Articles Of Dissolution Form

Articles Of Dissolution Form - Of the secretary of state. Enter the nc secretary of state id number (sosid#) to ensure the dissolution is filed on the appropriate entity. Sole proprietorships and general partnerships; Web personal property report is filed with the articles of dissolution. Take care of taxes and licenses; Web a corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. _________________________________ 1977 read all instructions prior to completing. The completed articles of dissolution, together with the statutory fee of $60, should be forwarded to: Web the nonprofit corporation certifies under penalty of perjury by the signature appearing below that the dissolution was duly authorized by act of the board of directors or a majority of the original incorporators or initial directors and, if applicable, by written consent of any other person required by its articles of incorporation. It does not contain all optional provisions under the law.

Web articles of dissolution of limited liability company item 1 enter the complete name of the limited liability company exactly as it appears on the records of the north carolina dept. Web what are articles of dissolution and why should i file them? Current revision form 966 pdf recent developments none at this time other items you may find useful all revisions for form 966 about publication 542, corporations other current products The completed articles of dissolution, together with the statutory fee of $60, should be forwarded to: Web a corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Web this form was prepared by the new york state department of state for filing articles of dissolution for a domestic limited liability company. Sole proprietorships and general partnerships; Web complete and file the articles of dissolution with the department of state. Enter the nc secretary of state id number (sosid#) to ensure the dissolution is filed on the appropriate entity. Take care of taxes and licenses;

To voluntarily dissolve the articles of an ontario business corporation (who has or has not commenced business), under the business corporations act (bca). Web a corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Web what are articles of dissolution and why should i file them? Web the nonprofit corporation certifies under penalty of perjury by the signature appearing below that the dissolution was duly authorized by act of the board of directors or a majority of the original incorporators or initial directors and, if applicable, by written consent of any other person required by its articles of incorporation. New york department of state, division of corporations, one commerce plaza, 99 washington avenue, albany, ny 12231. The completed articles of dissolution, together with the statutory fee of $60, should be forwarded to: Take care of taxes and licenses; Web personal property report is filed with the articles of dissolution. Articles of dissolution page 3 of 5. It does not contain all optional provisions under the law.

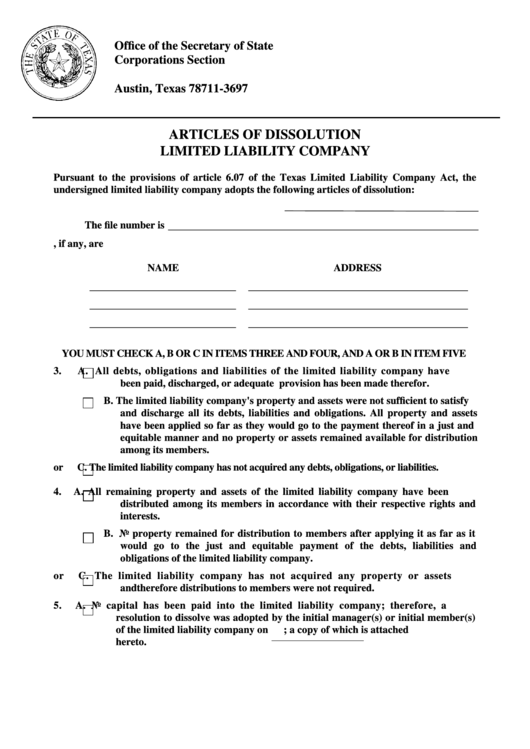

Articles Of Dissolution Limited Liability Company Form printable pdf

Current revision form 966 pdf recent developments none at this time other items you may find useful all revisions for form 966 about publication 542, corporations other current products Web a corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Web this form was.

Dissolution Corporation Any Fill Out and Sign Printable PDF Template

Web personal property report is filed with the articles of dissolution. Sole proprietorships and general partnerships; Take care of taxes and licenses; Of the secretary of state. To voluntarily dissolve the articles of an ontario business corporation (who has or has not commenced business), under the business corporations act (bca).

