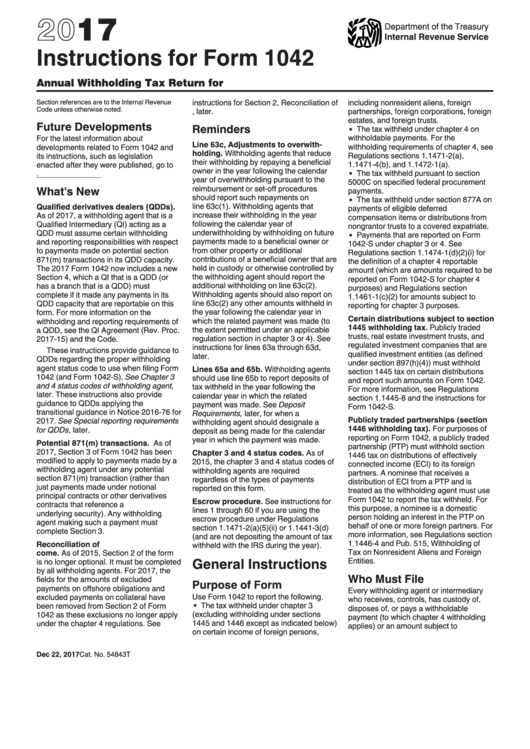

Form 1042 Instruction

Form 1042 Instruction - Web payment instruction booklet for business & individual taxpayers. A withholding agent must ensure that all required fields are completed. Draft versions of tax forms, instructions, and publications. The form reports tax withheld from payments. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Do not file draft forms and do not rely on information in draft instructions or publications. Web the form 1042 is required to be filed by withholding agents. Final instructions for the 2022 form 1042 mention the form can be filed online. 3 select the tax form, payment type, tax period, and amount (and subcategory information, if applicable). Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s.

Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Source income of foreign persons, via modernized e. Web payment instruction booklet for business & individual taxpayers. Draft versions of tax forms, instructions, and publications. Web form 1042, also annual withholding tax return for u.s. The form reports tax withheld from payments. A 1042 is required even if no tax. Web you must file form 1042 if any of the following applies. 3 select the tax form, payment type, tax period, and amount (and subcategory information, if applicable). The requirements under chapter 3 are in respect to payments of u.s.

A withholding agent is anyone who receives, controls, has custody of, disposes of, or pays a withholdable payments of. Do not file draft forms and do not rely on information in draft instructions or publications. Web the form 1042 is required to be filed by withholding agents. The requirements under chapter 3 are in respect to payments of u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. 3 select the tax form, payment type, tax period, and amount (and subcategory information, if applicable). Web you must file form 1042 if any of the following apply. Web payment instruction booklet for business & individual taxpayers. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s.

