California Llc Dissolution Form

California Llc Dissolution Form - Web must cease doing or transacting business in california after the final taxable year. Web dissolution (check the applicable statement. Online submission for corporation and partnership dissolution/cancellation forms is. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return. Web forms, samples and fees. Web you can request a voluntary administrative dissolution/cancelation if your business is: Once logged in, you must: Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. You must meet specific requirements to. Currently, llcs can submit termination forms online.

Online submission for corporation and partnership dissolution/cancellation forms is. File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. Currently, llcs can submit termination forms online. Web you can request a voluntary administrative dissolution/cancelation if your business is: Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. (1) find the applicable entity under your my business. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return. You must meet specific requirements to. Once logged in, you must: If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel.

(1) find the applicable entity under your my business. Web dissolution (check the applicable statement. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. Web you can request a voluntary administrative dissolution/cancelation if your business is: Web forms, samples and fees. Web must cease doing or transacting business in california after the final taxable year. If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return. Online submission for corporation and partnership dissolution/cancellation forms is. Active suspended dissolved canceled if your business is active, file a certificate of dissolution or certificate of cancelation with the secretary of state (sos) to dissolve/cancel the business.

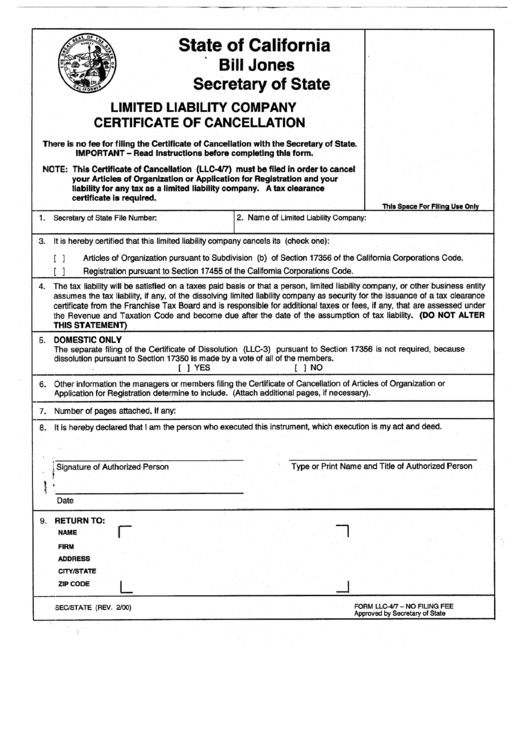

California Dissolution Package to Dissolve Limited Liability Company

Web forms, samples and fees. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return. (1) find the applicable entity under your my business. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available.