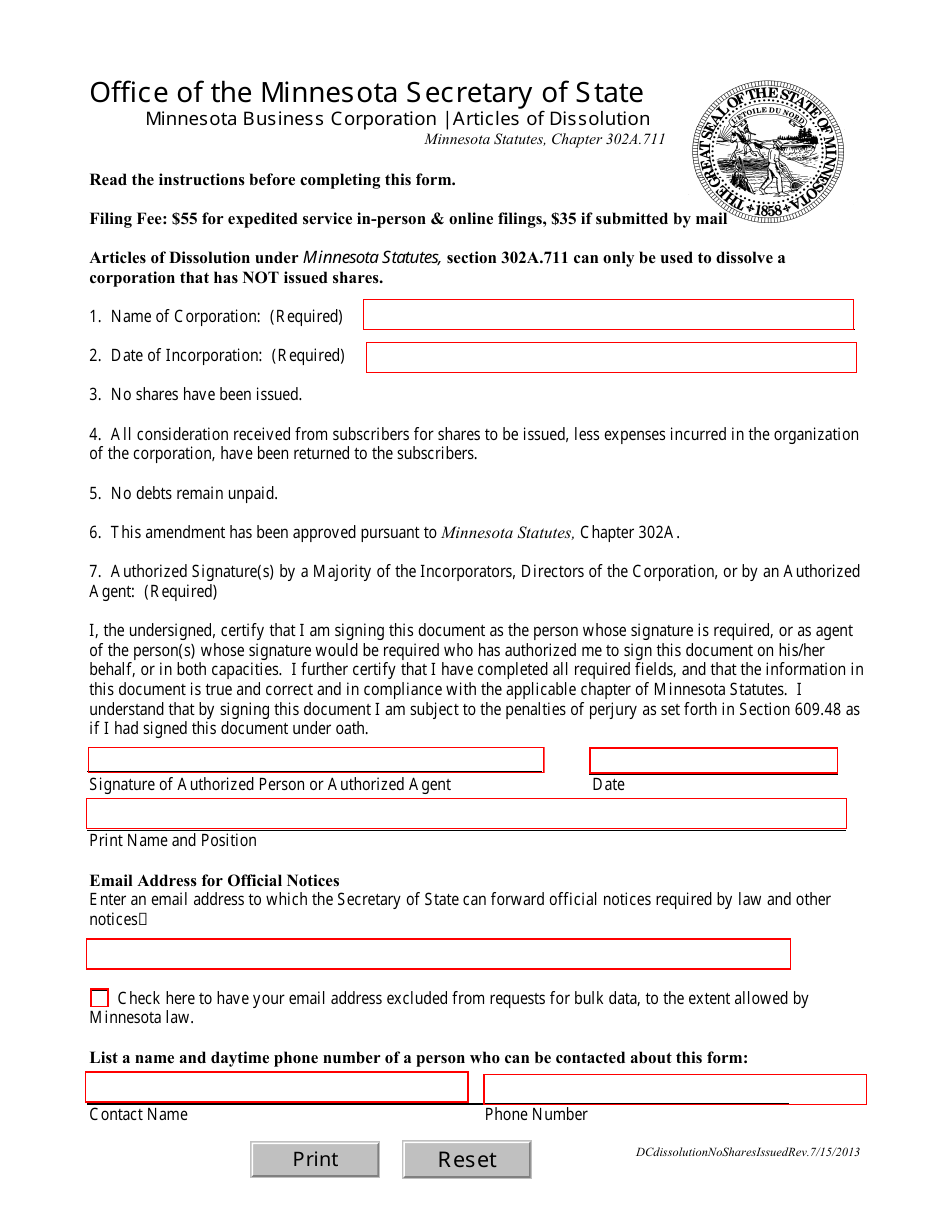

Minnesota Minnesota Business Corporation Articles of Dissolution Form

Web the nonprofit corporation certifies under penalty of perjury by the signature appearing below that the dissolution was duly authorized by act of the board of directors or a majority of the original incorporators or initial directors and, if applicable, by written consent of any other person required by its articles of incorporation. Sole proprietorships and general partnerships; The completed.

