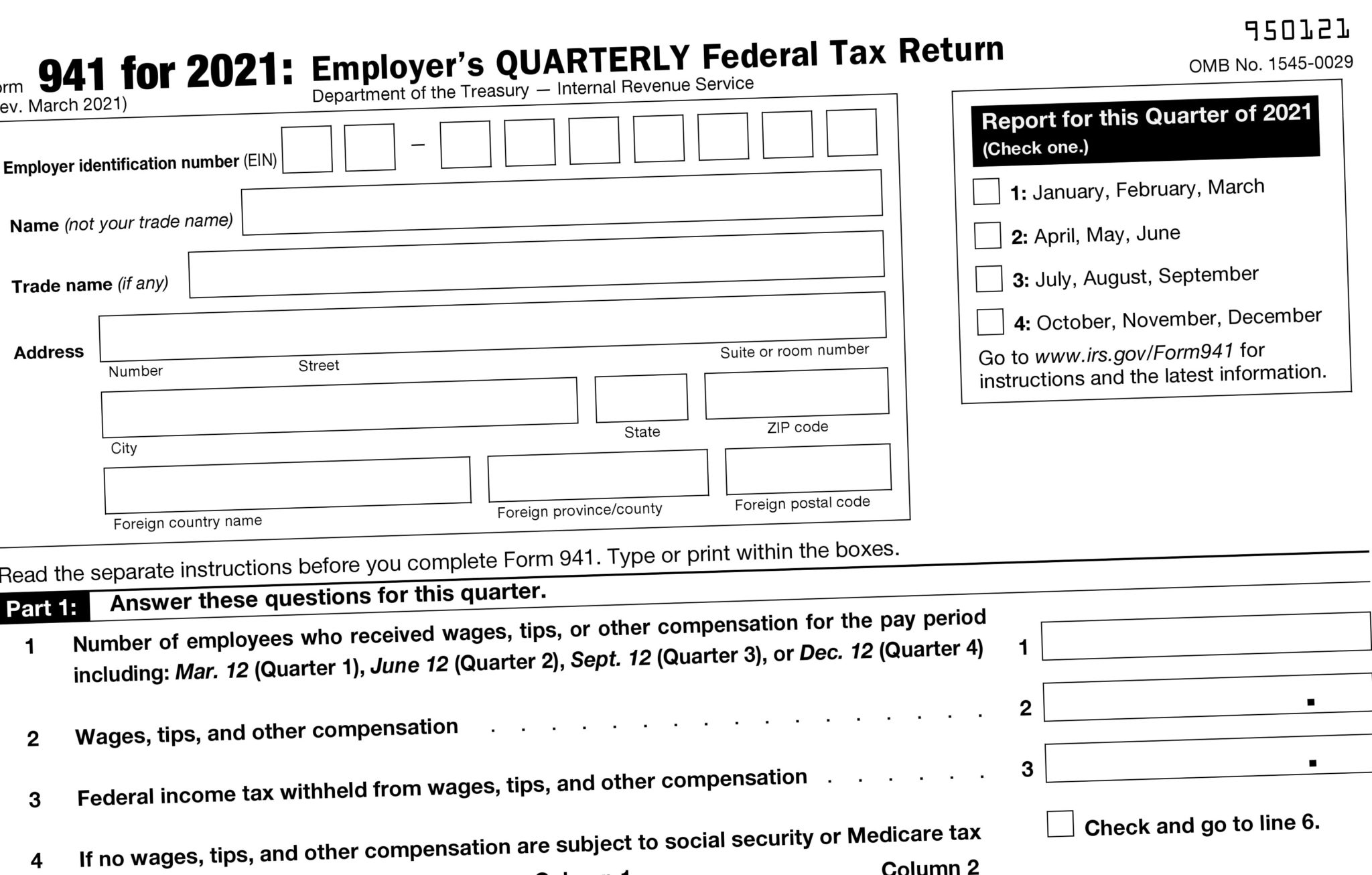

Completed Form 941 2020

Completed Form 941 2020 - Enter the irs form 941 2020 in the. Instructions for form 1040 (2020) pdf form 1040. Complete, edit or print tax forms instantly. You should simply follow the instructions: July 2020) employer’s quarterly federal tax return 950120 omb no. Web payroll tax returns. Who must file form 941? Form 1040 (2020) pdf related: Web generally, you must file form 941, employer's quarterly federal tax return or form 944, employer's annual federal tax return to report wages you've. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Complete, edit or print tax forms instantly. Web purpose of form 941. How should you complete form 941? Who must file form 941? Those returns are processed in. Web the july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web form 941 employer's quarterly federal tax return.

Enter the irs form 941 2020 in the. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Complete, edit or print tax forms instantly. Those returns are processed in. Web generally, you must file form 941, employer's quarterly federal tax return or form 944, employer's annual federal tax return to report wages you've. Web how to complete a fillable 941 form 2020? Who must file form 941? Get ready for tax season deadlines by completing any required tax forms today. Web mailing addresses for forms 941.

