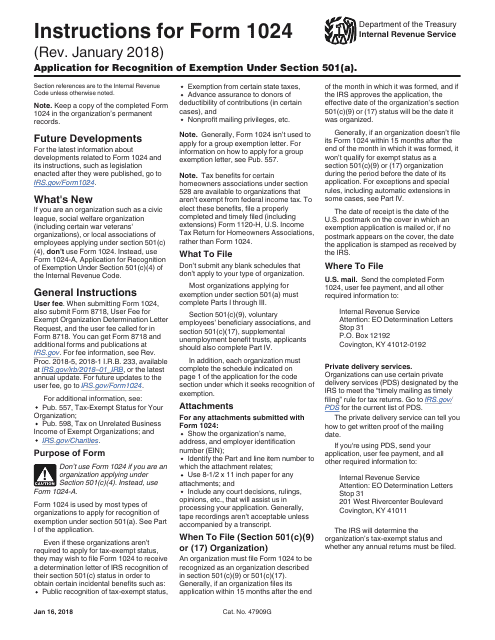

Form 1024 Instructions

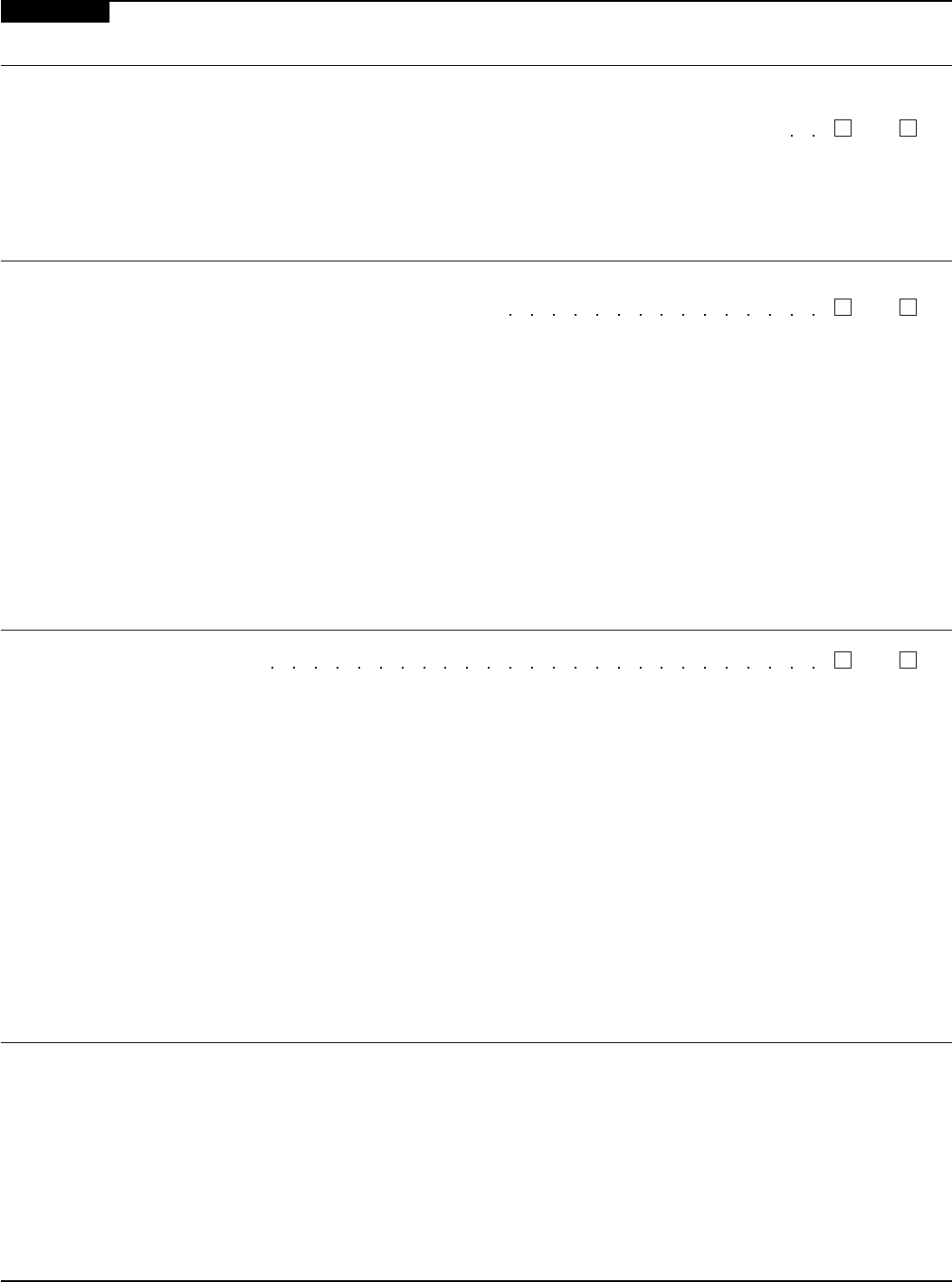

Form 1024 Instructions - Web you can access the most recent revision of the form at pay.gov. Web there are ten documents to choose from. Web form 1024, individual status summary author: Complete, edit or print tax forms instantly. Each schedule form contains short instructions. Texas health and human services subject: Articles of incorporation, if any, or other organizational document; For instructions and the latest information. Web organizations filing form 1024, application for recognition of exemption under section 501(a) or section 521 of the internal revenue code, must complete and. Statement of revenue and expenses revenue line 1 ^gross dues and assessments of members:

Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Web there are ten documents to choose from. The paperwork must be filed with the 1024 application form. Form 1024 is used to document the. Organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section 521. See part i of the application. Web you can access the most recent revision of the form at pay.gov. Web organizations filing form 1024, application for recognition of exemption under section 501(a) or section 521 of the internal revenue code, must complete and. More specifically, organizations other than public charities or private foundations need to file irs form.

Statement of revenue and expenses revenue line 1 ^gross dues and assessments of members: Web organizations filing form 1024, application for recognition of exemption under section 501(a) or section 521 of the internal revenue code, must complete and. Complete, edit or print tax forms instantly. Web download or print the 2022 federal form 1024 (application for recognition of exemption under section 501(a) for determination under section 120 of the internal revenue. Form 1024, individual status summary created date: Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to file. Web the irs now requires electronic filing of form 1024, application for recognition of exemption under section 501 (a) or section 521 of the internal revenue. Web you can access the most recent revision of the form at pay.gov. Form 1024 is used to document the waiver benefits that result in an individual service plan (isp) or individual plan of care (ipc). Estimated dues income line 2 “gross contributions, gifts, etc.” :

Form 1024 Application for Recognition of Exemption under Section 501

Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a). More specifically, organizations other than public charities or private foundations need to file irs form. Web information about form 1024, application for recognition of exemption under section 501(a), including recent updates, related forms, and instructions on how to.