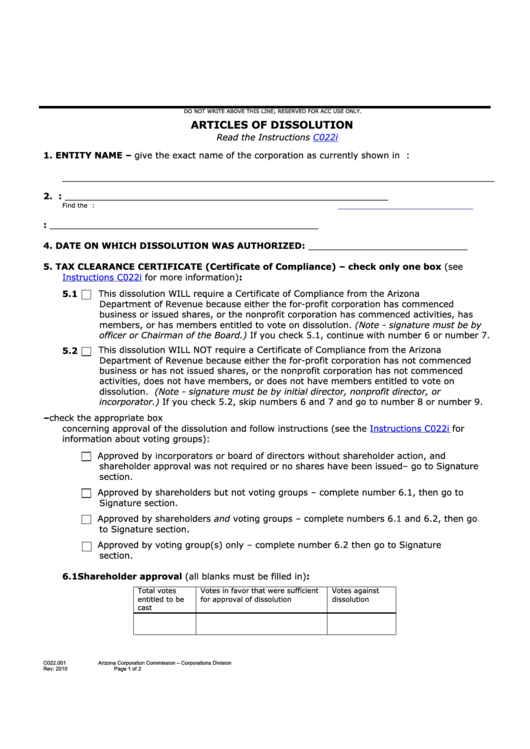

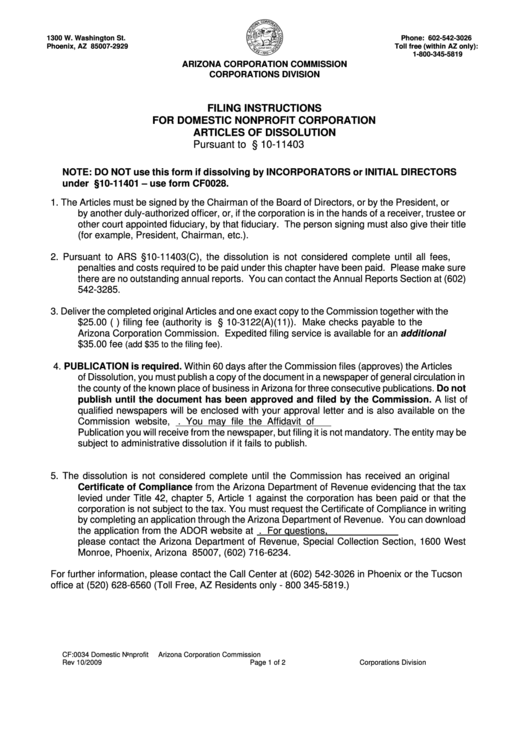

Fillable Articles Of Dissolution Arizona Corporation Commission

Of the secretary of state. Enter the nc secretary of state id number (sosid#) to ensure the dissolution is filed on the appropriate entity. 7/2015) address city state zip code *1977* return document by email to: Sole proprietorships and general partnerships; Web personal property report is filed with the articles of dissolution.