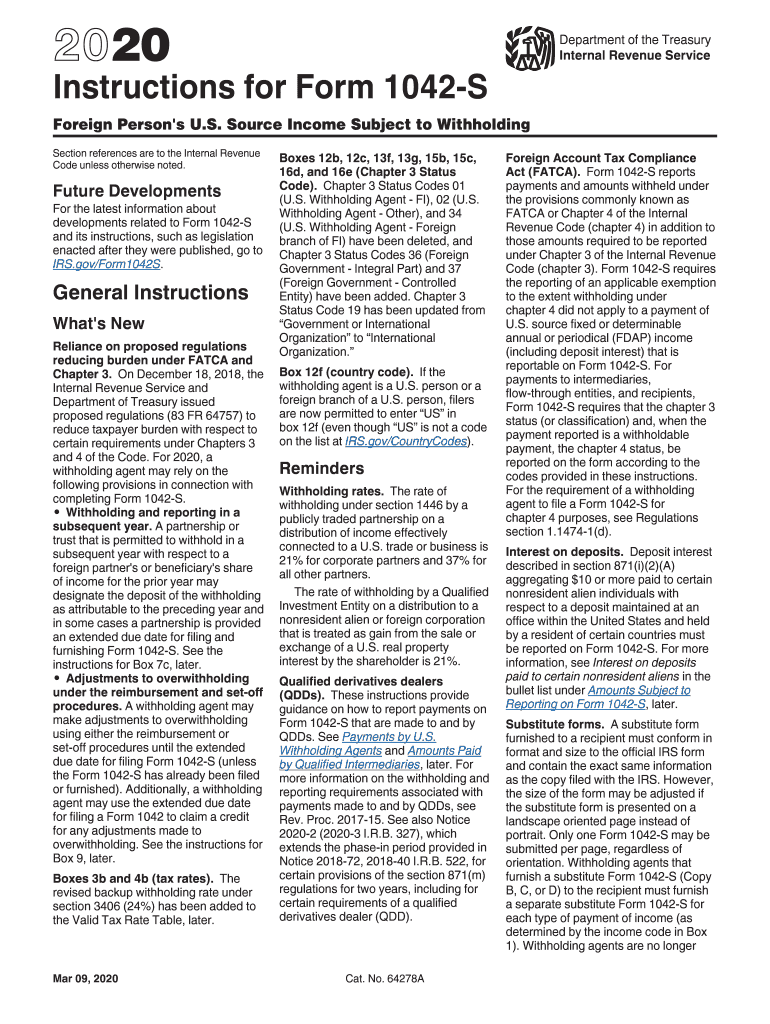

FORM 1042S 2014 PDF

3 select the tax form, payment type, tax period, and amount (and subcategory information, if applicable). Web (form 1042) 2022 tax liability of qualified derivatives dealer (qdd) department of the treasury internal revenue service attach to form 1042. The form reports tax withheld from payments. Final instructions for the 2022 form 1042 mention the form can be filed online. Web.

Top 12 Form 1042 Templates free to download in PDF format

Final instructions for the 2022 form 1042 mention the form can be filed online. A withholding agent is anyone who receives, controls, has custody of, disposes of, or pays a withholdable payments of. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Do not file draft forms and do not rely.

Instructions for IRS Form 1042S How to Report Your Annual

Web you must file form 1042 if any of the following apply. Web you must file form 1042 if any of the following applies. The requirements under chapter 3 are in respect to payments of u.s. A 1042 is required even if no tax. Draft versions of tax forms, instructions, and publications.

Form 1042S Efile Diagnostics Ref. 47040 47039 and 47310 Accountants

Web form 1042, also annual withholding tax return for u.s. Web you must file form 1042 if any of the following apply. Draft versions of tax forms, instructions, and publications. Web the form 1042 is required to be filed by withholding agents. A withholding agent must ensure that all required fields are completed.

IRS Instruction 1042S 2020 Fill out Tax Template Online US Legal Forms

Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. Web you must file form 1042 if any of the following apply. A withholding agent is anyone who receives, controls, has custody of, disposes of, or pays a withholdable payments of. Web payment instruction booklet for business & individual taxpayers. Web (form.

Irs 1042 s instructions 2019

Do not file draft forms and do not rely on information in draft instructions or publications. Web the irs now provides taxpayers the ability to file form 1042, annual withholding tax return for u.s. The requirements under chapter 3 are in respect to payments of u.s. Source income of foreign persons, via modernized e. The amount that should have been.

