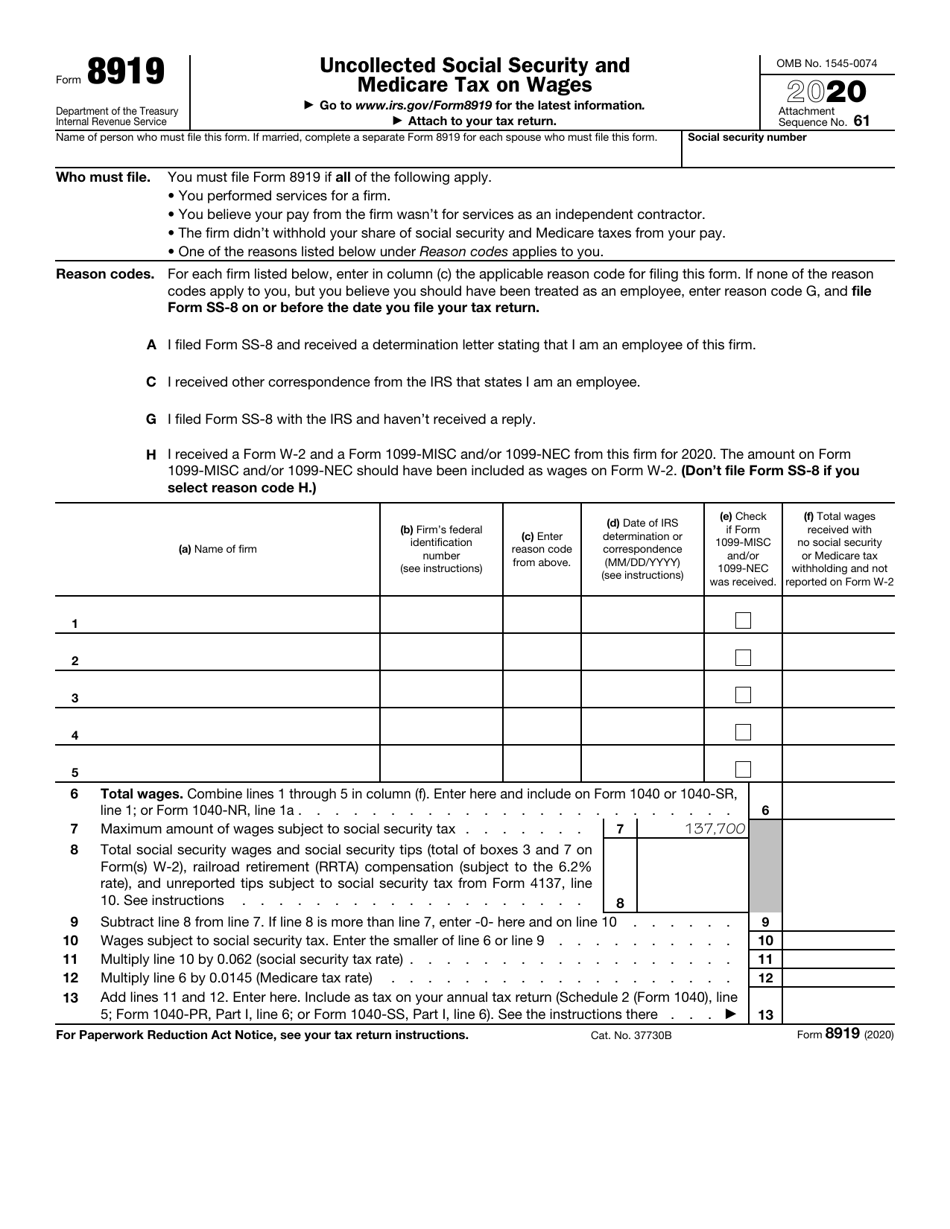

IRS Form 8919 Download Fillable PDF or Fill Online Uncollected Social

Web social security taxable benefits worksheet (2022) worksheet 1. Click the print icon in the forms toolbar. In some areas, you may request a replacement social security card online. Multiply line 1 by 50% (0.50) 2. 22 percent for income above $44,725.

Fillable Form 1040 Social Security Benefits Worksheet 1040 Form Printable

Fill in lines a through e. If joint return, spouse’s first name and middle initial. According to the irs tax tables, a person with. Do not use the worksheet below if any of the following apply to you;. Web social security taxable benefits worksheet (2022) worksheet 1.

2018 1040 Social Security Worksheet « Easy Math Worksheets

If you are married filing separately and you lived apart. Ask the taxpayer about the receipt of either of these benefits. Web application for a social security card. Web 2022 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. Web income subject to social security tax is $147,000.

1040x2.pdf Irs Tax Forms Social Security (United States)

Multiply line 1 by 50% (0.50) 2. Web 10 percent on income up to $11,000. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Calculating taxable benefits before filling out this worksheet: Web check only one box.

2018 1040 Social Security Worksheet « Easy Math Worksheets

Web the intake and interview sheet lists social security and railroad retirement benefits in the income section. Calculating taxable benefits before filling out this worksheet: Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter. If you are married filing separately and you lived apart. 12 percent.

Social Security Benefits Worksheet 2019 Calculator Worksheet Jay Sheets

Web application for a social security card. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax. Web february 21, 2022 8:03 am. Web social security taxable benefits worksheet (2022) worksheet 1. Ask the taxpayer about the receipt of either of these benefits.

1040 social security worksheet

If you are married filing separately and you lived apart. Calculating taxable benefits before filling out this worksheet: Tax return for seniors 2022. Web 2022 modification worksheet taxable social security income worksheet 2 enter your spouse’s date of birth, if applicable. Web jul 27, 2023 11:00 am edt.

2013 Form IRS 1040 Schedule 8812 Fill Online, Printable, Fillable

Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter. Web modification for taxable social security income worksheet step 1: Last name spouse’s social security. Web social security taxable benefits worksheet (2022) worksheet 1. Web 2020 social security taxable benefits worksheet keep for your records publication 915.

What’s New On Form 1040 For 2020 Taxgirl

Click the print icon in the forms toolbar. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Authorization to disclose information to the. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter. Tax return for seniors 2022.

IRS FORM 12333 PDF

The social security benefits worksheet is created within turbotax when any social security benefits are entered. Web jul 27, 2023 11:00 am edt. Web social security taxable benefits worksheet (2022) worksheet 1. Web the intake and interview sheet lists social security and railroad retirement benefits in the income section. Web income subject to social security tax is $147,000.

Tax Return For Seniors 2022.

Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web 10 percent on income up to $11,000. Do not use the worksheet below if any of the following apply to you;. Authorization to disclose information to the.

If You Are Married Filing Separately And You Lived Apart.

Web jul 27, 2023 11:00 am edt. Taxable amount of social security from federal. Fill in lines a through e. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax.

Web Income Subject To Social Security Tax Is $147,000.

Web modification for taxable social security income worksheet step 1: Last name spouse’s social security. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Web check only one box.

Web Application For A Social Security Card.

In some areas, you may request a replacement social security card online. Multiply line 1 by 50% (0.50) 2. 22 percent for income above $44,725. Web the intake and interview sheet lists social security and railroad retirement benefits in the income section.