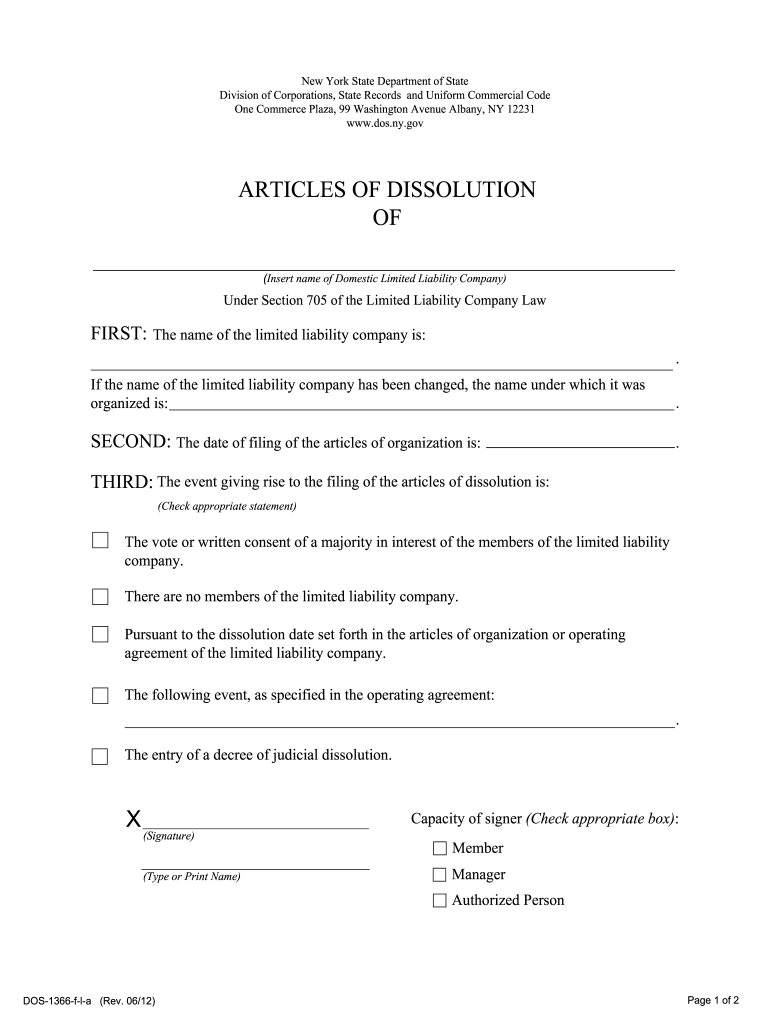

Articles Of Dissolution 2020 Fill and Sign Printable Template Online

Web must cease doing or transacting business in california after the final taxable year. Once logged in, you must: Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Currently, llcs can submit termination forms online. If the business entity is suspended or forfeited, it will need to go through the.

Alabama Dissolution Package to Dissolve Corporation Dissolve Llc

Web must cease doing or transacting business in california after the final taxable year. (1) find the applicable entity under your my business. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return. You must meet specific requirements to. Active suspended dissolved canceled if your business is active,.

How To File A Dissolution Of Corporation In California Nicolette Mill

Web forms, samples and fees. Web certificate of dissolution certificate of cancellation short form cancellation certificate: Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online..

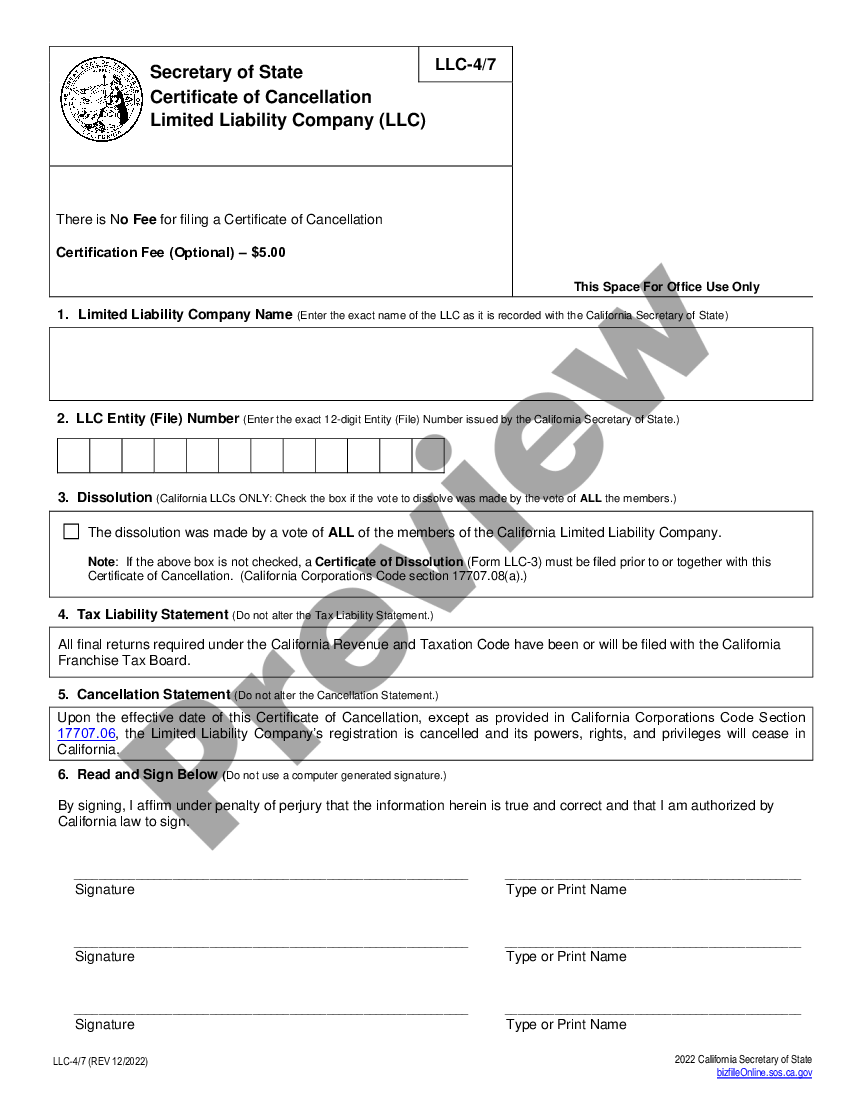

Form Llc4/7 Certificate Of Cancellation For A Limited Liability

Web forms, samples and fees. Online submission for corporation and partnership dissolution/cancellation forms is. Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Web dissolution (check the applicable statement. Web must cease doing or transacting business in california after the final taxable year.