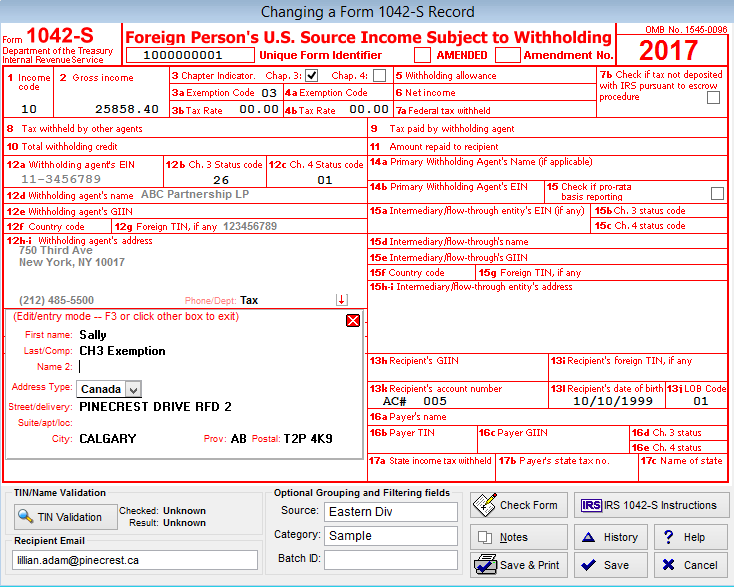

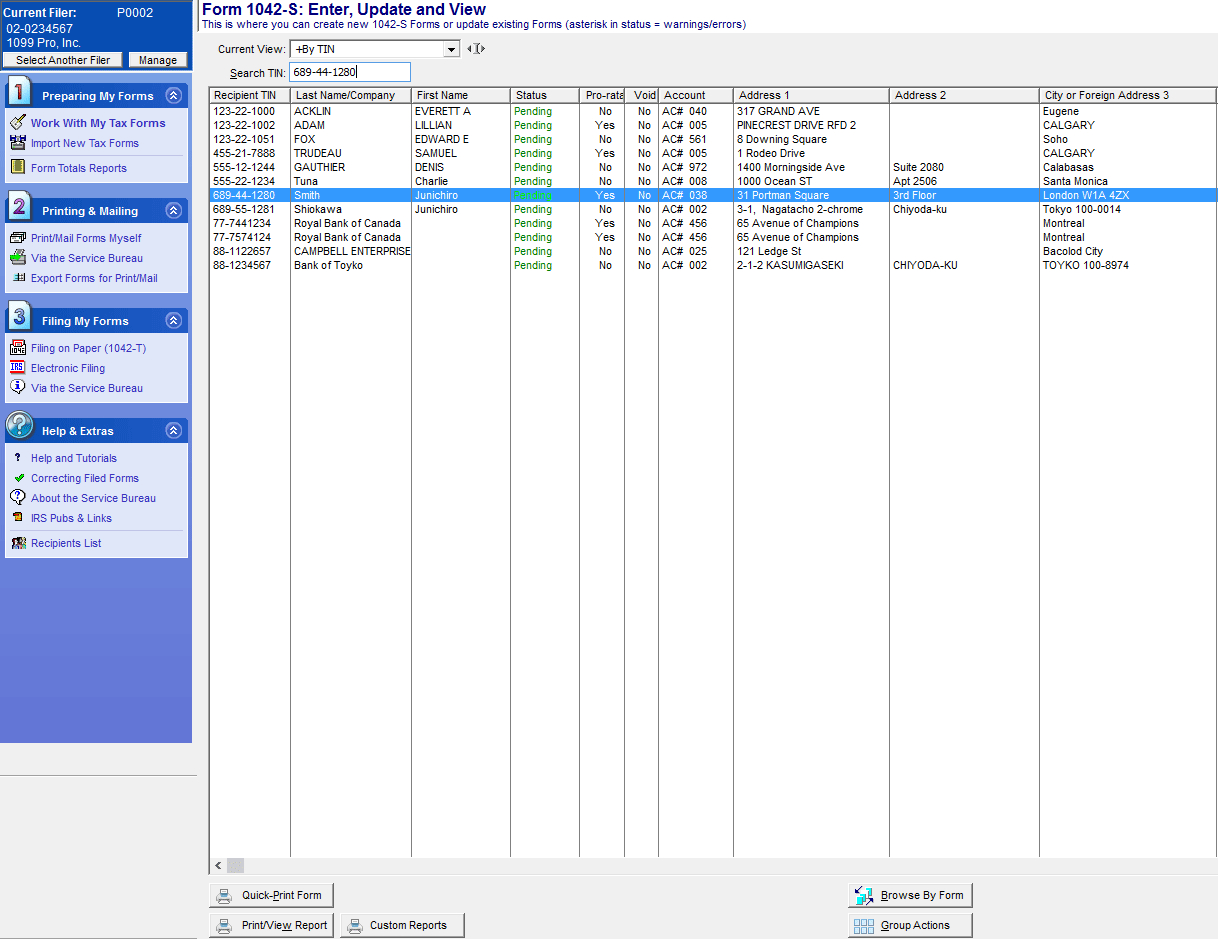

1042S Software WorldSharp 1042S Software Features

Web (form 1042) 2022 tax liability of qualified derivatives dealer (qdd) department of the treasury internal revenue service attach to form 1042. The requirements under chapter 3 are in respect to payments of u.s. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. A withholding agent is anyone who receives, controls, has.

Form Instruction 1042S Fill Online, Printable, Fillable Blank form

The amount that should have been withheld must be included in liabilities on the organization’s form. Source income of foreign persons, via modernized e. Draft versions of tax forms, instructions, and publications. 3 select the tax form, payment type, tax period, and amount (and subcategory information, if applicable). A withholding agent is anyone who receives, controls, has custody of, disposes.