20212022 年版 IRS Form 941 (連邦給与税報告書フォーム) を記入する方法 PDF Expert

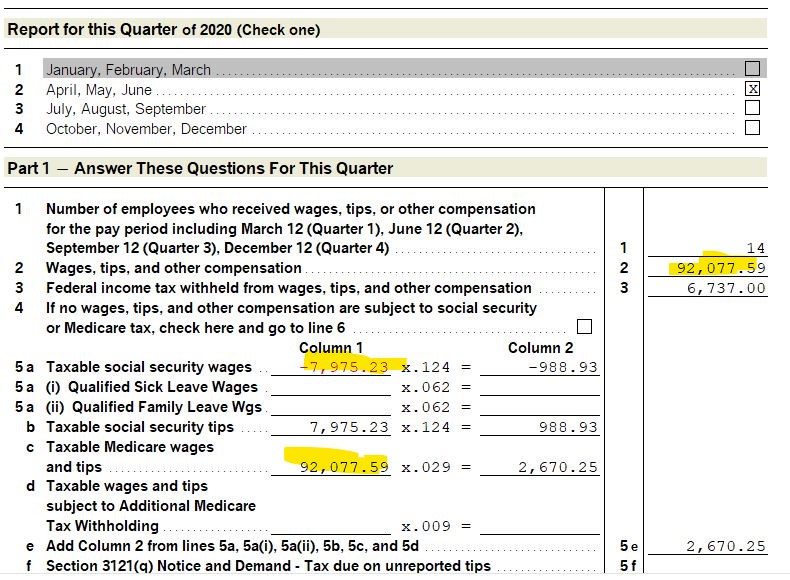

Web corrections to amounts reported on form 941, lines 5a (i), 5a (ii), 11b, 13c, 19, and 20, for the credit for qualified sick and family leave wages for leave taken after march 31, 2020,. Instructions for form 1040 (2020) pdf form 1040. The following significant changes have been made to form. Those returns are processed in. Get ready for.

Guest column Employee Retention Tax Credit cheat sheet Repairer

Enter the irs form 941 2020 in the. Who must file form 941? Web how to complete a fillable 941 form 2020? April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Get ready for tax season deadlines by completing any required tax forms today.

Form 941

July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Instructions for form 1040 (2020) pdf form 1040. Web form 941 employer's quarterly federal tax return. We will use the completed voucher to credit your payment more. As of july 13, 2023, the irs had 266,000 unprocessed forms.

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Those returns are processed in. We will use the completed voucher to credit your payment more. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Who must file form 941? We will use the completed voucher to credit your payment more.

2020 QB Desktop Payroll Reports (Form 941) Populat... QuickBooks

Connecticut, delaware, district of columbia, georgia,. Web payroll tax returns. The following significant changes have been made to form. Complete, edit or print tax forms instantly. Web annual income tax return filed by citizens or residents of the united states.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Those returns are processed in. Web corrections to amounts reported on form 941, lines 5a (i), 5a (ii), 11b, 13c, 19, and 20, for the credit for qualified sick and family leave wages for leave taken after march 31, 2020,. Who must file form 941? Get ready for tax season deadlines by completing any required tax forms today. Enter the.

Update Form 941 Changes Regulatory Compliance

Those returns are processed in. We will use the completed voucher to credit your payment more. The following significant changes have been made to form. Web purpose of form 941. Form 1040 (2020) pdf related:

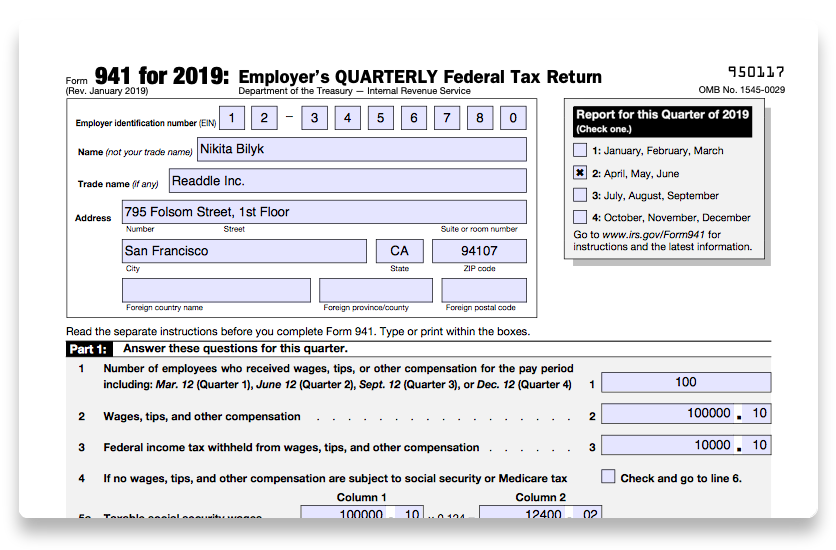

How to fill out IRS Form 941 2019 PDF Expert

Complete, edit or print tax forms instantly. Web the july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Web mailing addresses for forms 941. Connecticut, delaware, district of columbia, georgia,. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue.

