Form 1023 Ez Worksheet

Form 1023 Ez Worksheet - Part i identification of applicant 1a full name of organization You must apply on form 1023. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). You can visit irs.gov/charities for more information on application requirements.

Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). Part i identification of applicant 1a full name of organization You must apply on form 1023. You can visit irs.gov/charities for more information on application requirements.

Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). You must apply on form 1023. Part i identification of applicant 1a full name of organization You can visit irs.gov/charities for more information on application requirements.

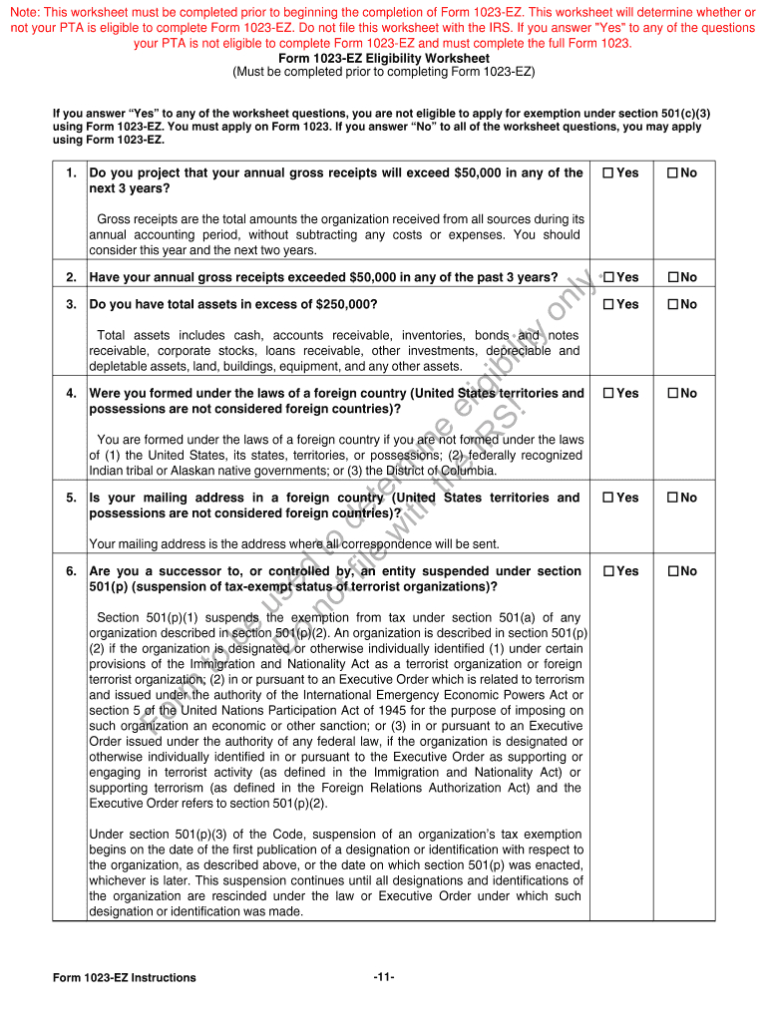

Form 1023 Ez Eligibility Worksheet —

You must apply on form 1023. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). You can visit irs.gov/charities for more information on application requirements. Part i identification of applicant 1a full name of organization

31 Form 1023 Ez Eligibility Worksheet support worksheet

You can visit irs.gov/charities for more information on application requirements. Part i identification of applicant 1a full name of organization You must apply on form 1023. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3).

IRS EZ Worksheet 2022 2023 Student Forum

You must apply on form 1023. You can visit irs.gov/charities for more information on application requirements. Part i identification of applicant 1a full name of organization Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3).

Should Your Charity Submit IRS Form 1023EZ?

You can visit irs.gov/charities for more information on application requirements. You must apply on form 1023. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). Part i identification of applicant 1a full name of organization

Form 1023EZ Streamlined Application for Recognition of Exemption

You can visit irs.gov/charities for more information on application requirements. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). Part i identification of applicant 1a full name of organization You must apply on form 1023.

31 Form 1023 Ez Eligibility Worksheet support worksheet

Part i identification of applicant 1a full name of organization You can visit irs.gov/charities for more information on application requirements. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). You must apply on form 1023.

Form 1023 Ez Eligibility Worksheet

Part i identification of applicant 1a full name of organization You can visit irs.gov/charities for more information on application requirements. You must apply on form 1023. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3).

31 Form 1023 Ez Eligibility Worksheet support worksheet

Part i identification of applicant 1a full name of organization Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). You must apply on form 1023. You can visit irs.gov/charities for more information on application requirements.

Form 1023 Ez Eligibility Worksheet —

You can visit irs.gov/charities for more information on application requirements. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). Part i identification of applicant 1a full name of organization You must apply on form 1023.

Form 1023 Ez Eligibility Worksheet —

You can visit irs.gov/charities for more information on application requirements. You must apply on form 1023. Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). Part i identification of applicant 1a full name of organization

You Can Visit Irs.gov/Charities For More Information On Application Requirements.

Any organization may file form 1023 to apply for recognition of exemption from federal income tax under section 501(c)(3). Part i identification of applicant 1a full name of organization You must apply on form 1023.