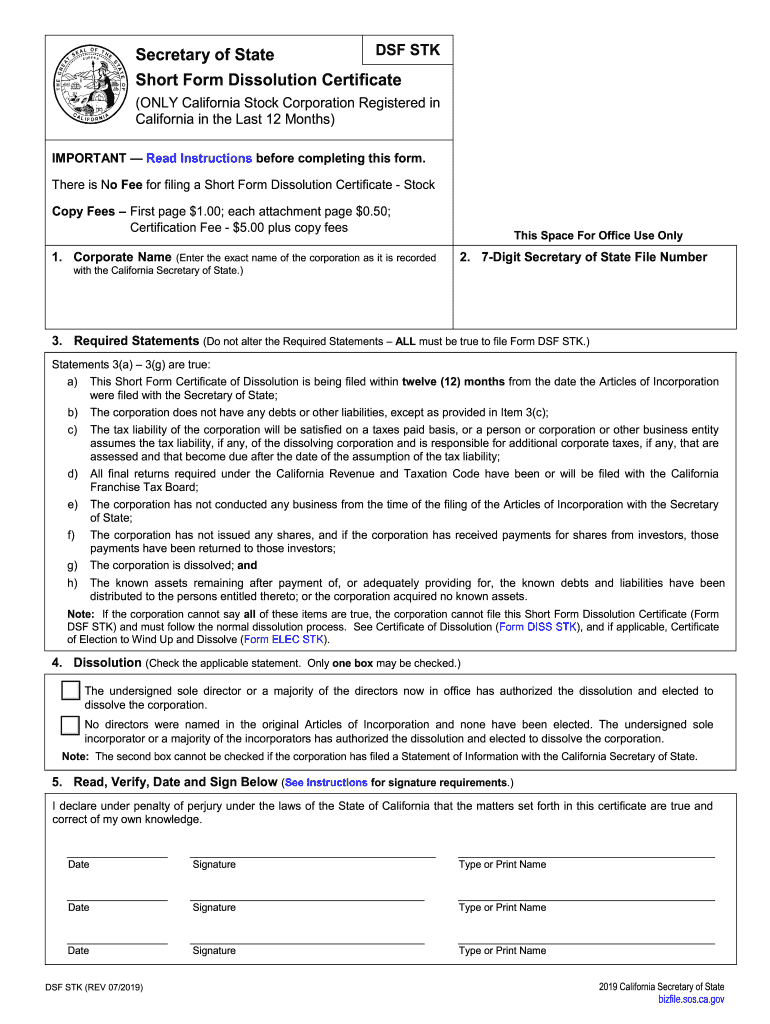

Form Dsf Stk Fill Out and Sign Printable PDF Template signNow

Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Online submission for corporation and partnership dissolution/cancellation forms is. Once logged in, you must: File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. Web file the appropriate dissolution, surrender, or.

How To Dissolve A Foreign Llc In California California Application

(1) find the applicable entity under your my business. Once logged in, you must: Active suspended dissolved canceled if your business is active, file a certificate of dissolution or certificate of cancelation with the secretary of state (sos) to dissolve/cancel the business. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing.

Business Dissolution Plan Patricia Wheatley's Templates

Active suspended dissolved canceled if your business is active, file a certificate of dissolution or certificate of cancelation with the secretary of state (sos) to dissolve/cancel the business. Currently, llcs can submit termination forms online. Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return. Once logged in, you must: Web.

California Dissolution Package to Dissolve Corporation Form Online

If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. Online submission for corporation and partnership dissolution/cancellation forms is. File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. Active.