Fill Free fillable Di Form DI (HM Land Registry) PDF form

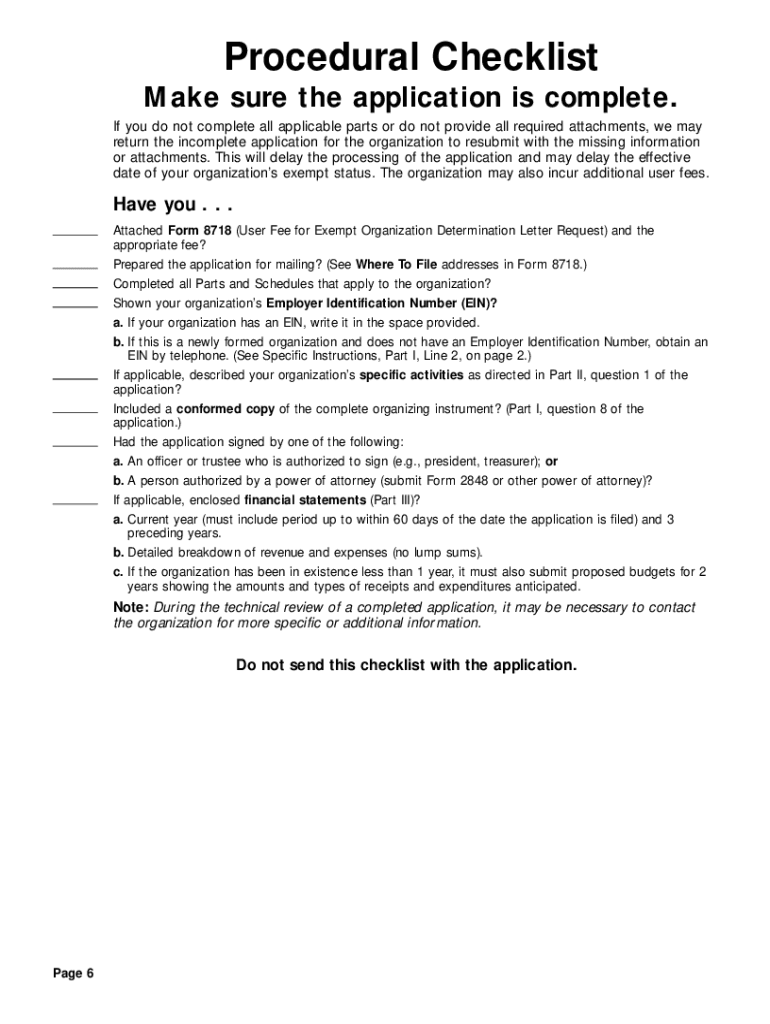

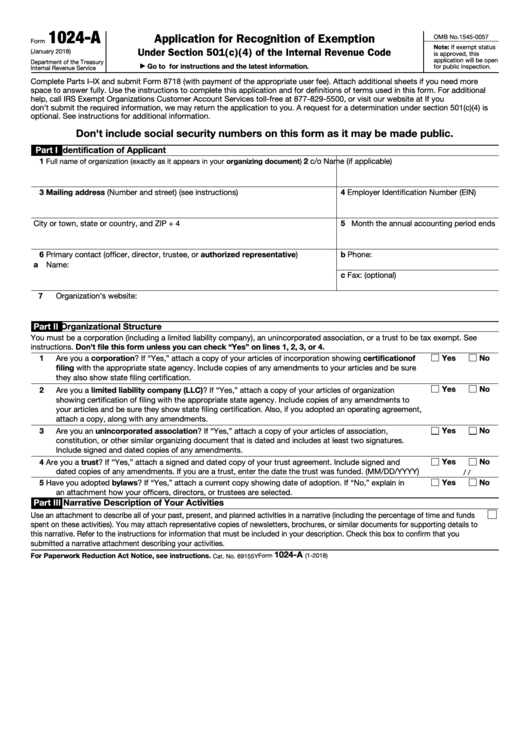

Organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). See part i of the application. (january 2018) department of the treasury internal revenue service. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section.

Form 1024 Edit, Fill, Sign Online Handypdf

Organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Application for recognition of exemption. Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a). Web application for recognition of exemption under section 501(a) go to. Register for an.

Form 1024 Application for Recognition of Exemption under Section 501

The paperwork must be filed with the 1024 application form. Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a). Web application for recognition of exemption under section 501(a) go to. Web you can access the most recent revision of the form at pay.gov. Form 1024 is used.

Form 1024 Fill Out and Sign Printable PDF Template signNow

Form 1024, individual status summary created date: Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section 521. Register for an account on pay.gov. Under section 501(c)(4) of the internal. Estimated dues income line 2 “gross contributions, gifts, etc.” :

Instructions For Form 1024A Application For Recognition Of Exemption

Estimated dues income line 2 “gross contributions, gifts, etc.” : (january 2018) department of the treasury internal revenue service. The paperwork must be filed with the 1024 application form. Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a). Web there are ten documents to choose from.

Form 1024 Application for Recognition of Exemption under Section 501

Each schedule form contains short instructions. (january 2018) department of the treasury internal revenue service. Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a). Statement of revenue and expenses revenue line 1 ^gross dues and assessments of members: Chuck grassley of iowa on thursday released an internal.