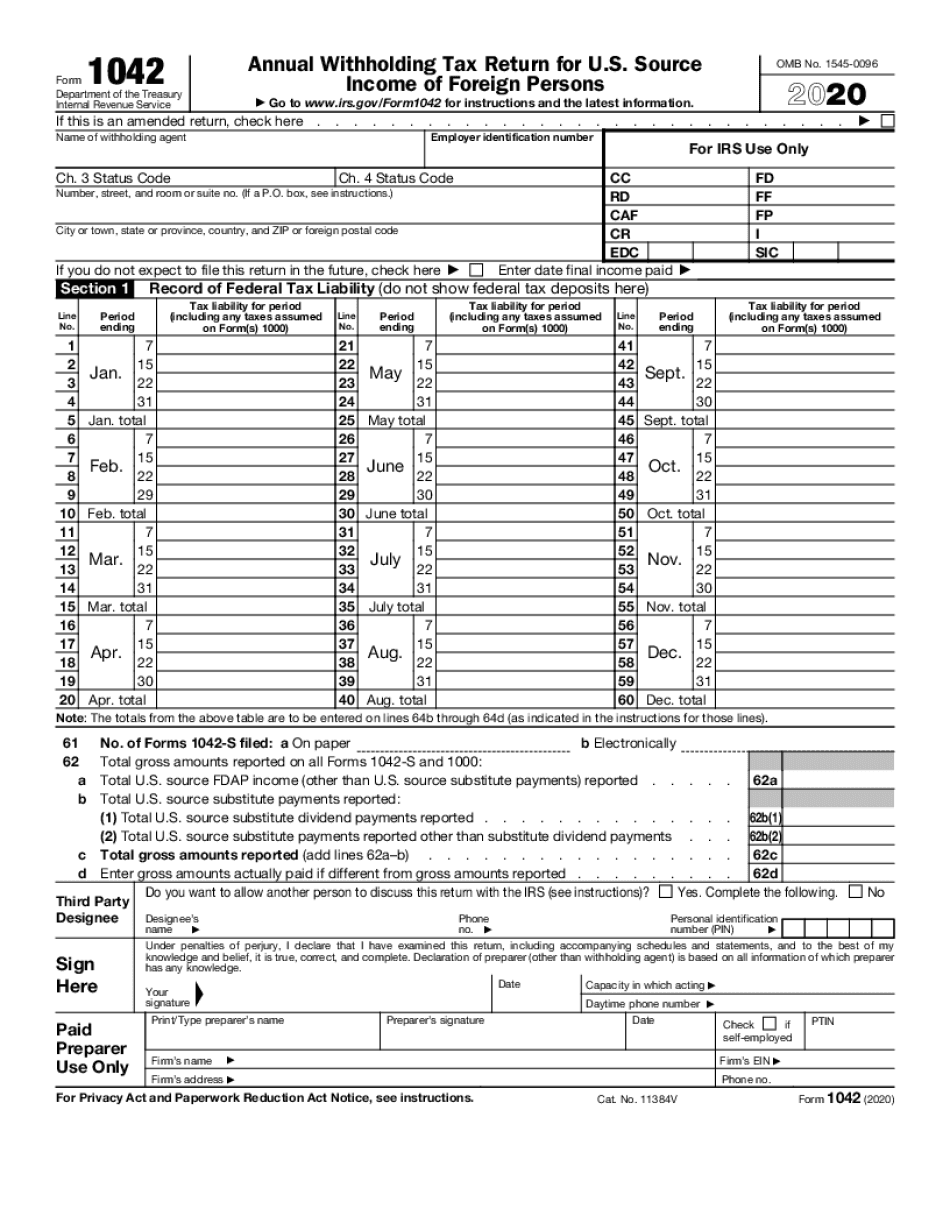

2020 Form 1042 Fill Out and Sign Printable PDF Template signNow

Web you must file form 1042 if any of the following applies. Do not file draft forms and do not rely on information in draft instructions or publications. A withholding agent is anyone who receives, controls, has custody of, disposes of, or pays a withholdable payments of. The amount that should have been withheld must be included in liabilities on.

1042S Software, 1042S eFile Software & 1042S Reporting

Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. The requirements under chapter 3 are in respect to payments of u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web (form 1042) 2022 tax liability of qualified derivatives dealer (qdd) department of the treasury.

3 Select The Tax Form, Payment Type, Tax Period, And Amount (And Subcategory Information, If Applicable).

The form reports tax withheld from payments. Web (form 1042) 2022 tax liability of qualified derivatives dealer (qdd) department of the treasury internal revenue service attach to form 1042. A withholding agent is anyone who receives, controls, has custody of, disposes of, or pays a withholdable payments of. Web payment instruction booklet for business & individual taxpayers.

Web The Irs Now Provides Taxpayers The Ability To File Form 1042, Annual Withholding Tax Return For U.s.

Final instructions for the 2022 form 1042 mention the form can be filed online. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Do not file draft forms and do not rely on information in draft instructions or publications.

The Requirements Under Chapter 3 Are In Respect To Payments Of U.s.

Draft versions of tax forms, instructions, and publications. A 1042 is required even if no tax. The amount that should have been withheld must be included in liabilities on the organization’s form. A withholding agent must ensure that all required fields are completed.

Web You Must File Form 1042 If Any Of The Following Apply.

Web you must file form 1042 if any of the following applies. Web the form 1042 is required to be filed by withholding agents. Source income of foreign persons, via modernized e. Web form 1042, also annual withholding tax return for u.s.