What Is Form 8862 Turbotax

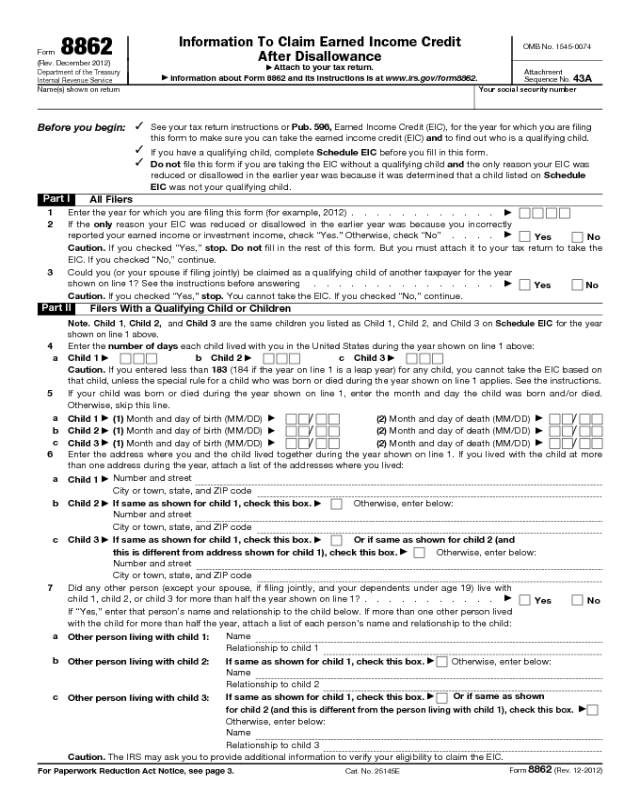

What Is Form 8862 Turbotax - Web how do i file an irs extension (form 4868) in turbotax online? • your eic, ctc/rctc/actc/odc, or aotc was previously reduced or disallowed for any reason other than a math or clerical error. You can download form 8862 from the irs website and file it. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than a math or clerical error and they now meet the requirements for the credit and wish to take it: Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Click here to view the turbotax article. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. You’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another notice from the irs). Information to claim earned income credit after disallowance video:

Web what is irs form 8862? Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Web what is form 8862? Web how do i enter form 8862? Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Information to claim earned income credit after disallowance video: Do not file form 8862 for the: Open your return if you don't already have it open. You can not efile forms to the irs or state from docuclix. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits.

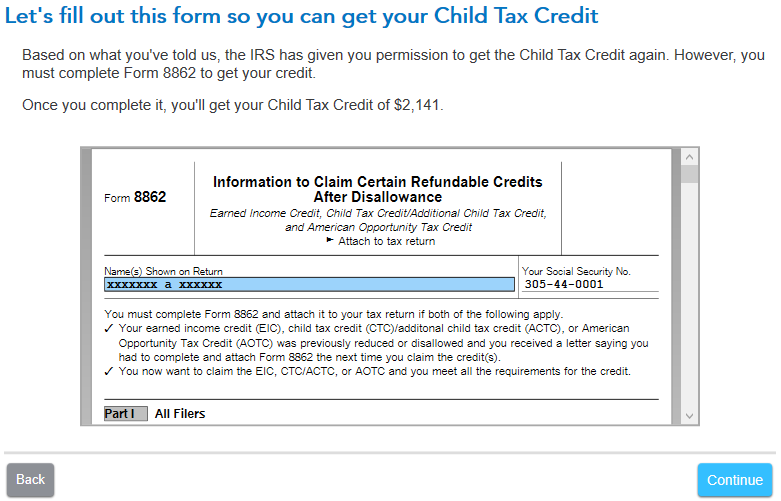

Turbotax edition screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Web what is form 8862? Information to claim earned income credit after disallowance video: Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web what is the irs form 8889? Here is how to add form 8862 to your tax return. Turbotax can help you fill out your 8862 form, see below for instructions on how to find this form in turbotax and on how to complete it. Web taxpayers complete form 8862 and attach it to their tax return if:

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Prepare and efile your 2020 tax returns on efile.com. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Web form 8862 is the form the irs requires to be filed when the.

PPT Form 8862 TurboTax How To Claim The Earned Tax Credit

We can help you file form 8862. Web what is form 8862? Web what is the irs form 8889? Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web what is form 8862? Click here to view the turbotax article. Web you must.