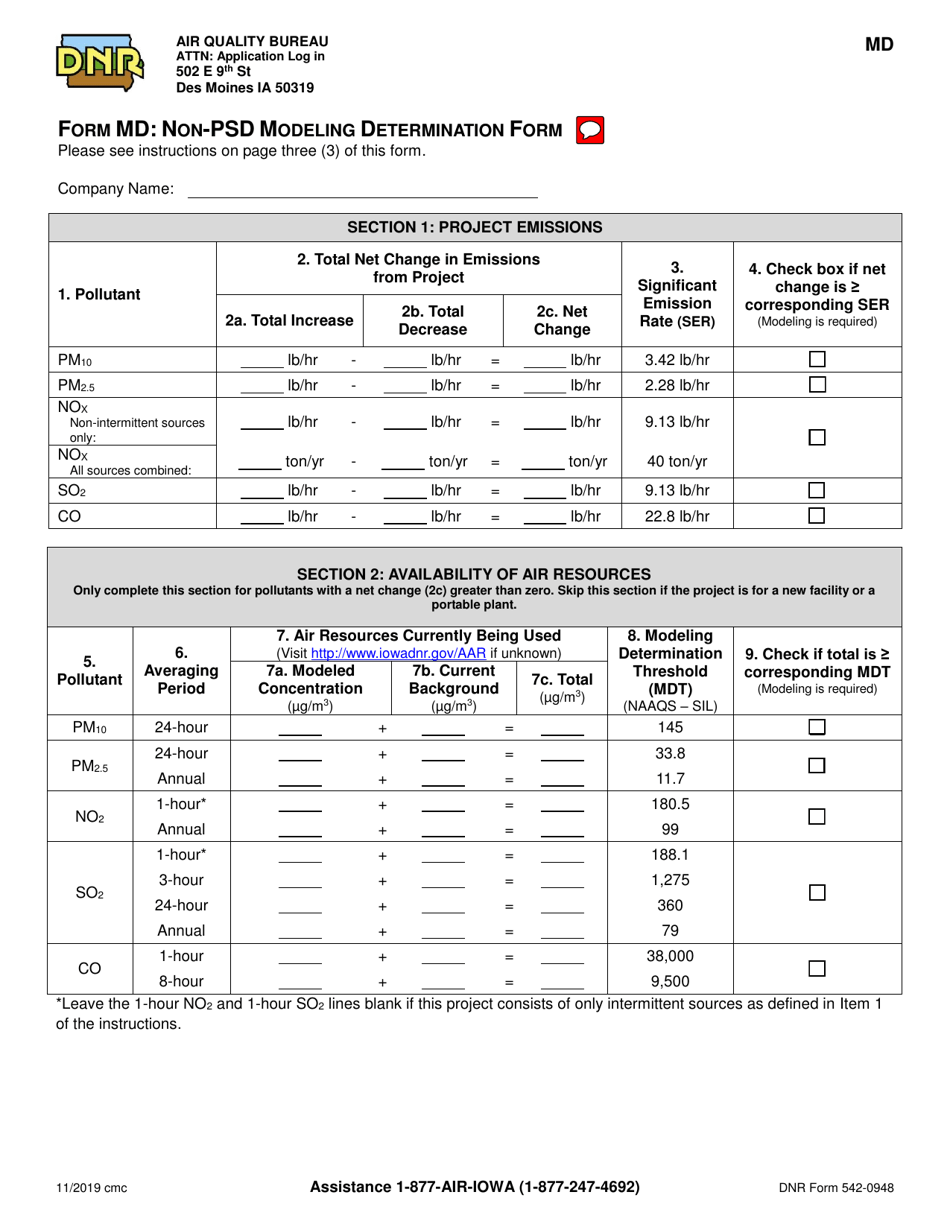

Form MD (DNR Form 5420948) Download Fillable PDF or Fill Online Non

Articles of incorporation, if any, or other organizational document; Web you can access the most recent revision of the form at pay.gov. Complete, edit or print tax forms instantly. Form 1024 is used to document the. See part i of the application.

Download Instructions for IRS Form 1024 Application for Recognition of

Web organizations filing form 1024, application for recognition of exemption under section 501(a) or section 521 of the internal revenue code, must complete and. The paperwork must be filed with the 1024 application form. Web there are ten documents to choose from. Articles of incorporation, if any, or other organizational document; Web form 1024, individual status summary author:

Fillable Form 1024A Application For Recognition Of Exemption

Statement of revenue and expenses revenue line 1 ^gross dues and assessments of members: For instructions and the latest information. Ad access irs tax forms. Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a). Web you can access the most recent revision of the form at pay.gov.

More Specifically, Organizations Other Than Public Charities Or Private Foundations Need To File Irs Form.

Form 1024, individual status summary created date: Web the irs now requires electronic filing of form 1024, application for recognition of exemption under section 501 (a) or section 521 of the internal revenue. Web download or print the 2022 federal form 1024 (application for recognition of exemption under section 501(a) for determination under section 120 of the internal revenue. Register for an account on pay.gov.

Web Organizations File This Form To Apply For Recognition Of Exemption From Federal Income Tax Under Section 501(A) (Other Than Sections 501(C)(3) Or 501(C)(4)) Or Section 521.

Web you can access the most recent revision of the form at pay.gov. (january 2018) department of the treasury internal revenue service. Web application for recognition of exemption under section 501(a) go to. Application for recognition of exemption.

For Instructions And The Latest Information.

Estimated dues income line 2 “gross contributions, gifts, etc.” : Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a). Complete, edit or print tax forms instantly. Web form 1024, individual status summary author:

The Paperwork Must Be Filed With The 1024 Application Form.

Organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Form 1024 is used to document the. Articles of incorporation, if any, or other organizational document; Under section 501(c)(4) of the internal.