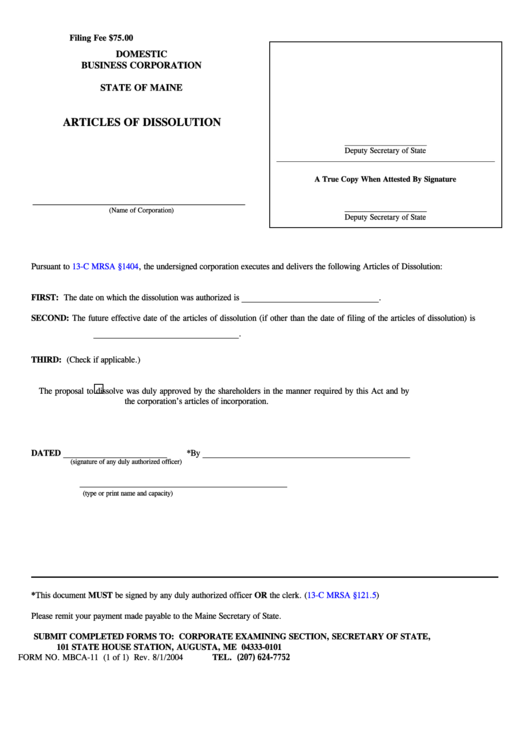

Fillable Form Mbca11 Domestic Business Corporation Articles Of

Current revision form 966 pdf recent developments none at this time other items you may find useful all revisions for form 966 about publication 542, corporations other current products Of the secretary of state. Web the nonprofit corporation certifies under penalty of perjury by the signature appearing below that the dissolution was duly authorized by act of the board of.