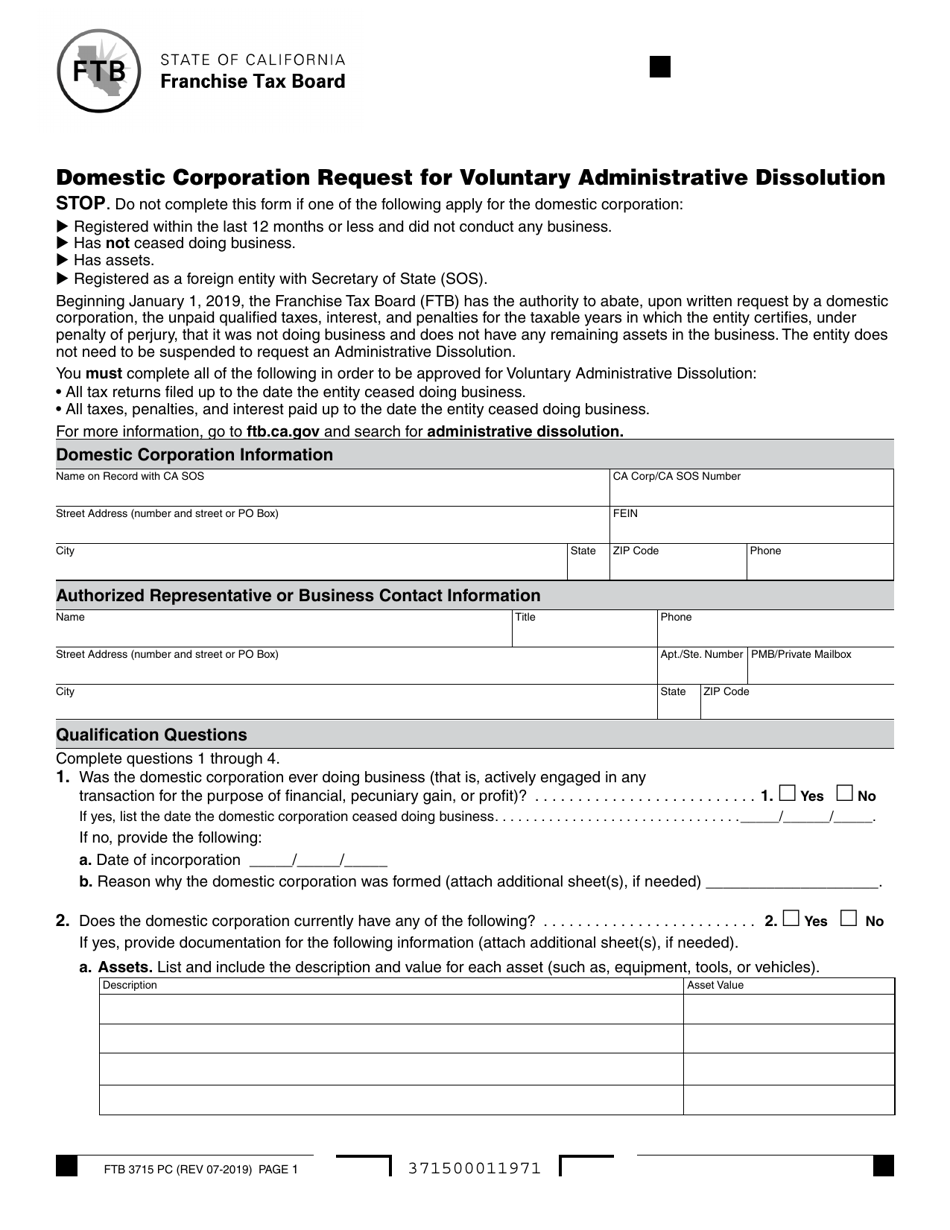

Form FTB3715 PC Download Fillable PDF or Fill Online Domestic

Web must cease doing or transacting business in california after the final taxable year. Currently, llcs can submit termination forms online. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return. (1) find the applicable entity under your my business. Once logged in, you must:

Web Certificate Of Dissolution Certificate Of Cancellation Short Form Cancellation Certificate:

Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. You must meet specific requirements to. File the appropriate dissolution, surrender, or cancellation form(s) with the sos within 12 months of filing your final tax return. Web file the appropriate dissolution, surrender, or cancellation sos form(s) within 12 months of filing your final tax return.

Web Forms, Samples And Fees.

Web must cease doing or transacting business in california after the final taxable year. Web you can request a voluntary administrative dissolution/cancelation if your business is: Currently, llcs can submit termination forms online. Web file the appropriate dissolution, surrender, or cancellation form (s) with the sos within 12 months of filing the final tax return.

(1) Find The Applicable Entity Under Your My Business.

If the business entity is suspended or forfeited, it will need to go through the revivor process and be in good standing before being allowed to dissolve, surrender, or cancel. Active suspended dissolved canceled if your business is active, file a certificate of dissolution or certificate of cancelation with the secretary of state (sos) to dissolve/cancel the business. Once logged in, you must: Online submission for corporation and partnership dissolution/cancellation forms is.