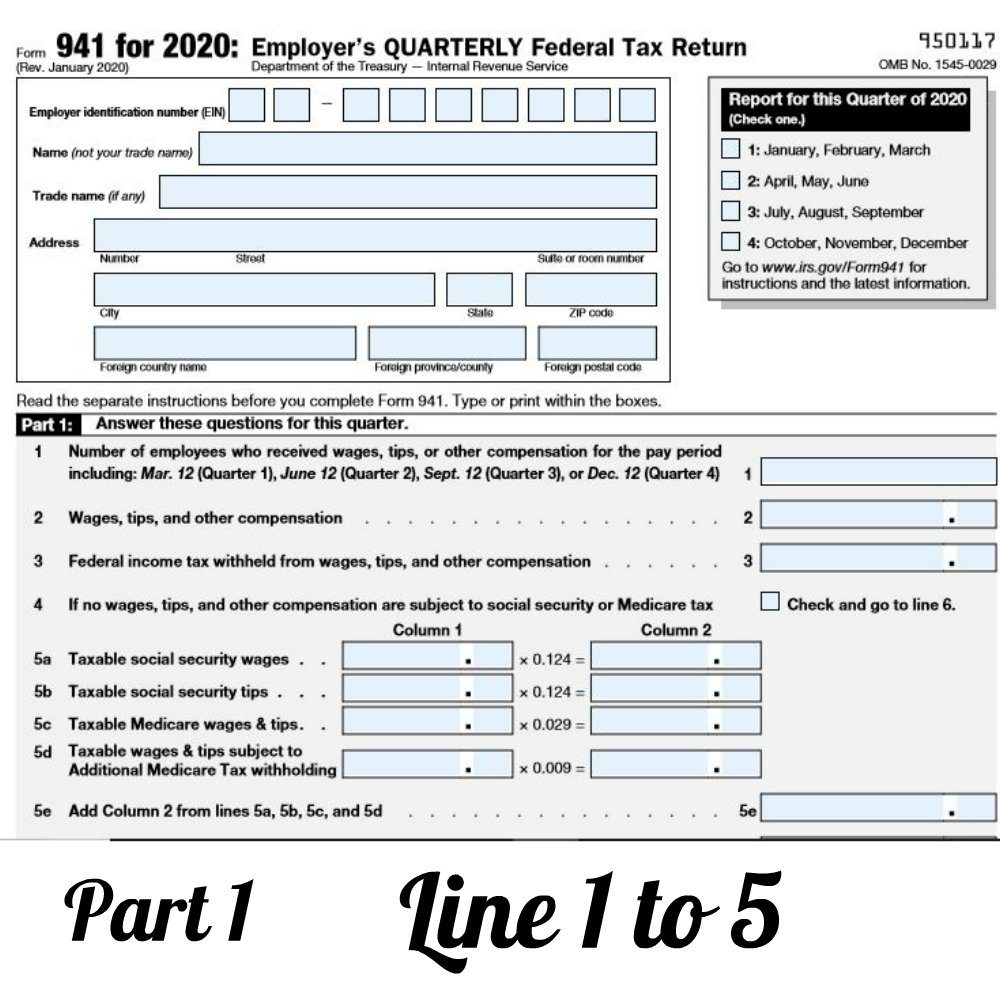

The NoWorry Guide To File Form 941 During Tax Year 2020 Blog

You should simply follow the instructions: We will use the completed voucher to credit your payment more. Get ready for tax season deadlines by completing any required tax forms today. Form 941 has been revised to allow employers that defer the. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

Form 941

Instructions for form 1040 (2020) pdf form 1040. Enter the irs form 941 2020 in the. July 2020) employer’s quarterly federal tax return 950120 omb no. Web generally, you must file form 941, employer's quarterly federal tax return or form 944, employer's annual federal tax return to report wages you've. April 2023) adjusted employer’s quarterly federal tax return or claim.

Those Returns Are Processed In.

How should you complete form 941? Web payroll tax returns. October, november, december go to www.irs.gov/form941 for instructions and the latest. Connecticut, delaware, district of columbia, georgia,.

Web Generally, You Must File Form 941, Employer's Quarterly Federal Tax Return Or Form 944, Employer's Annual Federal Tax Return To Report Wages You've.

Web corrections to amounts reported on form 941, lines 5a (i), 5a (ii), 11b, 13c, 19, and 20, for the credit for qualified sick and family leave wages for leave taken after march 31, 2020,. Who must file form 941? Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. July 2021) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

Web How To Complete A Fillable 941 Form 2020?

We will use the completed voucher to credit your payment more. Web annual income tax return filed by citizens or residents of the united states. Web purpose of form 941. July 2020) employer’s quarterly federal tax return 950120 omb no.

As Of July 13, 2023, The Irs Had 266,000 Unprocessed Forms 941, Employer's Quarterly Federal Tax Return.

You should simply follow the instructions: Web the july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Form 1040 (2020) pdf related: Web form 941 employer's quarterly federal tax return.