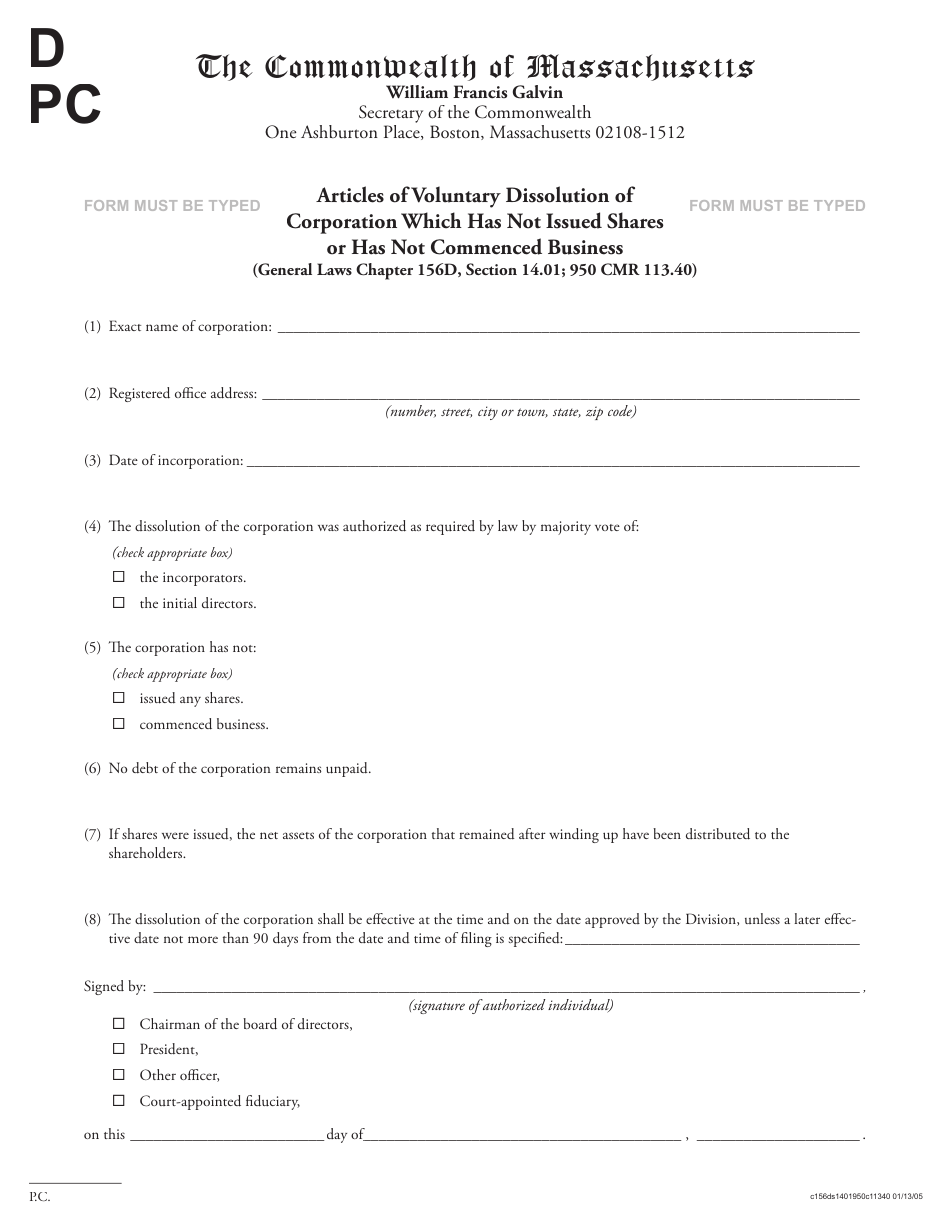

Massachusetts Articles of Voluntary Dissolution of Corporation Which

Web a corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Web this form was prepared by the new york state department of state for filing articles of dissolution for a domestic limited liability company. Web the nonprofit corporation certifies under penalty of perjury.

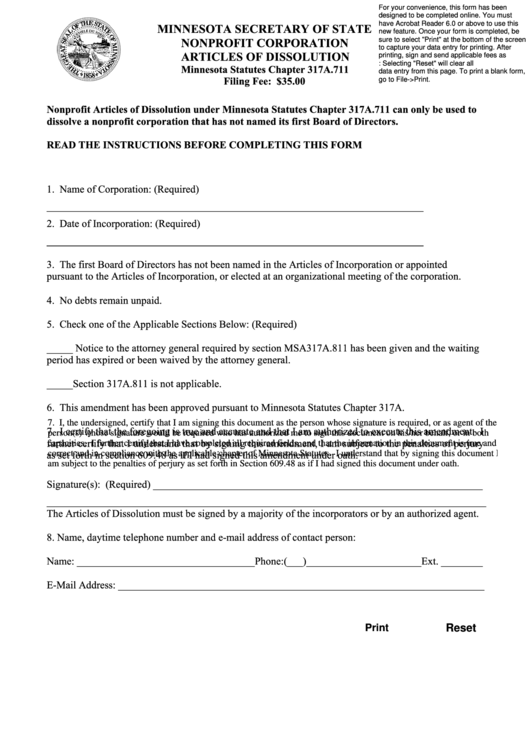

Fillable Nonprofit Corporation Articles Of Dissolution Form Minnesota

Web a corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. 7/2015) address city state zip code *1977* return document by email to: Articles of dissolution page 3 of 5. Sole proprietorships and general partnerships; It does not contain all optional provisions under the.

Form Cf0034 Articles Of Dissolution Domestic Nonprofit Corporation

New york department of state, division of corporations, one commerce plaza, 99 washington avenue, albany, ny 12231. 7/2015) address city state zip code *1977* return document by email to: _________________________________ 1977 read all instructions prior to completing. Web articles of dissolution of limited liability company item 1 enter the complete name of the limited liability company exactly as it appears.