2020 Form IRS 8867 Fill Online, Printable, Fillable, Blank pdfFiller

The irs—not efile.com—rejected your federal income tax return because you must add form 8862 to claim the earned income tax credit since you were not allowed to claim the credit in a previous tax year. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following.

how do i add form 8862 TurboTax® Support

If you haven't submitted payment, deducted the turbotax fee from your refund, or registered your product, you can still restart your return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Prepare and efile your 2020 tax returns on efile.com. Web if you plan on claiming one of the irs educational tax.

Top 14 Form 8862 Templates free to download in PDF format

• 2 years after the most recent tax year for which there was a final determination that your eic, ctc/rctc/actc/odc, or aotc claim was due to reckless or intentional disregard of. You’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another notice from.

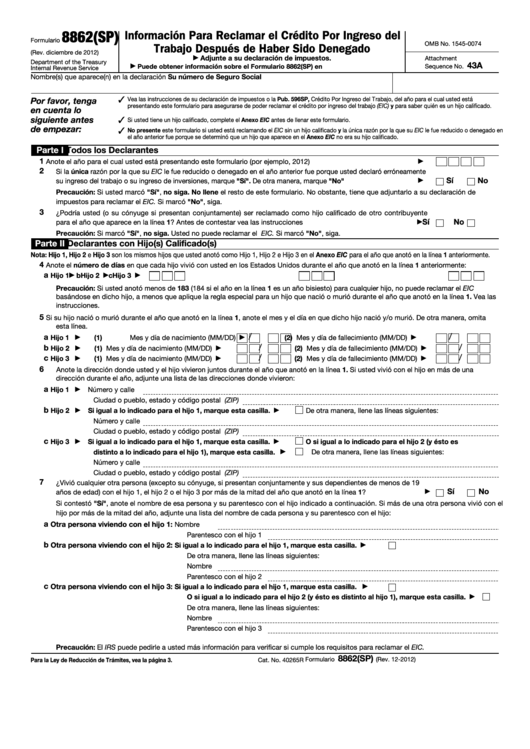

Form 8862(Sp) Informacion Para Reclamar El Credito Por Ingreso Del

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. We can help you file form 8862. Prepare and efile your 2020 tax returns on efile.com. Open your return if you don't already have it open. The irs—not efile.com—rejected your federal income tax return because.

How To File Form 8862 On Turbotax House for Rent

Turbotax security and fraud protection. • 2 years after the most recent tax year for which there was a final determination that your eic, ctc/rctc/actc/odc, or aotc claim was due to reckless or intentional disregard of. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Web taxpayers complete form 8862 and attach it to their tax return if: Information to claim earned income credit after disallowance video: You’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another notice from the irs). If it's not, the irs could reject.

Form 8862 Edit, Fill, Sign Online Handypdf

Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows you to use the credit again. Web you must complete form 8862 and attach it to your tax return.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

To find the 8862 in turbotax: Web taxpayers complete form 8862 and attach it to their tax return if: Web if your earned income credit (eic), child tax credit (ctc), additional child tax credit (actc), or american opportunity tax credit (aotc) was disallowed by the irs, you must complete and file the form 8862, information to claim certain refundable credits after disallowance, with your tax return if both of the following are true: Web form 8862 is required when the irs has previously disallowed one or more specific tax credits.

Their Earned Income Credit (Eic), Child Tax Credit (Ctc)/Additional Child Tax Credit (Actc), Credit For Other Dependents (Odc) Or American Opportunity Credit (Aotc) Was Reduced Or Disallowed For Any Reason Other Than A Math Or Clerical Error.

Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after 1996. Web how do i enter form 8862? The irs—not efile.com—rejected your federal income tax return because you must add form 8862 to claim the earned income tax credit since you were not allowed to claim the credit in a previous tax year. Tax forms included with turbotax.

Open Your Return If You Don't Already Have It Open.

Do not file form 8862 for the: If you haven't submitted payment, deducted the turbotax fee from your refund, or registered your product, you can still restart your return. You can not efile forms to the irs or state from docuclix. Web get the free form 8862 2018 small business how to file eitc and child tax credit for free:

Here Is How To Add Form 8862 To Your Tax Return.

Irs form 8862, information to claim certain credits after disallowance, is the federal form that a taxpayer may use to claim certain tax credits that were previously disallowed. • 2 years after the most recent tax year for which there was a final determination that your eic, ctc/rctc/actc/odc, or aotc claim was due to reckless or intentional disregard of. Follow these steps to add it to your taxes. Click here to view the turbotax article.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-172737-768x501.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)