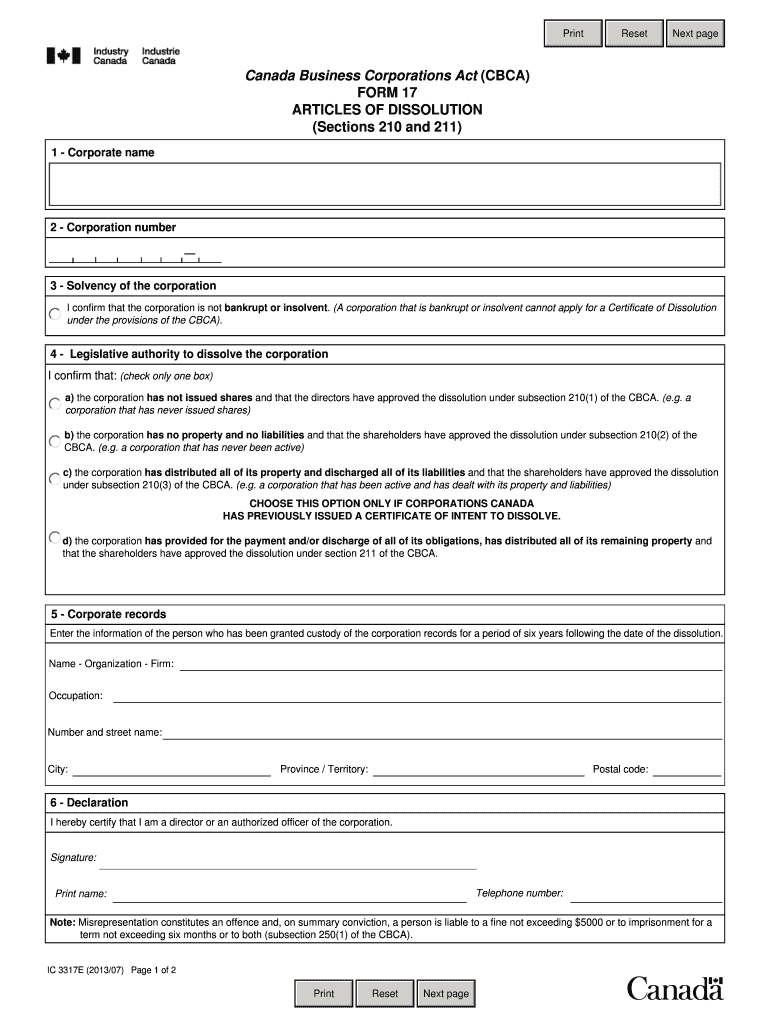

Form 17 Articles Of Dissolution 20202021 Fill and Sign Printable

Current revision form 966 pdf recent developments none at this time other items you may find useful all revisions for form 966 about publication 542, corporations other current products 7/2015) address city state zip code *1977* return document by email to: Web what are articles of dissolution and why should i file them? Of the secretary of state. Articles of.

Articles Of Dissolution 2020 Fill and Sign Printable Template Online

Web complete and file the articles of dissolution with the department of state. Articles of dissolution page 3 of 5. 7/2015) address city state zip code *1977* return document by email to: Current revision form 966 pdf recent developments none at this time other items you may find useful all revisions for form 966 about publication 542, corporations other current.

Web Personal Property Report Is Filed With The Articles Of Dissolution.

Articles of dissolution page 3 of 5. Web a corporation (or a farmer’s cooperative) files this form if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. The completed articles of dissolution, together with the statutory fee of $60, should be forwarded to: Other steps in closing a business

Web This Form Was Prepared By The New York State Department Of State For Filing Articles Of Dissolution For A Domestic Limited Liability Company.

It does not contain all optional provisions under the law. Web articles of dissolution of limited liability company item 1 enter the complete name of the limited liability company exactly as it appears on the records of the north carolina dept. Sole proprietorships and general partnerships; Enter the nc secretary of state id number (sosid#) to ensure the dissolution is filed on the appropriate entity.

Web Complete And File The Articles Of Dissolution With The Department Of State.

To voluntarily dissolve the articles of an ontario business corporation (who has or has not commenced business), under the business corporations act (bca). 7/2015) address city state zip code *1977* return document by email to: Current revision form 966 pdf recent developments none at this time other items you may find useful all revisions for form 966 about publication 542, corporations other current products Web what are articles of dissolution and why should i file them?

Web The Nonprofit Corporation Certifies Under Penalty Of Perjury By The Signature Appearing Below That The Dissolution Was Duly Authorized By Act Of The Board Of Directors Or A Majority Of The Original Incorporators Or Initial Directors And, If Applicable, By Written Consent Of Any Other Person Required By Its Articles Of Incorporation.

New york department of state, division of corporations, one commerce plaza, 99 washington avenue, albany, ny 12231. Of the secretary of state. Take care of taxes and licenses; _________________________________ 1977 read all instructions prior to completing.